Introduction

T. Rowe (NASDAQ:TROW) reported its results for the second quarter of 2023 on July 28th. The company saw its share price surge by over 8% that day as investors were thrilled with its performance. The company managed to show a sales increase of 6.6% as it beat the estimates for both the top and the bottom line. A few months ago, I wrote that, in my opinion, T. Rowe is a HOLD, and that report offers an opportunity to revisit my thesis.

According to Seeking Alpha’s company overview:

T. Rowe Price Group provides investment management services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed-income mutual funds. The firm invests in public equity and fixed-income markets across the globe. It employs fundamental and quantitative analysis with a bottom-up approach. The firm utilizes in-house and external research to make its investments. It uses socially responsible investing focusing on environmental, social, and governance issues. It makes investments in late-stage venture capital transactions and usually invests between $3 million and $5 million.

The Basic Thesis

When I analyzed T. Rowe, I found it to have excellent fundamentals with a long track record of top and bottom-line growth supporting dividend growth for over thirty years. I love the expansion potential to new products and geographies and its ability to beat the market in many of its leading funds. I found the opportunities attractive in their ability to push the company forward in the medium and long term.

However, I also had two main risks that I believe T. Rowe will face in the foreseeable future. First, its dependency on the markets is significant, and every downturn or recession may make that risk materialize. Second, the company has to deal with the growing passive investing trend. Investors are not as likely as they were to buy expensive products with high fees, and we see it as passive investor managers such as Blackrock and Vanguard are growing.

So what has changed for T. Rowe Price in Q2?

Not much has changed. I believe the surge in the share price was mainly because investors were expecting the results to be worse. The main positive news was the company’s ability to show growth in sales. However, the base analysis stays intact as we examine the company’s quarterly results.

The main points that investors should remember:

While equity outflows continued in the second quarter, we saw improved performance in a number of important investment strategies. Stronger equity markets helped lift revenue from first-quarter levels, and we identified substantial cost savings that will allow us to meaningfully slow expense growth while continuing to pursue our strategic initiatives.

Despite these gains, organic growth remains under pressure. As we reported, net outflows for the second quarter were $20 billion. The sales and redemption patterns that we saw in the first quarter largely continued in the second. U.S. equity outflows were primarily driven by U.S. large-cap growth strategies as market demand remained muted and we saw the lagging impact of past investment performance on sales and redemptions. International and global outflows slowed with improved market demand and better performance.

(Rob Sharps – Chief Executive Officer and President)

As Rob mentioned, we posted $20 billion in net outflows for the quarter. Across the entire complex, we continue to see clients taking longer to make decisions based on current market volatility, which is resulting in lower sales and net inflows than we’ve seen in prior years. Industry-wide, active equity, and fixed-income fund flows have been muted for over a year.

(Rob Sharps – Chief Executive Officer and President)

How does it compare to the base thesis?

First, let’s look at the risks. The company is still struggling with both risks. The uncertainty when it comes to the business environment is hindering its ability to grow sales. Clients are more hesitant, as Rob Sharps, its CEO, mentioned. Therefore, even before we see an actual recession, we see that the company struggles to grow its client base. If and when a recession comes, I think it will be much more brutal as clients who are already worried may exit quickly.

The second risk is the rise of passive investment strategies. T. Rowe suffered from outflows in Q1 ($16B) and Q2 (an additional $20B). When we look at Blackrock, one of the leading money managers in the passive investment realm, we see that in Q1, they had inflows of $110B and an additional $80B in Q2. Therefore, while active managers like T. Rowe struggle, passive managers have managed to attract more clients.

When we look at future opportunities, I believe the company will struggle to grow its product line and grow abroad while its core is a mess. The company must first ensure that it keeps beating the market to keep attracting new clients. As long as it cannot keep its clients, let alone attract new ones to the traditional funds in the United States, its ability to grow beyond the U.S. and traditional funds is limited.

When we look at the fundamentals, they haven’t changed much in my view. The consensus of analysts, as seen on Seeking Alpha, still sees declining top and bottom lines in 2023, and the increases in 2024 and 2025 will only be enough to cover the sales decline, but the EPS will still be lower than in 2022. Therefore, while the fundamentals are solid, it will take some time before the company can reach its prior highs.

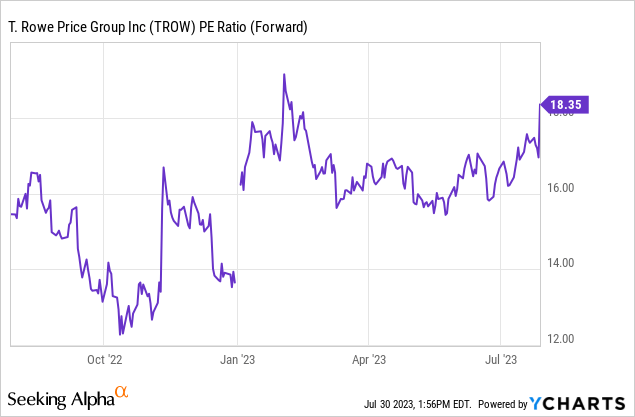

The growth in the assets under management, the AUM, is linked with the strong performance of the markets in Q2. Therefore, the company increased sales despite higher expenses and net outflows. It didn’t stop the investors, and as the share price surged, so did the P/E ratio. Right now, the P/E ratio is 18.35 based on the estimates for 2023, and it’s higher than the P/E back in April when I wrote about the company. Thus, in valuation terms, the shares are less attractive.

Conclusions

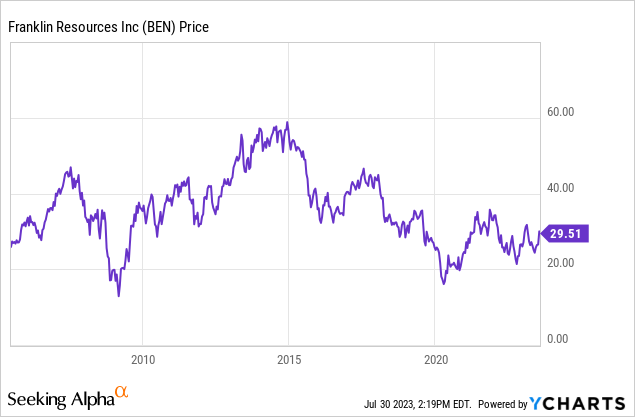

In my opinion, the company has to return to its growth path to be a BUY. While the company still faces challenges to grow, the risks are still intact, and the valuation is higher, T. Rowe stays a HOLD for me. I am always afraid that without a path to organic growth, we may see a similar case to Franklin Resources (BEN), where the share price today is at the same point as before the financial crisis of 2008.

So let’s examine the fundamentals, valuation, opportunities, and risks.

Fundamentals– improved

Valuation– Worse

Opportunities– harder to achieve with the core being unstable due to outflows

Risks– higher chances for materialization as passive income is prominent and attracts new investors, and the risk of recession is still here

I would need to change my rating to BUY in the following scenario. The company stabilizes its flows and achieve positive inflows. That will allow the company to show investors that it is ready to expand and pursue its opportunities. With a P/E ratio of 16-17 and positive inflows in a less uncertain business environment, T. Rowe would be a BUY. I will keep following the stock in the coming quarters.

Read the full article here