Crocs, Inc. (NASDAQ:CROX) has had a great five year run that I think should continue as current growth combined with development of the HEYDUDE brand make Crocs a compelling choice for investors. At prices below $120, Crocs presents a value to future earnings.

Once a company that created shoes mainly for nurses, medical professionals and small children, Crocs has gone mainstream. Young teens have driven sales using them as comfy slip on shoes, beach shoes, after practice shoes or even for everyday use. Children surprisingly run and even compete in Crocs by using the adaptive strap in the aptly named sports mode. According to the experts, my children, Crocs need gibbets. Gibbets fit in the Croc’s holes and allow people to personalize their Crocs with limitless attachment options. If you want sports gibbets or anime gibbets or dragon gibbets, CROX has got it for you. With the ability to slip them on easily and their insane comfort, it’s no wonder people enjoy wearing them.

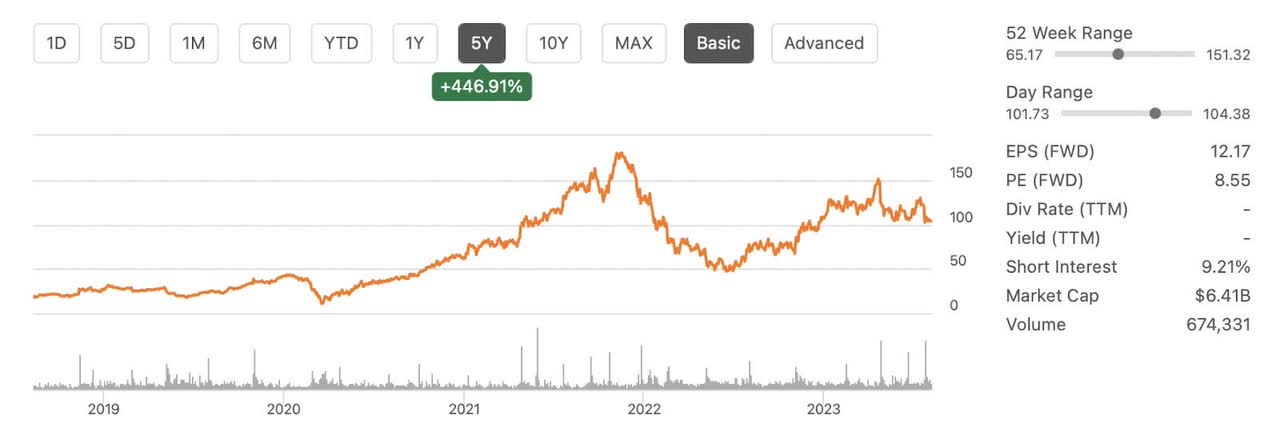

5 Year Chart (Seeking Alpha)

During the last five years Crocs has rewarded investors with over 88% returns annually. Crocs obviously has a great product with wide current demographic appeal, but let’s look at the current valuation.

Seeking Alpha

Crocs almost tripled its current assets from 380 million to 1.1 billion in just five years.

Seeking Alpha

While total assets have exploded ten fold, total liabilities increased by almost six fold.

Seeking Alpha

The company has also taken on a significant amount of long term debt. Crocs recently refinanced 1.1 billion dollars as reported here at a lower rate which should save them millions in interest yearly. The company also reported a balanced commitment to share repurchases and debt reduction discussed below.

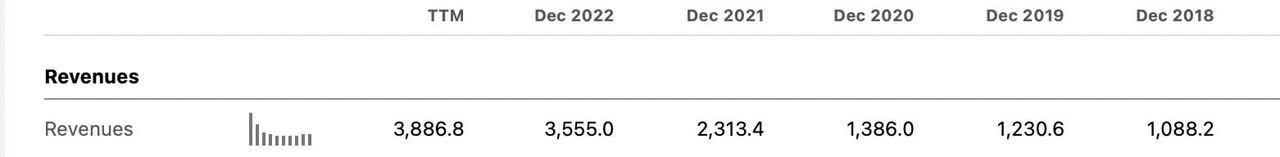

Growth in revenues and operating income has been impressive.

Seeking Alpha Seeking Alpha

With over $1 billion dollars a year in operating income, Crocs has tons of options. The dramatic increases in cash flow allows it to manage its debt, buy back shares and continue to grow and develop its brands. The buy back shares program was halted after the acquisition of HEYDUDE, but has recently resumed. Considering the growth of HEYDUDE, the management appears to have demonstrated its ability to use cash to grow brand value and shareholder value. As the debt gets paid down, the company could possibly buy back shares at a faster rate or they could start looking for additional acquisitions. In July, they bought back $50 million dollars’ worth of shares.

