Introduction

Considering the scale of Colgate-Palmolive’s (NYSE:CL) business, I believe the Company doesn’t need much of an introduction. For reporting purposes, CL distinguishes two operating segments:

- Oral, Personal, and Home Care, which is further divided into certain geographical regions: North America, Latin America, Europe, Asia Pacific, and Africa/Eurasia

- Pet Nutrition

CL operates globally, as its products are present in over 200 countries and around two-thirds of its revenue is derived from non-US markets. Such geographical diversification helps reduce risks of economic downturns or negative trends surrounding specific markets; however, it also exposes CL to currency fluctuations.

On the distribution channel front, CL realizes primarily B2B sales to brick-and-mortar and e-commerce retailers and wholesalers or dentists. However, the Company also sells some of its products in a B2C segment within the Pet Nutrition division through Hill’s Pet Nutrition.

Colgate-Palmolive is a member of the prestigious Dividend Kings group, meaning that it has consecutively increased dividend payments for over 50 years.

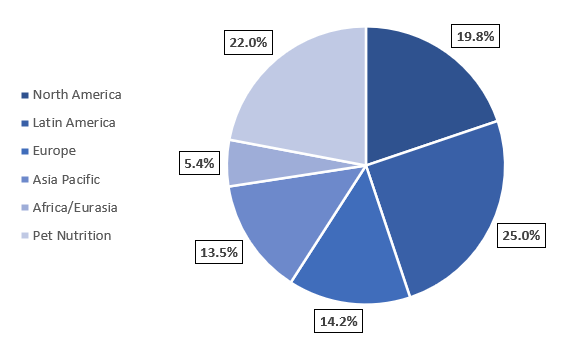

During Q2 2024, 78% of CL’s revenue was derived from the Oral, Personal, and Home Care segment. Latin America was the most important market for the above segment, with sales constituting 25% of CL’s total revenue. For details regarding CL’s sales structure, please refer to the chart below. Specific regions are related to the Oral, Personal, and Home Care segment.

Author based on CL

Investment Thesis

For transparency – I own a certain stake in CL.

Colgate-Palmolive is a top-tier pick for stability-seeking investors who value steady income and low stock price volatility. It’s a pleasant change from the trending tech stocks that typically can’t offer such characteristics, and let’s not fool ourselves – most investors like to have at least a part of their capital allocated to reliable, income-generating enterprises with business models that stand the test of time.

With that in mind, I took a look at CL. It’s not a value pick, as its valuation greatly reflects the quality of its business. It’s not a high-income pick, as the dividend yield is rather modest and stands at ~2%. Nor is it a ‘dynamic growth pick’ as there’s no clear catalyst for substantial multiple expansion, and the dividend recorded a low single-digit growth rate in recent years.

Nevertheless, CL is a stability pillar with reliable, growing income intended to reduce portfolio volatility. Long-time holders of CL certainly enjoy higher yields on cost, which increases the relevance of holding on to CL.

Naturally, there are better opportunities out there in terms of total return potential; however, considering the:

- solid, diversified business model in terms of geography, products, distribution

- Dividend King status with continuous dividend growth

- high profitability, ensuring free cash flow generation

- leadership position in specific product categories

- although the past performance is not an indicator of future results, the low volatility of stock price and business metrics recorded even during recent years of relatively high market uncertainty speaks volumes to the resilience of CL’s business and the ‘sleep-sound’ effect it brings to a portfolio

the risk-to-reward ratio is still attractive from my perspective. Therefore, I believe that CL’s shareholders (incl. myself) will do relatively well in the future and the Company will serve the abovementioned purpose.

Regardless, CL’s multiple has recently reached its fair level; therefore, although I am a happy holder, I prefer to allocate elsewhere. I tend to buy companies with a wider margin of safety, so CL is currently a ‘hold’ for me.

Strong Organic Growth Partially Offset By FX Fluctuations

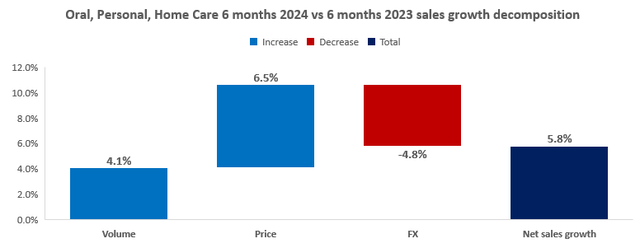

Looking at CL’s primary segment – oral, Personal, and Home Care – the Company recorded strong organic sales growth of 10.6%, driven mainly by the positive 6.5% price effect. An increase in volume also contributed positively by ~4.1%. That was somewhat offset by a negative foreign exchange effect amounting to (4.8%). For details regarding this segment’s net sales growth decomposition during the six months that ended in June 2024 vs six months that ended in June 2023, please refer to the chart below.

