Introduction

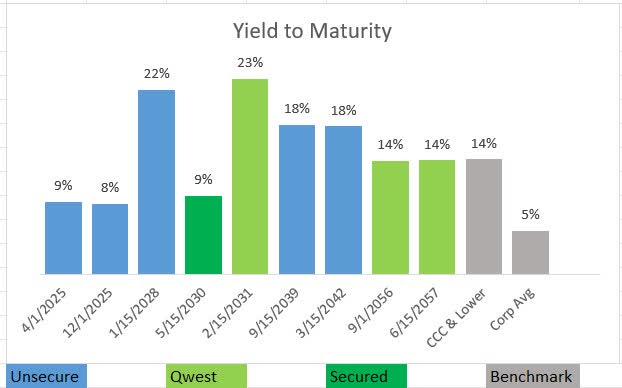

Long-term equity and debt investors of Lumen Technologies (NYSE:LUMN) have been on a wild ride. The company underwent financial challenges, management changes, asset sales, and debt exchanges to remain solvent. Back in May, I provided an update on Lumen’s progress on its turnaround plan. Since then, the company announced $5 billion in AI-driven sales, with $7 billion in additional sales being negotiated. The news sent shares skyrocketing and settling at over $5.50 per share on Friday. For investors who are not holding the equity, there are other options available for reasonable entry into Lumen Technologies, including the 22% yielding debt due in January of 2028.

FINRA

Lumen Second Quarter Results

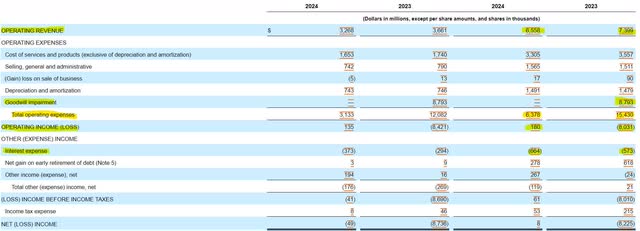

Lumen projected 2024 and 2025 to be challenging years, and the second quarter results showed those headwinds. Operating revenue decreased by $850 million to $6.5 billion in the first half of the year compared to a year ago. Operating expenses dropped by $250 million (if you remove the goodwill impairment charges) to $6.4 billion. Due to the drop in revenue being greater than the expense decline, operating income fell to $180 million. Lumen’s operating income in the first half of the year was not sufficient to cover the $664 million in interest expense.

SEC 10-Q

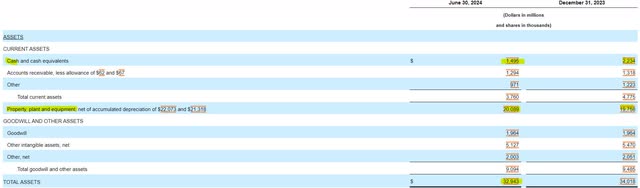

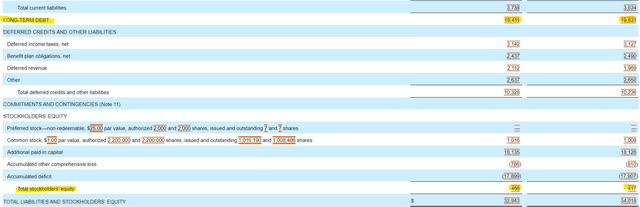

Lumen underwent a debt exchange earlier this year that changed its balance sheet. The company’s cash balance has dropped by $750 million over the last six months, but still has good liquidity with $1.5 billion of cash on hand. Lumen’s debt exchange reduced long-term debt by $1.4 billion to $18.4 billion. The company had $466 million in shareholder equity at the end of the second quarter, up from $417 million at the start of the year.

SEC 10-Q SEC 10-Q

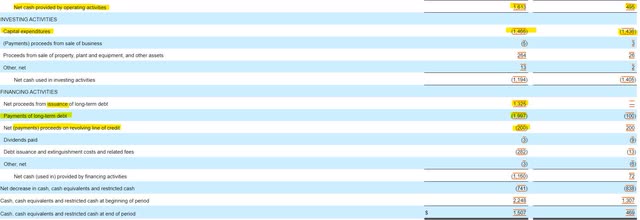

Lumen’s ability to generate cash is paramount to its ability to reduce debt and remain solvent, therefore, the statement of cash flows is important to both shareholders and noteholders. During the first half of the year, Lumen’s operating cash flow surged from $500 million to $1.6 billion, in part due to tax changes. The surge in operating cash flow allowed free cash flow to swing to a positive $150 million. Lumen used some of its extra cash to pay down debt by $800 million during the first half of the year.

