Introduction

SAAB was an uninteresting story until the Ukraine invasion. CFO Christian Luiga mentioned during an ACE CFO forum at the Stockholm School of Economics that institutional investors showed little to no interest in the military industry before 2022. In fact, the industry was seen as a detriment to ESG profiles that most funds aimed to achieve at the time, due to the negative wartime and environmental impact. However, the interest and stock development since then demonstrate how quickly perceptions can change. Since the start of the year, SAAB’s stock has risen over 70% as of July 19th. The demand for SAAB’s products has surged across almost all offerings, with the order book doubling in the second quarter to SEK 40 billion ($3.7 billion) (“High interest for Jas Gripen” | SvD). Additionally, SAAB just received a new $6.6 billion order within the Surveillance and Dynamics business areas, even surpassing the total sales value of the Dynamics segment ($5.9 billion) for the first half of the year. The question now is whether this trend will last, and how much of the growth is already priced in—can SAAB maintain a sustainable growth trajectory coupled with profitability to meet the market’s high expectations?

Founded in 1937 with the mission to build Swedish fighter aircraft (Saab website), SAAB leveraged Sweden’s engineering talent and water access to deliver critical defense systems domestically. Since then, SAAB has expanded globally, offering military and defense products and services in the business areas Aeronautics, Dynamics, Surveillance, Kockums, and Combitech. Despite growing foreign demand, about 40% of its sales are still domestic, a figure that has remained relatively constant over the years. This underscores SAAB’s importance as a national operator and a reliable partner for other countries. “It’s exciting to see how attractive our systems are in the market,” said CEO Micael Johansson in a recent interview with SvD (SvD).With Sweden joining NATO on March 7th (Sweden officially joins NATO | NATO), there could be even larger market opportunities ahead. However, a total of 80% of order bookings in the first half of 2024 were from markets outside Sweden, and the current backlog from the Swedish market is only 30%, indicating increased international demand for SAAB’s offerings (Q2 report Saab reports and presentations) that might, change the geographical sales distribution going forward – at least during times of conflict such as now.

Saab website

What Are Analysts Saying?

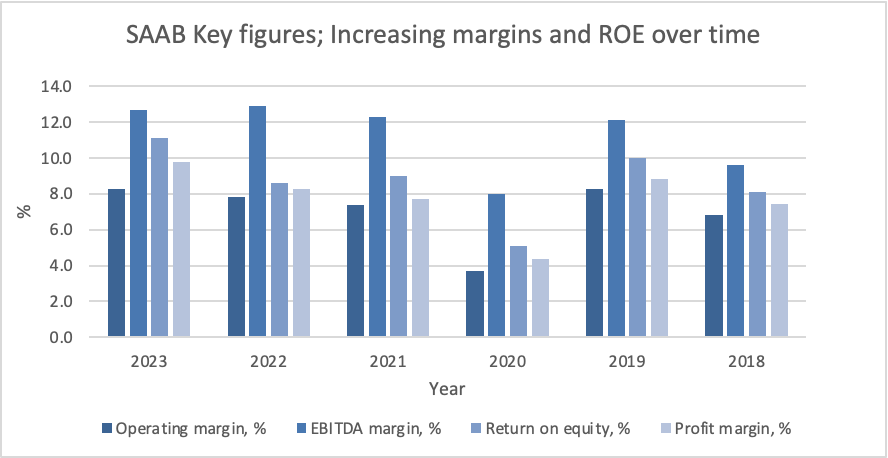

While the demand outlook is promising and rating agencies such as Carnegie and Pareto Securities have raised price targets to SEK 275/share and SEK 285/share respectively (compared to SEK 241/share on July 22nd) (“Lower profitability than expected” | DI), recent profitability has been disappointing. For instance, Surveillance’s operating profit and margin were below analysts’ estimates. However, CEO Micael Johansson remains confident about future profitability improvements: “We had to manage a mix of smaller projects this quarter, which slightly reduced profitability. These are old projects we will clean up moving forward. Surveillance will definitely increase in profitability,” Johansson stated. The overall EBIT margin has remained constant at 8.4%, slightly above the industry average, indicating high expectations and valuations for the firm.

Author’s chart

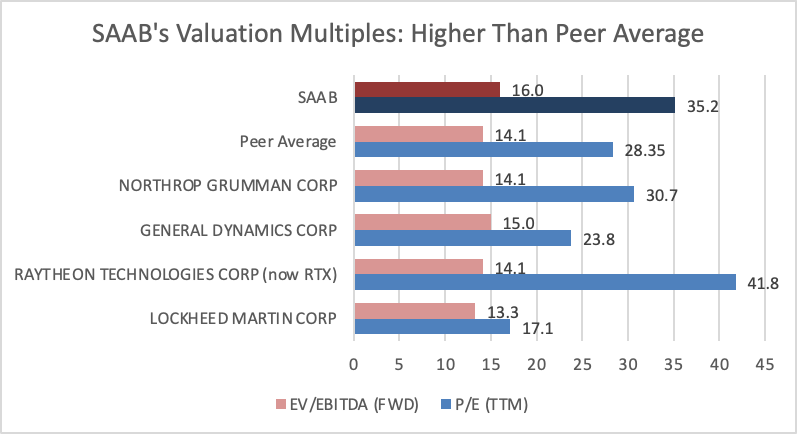

The valuation can also be explained by supply and demand theory. There are few listed defense companies in Sweden, leading the public to flock towards SAAB for exposure, especially during times of geopolitical instability. This trend suggests that SAAB may remain highly valued as there are no signs of geopolitical tensions easing.

