WTI crude oil sunk to fresh year-to-date lows earlier this week as supply/demand concerns continued to weigh on the cyclical commodity. Weakness in China’s economy and near-record high domestic production have kept the bears in control of oil’s price trend. Not surprisingly, the Energy sector is now the worst-performing area of the US stock market so far in 2024.

Shares of Occidental Petroleum (NYSE:OXY) have likewise suffered. The $47 billion market cap Integrated Oil and Gas industry company within the Energy sector now trades with a low-teens P/E while its fresh cash flow per share is high. Earnings estimates are also expected to improve, but there is a major risk seen on the technical chart.

Overall, despite awful momentum, I see the stock as a fundamental value case and reiterate a buy rating.

Oil Prices Sink Toward YTD Lows in September

TradingView

Back in August, OXY reported a solid set of quarterly results. Q2 non-GAAP EPS of $1.03 topped the Wall Street consensus target of $0.77 while revenue of $6.88 billion was also a material beat by $232 million. Shares traded higher after the release, jumping by 4.3% and there have been some sell side EPS upgrades since its issuance. It was the fourth consecutive bottom-line beat by the Houston-based large cap.

Helping to send OXY higher was the management team’s optimism, as seen by a guidance raise in its production and capital spending forecasts. The Q2 report came shortly after the close of a $12 billion acquisition of CrownRock. That deal expanded OXY’s footprint in the Midland Basin and has the potential to drive operating leverage through increased efficiencies.

Though the acquisition increases the firm’s debt burden modestly, executives have plans to pay down the borrowings within a year. With a prominent position in the key Permian Basin and its carbon capture projects, OXY stands out from its competition.

With prudent liquidity management and a high yield, I continue to favor its fundamentals today. Of course, much depends on how domestic oil and gas prices trend, and with WTI’s bear market ongoing, macro forces are key risks. What’s more, a strong dollar could hurt the company and rising labor expenses is another risk to keep in mind. Finally, a surprise increase in interest rates is another possible peril.

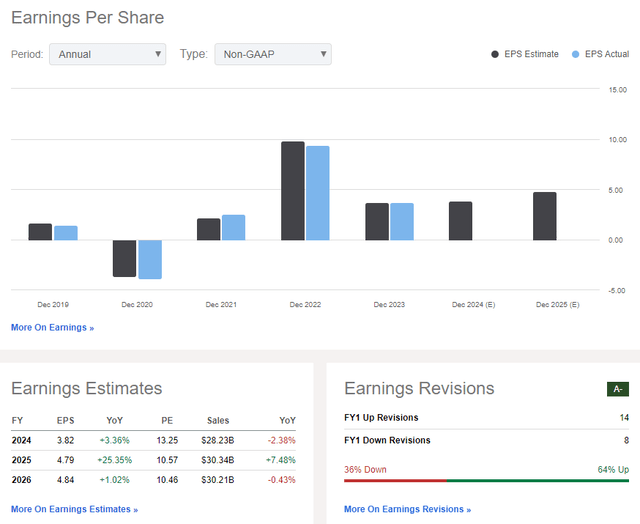

On the earnings outlook, analysts expect OXY’s operating EPS to rise just 3% this year, but then accelerate to $4.79 in the out year. By 2026, profit growth may slow and normalize just shy of $5 while revenue growth is less sanguine over the coming handful of quarters. The good news is that since the Q2 beat, there have been a high of 14 Wall Street upgrades of the stock, compared with eight downgrades.

I fear that lower oil prices today versus several weeks ago could result in tempered forecasts, but with a dividend yield above that of the S&P 500 (though lower than its peers) and a free cash flow yield of 9%, the company is in a decent position even with macro headwinds.

OXY: Revenue, Earnings, Revision Trends

Seeking Alpha

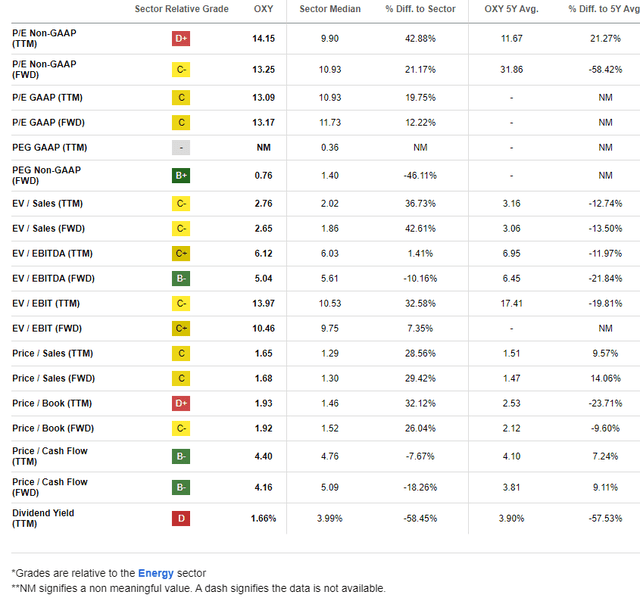

On valuation, I am dropping my normalized earnings figure and my multiple assumptions. Back in Q1, I used $5 of non-GAAP EPS and a 14 P/E, but as oil prices have sagged, more conservative numbers are required in my view.

