Article Thesis

PDD Holdings Inc. (NASDAQ:PDD) reported stronger-than-expected profits for the most recent quarter, but revenues missed estimates and management’s comments suggest that growth will slow down going forward. This has resulted in a hefty share price reaction, which might be an overreaction, as PDD wasn’t expensive even before this share price pullback.

Past Coverage

I have covered PDD Holdings Inc. here on Seeking Alpha, in an article from earlier this year. I gave the company a “Buy” rating back then, praising PDD’s strong growth, driven by Temu, but cautioning against risks such as PDD’s substantial China exposure.

With PDD’s shares crashing down this week and with the company updating us on the forward outlook and profitability in the most recent quarter, it is time for a thesis update.

What Happened?

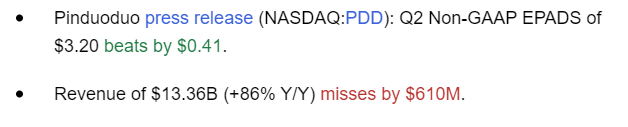

PDD Holdings Inc. reported its most recent quarterly earnings results, for its fiscal Q2, on Monday morning. The company’s headline results can be seen in the following screencap from Seeking Alpha:

PDD results (Seeking Alpha)

PDD missed revenue estimates by a couple of percentage points, but its year-over-year growth rate was still extraordinary, at more than 80%. The profit estimate was beaten by 15%, which was a surprisingly strong result. The company’s year-over-year earnings per share growth rate was 122% in its home currency, as earnings per share rose from RMB10.47 in last year’s second quarter to RMB23.24 in the most recent quarter.

The market reacted very negatively to these results — PDD Holdings was down 29% on the day of the earnings release. Shares ended below $100 per share, which is way below the 52-week high of $165 that was hit earlier this year. The market’s negative reaction was mainly due to management’s comments about the revenue growth outlook and what profitability could look like in the upcoming quarters.

PDD: Excellent Results And An Uncertain Outlook

Looking at PDD’s Q2 results, there were many things to like. Temu, which is a relatively young app that was created in 2022, is an important driver of PDD’s success in the recent past, and that was, most likely, also the case during the second quarter. The company doesn’t break out numbers across its different apps precisely, as we can see in the earnings release here, but with Temu’s ongoing success — it is one of the most-downloaded apps — it is likely that Temu is responsible for a major part of PDD’s business growth. Before Temu, business growth was attractive as well, but revenues nevertheless grew by a weaker 28% year-over-year two years ago, when Temu was not yet a major growth driver. Growth accelerated in 2023, with Q2 revenue growth of 58%, and pushed even higher during this year’s second quarter.

Of course, growth can’t accelerate forever — the law of large numbers dictates that relative revenue growth will have to slow down in the future. If PDD were to grow at an 80%+ pace forever, it would generate revenues of $18 trillion ($50 billion annual pace * 1.8^10) a decade from now, which would be roughly equal to China’s entire GDP — no one expects PDD to become that large. It should thus not be too surprising that PDD will not grow at the recent pace forever, and yet, management’s comments about a growth slowdown resulted in a very bad market reaction. This is surprising to me — investors should have known that the company won’t be able to maintain the 2024 revenue growth rate going forward.

Let’s take a closer look at what PDD’s management stated during the earnings call. Jiazhen Zhao, the company’s Co-CEO and one of the founders, stated the following (emphasis by author):

Over the past few quarters, the competition has been intensifying, which is natural to the e-commerce sector. In such a competitive environment, our revenue growth mix was down. For instance, in the second quarter, our revenue growth declined indicating that high revenue growth is not sustainable.

Competition in the e-commerce industry isn’t new, as there are major players both in China (think Alibaba (BABA), JD.com (JD), and so on) as well as in the US business where Temu is strong. In the US, Amazon (AMZN) is the key competitor in the e-commerce space. That being said, it does not look like competition is hurting PDD too much — the company is still gaining market share, after all: The e-commerce industry is forecasted to grow by 8% this year, yet PDD grew its revenues by 80%- which is only possible due to market share gains. This does not suggest that PDD is being steamrolled by the competition at all. I thus believe that the comment by management could be meant in the sense of “we won’t be gaining market share at the pace seen over the last year” instead of “we are losing market share”. After all, the Q2 trend still was highly positive, even though the annualized growth pace (still more than 60% for PDD based on the Q1 to Q2 growth rate) was below the year-over-year growth rate. But that holds true for many high-growth companies, even NVIDIA (NVDA), and it is not a reason for concern per se, I believe.

There were also some comments about profitability in the earnings call (see link above), such as this one from Lei Chen, chairman of the board and co-CEO of PDD (emphasis by author):

We have communicated on a number of occasions that profit growth in the past few quarters should not be used as a long term guidance. And it is a result of mismatch between the business investment and the financial reporting cycles. As we enter a new investment in the phase, I would like to make it clear to our investors that our process will gradually trend down starting in Q3, and there will be fluctuations or rebounds in the short term. In the long run, the decline in profitability is inevitable.

The fact that profit growth will not be as strong as it was in recent quarters is, I believe, not a surprise at all. Profits grew more than 120% over the last year, and the law of large numbers, again, dictates that this growth rate can’t be maintained in the long run. Analyst estimates also didn’t see a 100%+ earnings growth rate in the coming quarters; thus this statement should not be a surprise for investors.

The statement about a decline in profitability in the long run suggests that margins will decline going forward. Elsewhere in the earnings call, management explained that this was due to factors such as higher growth investments. The good news is that some minor margin declines, in combination with solid revenue growth, could still result in growing profits. In fact, the analyst consensus estimate for next year already saw revenue growth outpacing PDD’s earnings growth, with the consensus estimate implying a sales increase of 31% in 2025, while earnings per share are forecasted to grow a little less, by 29%. Is this a disaster? Ideally, one would like to see earnings growth outpace revenue growth, but even if earnings growth is a little lower than revenue growth, the forecasted earnings growth rate would still be excellent — especially for a company trading at just 8x forward earnings. In fact, even a 5% to 10% earnings per share growth rate would be very solid for a company this cheap, I believe.

Is PDD An Attractive Investment?

PDD Holdings has risks that shouldn’t be ignored — Temu-related regulatory risks in the US, for example, but also macro risks in China (for a more in-depth look at PDD’s risks you can check out my prior article here on Seeking Alpha that is linked above). The following statement by Lei Chen during the earnings call (linked above) could also be interpreted negatively (emphasis by author):

We fully recognize that simply measuring our company’s performance by short term capital returns no longer aligns with where we are today. As a global company in this area, we are committed to drive innovation, adapting to change and taking on greater social responsibilities in the region across the globe.

Maybe this means that the company will focus on the longer-term financial success of the company, which would be a good thing (for long-term oriented investors). But it is also possible that the company is seeing pressure from (Chinese) regulators to do more for suppliers, customers, etc., and to sacrifice a portion of its earnings for that. This is speculative, but I believe that this is a risk that investors should keep in mind.

But while PDD is not a risk-less stock at all, there are also major advantages — the company is very cheap, has a strong balance sheet with $39 billion of cash and short-term investments (not counting restricted cash), and the company should continue to grow in the future. Despite the growth slowdown, the quarter-to-quarter growth rate of 13% is still excellent.

For an enterprising investor, very cheap PDD could be a worthwhile investment following the steep share price decline following the company’s earnings release — where profits were much higher than expected.

Read the full article here