Earnings of First Bancorp (NASDAQ:FBNC) will most probably plunge this year due to margin shrinkage and higher operating expenses. On the other hand, loan book growth will support earnings. Overall, I’m expecting the company to report earnings of $3.08 per share for 2023, down 25% year-over-year. Compared to my last report on the company, I’ve reduced my earnings estimate as I’ve decreased my margin estimate. The year-end target price suggests a small upside from the current market price. Hence, I’m maintaining a hold rating on First Bancorp stock.

Further Margin Pressure Expected After First Half’s Disappointing Performance

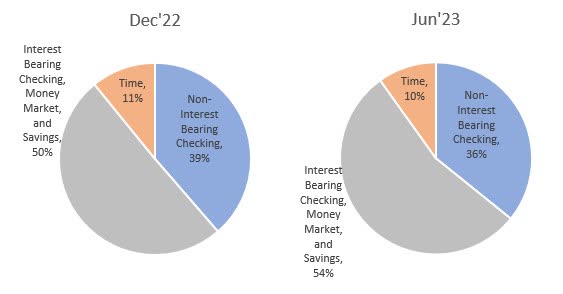

The net interest margin dipped by 23 basis points in the second quarter of 2023 after remaining almost stable during the first quarter of the year. The stability in the first quarter was attributable to the acquisition of GrandSouth Bancorporation. Had it not been for the acquisition, the margin would’ve most probably dipped in the first quarter too, mostly because the deposit mix has steadily worsened over the last half year (see chart below). The first half’s performance has been much worse than I previously anticipated because I had been expecting a better outcome of the acquisition on the margin.

SEC Filings

Further deterioration of the deposit mix is likely because rate hikes will encourage depositors to continue to shift their funds out of non-interest-bearing transaction accounts towards higher-yielding accounts.

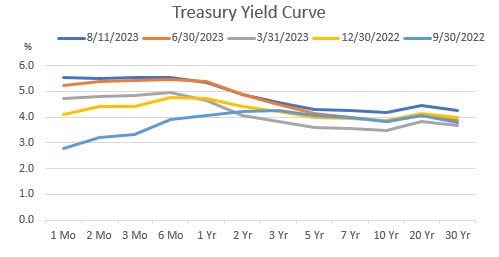

As the management noted in the 10-Q filing, the persistent and prolonged inversion of the yield curve is detrimental to the margin. For First Bancorp, short-term interest rates generally drive the deposit pricing and longer-term interest rates generally drive loan pricing. When these rates converge or invert, the profit spread realized between loan yields and deposit rates narrows, which pressures the net interest margin. As shown below, the inversion of the yield curve has deepened since the end of last year (see the dark blue line below and compare it with the bright yellow line).

U.S. Department of the Treasury

Considering these factors, I’m expecting the margin to dip by 10 basis points in the second half of the year, leading to a full-year margin contraction of 34 basis points (from the end of 2022). Compared to my last report on the company, I’ve slashed my margin estimate because I was mistaken about how beneficial the acquisition would be for the margin.

Regional Economic Activity Will Likely Maintain Loan Growth

First Bancorp’s loan portfolio grew by 1.2% in the second quarter of 2023, in line with my expectations. I’m expecting growth to remain stable at near the second quarter’s level for the remainder of the year. Regional economic factors will likely play a pivotal role in sustaining loan growth.

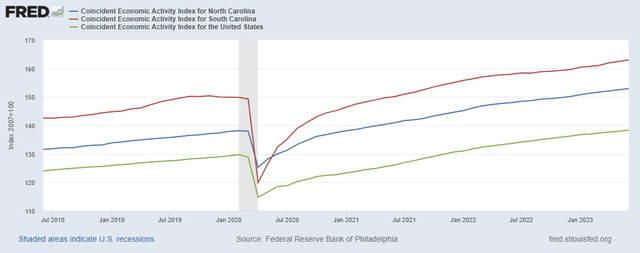

First Bancorp operates in North and South Carolinas and focuses on commercial real estate loans. Therefore, the economic activity indices of these states are important indicators of credit demand. As shown below, South Carolina’s economic activity trendline is steeper than the national average, while North Carolina’s trendline is almost as steep as the national average.

