Executive Summary

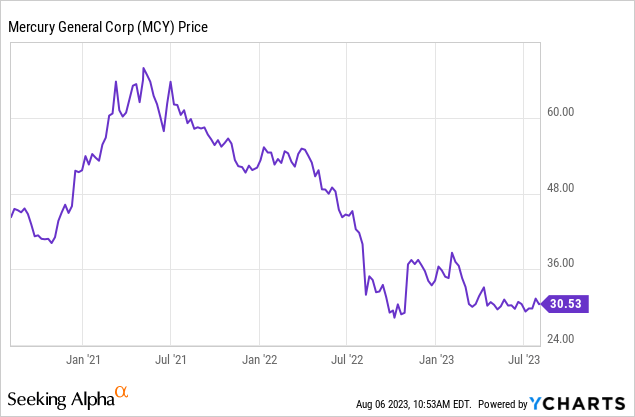

Mercury General (NYSE:MCY) faced challenges in 2022 that resulted in a dividend cut, losing its dividend aristocrat status. The company’s operational performance has been lackluster, impacting its profitability and share price.

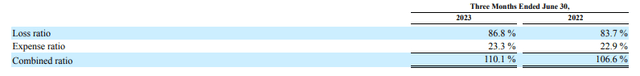

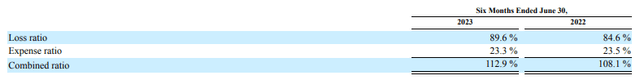

The company has recently released its second-quarter results, proving that the insurer is still struggling with operating performance issues, as the underwriting margins remained negative, with a quarterly combined ratio of 110.1%.

Q2 2023 Financial Report – Mercury General Corporation

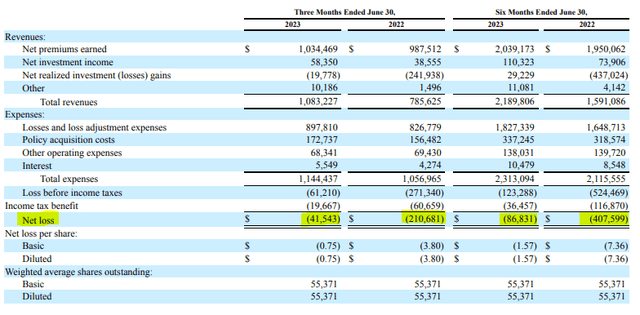

Despite the underwhelming operating performance, the results for the current quarter were relatively “better” compared to the same period one year ago. In Q2, the reported loss amounted to $41 million, a significant improvement from the $210 million loss recorded in Q2 2022.

Q2 2023 Financial Report – Mercury General Corporation

In the year-to-date perspective, the company incurred a loss of $87 million, a notable reduction from the $408 million loss reported in the same period one year ago.

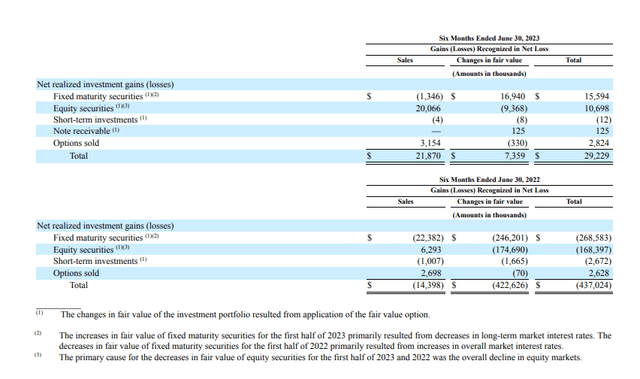

While the reduction in losses on both a quarterly and year-to-date basis might lead analysts and investors to believe that the situation is improving and the recovery is underway, they should not be misled. The decrease in losses is primarily attributed to the reduction in unrealized losses of the investment portfolio.

Q2 2023 Financial Report – Mercury General Corporation

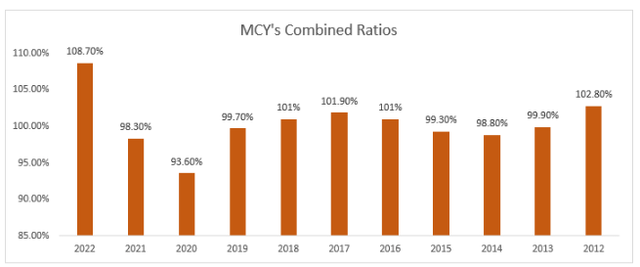

Unprofitable Decade & 2023 Concerns

Over the past decade, Mercury General has struggled to improve its profitability consistently. While 2020 showed a temporary improvement due to COVID-19 restrictions reducing claims, the subsequent return to normalcy resulted in a sharp increase in the loss ratio, leading to a combined ratio of 108.7% in 2022.

