Introduction To The Company

My first notes on Sangamo Therapeutics, Inc. (NASDAQ:SGMO) go back to early 2014, when I was researching the “new” CRISPR gene editing companies, Editas Medicine (EDIT), Intellia Therapeutics (NTLA) and CRISPR Therapeutics (CRSP). SGMO had an old Zink Finger Protein [ZFP] technology that appeared to be potentially safer than CRISPR, but CRISPR on the surface looked like it would be able to do so much more. To me, it started to look like ZFPs might have already lost their moment, so I put SGMO in my “Needs More” file and updated it over the years.

During the past decade, the company struck many partnerships, made many promises and ultimately blew threw a lot of money, which happens to most potential new platform companies. However, over the past year, a couple of SGMO’s lead assets started to catch my attention due to other investments I had made in rival gene editing companies and/or disease states; specifically, Biomarin Pharmaceuticals (BMRN) and uniQURE (QURE) in hemophilia A & B respectively; Amicus Therapeutics (FOLD) and AvroBio (formerly AVRO) for Fabry disease; and Voyager Therapeutics (VYGR), Wave Life Sciences (WVE) and Meira GTx (MGTX; see my recent SA article here) for their gene therapy [GTx] work on vectors, genes, capsids, promoters, etc. for ways to potentially deliver genetic payloads across the blood brain barrier [BBB]. SGMO now has a few other assets in its pipeline that are very intriguing to me as well, but those are still very early and to move forward will require significant capital that the company does not have…yet.

I know that 10 years of tracking a company before making an investment may seem like an eternity for most investors, but it was through my other investments that I started to see the potential value of each of the 3 assets SGMO has developed, which I am going to discuss below. Over the coming weeks and months, an update on each asset individually could provide the company with the cash it needs to continue on, but that wouldn’t be good enough for me to invest. Success on 2 of 3 assets could set SGMO up for much longer-term success, which was enough for me to start accumulating shares. Positive outcomes for all 3 of the 3 would set the company up to actually – finally – be a legitimate player in the genomic medicine space.

It is my opinion that the company is likely to provide positive updates/actions on all 3 assets, which is why I have taken a 4% position in my portfolio (including options) for the company at an average price just over Friday’s close mentioned above. Again, this type of investment is not for most and if I am entirely wrong, I could lose 100% of my investment to a bankruptcy filing.

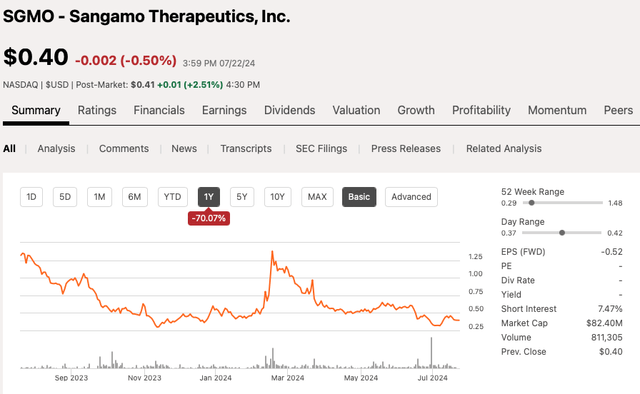

SGMO 12 month stock chart on 07/22/24 (Seeking Alpha)

Here are the 3 assets that, I believe, will drive the successful turnaround over the coming weeks and months ahead.

Pipeline: Three Current Assets Worth Up To ~$1B If Done Right

Part of SGMO’s financial problems stem from its attempt to do too many things at once. There are many reasons why it did so; most were driven by the science. However, by taking so many chances on so many assets, SGMO left itself vulnerable with a do-or-die cash situation. I am not concerned with the past. On 11/01/23 SGMO announced the cuts necessary in the clinic and across the organization to allow the company to survive. Successful execution on the three assets listed below are critical for the company’s short-term survival; it also could set the company up for longer-term success.

Giroctocogene fitelparvovec (giro-vec)/PF-07055480/SB-525:

Hemophilia A is caused by a genetic mutation in predominantly male patients, resulting in their inability to produce sufficient blood clotting protein Factor VIII. The lower the amount of Factor VIII a patient has, the greater the risk of bleeds, including spontaneous ones. According to the CDC, ~33K males in the US are living with the disorder and hemophilia A is about 3-4x more common than hemophilia B. Worldwide estimates run up to 400K patients. As such, SGMO’s giro-vec initially received Orphan Drug Designation [ODD] and has since gotten both Fast Track [FTD] and Regenerative Medicine Advanced Therapy [RMAT] designations in the US and the equivalent from the European Medicines Agency [EMA]. These designations allow for, and encourage, additional communications between a company and the respective regulatory body.

