A Quick Take On Perficient

Perficient, Inc. (NASDAQ:PRFT) provides a wide range of consulting, technology, IT, and outsourcing services to clients in the U.S. and internationally.

Given the general uncertainty and discretionary project softness in the IT consulting space in general, I’m cautious about management’s ability to deliver on its growth targets, which are already much lower than 2022’s growth rate.

As a result, my outlook on PRFT is Neutral [Hold] for the near term.

Perficient Overview

St. Louis, Missouri-based Perficient, Inc. was founded in 1999 to provide digital strategy, transformation and software design and implementation services to companies across major industry verticals and functional areas.

The firm is headed by Chairman and CEO Jeff Davis, who joined the company in 2001 as COO and was previously COO of Vertecon and a senior manager at Arthur Anderson’s Business Consulting Practice.

The company’s primary offerings include the following:

-

Strategy and transformation

-

Customer experience and digital marketing

-

Product development and innovation.

The firm acquires customers through its direct sales, marketing, and business development teams as well as through partner referrals.

Perficient’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth in IT consulting are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also expected growth in the number of industries adopting digital transformation strategies, such as manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

IT consulting firms can also leverage their expertise to help companies develop and maintain new or better business models which are better suited to the digital world. Many organizations are turning to IT consulting firms to help them align their digital transformation strategies with their business objectives. This can help companies better leverage technology to improve customer engagement, boost collaboration, and reduce costs.

Also, the COVID-19 pandemic likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

The growth of IT consulting is expected to continue due to the evolving digital landscape, increased demand for improved customer experience, the need to develop and maintain new or better business models, and the accelerated demand for modernization due to the pandemic.

Major competitive or other industry participants include:

-

Globant

-

Thoughtworks

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts.

