The investment thesis for DBS Group (OTCPK:DBSDY) is based on its strong position as a top-performing bank in Singapore, supported by a robust capital position and positive long term growth outlook. The bank’s improving asset quality and substantial return on equity (ROE) justify its premium valuation compared to other Singapore-based peers. With the ongoing reforms in banking regulations under Basel IV, DBS is expected to benefit from a 200-basis point increase in its CET1 capital adequacy ratio, further strengthening its capital adequacy.

Despite heightened regulatory scrutiny and additional capital requirements, DBS remains well above the regulatory minimum and its own targeted CET1 CAR range. Furthermore, while the net-interest margin is expected to decline in the short term due to the repricing of deposits, the bank’s focus on cost management and slower formation of non-performing assets is likely to drive improved earnings in the future. Therefore, while near-term catalysts may be limited, DBS is a long-term hold with solid fundamentals and offers a reasonable dividend yield of just over 5%.

Capital adequacy and asset quality

Singapore is currently in the process of reforming its banking regulations to align with the Basel regulations. The recent updates, known as the Basel IV regulations, will involve a revision of the method used to calculate risk-weighted assets. This means that banks will have less control over how they assign risk weights to their assets, moving towards a more standardized approach.

Despite these changes, analysts anticipate that the impact on Singapore banks will be limited due to their diverse portfolios. In the case of DBS the impact of the Basel IV regulations are in fact expected to have a positive impact on its Common Equity Tier-1 (CET1) Capital Adequacy Ratio (CAR). Management expects that the fully implemented Basel IV regulations would result in a 200-basis point increase in its CET1 CAR ratio.

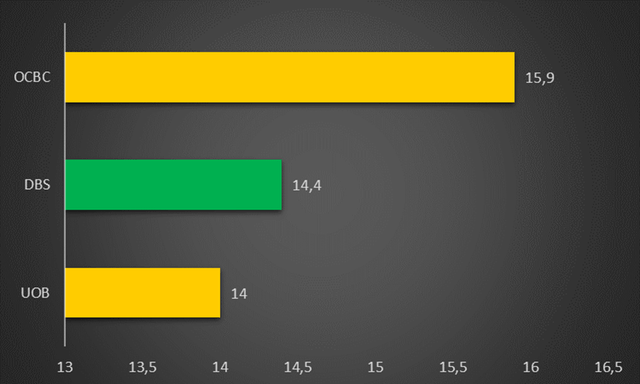

Singapore Bank’s CET CAR Ratios (Author created based on company fillings )

The bank’s CET1 CAR ratio is currently the second highest of the major Singapore banks. However, it must be noted that DBS is currently the subject of somewhat heightened regulatory scrutiny. The Monetary Authority of Singapore has imposed an extra capital requirement on DBS Bank due to the significant unavailability of its digital banking services on March 29 and May 5. Along with a previous capital requirement imposed in February 2022 (amounting to $930 million), this new requirement adds up to approximately $1.6 billion in additional regulatory capital required.

This additional capital requirement was imposed by requiring the bank to increase the risk weighting for operational risks. In terms of the new requirements, DBS must apply a multiplier of 1.8 to these operational risks from a previous multiplier of 1.5. These additional capital requirements may be subject to further regulatory review. In order to avoid the risk of a further increase in the risk-weighting of operational needs, and associated need for more regulatory capital, DBS would need to ensure that the threats to its online platform are addressed fully with a lower risk of future interruption.

Nevertheless, these additional capital requirements are still unlikely to result in the need for a dilutive capital raise or any adverse impact on the bank’s dividend policy. Ultimately, even with the increased risk weighting, DBS’ CET1 CAR is around double the regulatory minimum. It is additionally still well-above the bank’s own targeted CET1 CAR range of 12.5% – 13.5%. Tan Yong, an analyst at Citigroup, has noted that “[u]sing [the] 12.5% – 13.5% target CET1 ratio range, DBS still enjoys $2.1 billion – $5.7 billion of excess capital after adjusting for MAS’s additional capital requirement”.

Earnings outlook

In the first quarter of 2023 DBS’ net-interest margin increased by 8-basis points Quarter-over-Quarter (QoQ). However, management expects that its NIM has peaked this quarter and is likely to decline somewhat to 2.05% – 2.1% from its 2.12% level in the first quarter of 2023. This outlook by management seems realistic in light of the ongoing repricing of deposits in the Singapore market. As discussed in my article on United Overseas Bank (OTCPK:UOVEY), the Singapore based banks have been increasing the interest rates offered on deposits to attract more customers.

While deposits have started to increase again, with a 1% increase in deposits QoQ, the repricing in deposits seems likely to continue in the months ahead. This increased cost-of-funds means that it is unlikely that the bank’s NIM would see any meaningful appreciation in the short term. However, the fact that a substantial portion of the bank’s commercial loan portfolio (around 22%) is still in the process of being repriced will reduce the extent to which the bank’s NIM will decline. In its earnings call management indicated that it expects the bulk of these assets to reprice in the current financial year.