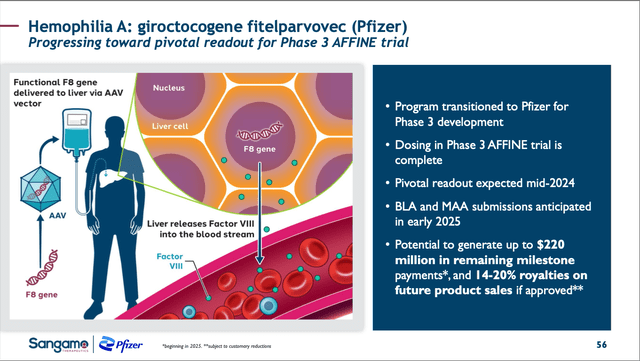

SGMO giro-vec slide from 05/09/24 Corp. Pres. (SGMO 05/09/24 Corporate Presentation)

Giro-vec is a GTx designed to utilize a recombinant AAV6 vector to deliver a functional F8 gene to a patient’s liver following a single treatment. Pfizer (NYSE: PFE) acquired the worldwide rights to giro-vec on 05/10/17 for $70M up front and up to $300M for development and commercialization milestones. SGMO became responsible for the Phase 1/2 ALTA trial, whose positive results were shared on 12/12/21 and then published in the American Society of Hematology’s “blood” on 02/29/24.

In ALTA, the efficacy and tolerability of giro-vec at the highest dose of 3e13vg/kg were clearly a success. My three biggest takeaways from this dose cohort were that, 1) At 104 weeks, this group had a mean Factor VIII activity of 25.4%, meaning patients were now making the protein in their liver as intended and none had dropped out of the study at 2 years; 2) The Annualized Bleeding Rate [ABR] was 0.0 in the first year and 1.4 throughout the total duration of follow-up, meaning the drug was working as intended and right from the start; and 3) Although 2 patients experienced bleeding events that required treatment, none of these patients needed to restart their prophylaxis therapy, confirming the efficacy and tolerability of the dose and a massive potential cost-savings to insurers if the treatment continued to work. ALTA’s results enabled PFE to take the asset into its Phase 3 AFFINE trial.

Why do I feel reasonably good about the potential results? The primary endpoint of AFFINE is total ABR at 15 months, which is a similar metric to ALTA. Thus, Giro-vec should hit this. Key secondary endpoints include FVIII levels, rescue use of FVIII and some Patient Reported Outcomes [PROs] which should be met as well. PFE has stated that they will share AFFINE’s results in mid’24 which means any time over the next 1–6 weeks (PFE’s 2Q’24 earnings call is scheduled for 07/30/24…wouldn’t it be convenient to update then?)

Should the efficacy and safety be maintained, PFE will most likely submit a Biologic License Application [BLA} with the FDA and EMA for giro-vec within the next couple of months and be ready to potentially sell it within a year. First sales in the US and an EU country would trigger up to $220M in milestones for SGMO.

Isaralgagene civaparvovec (isa-vec)/ST-290 for Fabry Disease:

Fabry disease is an X-linked Lysosomal Storage Disease that leads to a toxic accumulation of metabolizing globotriaosylceramide (Gb3) which can in turn lead to stroke, heart, and kidney failure. Standard of care [SOC] is Sanofi’s (SNY) enzyme replacement therapy [ERT] of the deficient galactosidase A (alpha-Gal-A) enzyme every two weeks. For patients with an amenable mutation, FOLD came out with an oral precision medicine approved on 08/10/18 called GALAFOLD that was designed as a “chaperone” to help stabilize some mutant forms of alpha-Gal A. GALAFOLD sales in 1Q’24 were ~100M worldwide of the estimated $2B market.