Perficient’s Recent Financial Trends

-

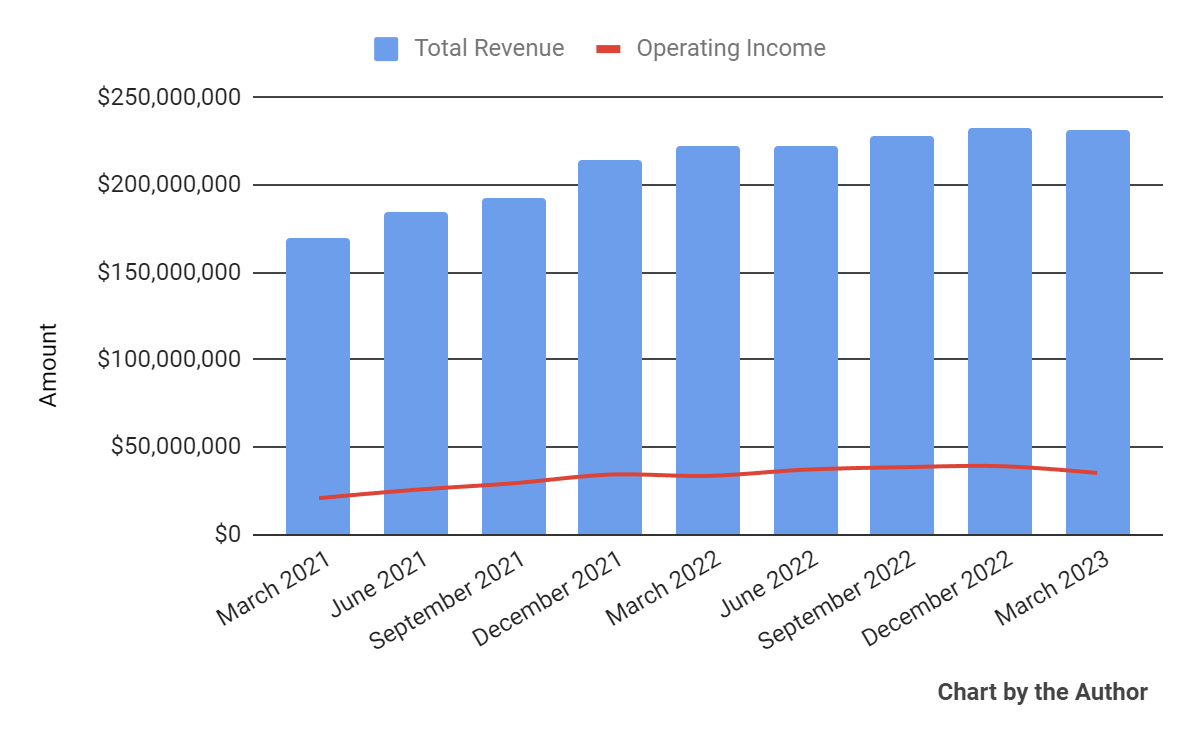

Total revenue by quarter has flattened in recent quarters; Operating income by quarter has dropped sequentially in Q1 2023.

Total Revenue and Operating Income (Seeking Alpha)

-

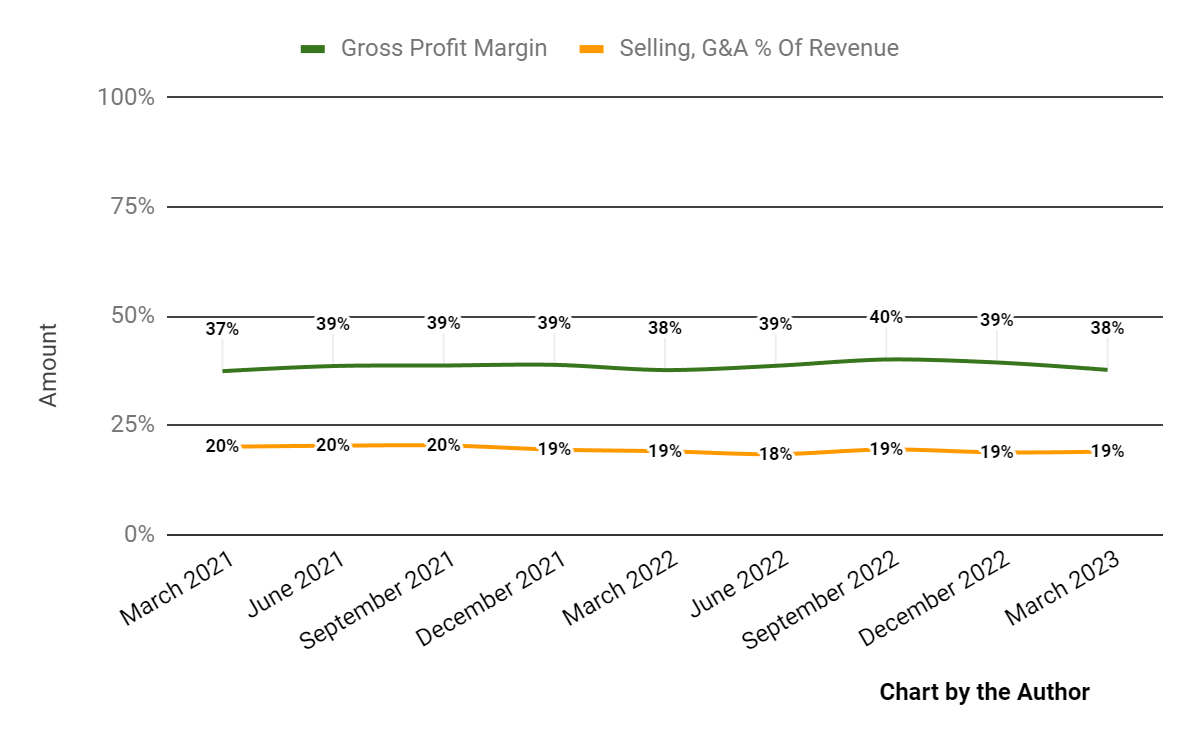

Gross profit margin by quarter has trended higher in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have remained stable more recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