I would currently consider buying shares and consider the impressive continued growth and management of its debt to be worth a premium.

My current prediction for 2024 earnings is somewhere above $14. This would put growth of Crocs at 17% a year and a company demonstrating that type of growth should have a PE between 12 and 18.

At 12 times estimated earnings of $14 dollars, put a floor fair value of $168 a share. At 18 times estimated earnings, the high end of the fair value would be $252. I put the fair value of the shares to be between $180 dollars and $240 dollars. I have narrowed the range upwards on the floor because of brand strength and I lowered it on the top end as well because I believe 18 times earnings is a bit excessive compared to historical norms.

My expectations are that Crocs continues to grow its brand globally. This growth will drive earnings per share increases. Lucrative partnerships and continued growth into mainstream culture could drive Crocs’ price even higher. My optimism was shared by executives during the recent earnings call.

Earnings Call

During the July 2023 earnings call Crocs’ CEO Andrew Rees reported impressive gains in revenue and profitability, “We delivered record quarterly revenues of over $1 billion… gained appreciable market share and once again delivered industry-leading profitability with 30% operating margins.” Providing proof that Crocs continues to grow while managing costs. These signs point to the possible long term growth potential of the brand.

Mr. Rees also discussed Crocs growth in Asia and direct to consumer growth, “Crocs brand revenues grew 15%, constant currency fueled by Asia revenues increasing 39% and global DTC comparable sales rising 20%… HEYDUDE brand revenues were $239 million with exceptional DTC growth of 30% and digital growth of 37%.” International growth is key to Crocs future success and its growth in the Asian market demonstrates the possibilities for the brand globally. The strong growth in direct-to-consumer (DTC) sales and digital growth indicates the brands’ ability to attract customers through their marketing and online strategies, which could be seen as positive indicators of brand strength and market demand. This points to future collaborations and increased product exposure.

Rees provided insight into the growing earnings per share and the decrease in leverage, “Constant currency adjusted diluted earnings per share increased 11% to $3.59 per share… Gross leverage ended at 1.8 and net leverage was 1.7 times at quarter end, allowing us to repurchase $50 million of shares in July.” The increase in adjusted diluted earnings per share looks promising. The mention of gross and net leverage indicates the company’s ability to manage its high debt levels while still engaging in share repurchases, which could be seen as a sign of prudent financial management. Given the amount of debt Crocs currently carries, paying off all of the debt would seem to be the prudent move, but it appears Crocs currently prefers to pay down the debt over time and support future growth.

HEYDUDE

A big part of Crocs’ growth story is its HEYDUDE brand which grew 80% over the last two years according to Crocs, Executive Vice President & Chief Financial Officer, Anne Mehlman. As a young brand that has grown revenues to almost $1 billion dollars, HEYDUDE has been a great addition to Croc’s growth story and fits nicely into the brand.

Risks

Crocs faces many risks as a retailer. Market shifts and fashion’s whims heavily influence Crocs’ fortunes, posing concern for value investors. The uniqueness of their designs makes them vulnerable to changing consumer whims, raising doubt about sustained demand. Additionally, the fiercely competitive footwear arena threatens pricing pressure and profit margins. Economic downturns cast shadows over discretionary spending, impacting Crocs’ sales. Operating across the globe, supply chain hiccups from geopolitical tensions to transport snarls jeopardize production and drive-up costs. Currency fluctuations pose profit volatility as Crocs operates internationally. Managing debt exposure is vital, particularly if expansion is on the horizon. Inherent operational risks and market reliance demand scrutiny. Legal adherence and sustainability resonate deeply, affecting reputation and consumer traction.

Conclusion

Crocs has experienced a remarkable transformation, evolving from a brand associated with medical professionals and children into a mainstream sensation embraced by young teens and people of all ages. With substantial returns of 88% annually over the last five years, Crocs has demonstrated its prowess in capturing market demand. The company’s strategic management of assets and liabilities, as well as its commitment to share repurchases and debt reduction, reflects prudent financial stewardship. Impressive growth in revenues and operating income is underscored by their ability to manage debt, invest in growth, and enhance their brand.

This positive trajectory leads me to consider Crocs a buy, with a fair value estimation ranging from $180 to $240. The company’s performance during the July 2023 earnings call, highlighted by record revenues and market share gains, underscores its potential for long-term growth. The expansion into the Asian market and strong direct-to-consumer sales are indicators of its robust market presence. Notable increases in adjusted diluted earnings per share and effective management of leverage further bolster my confidence. HEYDUDE’s contribution to Crocs’ growth story further solidifies its position as a brand with immense potential. As always, good luck investing and please do your own due diligence before considering buying any stock.

Read the full article here