Assuming $4.70 of forward profits and a 13x multiple, I now see the stock’s intrinsic value near $61, but that is still a sufficient margin of safety to reiterate a buy rating. OXY also trades at a significant discount to its long-term average on a price-to-sales basis, and its forward PEG ratio is modest.

OXY: Mixed Valuation Multiples, But Inexpensive on a Forward P/E Basis, Low PEG

Seeking Alpha

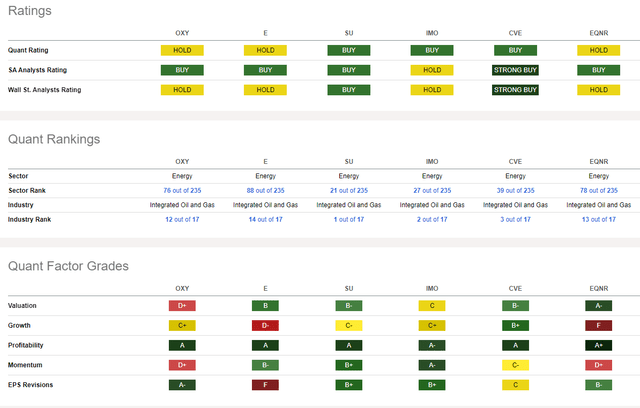

Compared to its peers, OXY sports a soft valuation rating, but that is largely due to distorted historical multiple trends during the post-pandemic period. The growth trajectory is admittedly not all that strong, but that’s reflected in a modest forward P/E today.

Profitability trends are very robust, however, and EPS revision trends are likewise favorable. A major risk aside from fundamental factors is the chart and share-price momentum – I will detail key price points to monitor later in the article.

Competitor Analysis

Seeking Alpha

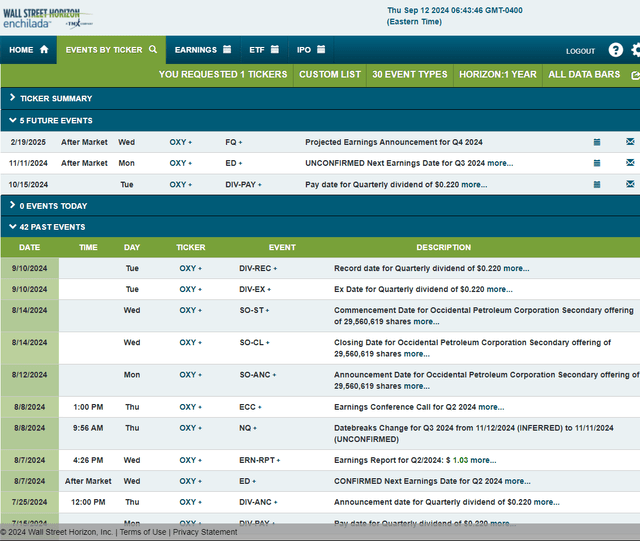

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2024 earnings date of November 11 AMC. Before that, the stock pays a $0.22 quarterly dividend on Tuesday, October 15.

Corporate Event Risk Calendar

Wall Street Horizon

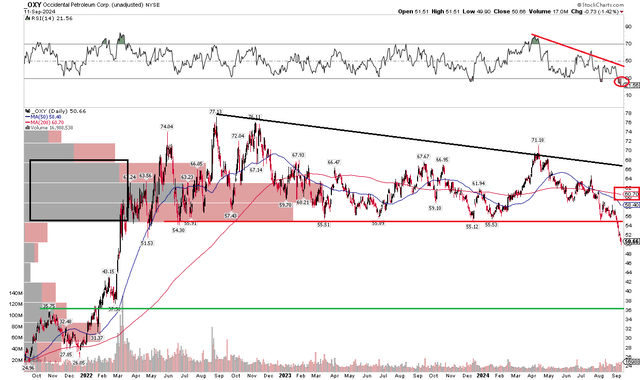

The Technical Take

With shares close to 20% undervalued and oil prices skidding along 2024 lows, OXY’s technical situation is poor. Notice in the chart below that shares broke below key support I pointed out back in February. Sticking with my conclusions then, a bearish measured move downside price target to near $42 is in play based on the height of the previous trading range. That may have shifted slightly with further chart developments in the past 7 months, but it’s clear that former support at $55 is now resistance.

Also take a look at the volume by price indicator on the left side of the graph – there’s significant overhead supply up to the mid-$60s while the RSI momentum gauge at the top of the chart illustrates just how bad momentum is today. I also see possible support way down in the $36 to $37 range. That would be a massive drop, likely coinciding with a global recession and oil prices plunging below $50/bbl. With a falling long-term 200-day moving average, the bears clearly control the primary trend.

Overall, with resistance at $55 and support perhaps in the low $40s, the technical situation is very weak today.

OXY: Bearish Technical Breakdown, $55 Resistance

Stockcharts.com

The Bottom Line

I have a buy rating on OXY. While the chart is bearish, I see fundamental value in the stock given where its earnings and cash-flow-based fundamentals are. With EPS upside to come, the stock is clearly out of favor, which could set up well if some bullish headlines unfold.

Read the full article here