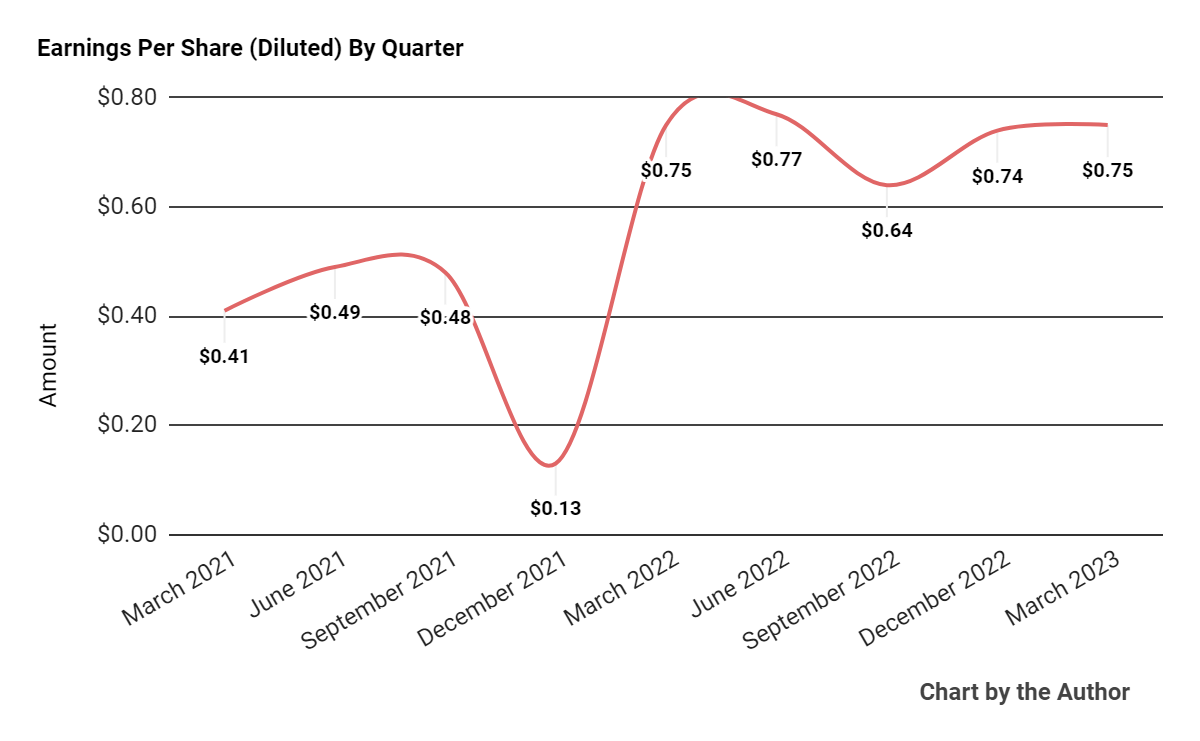

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

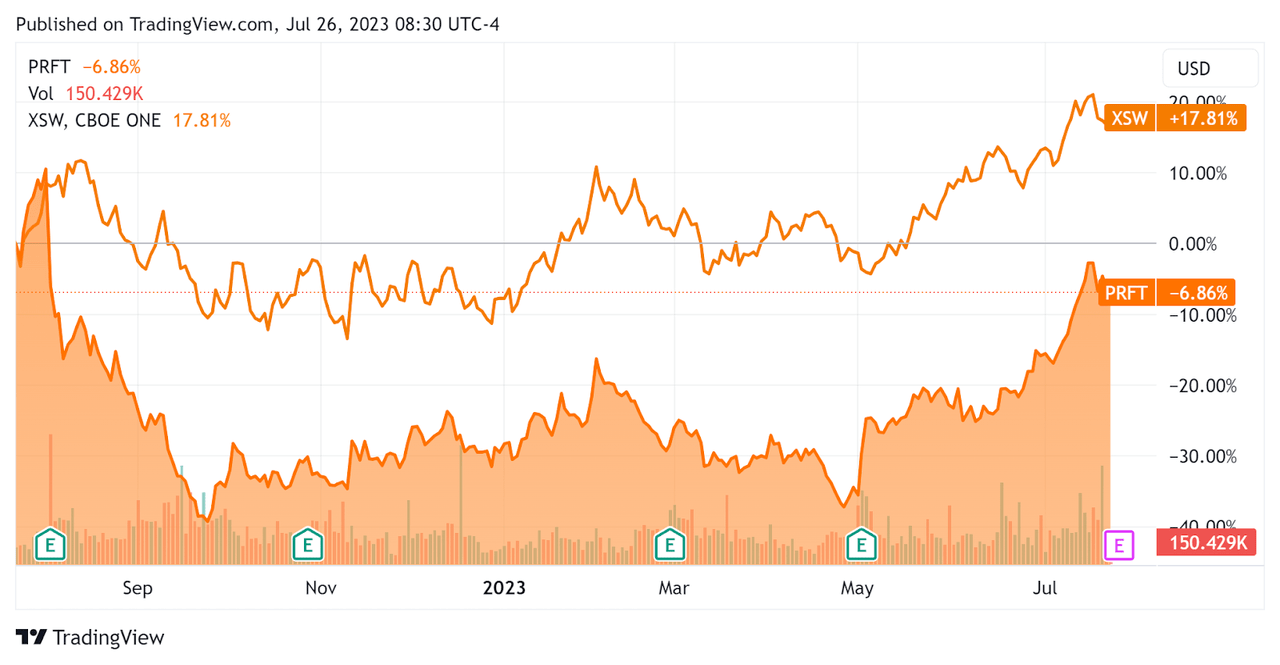

In the past 12 months, PFRT’s stock price has fallen 6.86% vs. that of the SPDR S&P Software & Services ETF (XSW) rise of 17.81%, so the stock has underperformed the index, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $41.0 million in cash and equivalents and $395.2 million in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $140.7 million, during which capital expenditures were $7.5 million. The company paid $25.0 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Perficient

Below is a table of relevant capitalization and valuation figures for the company.

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

4.0 |

|

Enterprise Value / EBITDA |

20.1 |

|

Price / Sales |

3.8 |

|

Revenue Growth Rate |

12.4% |

|

Net Income Margin |

11.4% |

|

EBITDA % |

20.0% |

|

Net Debt To Annual EBITDA |

1.9 |

|

Market Capitalization |

$3,290,000,000 |

|

Enterprise Value |

$3,670,000,000 |

|

Operating Cash Flow |

$148,220,000 |

|

Earnings Per Share (Fully Diluted) |

$2.90 |

(Source – Seeking Alpha.)

