Note: All amounts discussed are in Canadian dollars

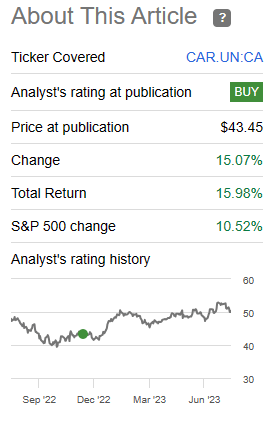

On our last coverage of Canadian Apartment Properties (TSX:CAR.UN:CA) (also known as CAPREIT) we continued to give it a buy and looked for a comeback story to materialize for this beaten down REIT. Specifically, we said:

But that will also make owning homes in Canada next to impossible. Apartment replacement costs should also rise as a result. CAPREIT will recycle capital accretively as well. We remain bullish on its prospects and think the longer-term cycle will play in its favor. We continue to own it and our covered calls (expiring in December) fortunately mitigated about half the decline so far. We rate it a buy and maintain our $64 price target.

Source: A Rarer Entry Point At 25% Below NAV

The stock turned out to be one of the unicorns that outperformed the AI-fueled S&P 500.

Seeking Alpha

We go over the Q2-2023 results and see if we can expect a similar performance for the next six months.

Q2-2023

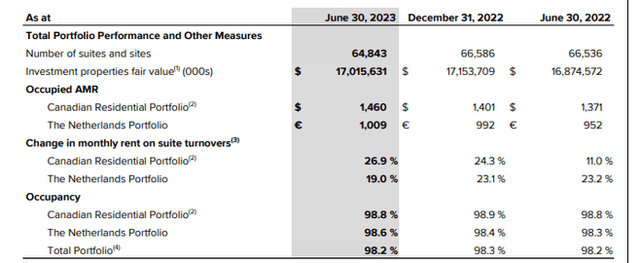

CAPREIT had a solid second quarter and occupancies held strong at home and in its Netherlands portfolio.

Q2-2023 Financials

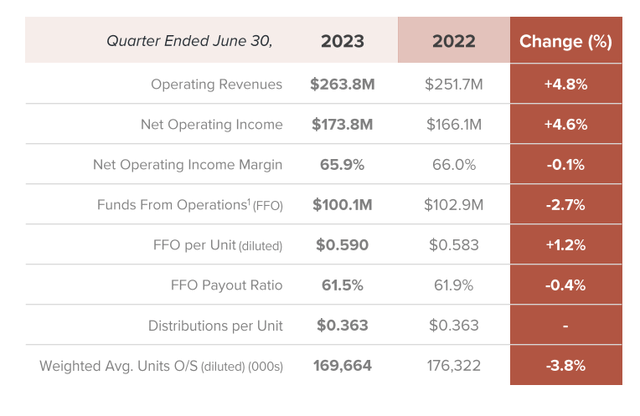

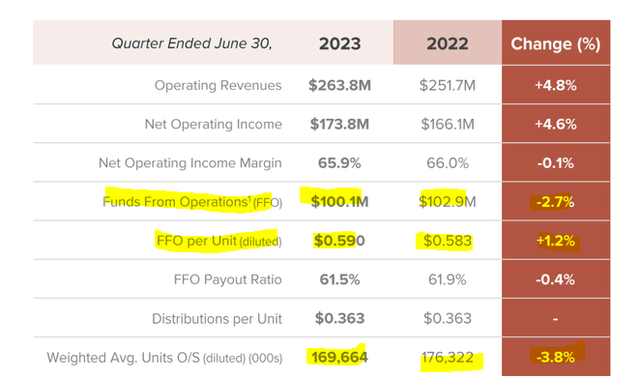

Q2-2023 showed a robust increase in operating revenues which rose almost 5% from 2022. Operating income expanded at a slightly less impressive clip of 4.6%.

Q2-2023 Presentation

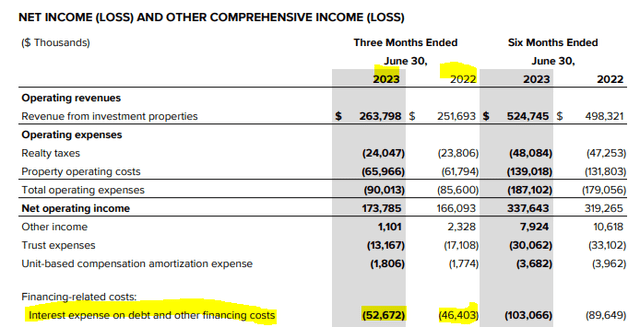

CAPREIT saw a slight drop in operating income margin, but considering the big inflationary headwinds we have seen, this was an acceptable result. In what has now become commonplace amongst many REITs, CAPREIT reported a drop in funds from operations (FFO) despite a rising net operating income (NOI). No bonus points here for identifying the culprit. Despite having very limited debt maturities over the last 12 months, interest expenses were up 13.5%.