Financial Reports – Mercury General Corporation (Figures gathered by the Author)

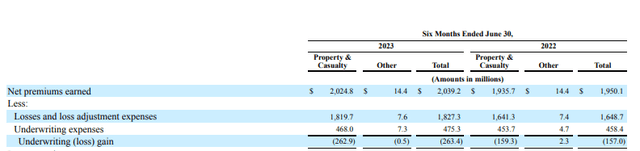

In 2023, the company recorded an underwriting loss of $263.4 million, which is significantly higher compared to the loss of $157 million in the same period last year.

Q2 2023 Financial Report – Mercury General Corporation

Simply put, the insurance portfolio’s performance deteriorated further in 2023. The year-to-date combined ratio worsened by 4.8 points to 112.9%, mainly due to the increase in the loss ratio.

Q2 2023 Financial Report – Mercury General Corporation

The loss ratio was negatively impacted by approximately $191 million of catastrophe losses, excluding favorable development of approximately $1 million on prior years’ catastrophe losses, primarily from winter storms and rainstorms in California, Texas, and Oklahoma.

However, catastrophe losses were not the only factor contributing to the deterioration in the loss ratio. The underlying loss ratio, (i.e., the loss ratio excluding the impact of catastrophe losses and prior claims’ development), worsened by 1.3 points to 81.2%. This increase in the loss ratio was primarily driven by an increase in loss severity in the automobile line of insurance business.

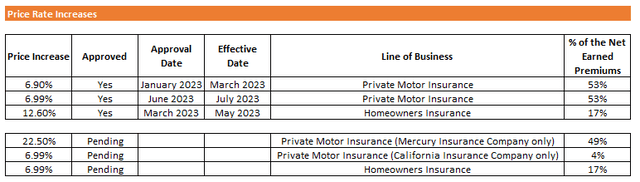

Consequently, the Company has increased rates and filed for additional rate increases in many states and is taking various non-rate actions to improve profitability.

Q2 2023 Financial Report – Mercury General Corporation (gathered by the author)

Despite the potential positive effects of the increased rates on the portfolio, Mercury remains an insurer with weaker underwriting margins.

An Ineffective Dividend Distribution

Mercury General is a former Dividend Aristocrat. Despite the operational struggles and the dividend cut in 2022, Mercury has maintained a small quarterly dividend, which may not be sustainable given the company’s current performance. Maintaining dividends is costly and prevents reinvestment to enhance profitability.

Valuation

Mercury’s market capitalization is around $1.69 billion for a loss-making business generating $4.0 billion in annual premium turnover. Debt stands at $448 million as of June 2023, making the valuation intriguing considering the losses.

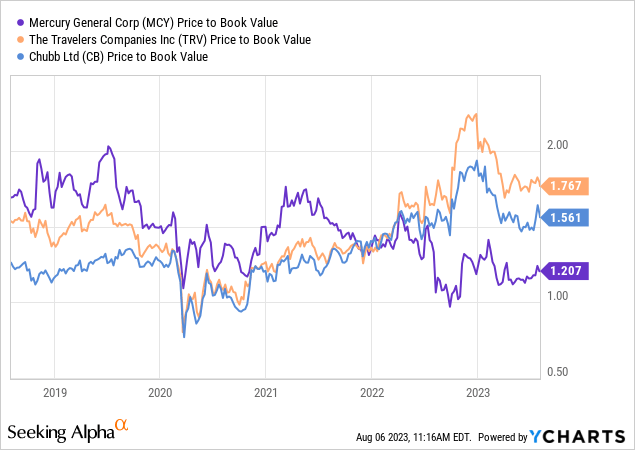

The insurance company is currently valued at 1.2 times the book value, while other insurers like Chubb (CB) or Travelers (TRV) are trading at higher valuations of 1.6 to 1.7 times the book value.

However, the significant difference between Mercury General and its competitors lies in its profitability level, underwriting performance resilience, and dividend sustainability.

Final Thoughts

As an investor, the current meager operating performance makes Mercury General an unattractive investment choice. While there is some hope for the company to recover, potential and current shareholders should remain cautious until substantial improvements are observed, especially if the pending price increases are approved by the California regulator.

Read the full article here