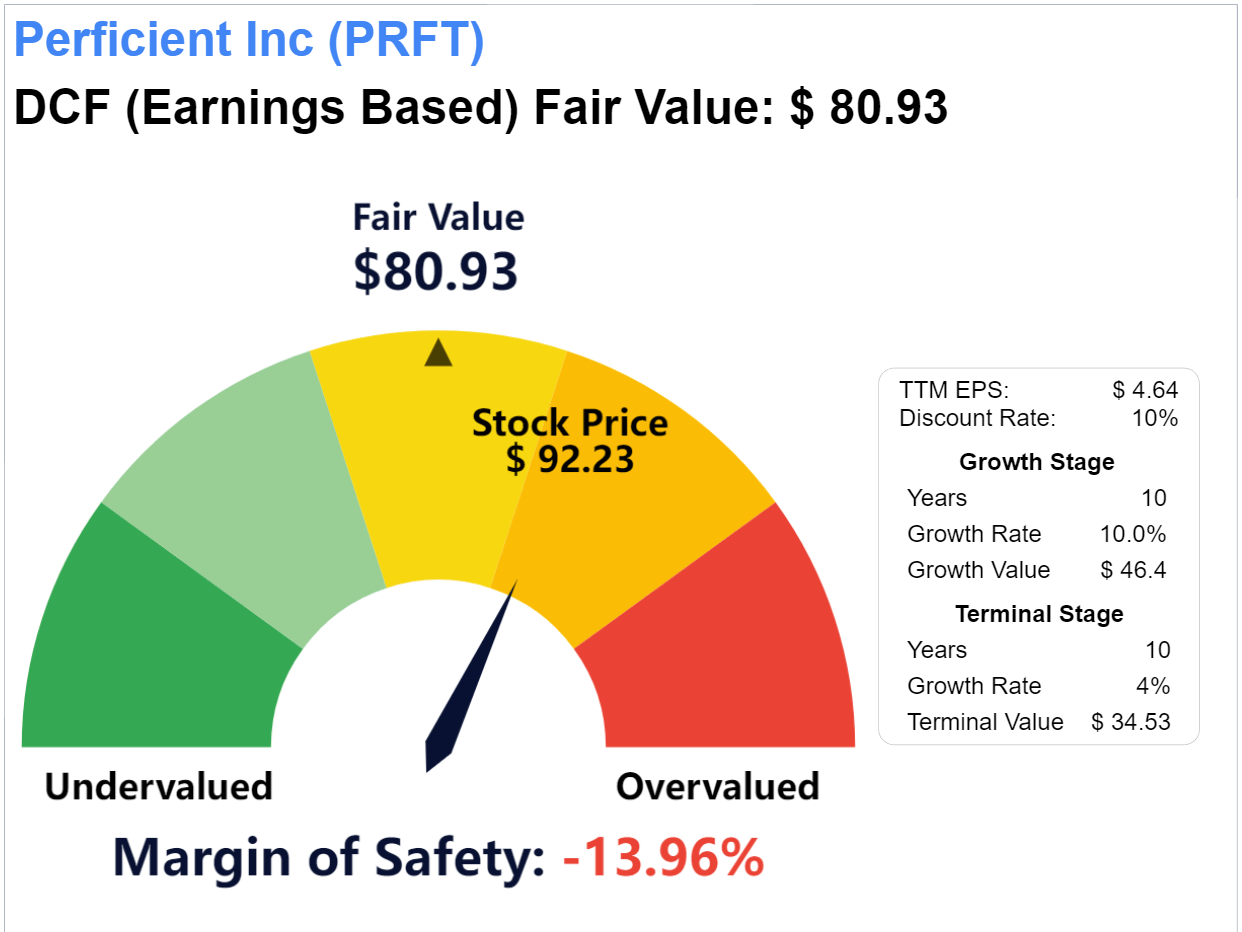

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings.

Discounted Cash Flow Calculation – PRFT (Guru Focus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $80.93 versus the current price of $92.23, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

As a reference, a relevant partial public comparable would be EPAM Systems, Inc. (EPAM); shown below is a comparison of their primary valuation metrics.

|

Metric [TTM] |

EPAM Systems |

Perficient |

Variance |

|

Enterprise Value / Sales |

2.5 |

4.0 |

61.4% |

|

Enterprise Value / EBITDA |

16.8 |

20.1 |

19.1% |

|

Revenue Growth Rate |

17.2% |

12.4% |

-28.3% |

|

Net Income Margin |

8.9% |

11.4% |

28.2% |

|

Operating Cash Flow |

$603,290,000 |

$148,220,000 |

-75.4% |

(Source – Seeking Alpha.)

Commentary On Perficient

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the firm’s bookings as ‘the strongest bookings quarter in our history with organic bookings up double digits.’

As a result of this bookings growth, management expects a more robust second half of 2023 as these projects begin their work phase.

Leadership also continues to pursue its M&A strategy, but the team continues to watch private valuations drop into more reasonable territory while it makes progress on integrating its existing acquisition activities.

Management didn’t disclose any company, customer, or employee retention rate metrics or characterize them in any way.

Total revenue for Q1 2023 was 4.2% higher year-over-year and gross profit margin was unchanged.

Selling, G&A expenses as a percentage of revenue slid by only 0.1% YoY while operating income rose by 5.1%.

The company’s financial position is moderate, with smallish liquidity against significant long-term debt and impressive free cash flow generation.