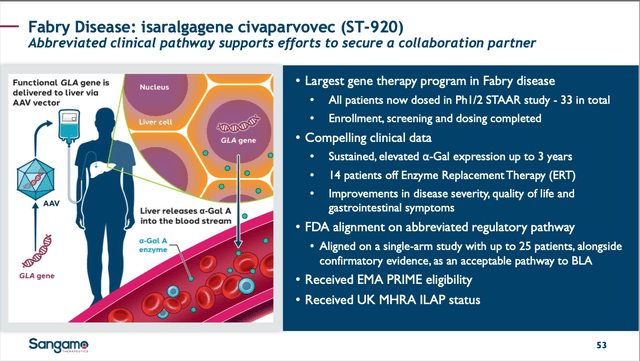

SGMO isa-vec slide from 05/09/24 Corp. Pres. (SGMO 05/09/24 Corp. Pres.)

Isa-vec is a GTx designed to carry the DNA for human alpha-Gal A to the liver of Fabry patients by a single IV infusion so that the liver can start producing functional alpha-Gal-A. The ph1/2 STAAR clinical trial (NCT04046224) dosed 24 patients who were either on ERT, been off it for 6 months or more, or were ERT-naïve.

Dr. Robert Hopkin of Cincinnati Children’s Hospital Medical Center was one of the investigators in the trial and discussed the disease and implications of the successful trial on 04/22/24. Dr. Hopkin went into additional details about the 13 of 24 patients able to come off their ERT: the entire cohort’s kidney functions were stable and GI symptoms improving, and quality of life (QOL) scores improved as well. While there is no guarantee that most Fabry patients will elect to pursue this type of therapy, the fact that a functional cure may be in reach means this asset now has clear value.

Following a Type D meeting with the FDA, SGMO announced on 02/12/24 that only a single pivotal trial of 25 patients would be required to prove isa-vec’s success, and that there would be no head-to-head with an existing ERT or control arm (SOC or placebo). This is a remarkable outcome and a clear sign that the FDA understands the need for this product; the safety and efficacy results demonstrated to date allowed them to proceed in such a streamlined manner. Further, the FDA announced that it would be assisting SGMO in the regulatory process with a “warm handoff” to the EMA so that additional time, effort, and money would not be wasted in the review and preparation process to that regulatory agency for what should be a similar pivotal study.

Depending on the structure of the potential deal, isa-vec could be worth a couple hundred million dollars upfront on a sale. Should the company elect to copromote or just license the drug out, they might see less upfront but a higher amount with more clinical and sales milestones.

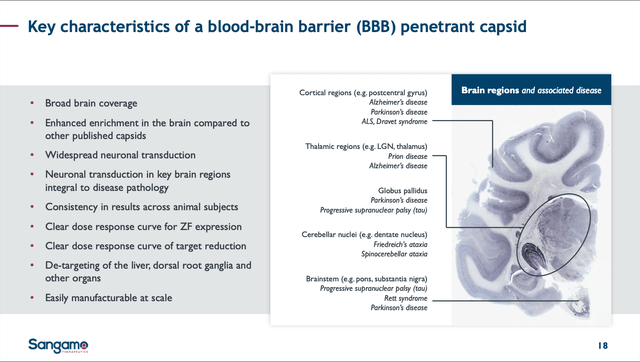

STAC-BBB: STAC-BBB is a unique capsid that was identified using SGMO’s SIFTER platform. I may write an additional article in the near future on this technology, but for simplicity and brevity now, it is sufficient to know SGMO was able to deliver a corrected gene across the blood brain barrier [BBB] in a non-human primate [NHP]. No one else has been successful in accomplishing this, and numerous companies have tried or are in the process of trying. On slide 8 of SGMO’s presentation at ASGCT on 05/08/24, the company showed that STAC-BBB exhibits 700-fold higher neuronal mRNA expression relative to AAV9.

It is still very early and the results are from a small # of NHPs. However, this is the type of clinical data that any biopharma interested in curing/treating CNS diseases in the brain has been waiting for – a way to test their assets inside the brain without surgical intervention. Therefore, SGMO has opened the door to delivering corrected genes for previously untouchable CNS diseases like ALS, Huntington’s, Parkinson’s and Alzheimer’s Disease.

SGMO STAC-BBB slide from 05/09/24 Corp. Pres. (SGMO 05/09/24 Corp. Pres.)

During a presentation at a recent RBC conference on 05/14/24, SGMO’s CEO shared that 10 parties were interested in deal discussions. I can think of half a dozen companies off the top of my head that have publicly stated their interest in CNS over the past two years, and they all have plenty of dry powder for deals. To put this in perspective, SGMO signed a collaboration with Biogen (BIIB) on 02/27/20 for $350M upfront consisting of a $125M licensing fee for ST-501 and ST-502 and $225M in equity. The deal ended when SGMO and BIIB couldn’t get either therapy across the BBB. With STAC-BBB, now SGMO can. This should get interesting very soon.

