By Jennifer Nash

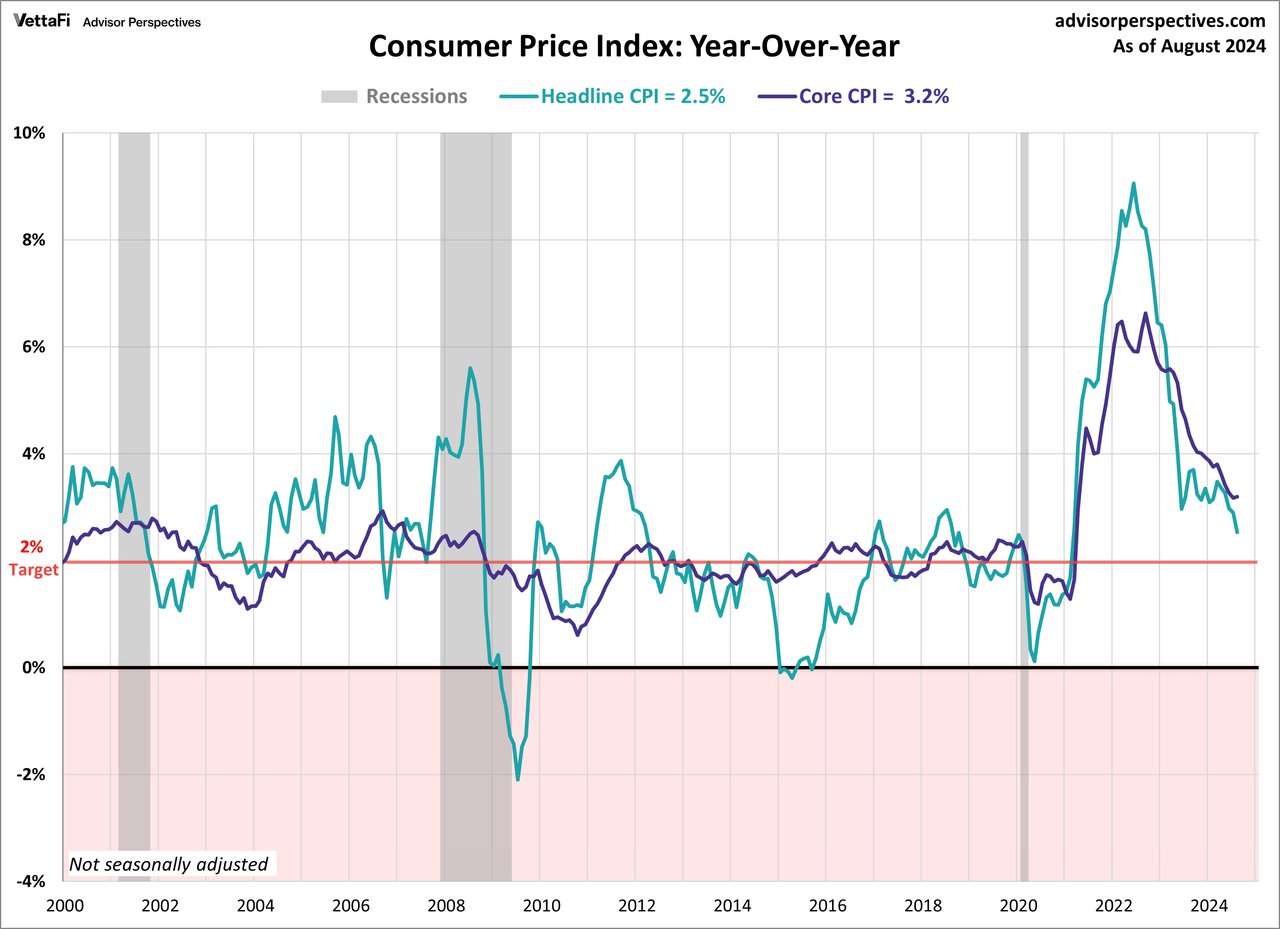

Inflation cooled for a fifth straight month in August, dropping to its lowest level since February 2021. According to the Bureau of Labor Statistics, the headline figure for the Consumer Price Index fell to 2.5% year-over-year, right in line with economist expectations.

Additionally, core CPI cooled to 3.2% as expected. Compared to last month, headline prices were up 0.2%, as expected, while core prices rose 0.3% – slightly above forecasts.

Here is the introduction from the BLS summary, which leads with the seasonally adjusted monthly data:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis, the same increase as in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.5 percent before seasonal adjustment.

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The index for all items less food and energy rose 0.3 percent in August, after rising 0.2 percent the preceding month. Indexes which increased in August include shelter, airline fares, motor vehicle insurance, education, and apparel. The indexes for used cars and trucks, household furnishings and operations, medical care, communication, and recreation were among those that decreased over the month.

The all items index rose 2.5 percent for the 12 months ending August, the smallest 12-month increase since February 2021. The all items less food and energy index rose 3.2 percent over the last 12 months. The energy index decreased 4.0 percent for the 12 months ending August. The food index increased 2.1 percent over the last year.