Looking ahead, management guided 2023 topline revenue growth to 6.6% YoY.

If achieved, this would represent a significant deceleration from the 18.94% YoY growth in 2022 versus 2021.

This growth rate drop is common among consulting firms as they come off a robust environment in 2022 to a more cautious outlook in 2023.

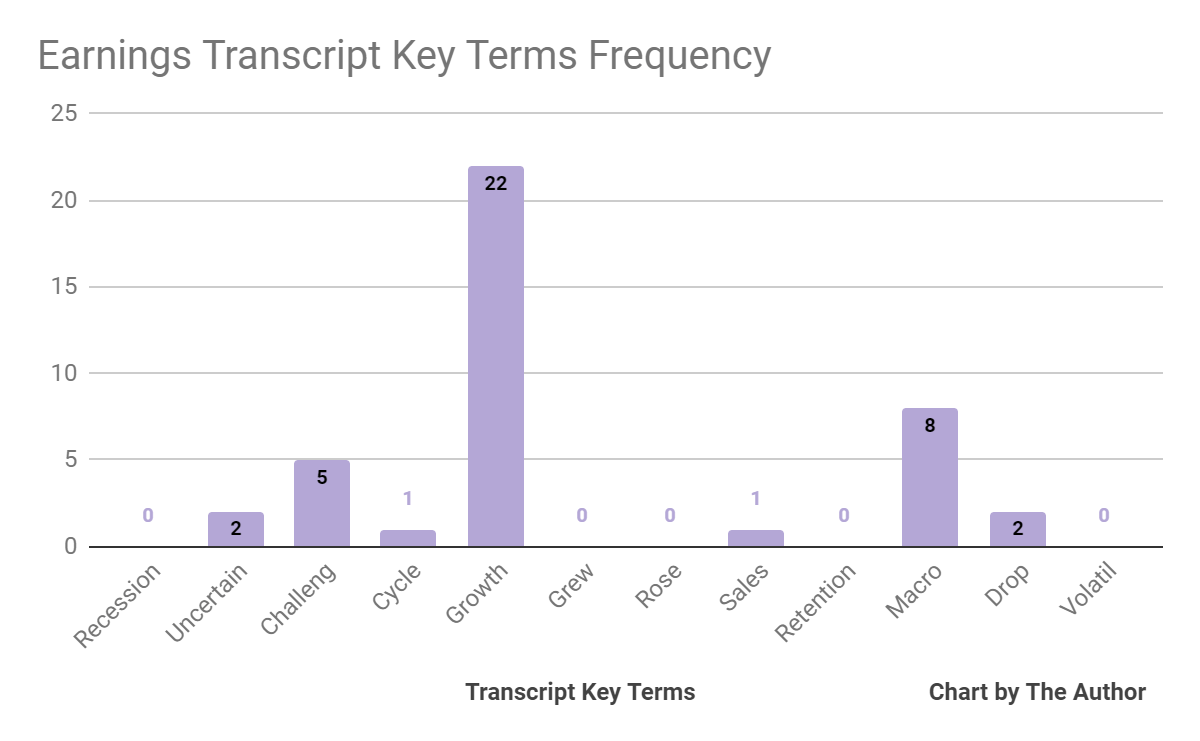

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” two times, “Challeng[es][ing]” five times, “Macro” eight times and “Drop” twice.

Analysts questioned company leadership about uncertainty in the macro environment and the effect on projects and management responded by noting a more ‘conservative’ approach by clients.

Also, it typically takes two quarters from bookings to begin to see delivery begin to show up in revenue, so the firm should see a more meaningful change in revenue in the second half of 2023 unless project delays, deferrals or cancellations pick up.

Regarding valuation, my discounted cash flow calculation above suggests the stock may be fully or overvalued at current levels.

Given the general uncertainty and discretionary project demand softness in the IT consulting space in general, I’m cautious about Perficient, Inc. management’s ability to deliver on its growth targets, which are already much lower than 2022’s growth rate.

As a result, my outlook on PRFT is Neutral [Hold] for the near term.

Read the full article here