Order of Operations – What Might Happen Next and Why

There are many investors out there clamoring for deals and/or lamenting that no deals are going to close. They need to relax. These types of deals take time, and no amount of external “noise” is going to influence the discussions that are playing out right now at SGMO’s home office. As I shared above, while playing with financial/liquidity fire, I believe the recent private placement (see more below) bought SGMO enough time to get through 3Q’24 to announce at least one update on one of these three assets. Which one first, and why?

Giro-vec first: If I were advising SGMO, I would wait for PFE’s giro-vec update, which, I think, will occur over the next 1–5 weeks (and this is what I believe the company is currently doing). Why? While the assumption is that the AFFINE results will be positive and PFE will submit a BLA to the FDA in ~6-9 months (triggering the potential $220M in milestones to SGMO), until the actual reveal, the risk of failure is real. If, for some reason, AFFINE is negative, the company would still be able to share the news of an isa-vec/Fabry deal afterward to help offset the significant cash loss. However, if AFFINE is positive, SGMO can then follow it up with additional positive news on isa-vec/Fabry for a double-win. This would be quite a turnaround for the company, potentially bringing in several hundred million dollars over the next year and most likely driving the stock price back up overnight.

STAC-BBB: Theoretically, there should be no rush to make deals for this asset once giro-vec and isa-vec’s next steps are revealed. That being said, the sooner SGMO can get a deal done for just one of the potential CNS diseases that STAC-BBB can deliver the correct gene for, the sooner its long-term cash needs are answered, and the company can focus on execution. I could see the first deal being announced either before the end of the year or by JPM in early January.

Discussion on Financials

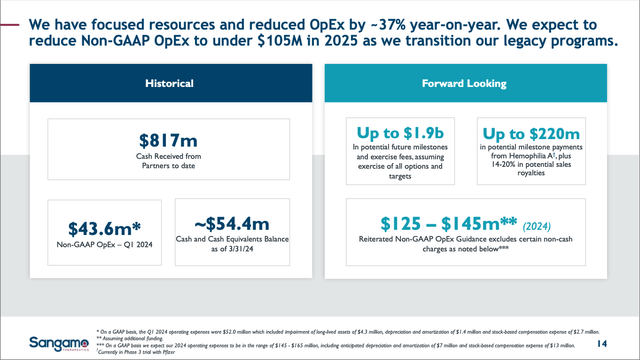

SGMO is on the edge of bankruptcy, so the only financials I am concerned with currently are the company’s Cash and Burn Rate. In the company’s 1Q’24 Financial Report, Cash was reported ~$54.5M and Total Operating Expenses, or burn rate, ~$52M. Even with additional cost reductions stemming from the recent reorg that should show up in 2Q’24’s earnings report, this looks terrible on the surface that SGMO will soon be out of cash with a cash runway only until some point in 3Q’24.

From slide 12 of their 05/09/24 Corporate Presentation, SGMO stated in their Financial Highlights that cash:

“will be sufficient to fund planned operations into 3Q 2024…We are actively pursuing opportunities to raise additional capital.”

In my experience, when companies with viable assets and/or licensing streams they can monetize are extremely pressed for cash as they wait on clinical events and/or deals to close, they typically have a debt-financing plan in-hand just in case as a backup. I am speculating here, of course, but I am very confident that there are plenty of royalty-type companies that would love a shot at isa-vec and/or giro-vec as well as the STAC-BBB asset. Additionally, pure distressed/vulture-debt outfits are out there as a last resort as well.

Therefore, it is do-or-die time for SGMO to do a deal.

SGMO Financial Slide from 05/09/24 Corp. Pres. (SGMO 05/09/24 Corp. Pres.)

The company conducted a Direct Offering on 03/22/24 for ~$24M at $0.84/s and pre-funded warrants to purchase up to ~3.81M shares (the warrants are exercisable in 6 months at an exercise price of $1/s). What this says to me is that 1) Management acknowledged that they needed the cash immediately to make it to the first milestone and/or deal; 2) The amount they felt they needed was small (I do not have concerns with the company making it through 3Q’24 now); and 3) There is likely going to be “more information” around PFE’s giro-vec update before the end of August than just clinical. Why on this last point? Because while the giro-vec update will not provide immediate cash to SGMO, the future milestone achievements will help determine how much cash SGMO will need to raise now either through licensing, collaborations or outright asset sales.