The Federal Reserve Bank of Philadelphia

Overall, I’m expecting the loan portfolio to grow by 1.25% in each of the last two remaining quarters of 2023, leading to full-year growth of 21.4%. Further, I’m expecting deposits to grow in tandem with loans. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 4,228 | 4,432 | 4,679 | 6,003 | 6,574 | 7,984 |

| Growth of Net Loans | 5.2% | 4.8% | 5.6% | 28.3% | 9.5% | 21.4% |

| Other Earning Assets | 1,014 | 1,076 | 1,943 | 3,557 | 3,027 | 3,068 |

| Deposits | 4,659 | 4,931 | 6,274 | 9,125 | 9,228 | 10,424 |

| Borrowings and Sub-Debt | 407 | 301 | 62 | 67 | 288 | 489 |

| Common equity | 764 | 852 | 893 | 1,231 | 1,032 | 1,362 |

| Book Value Per Share ($) | 25.7 | 28.7 | 30.8 | 41.0 | 28.9 | 33.1 |

| Tangible BVPS ($) | 17.1 | 20.2 | 22.0 | 28.3 | 18.4 | 20.6 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Slashing the Earnings Estimate

Mostly because I misjudged the impact of the acquisition on the margin which led to a quarterly earnings miss, I’m now reducing my earnings estimate for the full year. In my last report, I projected earnings of $4.23 per share for 2023. I’m now expecting the margin contraction to pressurize earnings. Further, I’m expecting higher operating expenses because of the merger as well as general inflationary pressures in the economy. Overall, I’m expecting First Bancorp to report earnings of $3.08 per share for 2023, down 25%. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 207 | 216 | 218 | 246 | 325 | 350 |

| Provision for loan losses | (4) | 2 | 35 | 15 | 12 | 21 |

| Non-interest income | 59 | 60 | 81 | 74 | 68 | 61 |

| Non-interest expense | 156 | 157 | 161 | 185 | 195 | 229 |

| Net income – Common Sh. | 89 | 92 | 81 | 96 | 147 | 127 |

| EPS – Diluted ($) | 3.01 | 3.10 | 2.81 | 3.19 | 4.12 | 3.08 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risks are High Due to the Securities, Deposit Books

In my opinion, First Bancorp’s risks are substantial. Firstly, unrealized losses on the available-for-sale securities portfolio totaled $440 million at the end of June 2023, which is a sizable 34% of the total equity balance. Moreover, around 29% of the total deposit book is uninsured, so the liability side of the balance sheet also carries risk.

However, the loan book’s credit risk is comfortable. First Bancorp has no notable concentrations in geographies or industries, as mentioned in the 10-Q filing. Further, non-owner-occupied commercial office loans represent just 5.7% of the total loan portfolio.

Maintaining a Hold Rating

First Bancorp is offering a dividend yield of 2.7% at the current quarterly dividend rate of $0.22 per share. The earnings and dividend estimates suggest a payout ratio of 29% for 2023, which is above the five-year average of 21%. Despite the above-average payout ratio, the dividend payment appears secure because paying out 29% of earnings is easily sustainable.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Bancorp. The stock has traded at an average P/TB ratio of 1.69 in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | Average | ||

| T. Book Value per Share ($) | 20.2 | 22.0 | 28.3 | 18.4 | ||

| Average Market Price ($) | 36.8 | 26.7 | 42.6 | 40.6 | ||

| Historical P/TB | 1.82x | 1.21x | 1.51x | 2.21x | 1.69x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $20.6 gives a target price of $34.8 for the end of 2023. This price target implies a 7.4% upside from the August 11 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.49x | 1.59x | 1.69x | 1.79x | 1.89x |

| TBVPS – Dec 2023 ($) | 20.6 | 20.6 | 20.6 | 20.6 | 20.6 |

| Target Price ($) | 30.6 | 32.7 | 34.8 | 36.8 | 38.9 |

| Market Price ($) | 32.4 | 32.4 | 32.4 | 32.4 | 32.4 |

| Upside/(Downside) | (5.4)% | 1.0% | 7.4% | 13.7% | 20.1% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.2x in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | Average | ||

| Earnings per Share ($) | 3.10 | 2.81 | 3.19 | 4.12 | ||

| Average Market Price ($) | 36.8 | 26.7 | 42.6 | 40.6 | ||

| Historical P/E | 11.9x | 9.5x | 13.4x | 9.9x | 11.2x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.08 gives a target price of $34.4 for the end of 2023. This price target implies a 6.3% upside from the August 11 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.2x | 10.2x | 11.2x | 12.2x | 13.2x |

| EPS 2023 ($) | 3.08 | 3.08 | 3.08 | 3.08 | 3.08 |

| Target Price ($) | 28.3 | 31.3 | 34.4 | 37.5 | 40.6 |

| Market Price ($) | 32.4 | 32.4 | 32.4 | 32.4 | 32.4 |

| Upside/(Downside) | (12.7)% | (3.2)% | 6.3% | 15.9% | 25.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $34.6, which implies a 6.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 9.6%. Hence, I’m maintaining a hold rating on First Bancorp.

Read the full article here