The first chart is an overlay of headline CPI and core CPI (excludes Food and Energy) since the turn of the century. The highlighted two percent level is the Federal Reserve’s target inflation rate.

In August, headline CPI slowed for a fifth straight month to 2.5%, its lowest level since February 2021. Additionally, core CPI cooled to 3.2%, its lowest level since April 2021.

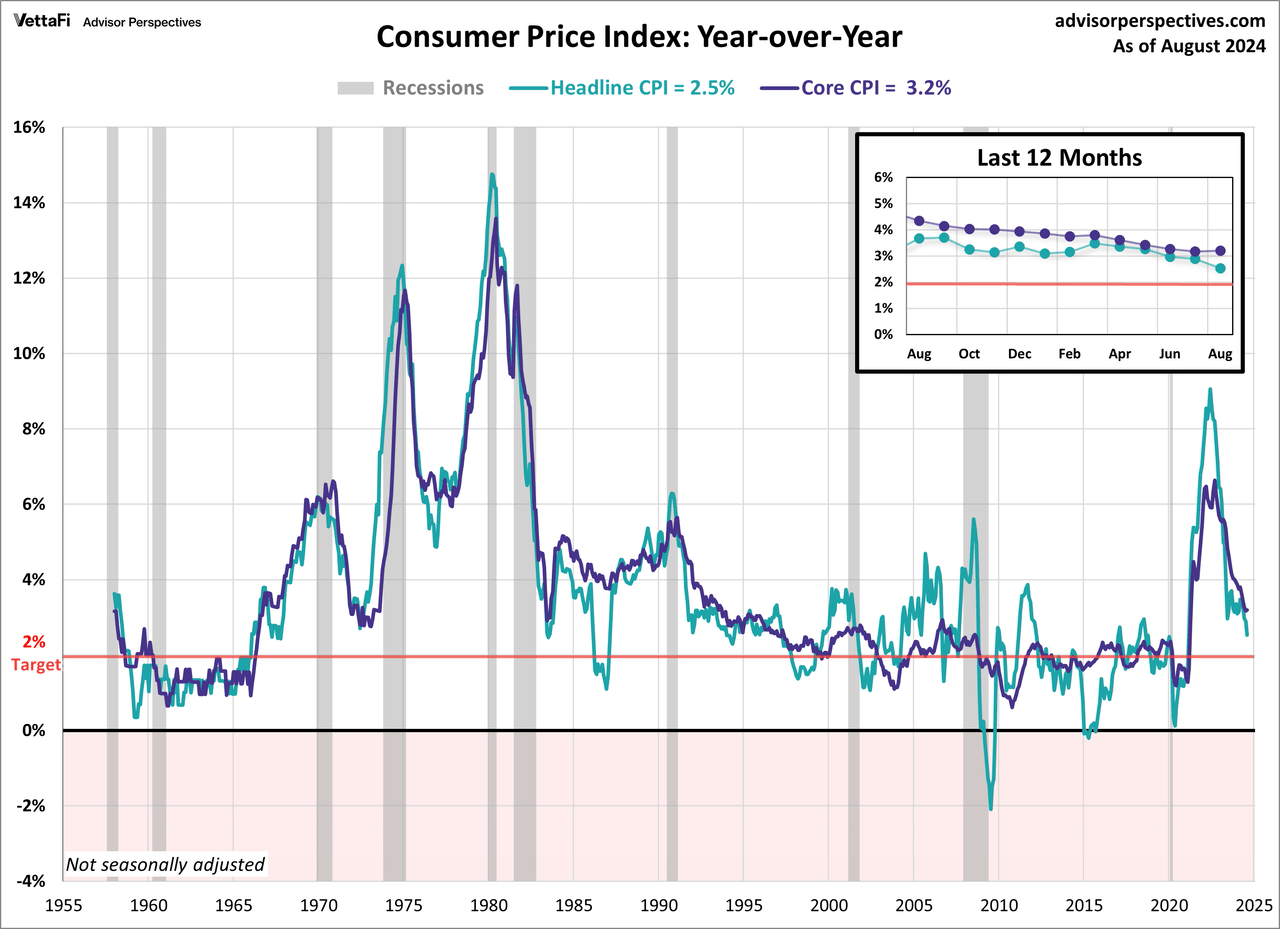

The next chart shows both series since 1957, the year the government first began tracking core inflation.

In the wake of the Great Recession, two percent has been the Fed’s target for core inflation. However, at their December 2012 FOMC meeting, the inflation ceiling was raised to 2.5% while their accommodative measures (low Fed Funds Rate and quantitative easing) were in place.

They have since reverted to the 2% target in their various FOMC documents. The COVID-19 pandemic helped launch inflation into its highest levels since the 1980s.

Federal Reserve policy, which in recent history has focused on core inflation measured by the core PCE Price Index, will see that the more familiar core PCE is currently above the target range of 2%. The Fed has been in a tightening cycle to tackle high inflation, among other things. Inflation has been easing, but it will it be enough to curb a recession?

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here