Introduction

Encore Capital Group, Inc. (NASDAQ:ECPG) has a quite niche market to work in, focusing on debt recovery solutions and related services to it. The quite recent report from the company showcased a miss on both the top and bottom lines. As credit lending continues to grow, the market for ECPG is growing too, as a result of more opportunities to purchase consumer receivables at severe discounts appears. It’s a risky market to be part of and solid risk management is required.

The actual valuation of the business isn’t presented as very undervalued. It has a p/e of 9 which is quite precisely in line with the sector. Where ECPG needs to perform is in raising the returns on investments and that isn’t showcased right now. The ROA of ECPG is at 0.8%, quite far below the historical average of 4.7% for the company. I don’t like this trend and can’t make an investment based on it. The growth of ECPG comes from more and more purchases of distressed assets or receivables. The volumes at which ECPG has added are stagnating but some things point to a very positive market environment going forward. That makes me rate ECPG a hold now at least.

Company Structure

As mentioned earlier on, ECPG is quite niche in what they do, focusing on purchasing distressed and defaulted consumer receivables. The company is part of the consumer finance industry and has grown its valuation quite decently over the years and has a market cap of $1.1 billion. One of the main priorities of operating like this is proper risk management as the assets they are acquiring are distressed and not immediately a fantastic return for the company.

The company occupies a pivotal position within the consumer credit ecosystem, contributing significantly to the resolution of unpaid debts, an anticipated and essential aspect of the lending business model. By engaging in this role, the company fulfills a critical function that facilitates the overall health and sustainability of the credit industry.

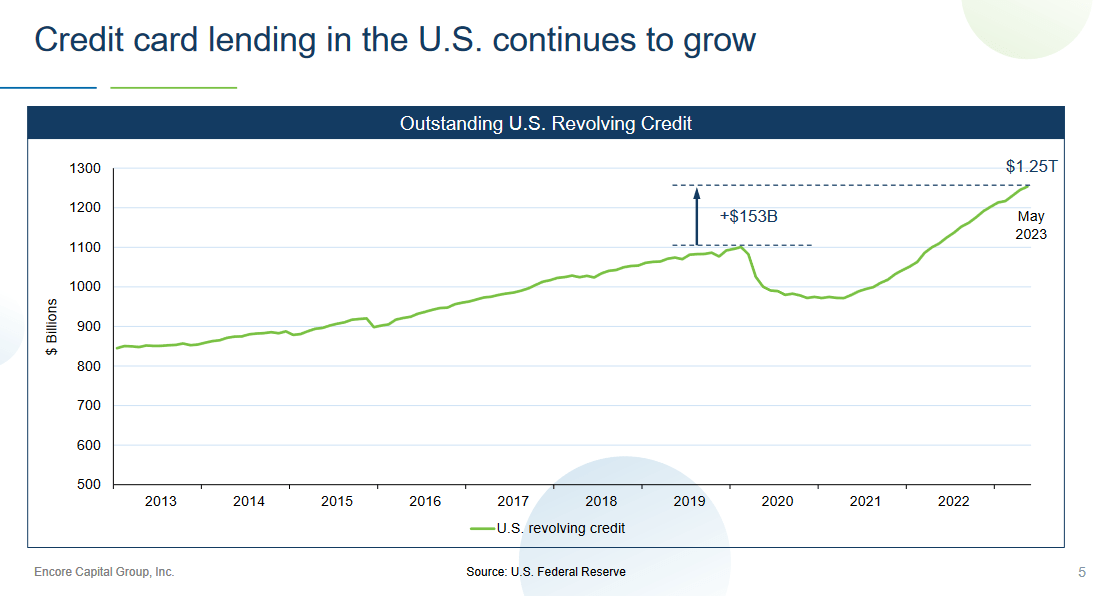

US Credit (Investor Presentation)

Driving growth for ECPG is the fact that consumer lending and credit card lending are continuing upwards in the US. In the last few years, only it has increased substantially. Between 2019 and now it grew by nearly 14%. That translates to an additional $153 billion and increased the TAM that ECPG has access to.

