The InfraCap REIT Preferred ETF (NYSEARCA:PFFR) is a passive index fund, which tracks the performance of preferred shares issued by the U.S. REITs.

The overall characteristics of PFFR resemble conventional ETF setup, where there is a significant diversification across the board that is bound by specifically targeted factors – i.e., U.S. REITs and preferred shares.

Virtus Exchange-Traded Funds

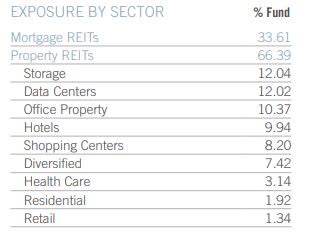

Currently, PFFR has allocated one third of the total AuM into the mortgage REIT preferred shares, with the remaining part placed in the U.S. equity REIT segment. The latter segment is then diversified further by nine different REIT sector exposures. On a Top 10 level, there is also no signs of single-security concentration risk, where the largest holding accounts roughly for 2.5% of the total AuM.

The only area of concern in terms of the potentially unfavourable concentration risk is the mortgage REIT segment, which constitutes a notable part of the portfolio and is inherently a rather volatile exposure.

Ycharts

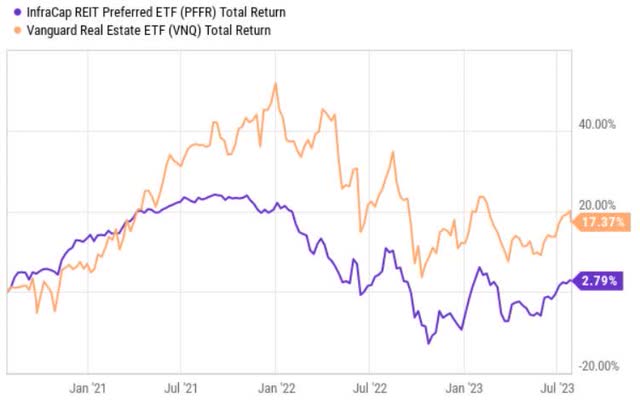

Looking at the past 3-year performance, we can clearly see that PFFR has underperformed the broader REIT market – Vanguard Real Estate ETF (NYSEARCA:VNQ).

Ycharts

Yet, if we compare the performance of PFFR to that of the iShares Preferred and Income Securities ETF (NASDAQ:PFF), the results of PFFR are in line with ‘preferred segment’ average.

Now, the key explanation why there is such a gap between PFFR and VNQ lies in the underlying dynamics of preferred shares, which carry risk and return profile that is somewhere in the middle between equity and bonds.

These ‘quasi bond / equity’ characteristics have inflicted a notable damage on the total return performance, where the juicy dividend yields of typical preferred instruments have not offset the effects of price depreciation.

Given that PFFR allocates its proceeds only into preferreds, the interest rate factor becomes extremely dominant. And in the context of drastically higher Fed Funds rate and still some uncertainty pertaining to the incremental hikes, it is obvious why there has been such an underperformance relative to the VNQ, which, inherently, embodies less of an interest rate risk exposure.

Finally, the significance of interest rate factor that is embedded in PFFR can be confirmed by comparing the performance of PFFR to PFF, which tracks the overall U.S. preferred share space. Namely, despite the fact that PFFR is heavily skewed towards the REIT component (or commercial real estate), the returns have been very similar to the PFF, which is structured on a sector agnostic manner.

This just speaks of the fact that when we think of preferred share instruments or funds that are sufficiently diversified (i.e., without too heavy reliance on single stocks or junk categories), the interest rate factor dominates the other auxiliary features.

Thesis

In my opinion, there are two elements offered by PFFR that the investors should at least consider in their investment allocation process.

First is the combination of juicy yield and defensive conditions.