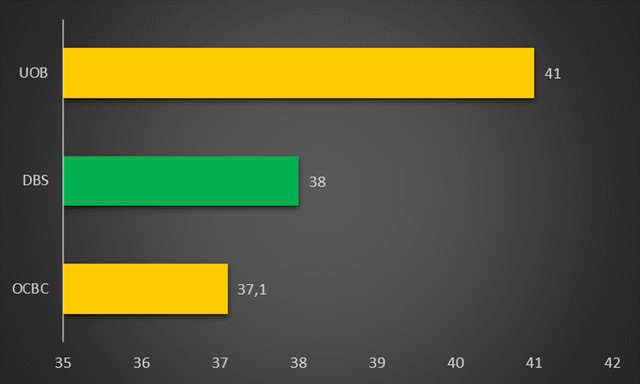

The bank has also continued to manage costs well with a cost-to-income ratio of around 38%. This is also the second-lowest cost-to-income ratio of the major Singapore based banks and represents the bank’s fifth consecutive quarterly decline in its cost-to-income ratio. The bank’s new non-performing assets (NPAs) formation has also slowed down substantially. In the first quarter of 2023 it reported around SGD218 million in new NPAs compared to an average of just over SGD340 million in the previous four quarters.

Singapore Banks Cost-to-Income Ratios (Author created based on company fillings )

The bank’s continued focus on reducing its cost-to-income ratio and slower formation of non-performing assets is likely to be key drivers of improved earnings in the year ahead. However, in my opinion, these drivers offer only limited upside in the immediate future. Therefore, while I remain positive on the long term outlook of DBS there appears to be limited catalysts towards a higher share price in the immediate future.

Valuation

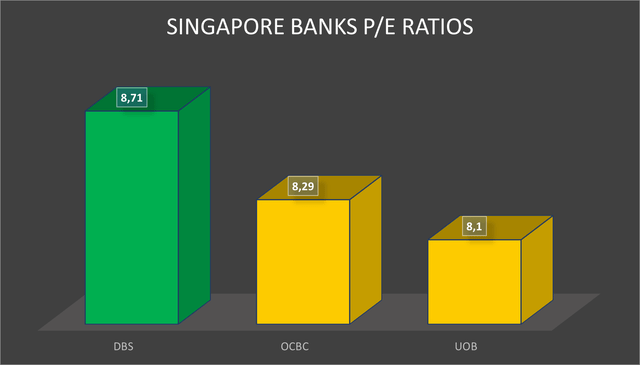

DBS is trading at a forward P/E ratio of around 8.71 which is the highest of the three major Singapore based banks. Nevertheless, this is below the bank’s 5-year average P/E ratio of around 11.7.

Singapore Banks P/E Ratios (Author created based on data from marketscreener)

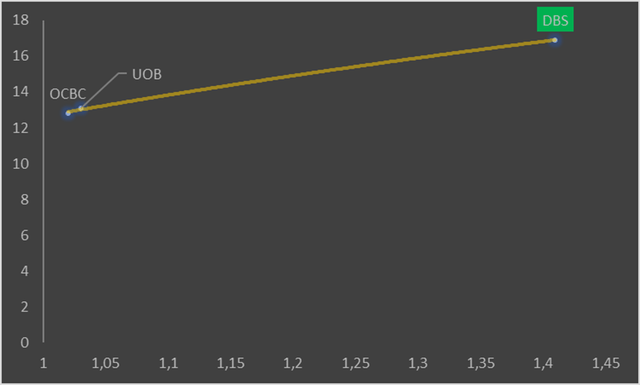

DBS’ price-to-book value is also the highest of the three major Singapore based banks at around 1.41 times its 2023 forecasted book value. The chart below compares the major Singapore based price to book value to their respective ROE levels and indicates that given DBS’s high return on equity (ROE), it is not substantially over valued relative to its peers despite its higher P/B ratio.

Singapore Banks P/B relative to ROE (Author created based on data from marketscreener)

Therefore, DBS appears to be fairly valued in my view. However, given the limited nearside catalysts, I would consider the share to be a long-term hold rather than a buy at current levels. As a share to be held for the longer term the bank offers patient investors a reasonable dividend yield of just over 5% with solid fundamentals.

Key risks to the investment thesis

Heightened regulatory scrutiny and the imposition of additional capital requirements could strain the bank’s operations and limit its ability to pursue growth opportunities. While Basel IV is currently expected to benefit the bank’s capital position, regulatory concerns over issues with DBS’ network unavailability on two prior occasions is likely to persist.

Conclusion

In conclusion, DBS appears to be a strong and well-performing bank. Its robust capital position, higher asset quality, and substantial return on equity justify its premium valuation. Nevertheless, there appears to be only limited catalysts foreseeable in the immediate future resulting in me considering it a hold rather than a strong buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here