Author based on CL

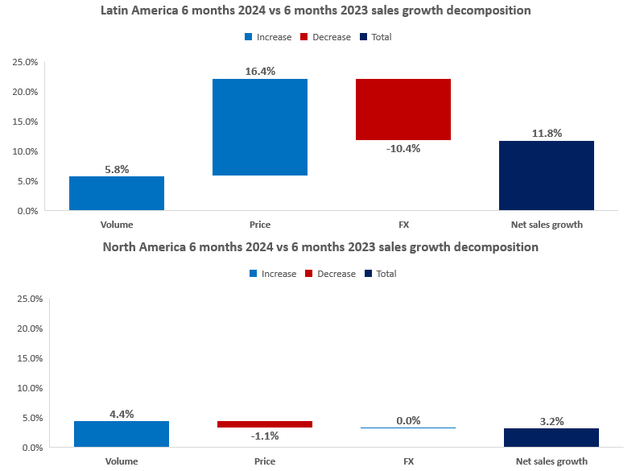

Let’s explore the two most important markets of the above segment: Latin America and North America. Both regions performed well in volume growth, providing 5.8% and 4.4% growth, respectively. However, there was a significant difference in organic sales growth, as the volume effect in North America was somewhat driven by price decreases amounting to (1.1%), while the positive price effect in Latin America amounted to 16.4%, showcasing substantial pricing power in the region. Therefore, the organic sales growth for Latin America and North America amounted to 22.2% and 3.2%, respectively. Significant growth recorded in Latin America was partially offset by negative FX fluctuations, leading to a net sales growth of 11.8% (still significantly higher than that recorded in NA, equal to 3.2%). For details, please review the charts below.

Author based on CL

Out of the outstanding Oral, Personal, and Home Care regions, Europe was the only one that showcased a noticeable, positive contribution to the segment’s overall revenue growth.

The Pet Nutrition segment contributed positively to the overall sales growth through:

- negative volume effect of (0.7%) – this segment was the only reportable segment that recorded volume decrease

- positive pricing effect of 5.9%

- negative, not substantial FX effect of (0.5%)

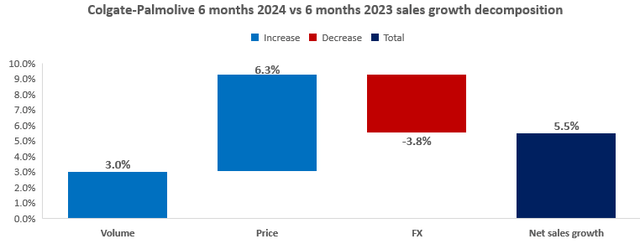

Considering each region’s performance, Colgate-Palmolive managed to increase its net sales in Q1-Q2 2024 compared to the analogical period of the previous year by 5.5%. The increase was driven through:

- positive volume effect of 3%

- positive pricing effect of 6.3%

- negative FX effect of (3.8%)

Author based on CL

Please review the table below for details regarding each reportable segment’s net sales growth decomposition.

Author based on CL

Cash-generating Business with Solid Margins Ensures Meaningful Shareholder Rewards

Each of the Company’s segments was profitable in terms of operating margin. Most recorded operating margins in the low twenties; however, the Latin America and Asia Pacific regions showcased operating margins equal to 32.9% and 28.7%, respectively, during Q2 2024. For details, please refer to the chart below, presenting operating margin by operating segment.

Author based on CL

Moving a little bit higher in the P&L Statement, CL generated a 60.3% gross margin during Q1-Q2 2024, which was 300 basis points higher than the one recorded in the analogical period of the previous year. Returning to the operating margin, its overall level has also improved and amounted to 21.1% vs 19.6% in the previous year.

Author based on CL

According to Seeking Alpha, the EBITDA margin has generally aligned with some of CL’s peers; however, it typically outperformed Church & Dwight (CHD) and Clorox (CLX).