Financials and Valuation

Let’s take a closer look at SAAB’s financials. Q2 sales reached SEK 15.170 billion, up from SEK 12.475 billion in the same period of 2023 (Aerospace and Defense Industry Key Financial Data 2023 | BlackNote Investment, Saab website). This strong performance, combined with SAAB’s order intake of SEK 40 billion—a 176% increase compared to the same period last year—and a record backlog of SEK 183 billion (up 35% from the previous year) (Q2 report), highlights the growing demand and robust market position of SAAB in the defense industry.

However, when examining SAAB’s current valuation, compared to some US-based industry peers, SAAB has relatively high multiples. By applying SAAB’s historical EBITDA growth rate of 16.5% over the past three years and conservatively adjusting it down to 15%—considering the five-year average is significantly lower at 11%—we can estimate SAAB’s future valuation. Based on peer EV/EBITDA, SAAB’s projected valuation in one year would be SEK 106,338 million (6558MSEK * 115% * 14.1) compared to today’s EV of SEK 104,928 million (6558MSEK * 16), representing a modest 1.3% gain over the year. This suggests that the current valuation already prices in much of the high order intakes and growth prospects, indicating limited upside unless there are significant margin improvements or unexpected large orders.

Author’s chart

While this preliminary valuation suggests a modest gain, it is important to consider potential factors that could enhance profitability, such as margin improvements and the large order backlog. For instance, if Saab proves an improvement in profitability of Surveillance, prioritize high margin projects within Dynamics or continue to secure healthy supplier contracts and automation in production there is room for continued high growth. Also, Saab’s long history of being a trusted local actor acts as a moat, making Sweden its primary and dominated market, which differentiates it from its peers that face difficulties entering this market. Yet, while this regional focus may benefit Saab when serving the Swedish market, in today’s competitive landscape it requires efforts to convince international players, even though the Swedish stamp is a symbol of quality, to buy into its offerings. In this way, the local Swedish political scene can serve as a catalyst as well as limit its potential in other key markets like the US or in sourcing countries such as China ( ChatGPT Saab warns about China: “May pose an increased future risk” | Omni)

SAAB’s Q2 Market Highlights: Soaring Demand Amid Challenges

SAAB experienced a dynamic quarter driven by strong demand and significant order intake across various segments. First and foremost, the Dynamics segment offered the highest EBITDA margins at 17.2%, and saw the largest increase in order backlog—84% compared to half-year 2023—indicating promising revenue and profitability prospects. Two highlights are the more than $1 billion worth CarlGustaf deal with Poland and a substantial defense equipment order. Saab announced that they continue to focus on this segment and invest in capacity expansion to meet growing demand. This segment also has the highest proportion of sales in markets outside Sweden. As much as 81% is attributable to foreign markets for the first half year, so this capacity expansion may indicate a strategic aim to develop their international footprint.

Second, the Surveillance also saw a surge in interest. Besides a 74% increase in order intake, some key achievements included Sweden’s order for a 3rd GlobalEye aircraft and deliveries to the UAE and Poland. However, despite these successes, as mentioned earlier, Surveillance was a disappointment this quarter. Faced with an 11% decrease in EBITDA, impacted by low-margin legacy contracts and recruitment costs, it is a cloud on the sky causing worries among investors.

Third, the Kockums division reported a 79% growth in EBITDA for the first half of the year, driven by strong demand from the Swedish navy and external clients. Highlights included the launch of Sweden’s submarine HMS Södermanland and orders for CB90 Next Generation combat boats and composite superstructures. And lastly, Combitech continued to attract attention, securing extended defense contracts with the Swedish Defence Materiel Administration (FMV) and adding a new cyber security client to its Security Operation Center. The establishment of a service operation in India and the strategic divestment of its Norwegian entity to focus on Nordic defense segments further strengthened Combitech’s position, diversifying its operational focus and risk.

Risks

There are notable risks to consider when investing in Saab. If peace agreements are reached in Ukraine and Israel under a new US administration, demand for Saab’s products could decline. Additionally, large contracts carry inherent risks, and Saab must navigate the complexities of a highly regulated market, adhering to export controls and sanctions. The conflict in Ukraine has led to increased security measures at Saab, which may drive up costs. Moreover, supply chain risks related to the Middle East conflict and China could impact operations, Saab is currently dependent on imports from Asian countries like China and is vulnerable for supply chocks witnessed lately. Though Saab is actively mitigating risks that can be mitigated. Notably, Saab has no defense-related sales exposure to Belarus, Russia, or Israel. On the other side, the conflicts also increase awareness and may lead to a general interest in Saab’s offerings, potentially benefiting from surging demand.

Conclusion

SAAB’s stock has experienced a significant surge, driven by increased demand for Saab’s offerings, improved profitability and increased media attention. While challenges remain, particularly in the Surveillance segment, the overall outlook for Saab appears promising. With a robust order backlog and continued interest in its diverse product offerings, Saab is well-positioned to capitalize on global defense market opportunities. However, investors should remain cautious due to the uncertainties ahead. If global tensions and conflicts persist, Saab’s specialized and high-quality offerings will continue to be in high demand, potentially improving margins if the strategy is executed well. Conversely, if peace agreements are reached, Saab’s appeal may wane, and the stock could lose its luster, especially in the tougher international markets. Given these factors, a hold recommendation is prudent as we wait to see how these geopolitical dynamics unfold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here