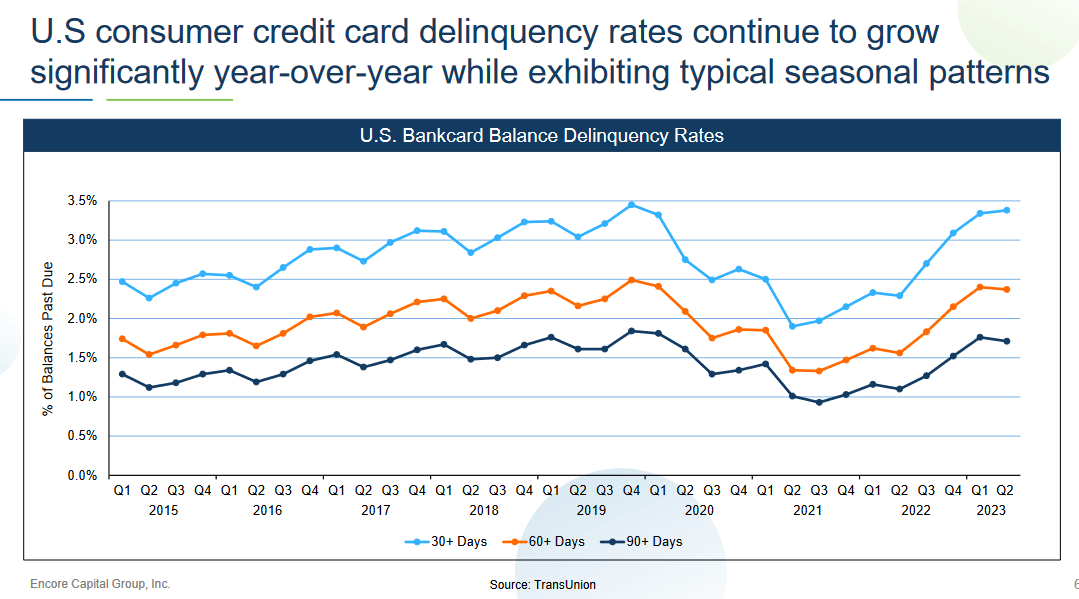

Rates (Investor Presentation)

Higher US credit card delinquencies are also creating more buying opportunities for ECPG and the assets have grown very quickly, around 9.3% YoY. The opportunities that ECPG is seeing seem plenty but we are yet to see any immediate impact on the ROA as a result. It still sits quite low and under the 5-year average. The higher delinquencies seem to be a result of the heightened interest rates in the United States but what I fear is that as rates lower then delinquencies will also go lower, resulting in a smaller market to tap into.

Earnings Transcript

I think that getting some comments from the management team about the outlook is incredibly important here as much of the top and bottom-line growth is driven by favorable conditions. Seems quite obvious but as we have seen historically the revenues have been quite up and down. In the earnings call the CEO Ashish Masih had the following to say.

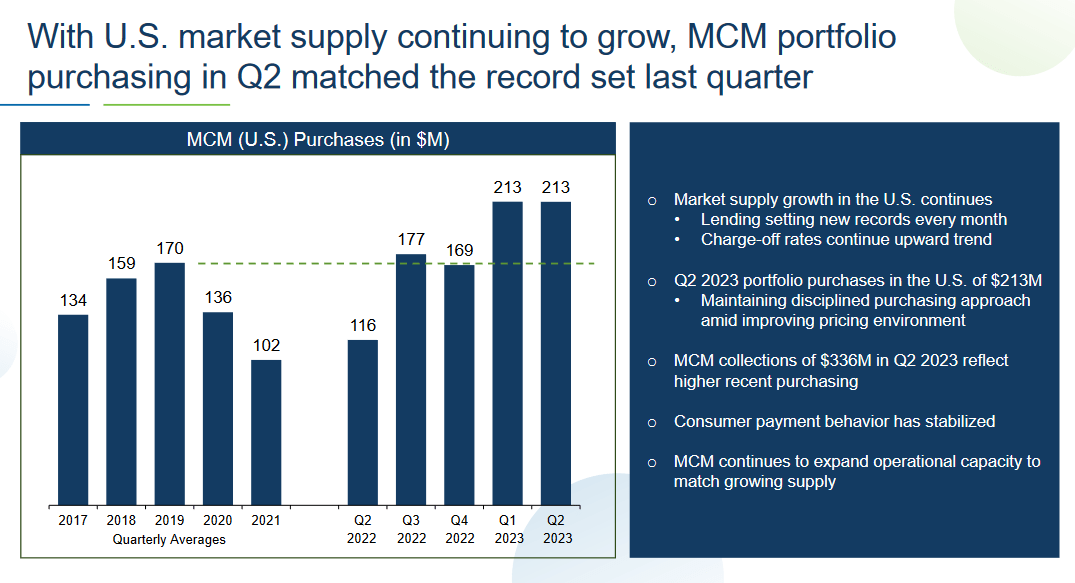

Consequently, MCM portfolio purchases in the U.S. in the second quarter matched our Q1 total of $213 million. Our cash generation grew sequentially again in the second quarter, the result of increases in collections from purchasing portfolios at attractive returns over the past several quarters, especially in the U.S”.