(Potential spoiler alert and pure speculation on my part – SGMO has delayed the isa-vec/Fabry deal announcement because PFE wants the asset and/or PFE buys SGMO’s future royalties on giro-vec now so that PFE wholly owns that asset and SGMO gets the cash it needs.)

More shares coming! On 06/04/24, SGMO released the notes from its Annual Meeting. One of the topics to vote on was to increase the number of common shares to 960M from 640M, which passed. Considering the company had ~203M shares after its Direct Offering, my gut says that 1) There is now interest (and certainly a need) for more shares from potential partners and/or investors, and 2) We may see a reverse-split in the near future. My reasoning? Even a 5x from here would take SGMO’s stock to ~400M valuation, but only a $2/s range without any further dilution. That sub-$5 stock price would still prevent large institutional investors from owning the company’s shares.

Therefore, I can see the company raising the funds it can from an isa-vec/Fabry deal over the coming weeks/couple months; factoring in the giro-vec milestones around the same time; and then conducting another follow-on/PIPE offering shortly thereafter with well-known biotech-focused funds which can purchase stock at any price. SGMO could then initiate a 1-for-5 or 1-for-10 reverse-split; leaving the shares in the $10-$20 range, just in time for the company to announce partnership deals on the new BBB-penetrating capsid. I know it sounds like a lot, but for a company that has been through the ringer and now actually has a couple of commercially viable assets and an impressive CNS pipeline, the chance for success at SGMO has never been higher due to the de-risking of its two lead two assets. Thus, I believe there is a clear path to at least a $1B valuation over the next 12–24 months, and maybe more.

Additional value not discussed in-depth in this article:

SGMO has wholly owned assets for chronic pain (a NAV1.7 target), Prion Disease and Tauopathies. While early, a couple of these could most likely be licensed out for up to $50-$100M each if needed.

In addition, the company has existing collaborations with companies like Alexion/AstraZeneca (AZN) for ALS and Takeda (TAK) in Huntington’s Disease as well as Prevail Therapeutics/Eli Lilly (LLY) and Chroma Medicine for genome engineering. Cumulatively, the potential milestones are worth over $1.5B if options and targets are exercised.

And finally, I will also mention SGMO’s newly revealed MINT Platform here because if it can eventually do what the company says it can, and enable large-scale genome editing, the platform would basically render Base Editing of CRISPR useless. Definitely will be one to watch.

Peer Comparisons/Competition

I am not going to compare SGMO to any other GTx. company right now due to the complexity of each GTx company’s assets; platforms in various stages of development; and different financial and institutional backing. Overall valuations just get too complicated for the purpose of this article. Instead, here are some direct competitors for each disease state/asset of SGMO’s that in my opinion are worth keeping track of. This list is not comprehensive, so I look forward to readers replying to me if you have others that you think are strong as well.

Hemophilia A: BMRN’s GTx ROCTAVIAN is on the market for hemophilia A, but is not off to a strong launch. Based on what I have read and reviewed, there are two reasons for this poor performance. First, the drug’s durability has been questioned and as a result patients and HCPs may delay using it because they want to see giro-vec’s final data. If a patient can only try one of these GTx’s once, why waste that chance on an inferior product?

Second, BMRN priced ROCTAVIAN extremely high and is having difficulty getting reimbursement for it. It does not have the heft, leverage, and experience of a PFE and could have benefited from partnering with a larger biopharma partner [the same goes for CSL Limited (OTCQX:CSLLY) trying to launch HEMGENIX for Hemophilia B]. We will get more clarity on this situation hopefully over the coming weeks. I, personally, think PFE will go all-in on giro-vec, especially after its recent set-back in Duchenne Muscular Dystrophy (DMD). And if PFE prices giro-vec lower than ROCTAVIAN, BMRN could be in big trouble in the hemophilia space.

On an aside, there are people out there discrediting giro-vec and the potential hemophilia A & B markets for GTx in general due to ROCTAVIAN’s and HEMGENIX’s poor launches to date. For me, I am not going to discount PFE in either asset before it gets a chance to put its marketing might behind them. PFE just started selling its recently approved hemophilia B drug, BEQVEZ, and my guess is: It is eagerly awaiting the chance to add a second hemophilia GTx into its rep’s “bag” for both commercial and market access reasons.

