With almost very few exceptions, most tech stocks have enjoyed generous rebounds this year. And even though many stocks have wobbled even after meeting high expectations this earnings season, most are clinging onto double-digit returns.

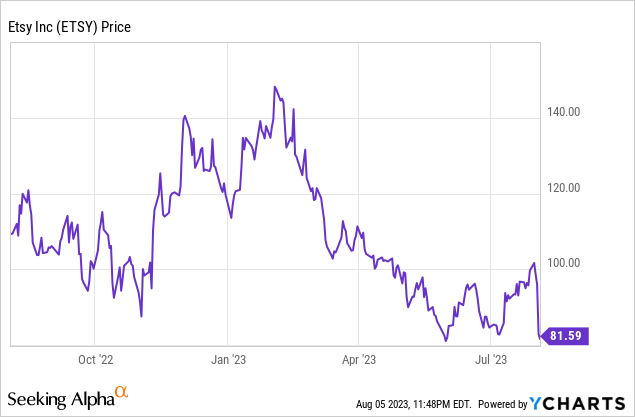

Etsy (NASDAQ:ETSY) is one notable exception. This crafts e-commerce company has suffered a ~30% YTD stumble, alongside general malaise in the retail and e-commerce industries. Losses stiffened after Etsy reported dismal Q2 results, and the stock has dropped ~20% post-earnings.

This is a juncture at which many investors may be considering buying the dip in Etsy. Though I maintain some caution on this name, I am upgrading my viewpoint on Etsy to neutral owing to its sharp drop amid signs of stabilizing GMV trends. Ultimately, while I think Etsy’s long-term appeal is rather limited given it has likely exceeded the bounds of its niche, in the short term Etsy can make up lost ground from a valuation perspective, especially as its adjusted EBITDA is holding up amid pressured top-line trends.

I now see a balanced bull and bear case for Etsy. Some of the key red flags remain very real risks:

- Etsy’s niche was popular during the pandemic, but amid tighter spending conditions the company may lose share. Etsy was applauded during the pandemic for having Amazon-proof (AMZN) categories that were quite unique, including crafts and musical instruments. In this rockier spending environment, however, consumer wallets are shifting back toward big-box (or simply delaying purchases), which is pushing Etsy further into irrelevance.

- Category-specific approach shrinks overall market opportunity. eBay (EBAY) is trying a similar approach – knowing that its niche is dying, the company is focusing on auto parts and collectibles. Etsy’s focus on housewares and musical instruments also prevents the company from expanding its overall share.

- Out of one-time revenue drivers. Etsy has been able to mask its GMS weakness by implementing a seller fee increase as well as leaning into advertising in order to grow revenue. However, Etsy can’t perpetually raise fees (its seller base is already quite vocal about fee hikes) or continue loading its site with ads, which will make the buying experience clunkier.

At the same time, however, it’s not all bad news for Etsy. I see the following upside catalysts as well:

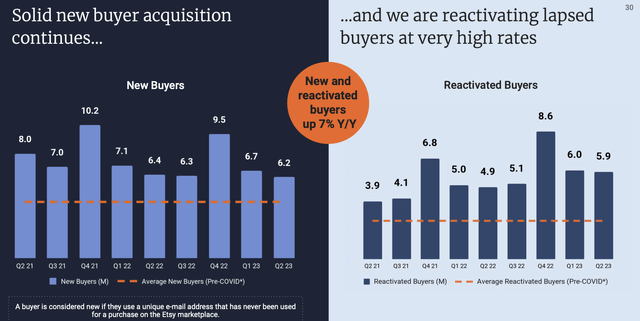

- New buyer trends still remain well above pre-pandemic levels. Though certainly a niche site, Etsy continues to draw a following, with ~6 million net-new active buyers added per quarter. Reactivated buyers are also high, allowing Etsy to shift the focus of its marketing spend to retention rather than new customer acquisitions.

- Seller fees are still below the competition. Though Etsy seller fee increases trigger immediate ire, it must be noted that Etsy’s 7.5% fee is still less than eBay, Amazon, and Poshmark. Fees for these sites vary by category, but generally average around ~10% or more of final sales prices.

From a valuation perspective, Etsy’s recent fall has also put the stock in more reasonable territory. At current share prices near $82, Etsy trades at a market cap of $10.06 billion. After we net off the $1.15 billion of cash and $2.28 billion of debt on Etsy’s most recent balance sheet, the company’s resulting enterprise value is $11.19 billion.

Meanwhile, for the next fiscal year FY24, Wall Street analysts are expecting Etsy to generate 10% y/y revenue growth to $3.02 billion (data from Yahoo Finance), and if we extrapolate out Etsy’s current ~27% adjusted EBITDA margin through next year, adjusted EBITDA would be roughly $815 million. This puts Etsy’s valuation multiples at:

- 3.7x EV/FY24 revenue

- 13.7x EV/FY24 adjusted EBITDA

Etsy is still a “show me” story – I don’t think the stock can rebound too quickly, but neither do I see Etsy materially falling from here. This stock is worth either putting on your watch list (buy with confidence below $70) or putting in a small stake now.