SEC 10-Q

Transformation to Speed Up

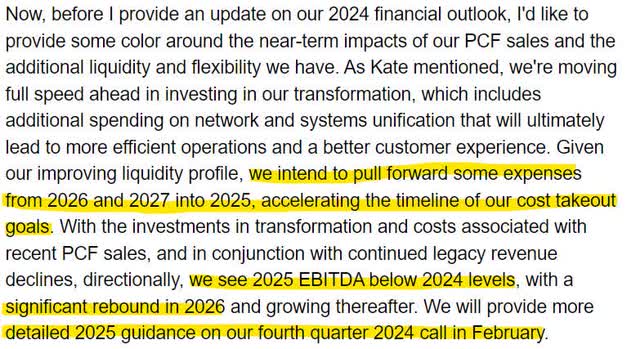

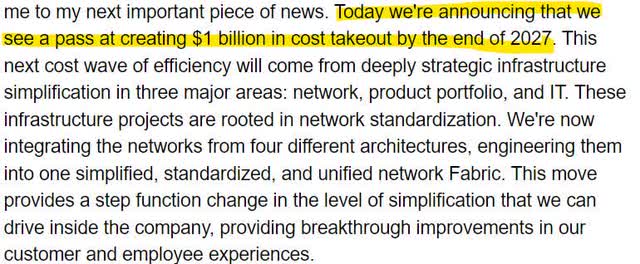

While the results do not show anything related to the recent sales announcements, Lumen’s management did provide some context as to how these big sales will accelerate the company’s transformation plans. First, due to the infusion of cash that these new sales will generate, Lumen is going to speed up its operational efficiency objectives by bringing projects scheduled for 2026 and 2027 into 2025. The result of these efficiencies will be $1 billion in cost savings by 2027.

Earnings Call Transcript Earnings Call Transcript

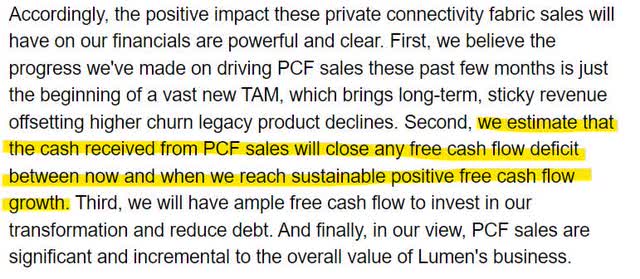

Secondly, the cash coming in from these sales will officially close the free cash flow gaps projected in Lumen’s turnaround plan. These free cash flow gaps were expected to be covered by the additional liquidity generated by the debt exchange deal, but now Lumen can deploy that extra cash in any way it sees fit (additional capex, debt reduction, etc.). Essentially, management is projecting that Lumen will be free cash flow positive going forward.

Earnings Call Transcript

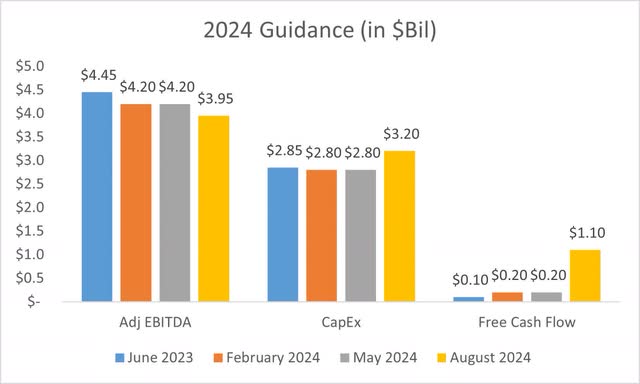

A Look at the Updated 2024 Guidance

Management provided an updated guidance outlook for 2024 which was mostly positive. The company expects Adjusted EBITDA to be $3.95 billion, which is $500 million lower than the original turnaround plan. What is important to note is that Lumen’s free cash flow in 2024 is now projected to be $1.1 billion, five times higher than previously estimated. Capital expenditures have also guided higher by $400 million to $3.2 billion. Lumen’s collection of cash upfront in its new sales deals has allowed for greater capital expenditure and free cash flow.

Management Guidance over Time Recorded in Excel

FOMO on Shares? Look to the Debt

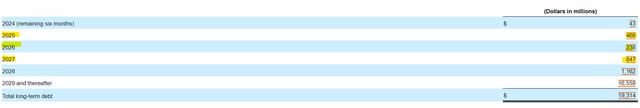

I’m not a proponent of buying shares after a major runup, and I was lucky enough to buy a small amount of shares below current prices in early 2023, but the pricing of Lumen’s debt continues to highlight opportunity. Debt maturing in January of 2028 is trading at over 20% yield to maturity, with a greater than 10% coupon yield. The 2028 bond is attractive because it represents the next maturity due of greater than $1 billion. With almost all the debt exchanged to mature in 2029 or 2030, investors should expect boosted free cash flow to be able to cover debt maturities up to 2029.

SEC 10-Q

Risks to Lumen Technology

Lumen Technology is leveraging the future of AI to fund the buildout of its transformative vision. Should the AI bubble pop, the company may be challenged once again to generate cash. The large maturity in 2028 is discounted in price because it is unsecured, and secured debt holders are going to want to see substantial progress in operations before consenting to that amount of capital leaving the corporation. If Lumen is performing at 2023 or early 2024 levels when that debt comes due, secured noteholders may opt to force a restructuring to keep that capital within their grasp.

Conclusion

While I did not envision the transformation of Lumen taking this degree of turn, I’m certainly happy for the shareholders and unsecured debt holders who have taken this ride for the past few years. The company’s continued negotiation of up to $7 billion in additional sales adds another layer of excitement that could pay off sooner rather than later. For those still looking for opportunity, the 2028 notes provide great income with a strengthening probability of capital return.

Read the full article here