PFE also has marstacimab, a once weekly anti-TFPI for hemophilia A or B patients, that is expected to be approved during 4Q’24. While not a direct competitor to GTxs, marstacimab’s Factor replacement-like effect will help cement PFE as a dominant player in hemophilia going forward.

Fabry disease: As shared above, SNY and FOLD own most of the $2B/year market for ERT-type drugs. But neither option offers a potential cure, making the Fabry market ripe for a GTx. AVRO used a lentiviral vector which required chemo conditioning and the failure was painful after early success. There are a couple of other companies with GTxs in-progress, such as 4D Molecular Therapeutics (FDMT) and QURE, but their efficacy and safety data to date are not close to isa-vec’s. And first-mover advantage will also be key, so I am very pleased that SGMO has elected to partner this program.

With the right partner, isa-vec could become a $400-$500M/yr drug in the US alone (250 patients/yr at $2M/treatment at peak sales?) Even at $1M/treatment, isa-vec could make a run at ~$1B /yr with additional sales eventually coming from the EU, Asia, and the rest of the world. Again, the biggest question for me will be on the structure of the deal. SGMO’s CEO has spoken of “partnering” the asset, but whether that is a collaboration or outright sale is difficult to guess at this point. And yes, I would think PFE is absolutely one of the three biopharmas in the running for isa-vec.

BBB-crossing GTxs:

Many have tried, and none have been very successful at this task. I have been following VYGR for its TRACER capsid delivery platform and up until SGMO’s news release on STAC-BBB, I considered VYGR to have the best potential platform out there. They, too, are still early in development and one to watch. On 01/02/24, they signed a license agreement with Novartis (NVS) for $100M upfront to target Huntington’s Disease and spinal muscular atrophy.

Denali Therapeutics (DNLI) is another CNS focused company I have been following for years, and its efforts to cross the BBB come from its Transport Vehicle platform. BIIB closed a collaboration agreement with DNLI on 10/07/20 for $560M upfront to co-develop small molecule inhibitors of LRRK2 for Parkinson’s Disease. This was after BIIB closed an equity purchase agreement with DNLI for $465M on 09/22/20.

Risk Recap

There are numerous risks facing SGMO and I have tried to cover the most pressing above. Here is how I would rank the ones at the front of my mind:

The most obvious, and yet in my opinion, least likely to occur, is bankruptcy before the end of the year. Isa-vec itself is worth at least $50-$100M upfront in a fire sale, depending on how the deal for the asset is structured. And there are plenty of options available now for additional cash from the pipeline. Although dilution is coming down the road, as I have shared in each of my articles for Seeking Alpha, where or when this is a possibility, I would rather have a shot at significant outperformance first and then be diluted, then the other way around.

Giro-vec’s AFFINE update is negative, either on efficacy and/or safety, forcing PFE to not submit a BLA to the FDA. In this scenario, which, I think, is unlikely based on publicly available data to date, SGMO loses out on significant future milestones that would have funded the company for a couple of years. The stock would most likely drop, and greater pressure would be on the consummation of the other deals. For those arguing that it is the Hemophilia GTx market opportunity that in reality is lacking – once PFE starts selling giro-vec in the US and then EU, the milestones to SGMO are due. As for the potential 14-20% sales royalties, I didn’t put any value from them into my models. In fact, I would actually like to see PFE buy out SGMO’s royalty rights now for a win-win today.

Management makes bad deals and brings in less money for each asset. Always a risk. However, the assets SGMO now has to play with are better/further along than some of the ones they had years ago. For example, I think the potential STAC-BBB licensing deals could bring in 100’s of millions of dollars once they get started.

Management goes back to its old spending habits. Again, always a risk. Management could conceivably raise several hundred million dollars over the next 6–9 months and fritter it away, but not likely. I think the CEO got a full-dose reality check as he almost lost the company over the past year and that genuinely scared him. However, if I think the company is losing focus again at any point, I would most likely decrease and/or exit my position.

Conclusion

SGMO is just about out of cash, making an investment in the company unsuitable for most. However, the company has 3 different clinical biotech assets with pivotal updates coming over the next couple of weeks to 6 months that could be transformational and provide a path to a potential $1B valuation. PFE could announce giro-vec’s update as soon as next week around that company’s 2Q’24 earnings call. SGMO could shortly thereafter announce a partner/sale for isa-vec. And SGMO should announce a collaboration for STACT-BBB candidates before the end of the year.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Growth Idea investment competition, which runs through August 9. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here