I have been covering Fidus Investment (NASDAQ:FDUS) since late December last year, and issuing follow-up articles after each earnings report. The overarching investment thesis is based on durable cash flow that is underpinned by a strong portfolio base operating in inherently defensive industries. In other words, FDUS is one of the few BDCs out there, where investors could really count on capturing the base dividends in a sustainable manner even if the interest rates fall back to extremely accommodative territory or if there are some distracting challenges at FDUS end.

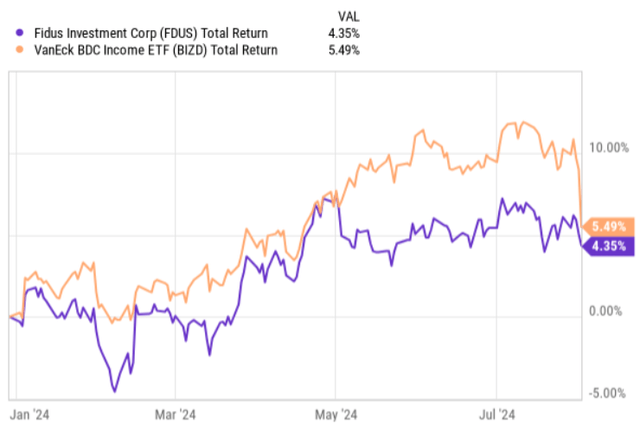

If we look at how FDUS has performed relative to the overall BDC market on a YTD and total return basis, we will observe similar returns, but at much lower volatility for FDUS. In the chart below, we can nicely see how over the past couple of days when other BDCs have started to publish their quarterly reports, the market has dropped (mostly due to deteriorating credit quality), while FDUS has remained stable after the release of its Q2, 2024 earnings.

YCharts

With this in mind, let me now elaborate on why FDUS ranks in my Top 3 BDC pick list (especially after the recent earnings report) together with FS KKR Capital (NYSE:FSK) and Ares Capital (NASDAQ:ARCC).

Thesis review

During Q2, 2024 FDUS managed to yet again expand its adjusted net investment income generation by close to 18% relative to the same period last year. However, after adjusting for the higher weighted average share count from ATM proceeds, the adjusted net investment income per share landed at $0.57 per share, which marks a decrease of $0.05 per share compared to Q2, 2023. On a quarter-to-quarter basis, the drop in the adjusted NII per share figure was $0.02 per share, once again primarily due to the higher share count. In terms of the NAV per share dynamics, the results took an opposite direction than the adjusted NII with the underlying NAV per share base expanding by $0.14 and $0.37 from the previous quarter and Q2, 2023, respectively.

Now, here it is important to elaborate on the two main reasons why the adjusted NII per share result has not exhibited growth for three quarters in a row:

- One overarching driver is the general spread compression in the BDC space, which introduces a headwind on growing the cash flows when the previously funded investments come due and get either refinanced or offset by new ones. In FDUS’ case, there has been a spread drop by ~ 20 basis over the past three quarters, with the Q2, 2024 spreads remaining at the same level where they were in the prior quarter. This is not a major negative, as we can see how FDUS has actually benefited from its niche-like focus in the lower middle market company segment.

- A significant element in this context is the equity dilution from the additional ATM issuances, which, as we saw above, help grow the portfolio, but at the same time add pressure on the per-share results. The issue for FDUS has been that it has failed to immediately channel the fresh liquidity into new investment opportunities that results in two consequences: 1) a notable drag on the adjusted NII per share result, 2) retention of a significant surplus liquidity.

So, in a nutshell, the key problem is that FDUS has an underleveraged balance sheet, which per definition is restrictive for registering decent growth. The commentary in the recent earnings call by Shelby Sherard – Chief Financial Officer – confirms this:

No, I would just echo that. We are currently underlevered, but in terms of increasing leverage on the balance sheet, its first line of credit and then SBIC debt once that becomes available to us. And we’re obviously well positioned in the unsecured market, but that’s probably more opportunistic as opposed to a near-term need.

An additional confirmation here is the fact that, as of now, FDUS has the lowest leverage profile in the entire BDC space with the debt-to-equity (statutory leverage excluding exempt SBA debentures) ratio at 0.5 times.

In my opinion, this is only a temporary issue and an issue that is actually good to have as it provides the Management with sufficient liquidity to growth portfolio and thus achieve the necessary growth.

Speaking of the growth, the prospects look solid. What I mean by that is, if we analyse the quarterly new investment funding dynamics, we will notice that FDUS has been in a position in which it is possible to grow the portfolio without sacrificing yields or credit quality. For example, the originations for Q2, 2024 totaled ~ $62 million for the second quarter, including $17.8 million in one new portfolio company. The net investment reached ~ $58 million, all of which was in first lien securities, and the equity investment part landed at circa $4.3 million. With the debt originations for Q2 coming in the form of only first lien transactions, the total exposure that FDUS has in first lien securities has reached 71%. These dynamics bode well for FDUS’ ability to source fresh investment and expand the portfolio accordingly. Also, in the Q2 earnings call Edward Ross – Chairman, Chief Executive Officer – provided an encouraging color on the M&A front:

Turning to our outlook, we still expect deal flow and M&A activity for the remainder of the year to be at reasonable levels. While we expect to see higher investment activity levels, we do also expect to see a pickup and repayment as numerous portfolio companies are evaluating strategic alternatives.

Finally, let me now explain why, besides the promising trajectory for FDUS’ adjusted NII generation, this BDC embodies the right characteristics for being considered one of the best income plays in the sector:

- The base dividend coverage remains at 132% despite the recent drop in the adjusted NII per share and an attractive yield of 8.9%. If we include the supplemental dividend that was paid in Q2, we will land an FWD annualized yield of ~ 12.2%.

- FDUS’ portfolio credit quality could be easily deemed as truly defensive and strong enough to avoid material build-up in non-accruals. As of Q2, 2024 the non-accruals on a fair value basis remained under 1% of the total portfolio value. In addition, it is worth mentioning that FDUS has not had a single first lien-related non-accrual since 2019.

- On top of debt investments, FDUS is active on the equity investment side as well, where it has injected its equity in circa 81% of the portfolio companies with an average ownership of 3.6%. This is a very critical component as it is not directly reflected in the adjusted NII figure since returns are not generated by steady income streams but rather attractive exits, which fall out of the adjusted NII measurement. In fact, successful exits have been the key driving force behind FDUS’ ability to consistently grow its NAV per share base as well as distribute enticing supplemental dividends. For example, if we take Q2, 2024 quarter, FDUS captured circa $12.5 million in proceeds from the equity monetization process, which resulted in net realized gains of just over $9 million.

The bottom line

While on the surface the Q2, 2024 results might seem negative, if we peel back the onion a bit we will notice that the underlying dynamics remain solid both from the growth and portfolio quality perspective.

In a nutshell, Fidus Investment offers an investment case, where income-seeking investors can count on capturing the base dividend (resulting in a yield of 8.9%) at a very limited risk of being cut even if the market conditions turn south. The embedded margin of safety is so strong that in the foreseeable future (considering surplus base dividend coverage and further growth prospects) income investors could also count on benefiting from consistent supplemental dividends.

Read the full article here