The president of the Atlanta Federal Reserve said a “significant” slowdown in inflation gives the central bank scope to leave interest rates unchanged in September and keep the Fed on hold until next year.

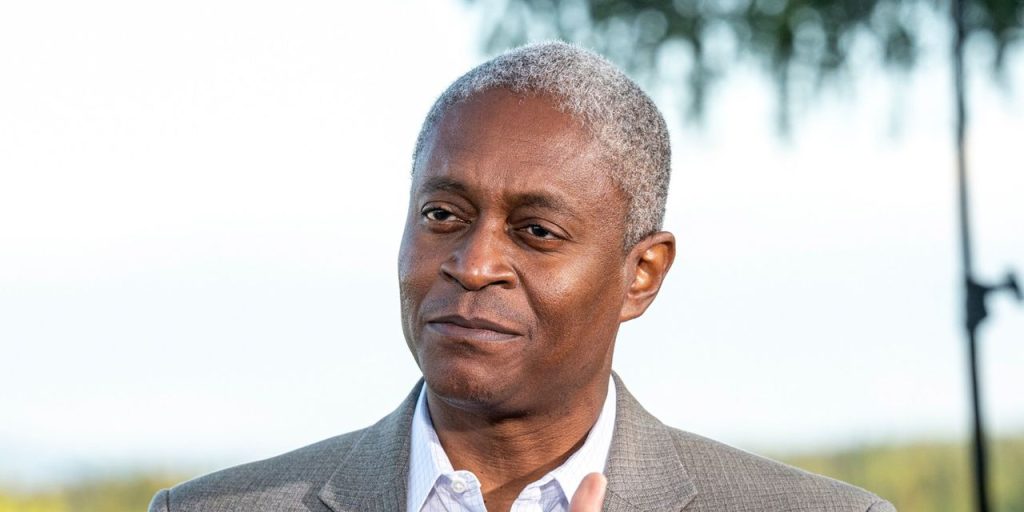

Raphael Bostic on Tuesday said there’s a growing risk the Fed could overdo it by continuing to raise rates, potentially damaging the economy unnecessarily. He made his remarks in a Zoom roundtable with reporters.

The Fed last week raised a key short-term interest rate for the 11th time in less than a year in a half. That brought the rate up to a top end of 5.5% from near zero in the spring of 2022.

The central bank has been trying to slow inflation without tipping the economy into a recession. Higher borrowing costs typically depress economic growth.

The economy has remained fairly strong, however, despite higher rates and inflation has eased considerably. The rate of inflation slowed to 3% in June from a 40-year high of 9.1% last year, based on the consumer price index.

Other measures show inflation somewhat stickier in the 4%-plus range, more than double the Fed’s 2% target.

Bostic said the Fed would keep rates high and probably not cut them at least until the second half of 2024. A period of higher rates is needed, he said, to make sure the rate of inflation slows toward 2%.

Bostic is not a voting member of the Feds interest-rate setting committee this year. He has been one of the leading voices at the Fed urging more caution now in light of the steep increase in interest rates.

Read the full article here