Earnings of Southside Bancshares, Inc. (NASDAQ:SBSI) will most probably dip this year because of pressure on the margin from changes in the deposit mix. Further, higher operating expenses will drag earnings. Overall, I’m expecting Southside Bancshares to report earnings of $3.11 per share for 2023, down 5% year-over-year. The current market price is above the year-end target price. Based on the total expected return and the low-risk level, I’m maintaining a hold rating on Southside Bancshares stock.

Further Margin Contraction Likely Because of Deposit Migration

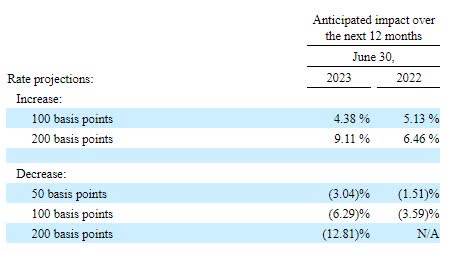

The results of the management’s rate sensitivity analysis given in the 10-Q Filing show that theoretically, a 200-basis points hike in rates could increase the net interest income by a hefty 9.11% over twelve months. However, the empirical results are quite different. The net interest margin shrank by 19 basis points in the first quarter and four basis points in the second quarter even as the average fed funds rate rose by 87 basis points in the first quarter and 42 basis points in the second quarter of the year.

2Q 2023 10-Q Filing

The reason why the actual results were so different from the simulation was that the balance sheet composition significantly deteriorated during the last few quarters. The proportion of non-interest-bearing deposits in total deposits shrank to 24.0% by the end of June from 27.0% at the end of December 2022. Additionally, costly borrowings increased from $533 million at the end of December 2022 to $855 million at the end of June 2023.

Fortunately, the asset mix improved this year. Loans, which are among the highest-yielding assets, rose to 70% of deposits by the end of June 2023 from 66% at the end of December 2022.

Going forward, the deposit mix will likely continue to deteriorate because rising interest rates will increase the incentive to move funds toward higher-rate accounts. Further, depositors will want to lock in high rates through time deposits ahead of expected rate cuts next year. However, there is no guarantee that the asset mix will continue to improve in upcoming quarters.

Considering all of the above factors, I’ve decided to incorporate a ten basis points dip in the margin for the remainder of 2023. In my last report on the company, which was issued before the first quarter’s results, I projected the margin to remain unchanged this year. I’m now expecting a 33 basis points fall for the year.

Local Economy to Drive Commercial Real Estate Loan Growth

Loan growth rebounded in the second quarter after a lackluster performance in the first quarter of 2023. Most of the second quarter’s growth was attributable to the commercial real estate segment, as can be deduced from information given in the earnings release. Commercial real estate is an important focus area for Southside Bancshares as it makes up around half of total loans.

Meanwhile, the size of the 1-4 family residential loan segment remained flattish. This segment will likely continue to underperform in the coming quarters because it is sensitive to borrowing costs.

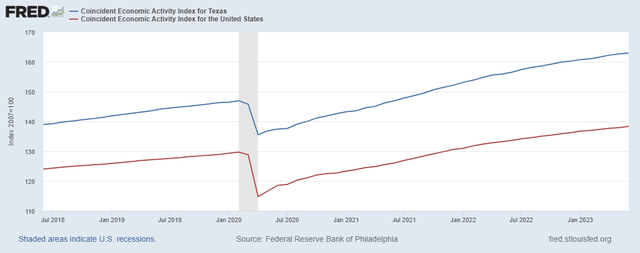

Apart from the residential loan segment, the outlook for loans remains positive. Southside Bancshares operates mostly in Texas; therefore, the state’s health is a key driver of the company’s credit products’ demand. The chart below shows Texas’ economic activity index in comparison with the US economic activity index. The distance between the two trendlines has widened, which means the state’s economic activity is better than the national average.

The Federal Reserve Bank of Philadelphia

Overall, I’m expecting the loan portfolio to grow by 1.0% in each of the last two quarters of 2023, leading to full-year growth of 6.5%. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 3,286 | 3,543 | 3,609 | 3,610 | 4,111 | 4,379 |

| Growth of Net Loans | 0.4% | 7.8% | 1.8% | 0.0% | 13.9% | 6.5% |

| Other Earning Assets | 2,164 | 2,588 | 2,733 | 2,994 | 2,720 | 2,790 |

| Deposits | 4,425 | 4,703 | 4,932 | 5,722 | 6,198 | 6,241 |

| Borrowings and Sub-Debt | 915 | 1,160 | 1,113 | 543 | 533 | 863 |

| Common equity | 731 | 805 | 875 | 912 | 746 | 787 |

| Book Value Per Share ($) | 20.8 | 23.7 | 26.3 | 27.9 | 23.1 | 25.6 |

| Tangible BVPS ($) | 14.6 | 17.4 | 20.0 | 21.5 | 16.8 | 18.9 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Reducing my Earnings Estimate

Earnings of Southside Bancshares will likely dip this year because of pressure on the margin which will counter loan growth. Further, earnings will suffer from higher operating expenses. The above-average inflation will likely keep the growth of non-interest expenses, especially salary expenses, above normal this year.