As we have discovered the market conditions for ECPG seem very positive right now and this is visible from the activity that the company has had recently in growing the asset base. The quickly rising rates in the US are helping this to be possible.

In addition to the upward trend in credit card outstandings, credit card delinquency rates in the U.S. have continued to rise in recent quarters and now at or near pre-pandemic levels. This sustained increase in delinquency rates is now leading to higher charge-offs and increased supply of portfolios in the U.S. for debt buyers such as Encore”.

I don’t think that ECPG will face any significant competition in buying these distressed portfolios of consumer receivables. The market has grown so much that there looks to be an oversupply even. This lets ECPG be picky with what they acquire, ultimately lending them to have a more solid portfolio.

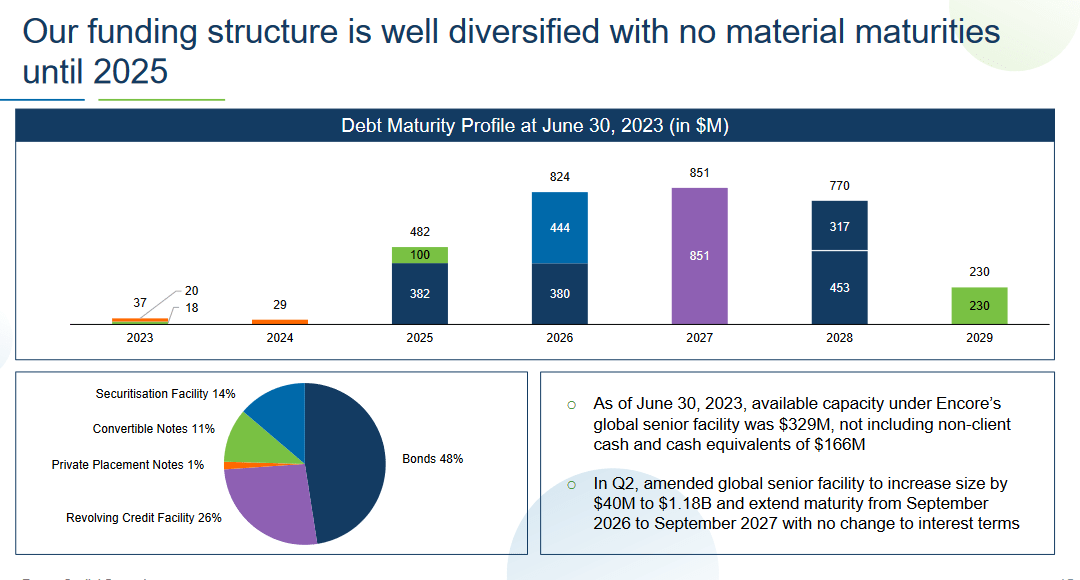

Debt Profile (Investor Presentation)

Funding some of these acquisitions is debt and the debt profile of ECPG is quite decent right now I think. The most prominent maturity of debt is in 2025 and this leaves the company some time to at least raise the FCF margin to an acceptable level, something above positive at least to help tackle this. Given that FCF isn’t positive yet it constitutes me to have the hold rating even more.

Risk Associated

The key inquiry that arises pertains to the impact of the escalated purchase costs, which stem from the influence of interest rates, albeit partly mitigated by lower-than-anticipated collection rates. This prompts contemplation on how these dynamics will ultimately shape the company’s profitability and its ability to generate returns on invested capital.

Market Outlook (Investor Presentation)

The interplay of these factors introduces an intricate challenge. The concurrent rise in purchase prices due to interest rate dynamics can potentially exert downward pressure on the company’s profit margins. However, the counterbalancing effect of lower collection rates should also be considered, as it could, to some extent, offset the aforementioned cost increase.

Investor Takeaway

Investing in a debt-collecting company is perhaps not the most exciting opportunity right now in the market and I do tend to agree. I think of ECPG as a hold given the quite poor margins of the business but the solid market conditions and growth of assets for the business do lead me to believe some recovery in margins might be possible going forward. With rising US consumer debt there is a larger market for ECPG to tap into and they can be picky with what they take on.

Read the full article here