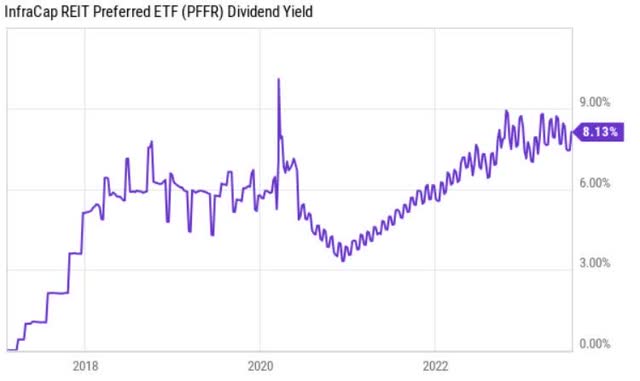

Currently, PFFR yields just over 8.1%, which compared to 4.4% offered by VNQ and 6.8% by PFF result in a rather attractive spread. Also, looking deeper into the overall REIT space, there are very rare opportunities, where investors can enter 8.1% yielding REIT exposure on an unleveraged and defensive basis.

Granted, there are some REIT names, which yield close or even above 8%, but in almost all cases this comes with an elevated risk stemming from relatively weak balance sheets or struggling cash generation.

Ycharts

Moreover, from the historical perspective, the prevailing yield offered by PFFR is hovering around the all time highs, which sends a comforting signal of an attractive entry point.

Now, an additional aspect to keep in mind about this high-yielding play is the underlying financial dynamics of the PFFR’s instruments.

Since the preferred shares are placed above the equity in the capital structure, it is automatically less likely to experience a dividend cut. In other words, if a company falls in a situation, where it struggles to keep the dividend payments running, the equity holders will be first in the line, who will suffer from decreased cash distributions. Only after the equity holders receive no cash and if there is still a need to cut back on distributions, the preferred shareholders would be impacted.

Moreover, many preferred shares are structured with a cumulative component, which means that the preferred shareholders have to receive the previously cut dividends until equity holders can access any dividends.

And second aspect, which renders PFFR an interest opportunity is the aforementioned exposure to the interest rate factor.

Ycharts

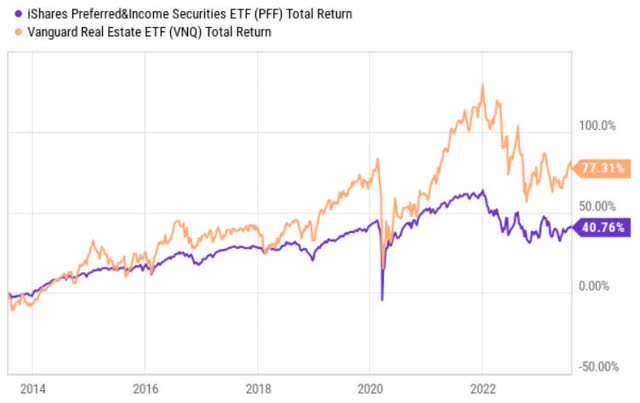

As described above, the PFFR and the overall preferred instrument segment have considerably underperformed REITs and obviously the S&P 500 as well. The key reasons for this divergence has been the increased levels of interest rates to which preferred shares tend to respond in a magnified manner.

Now, the opposite directionality of interest rates should provide notable tailwinds for a significant bounce back in the PFFR’s price. In this case, the PFFR would not only generate returns from the 8% yield, but also from a strong capital appreciation aspect, primarily via duration aspect.

Considering the recent hike, commentary by the Fed and looking at how the market has been pricing the trajectory of future interest rate curve, it seems that the probability of experiencing decreased interest rates in the foreseeable future is becoming more material. I consider these dynamics comforting at least from the downside risk angle – if we do not see falling interest rates, then at least the odds of having incremental rate hikes seem very low.

Lastly, the ~10 year graph (VNQ vs PFF; no reflection of PFFR due to relatively recent inception date) depicted above reveal an interesting pattern, where equity REITs have significantly diverged from the preferred segment. The historical discount is again mostly attributable to the interest rate factor, which has depressed preferred stocks. In case of even slightest cut, we should expect a closure of the prevailing gap.

Bottom line

In my humble opinion, PFFR is a buy for investors, who seek abnormal yield in 8% territory that is backed with robust fundamentals, where the probability of dividend cut is extremely limited. Plus, PFFR should be considered by investors, who believe in gradual normalization of interest rates, which in that case should provide a major boost for the PFFR’s price.

Read the full article here