Q2 download

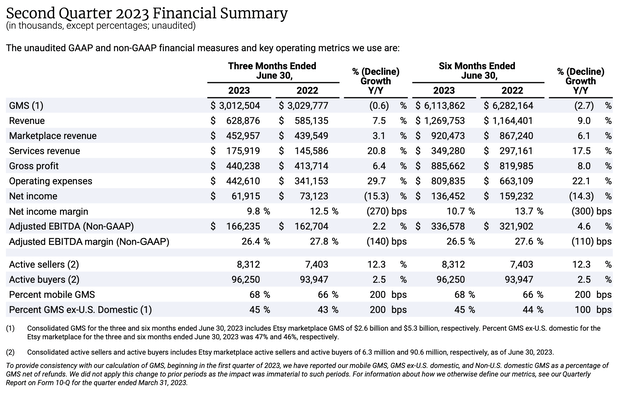

Let’s now go through Etsy’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Etsy Q2 earnings summary (Etsy Q2 shareholder letter)

For several quarters now, Etsy’s revenue has outpaced its GMS. Revenue grew 7.5% y/y to $628.9 million, ahead of Wall Street’s expectations of $617.5 million (+5.5% y/y). As a reminder, this is a function of Etsy’s fee increase to 7.5% implemented last April, and for which there is a partial comp this quarter. Take rates, as a result, are up to 21%. Etsy will lap this increase in Q3, and so revenue growth is set to decelerate (consensus is calling for 5.7% y/y growth in Q3).

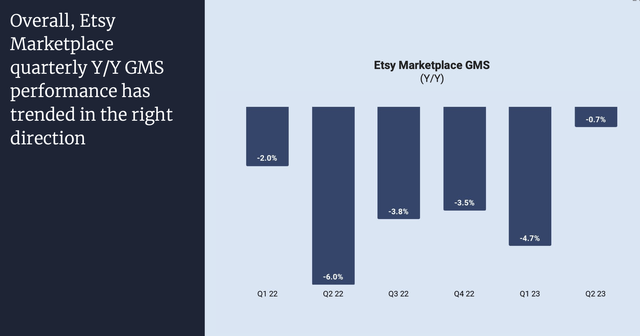

Underlying GMS, meanwhile, continues to deteriorate. GMS declined -0.7% y/y to $3.01 billion this quarter:

Etsy GMS trends (Etsy Q2 shareholder letter)

The pessimistic way of looking at this is that Etsy has suffered multiple quarters of decline since pandemic demand faded. The brighter side is that declines have been more muted than in the past several quarters (growth improved by 400bps), but that’s largely a function of lapping easier comps as well as softening FX headwinds which were a major drag to Q1 results.

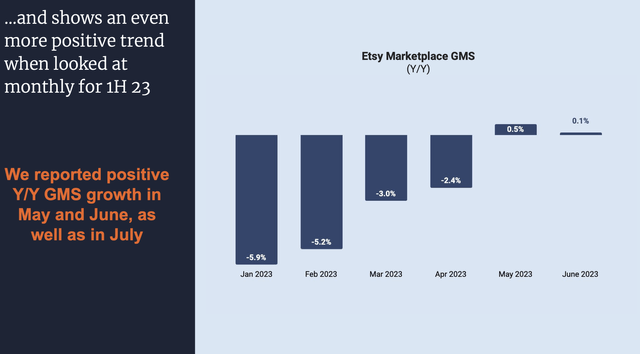

Do note that on a monthly trends basis, Etsy has seen improvement, flipping from a -2.4% decline in April to slightly positive GMS growth in May and June: though again, this is likely due to comps getting easier in the prior-year back half of Q2. And though not shown on the chart, Etsy also reported that July trends were marginally positive. Etsy is guiding to $2.95-$3.10 billion in GMS in the third quarter, which would indicate a relatively wide range of -2% to +3% growth.

Etsy monthly GMS (Etsy Q2 shareholder letter)

Etsy also hit an all-time high in terms of active buyers, up 3% y/y to 90.3 million total buyers. The company added 6.2 million net-new buyers in the quarter and reactivated 5.9 million lapsed ones – the sum of which was up 7% y/y, and remains well above pre-COVID levels.

Etsy active buyer adds (Etsy Q2 shareholder letter)

Here is some helpful anecdotal commentary from CFO Rachel Blazer’s remarks on the Q2 earnings call, detailing the categories and customer segments that exceeded expectations in the quarter:

We are pleased to report that year-over-year GMS trends improve sequentially in three of our top categories: home and living, apparel, and craft supplies, as shown on the left side of this slide. We also had year-over-year growth in horizontal categories such as gifts and personalized items with Etsy being a great mother’s and father’s day destination. We remain extremely excited about our long-term ability to gain market share in our top categories, as well as improve awareness of Etsy for specific purchase occasion where we have so much great and unique merchandise to offer.

The Etsy marketplace ended the second quarter with a new all-time high of 90.6 million active buyers, and our positive year-over-year growth rate accelerated sequentially to 3% from 1% in the first quarter. Growth in our non-U.S. active buyers continued to outpace trends in the U.S. as the majority of our active buyers are still in the U.S. We also continue to see strength in active buyers, who identify as men, which increased 8% year-over-year.”

From a profitability standpoint, Etsy’s adjusted EBITDA grew slightly on a nominal basis, up 2% y/y to $166.2 million, though adjusted EBITDA margins shed 140bps y/y to 26.4%. The margin deterioration was driven by heavier product development spend (+19% y/y), though the company is expecting adjusted EBITDA margins to improve to a 27-28% range in Q3.

Key takeaways

In my view, at least across the short-term horizon, I don’t see much risk or reward in Etsy shares. This may be a good stock to play short-term swings with, but given the long-term risk to fundamentals as more popular e-commerce sites crowd around Etsy, I wouldn’t think of this stock as a long-term buy and hold.

Read the full article here