Q2-2023 Financials

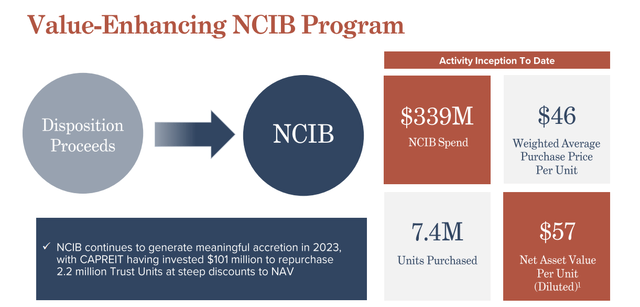

It is pretty clear that almost no REIT saw the pace or magnitude of the rate raise cycle, either in Canada or in the US. But CAPREIT managed to deliver something good in the end with FFO per unit rising despite a drop in total FFO. This was accomplished by a rather healthy dose of unit repurchases.

Q2-2023 Presentation

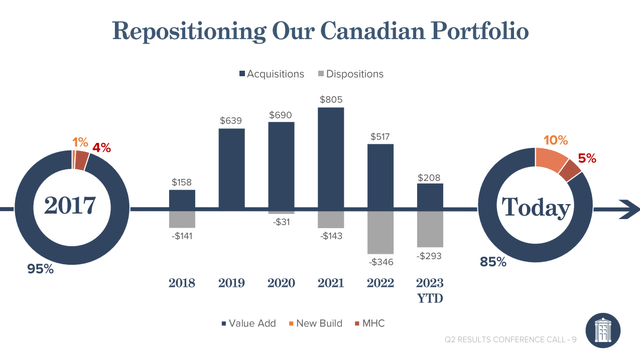

2023 was one of the rare years where CAPREIT sold more assets than it bought and that helped power the buybacks.

Q2-2023 Presentation

The repurchases were also conducted at an average price of $46, a substantial discount to its own NAV estimate.

Q2-2023 Presentation

Outlook

With the portfolio at almost full occupancy, NOI increases will have to be driven by rent hikes. Even with rent controls on a substantial portion of its portfolio, CAPREIT can capture big spreads on turnovers.

On turnovers, monthly residential rents for the three and six months ended June 30, 2023 increased by 26.9% on 3.3% and 26.8% on 5.8%, respectively, of the Canadian portfolio, compared to an increase of 11.0% on 4.2% and 10.6% on 7.9%, respectively, of the Canadian portfolio, for the three and six months ended June 30, 2022.

Source: Q2-2023 Financials

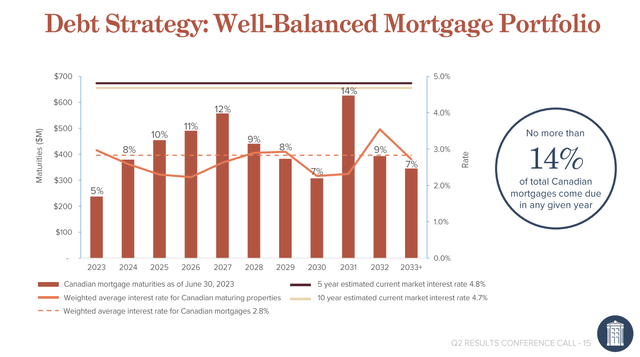

This goes to show the longer term embedded value in its portfolio as it can capture these higher rents over the next few years. The other side of the equation is the debt and the far higher interest expense that it will face down the line. Remaining 2023 and full year 2024 mortgage maturities are manageable from an overall debt load perspective. But the slide below has two other important pieces of information.

Q2-2023 Presentation

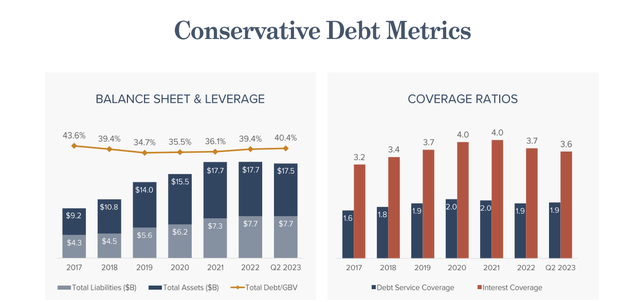

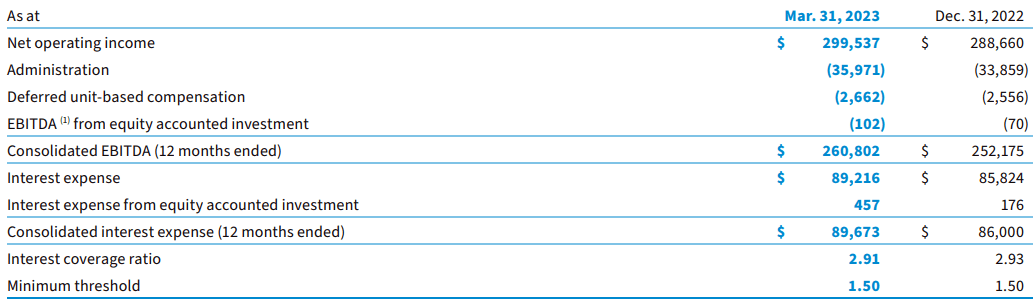

The weighted average interest rate for CAPREIT is just under 3% and current 5 and 10-year estimated rates are near 4.75%. To be clear, CAPREIT has the financial strength to deal with this with interest coverage of near 3.6X.