Overall, I’m expecting Southside Bancshares to report earnings of $3.11 per share in 2023, down 4.6% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 172 | 170 | 187 | 190 | 212 | 213 |

| Provision for loan losses | 8 | 5 | 20 | (17) | 3 | 2 |

| Non-interest income | 41 | 42 | 50 | 49 | 41 | 44 |

| Non-interest expense | 120 | 119 | 123 | 125 | 130 | 142 |

| Net income – Common Sh. | 74 | 75 | 82 | 113 | 105 | 95 |

| EPS – Diluted ($) | 2.11 | 2.20 | 2.47 | 3.47 | 3.26 | 3.11 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

In my last report, I estimated earnings of $3.38 per share for 2023. I’ve reduced my earnings estimate as I’ve decided to decrease my margin estimate.

Risks Appear Low

Although Southside Bancshares has a rather large Available-for-Sale securities portfolio, the unrealized mark-to-market losses on it aren’t too high. These losses totaled $70.8 million at the end of June 2023, which is 9% of the total equity balance. As the stock’s market capitalization has dipped by around 8% year-to-date and 16% over twelve months, 9% of equity book value isn’t a big deal.

The deposit book’s risk level also seems manageable. Uninsured deposits were 21.4% of total deposits at the end of June 2023, which isn’t too bad. Further, asset quality is also good as non-performing assets were just 0.04% of total assets at the end of the last quarter.

Total Expected Return is Negative

Southside Bancshares is offering a dividend yield of 4.3% at the current quarterly dividend rate of $0.35 per share and an annual special dividend of $0.04 per share. The earnings and dividend estimates (including the special dividend) suggest a payout ratio of 47% for 2023, which is close to the five-year average of 50%. Therefore, there is no threat to the dividend payout despite my earnings outlook.

I’m using the peer average price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Southside Bancshares. Peers are trading at an average P/TB ratio of 1.2 and an average P/E ratio of 9.7, as shown below.

| SBSI | LBAI | OBK | PEBO | BHLB | BRKL | Peer Average | |

| P/E (“ttm”) | 9.9 | 9.9 | 10.8 | 8.2 | 10.0 | 9.8 | 9.7 |

| P/B (“ttm”) | 1.33 | 0.90 | 1.01 | 0.98 | 1.01 | 0.82 | 0.9 |

| P/TB (“ttm”) | 1.81 | 1.20 | 1.22 | 1.67 | 1.04 | 1.06 | 1.2 |

| Source: Seeking Alpha | |||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $18.9 gives a target price of $23.4 for the end of 2023. This price target implies a 29.4% downside from the July 28 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.04x | 1.14x | 1.24x | 1.34x | 1.44x |

| TBVPS – Dec 2023 ($) | 18.9 | 18.9 | 18.9 | 18.9 | 18.9 |

| Target Price ($) | 19.6 | 21.5 | 23.4 | 25.3 | 27.2 |

| Market Price ($) | 33.2 | 33.2 | 33.2 | 33.2 | 33.2 |

| Upside/(Downside) | (40.8)% | (35.1)% | (29.4)% | (23.7)% | (18.0)% |

| Source: Author’s Estimates |

Multiplying the average P/E multiple with the forecast earnings per share of $3.11 gives a target price of $30.2 for the end of 2023. This price target implies a 9.0% downside from the July 28 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.7x | 8.7x | 9.7x | 10.7x | 11.7x |

| EPS 2023 ($) | 3.11 | 3.11 | 3.11 | 3.11 | 3.11 |

| Target Price ($) | 24.0 | 27.1 | 30.2 | 33.3 | 36.4 |

| Market Price ($) | 33.2 | 33.2 | 33.2 | 33.2 | 33.2 |

| Upside/(Downside) | (27.7)% | (18.3)% | (9.0)% | 0.4% | 9.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $26.8, which implies a 19.2% downside from the current market price. Adding the forward dividend yield gives a total expected return of negative 14.9%. Considering the total expected return and the low-risk level, I’m maintaining a hold rating on Southside Bancshares.

Read the full article here