The scale of CL’s business combined with its profitability ensured the ‘cash machine’ characteristic of the Enterprise, which is well reflected within its Cash Flow Statement. During Q1-Q2 2024, the Company generated $1.67B of operating cash flow, which supported its investing and financing activities, including the ~$0.9B of dividend payments and ~1B of share repurchases.

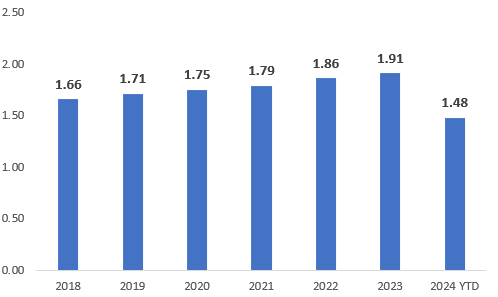

Although a ~2% dividend yield is modest for many income-oriented investors, it’s important to factor in CL’s low payout ratio and outstanding track record of 60 consecutive dividend increases, which continue to proceed. During 2019 – 2023, CL provided a compound annual growth rate of its DPS, amounting to 2.8%. Moreover, assuming the dividend paid in Q4 2024 will amount to $0.50 per share, it would indicate a 3.7% growth year-over-year. Please review the chart below depicting CL’s DPS for 2018 – 2024 YTD.

Author based on CL

Valuation Outlook: Limited Upside Potential

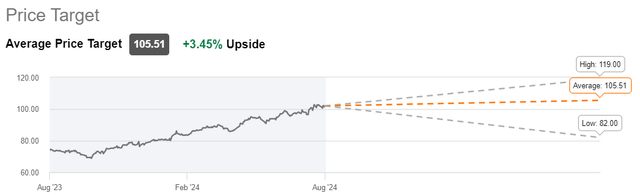

For reference, Wall Street analysts’ average price target is ~$105.51, constituting a potential for ~3.5% upside as of the time of writing. This suggests that the upside potential is limited. I also believe that after recent stock price increases, the upside resulting from the multiple expansion has mostly been realized.

Seeking Alpha

As an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors, especially mature ones.

That said, the forward-looking EV/EBITDA stood at:

- 18.2x for CL

- 17.3x for Procter & Gamble (PG)

- 18.8x for CHD

- 14.8x for CLX

Considering CL’s business model and recent financial developments, I believe that the multiple is well-reflective of CL’s quality. My expectations align with the analysts’ average price target, and I believe we will see CL’s multiple range from 17.5x to 19x.

The Bottom Line

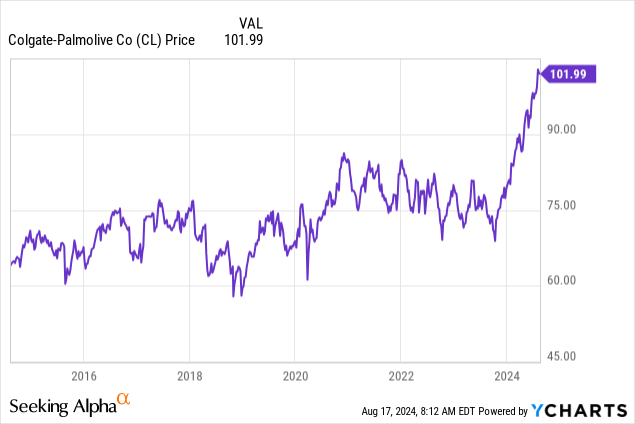

I am a happy CL holder. However, as I believe that its recent stock price increase, reaching ~18 EV/EBITDA multiple, is well-reflective of the quality of its business, I’ve stopped adding.

To avoid doubts, I don’t intend to sell my position. Even if we witness increased stock price volatility and downward pressure, I will remain a shareholder as CL has provided my portfolio with a reliable, steady income and a pillar of stability.

CL is certainly worth considering as an addition to a well-structured portfolio due to the following:

- solid, diversified business model in terms of geography, products, distribution

- Dividend King status with continuous dividend growth

- high profitability, ensuring free cash flow generation

- leadership position in specific product categories

Nevertheless, there are better opportunities in the current market, so I intend to keep collecting the dividends and allocate them to other businesses. The main reason for that is a dynamic increase in CL’s valuation over the course of the last couple of quarters. In my taste, it is well-deserved, but I’m looking for higher margins of safety and somewhat discounted businesses.

CL is a ‘hold’ for me.

Read the full article here