Q2-2023 Presentation

This is better than all other apartment REITs based in Canada. For example, Boardwalk REIT (BEI.UN:CA), which we regularly cover, was at 2.91X last quarter.

Boardwalk Q1-2023 Presentation

But CAPREIT will still feel this pinch and the outlook is for FFO per unit to remain flat this year and then rise by about 1-2% in 2024.

Verdict

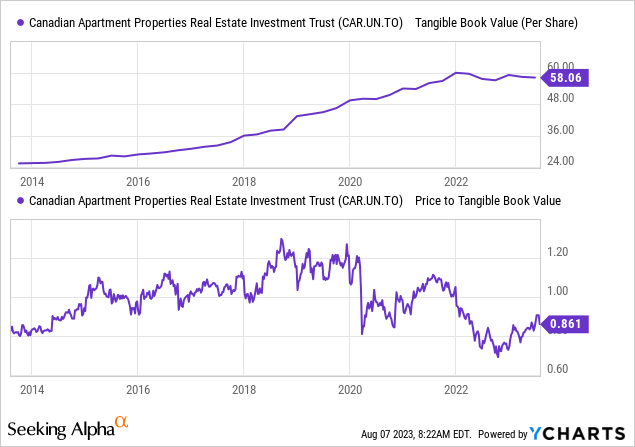

If you examine the last decade, CAPREIT has not traded under its estimated NAV, other than in 2022 and 2023.

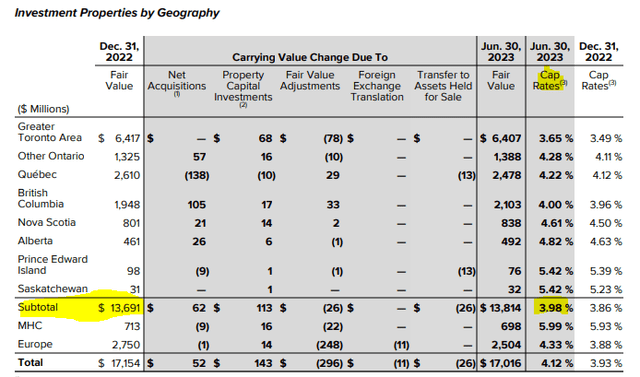

We did not go before 2014 as Canada started using IFRS around that time and numbers prior to that are not comparable. So it rings in cheap on that front. The counterargument here that cap rates on which that NAV is based, are stupidly low.

Q2-2023 Financials

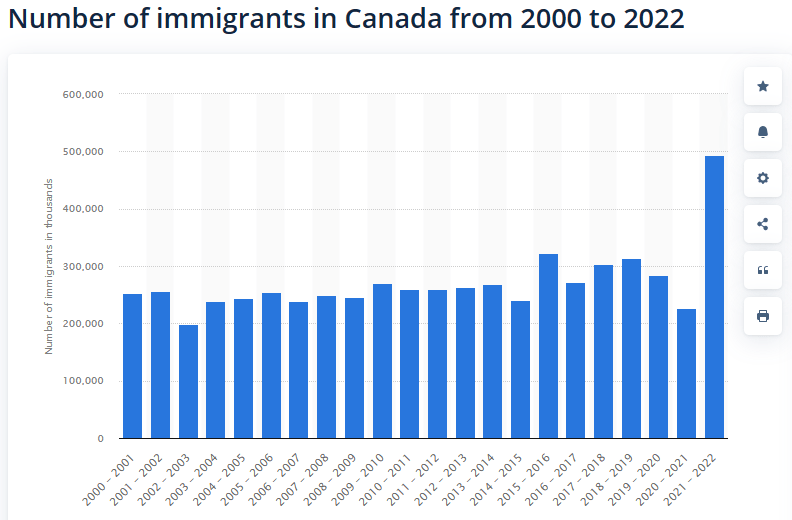

We don’t dispute the numbers that CAPREIT is using. The market is indeed right there with a sub 4% average across Canada. But that still seems an absurd bet with risk-free rates at 5%. The reason cap rates are so low is that Canada is experimenting with one of the most massive immigration policies we have ever implemented.

Statista

Unfortunately immigrants cannot bring their home with them to Canada when they come in and housing shortages are everywhere. The rate hikes by Bank of Canada are making the unaffordability worse for buying a home and putting more pressure on apartment rents. So in that environment, you generally have to reserve your bearish views, especially when you are 15% below NAV.

We are still hesitant to slap another buy rating here with the stock trading near 22X FFO. Yes, that is cheaper relative to what we have seen in the past, but there are far better opportunities today in REIT world than what we are seeing in case of CAPREIT. We are downgrading this to a “hold” and would get interested on the long side under $45.00

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here