Investment Summary

Consistent, expanding, and discounted are all things I would be describing Energy Transfer LP (NYSE:ET) as right now. The company has proven itself to be best-in-class in terms of growth and the cash it distributes to shareholders. Just in the second quarter of 2023 the company had $1.55 billion in DCF and managed to distribute nearly $1 billion to shareholders too. This sort of incentive to reward shareholders is something that makes me stick around with ET.

But it’s important to realize why ET can have practices such as this. It comes from the fact they have built a fantastic and well-run machine of a business that can leverage the asset base it has and capture demand and market momentum when the time comes. I have it in the title that I think ET comes at a discount and it certainly does when we compare it to the sector. Trading 10% based on earnings and 26% below based on FCF. This limits the downside risk from here in my opinion and further bolsters my buy case. It’s not often that I make a strong buy for a company, but when you come across and cover a company like ET which extrudes quality it’s hard not to.

Fantastic Business Model Benefiting From Broad Demand

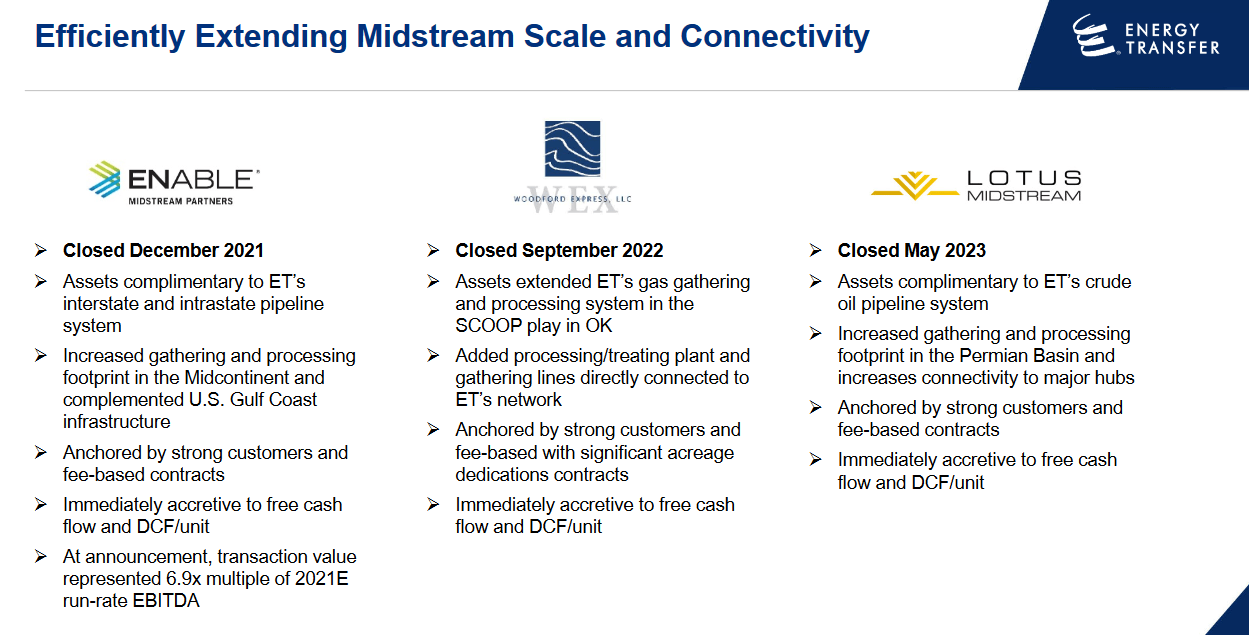

Energy Transfer has during the last couple of years made strong strides to evolve its business and secure a strong market share to ensure that shareholders can generate solid ROI from their stake in the company. The company is included in the energy sector but focuses more specifically on natural gas transportation and natural gas storage.

Company Overview (Investor Presentation)

The company has a massive network of natural gas transportation pipelines reaching 11.600 miles and 19.945 interstate natural gas pipelines. This sort of position has lent ET to generate a strong ROA which right now sits at some of the highest levels in the last 5 years, 3.98%. Besides operating these pipelines the company also engages in selling natural gas to electric utilities and independent power plants. The company has established itself across several states in the US and my opinion offers investors the opportunity to get exposure to the natural gas industry as a whole rather than one key area.

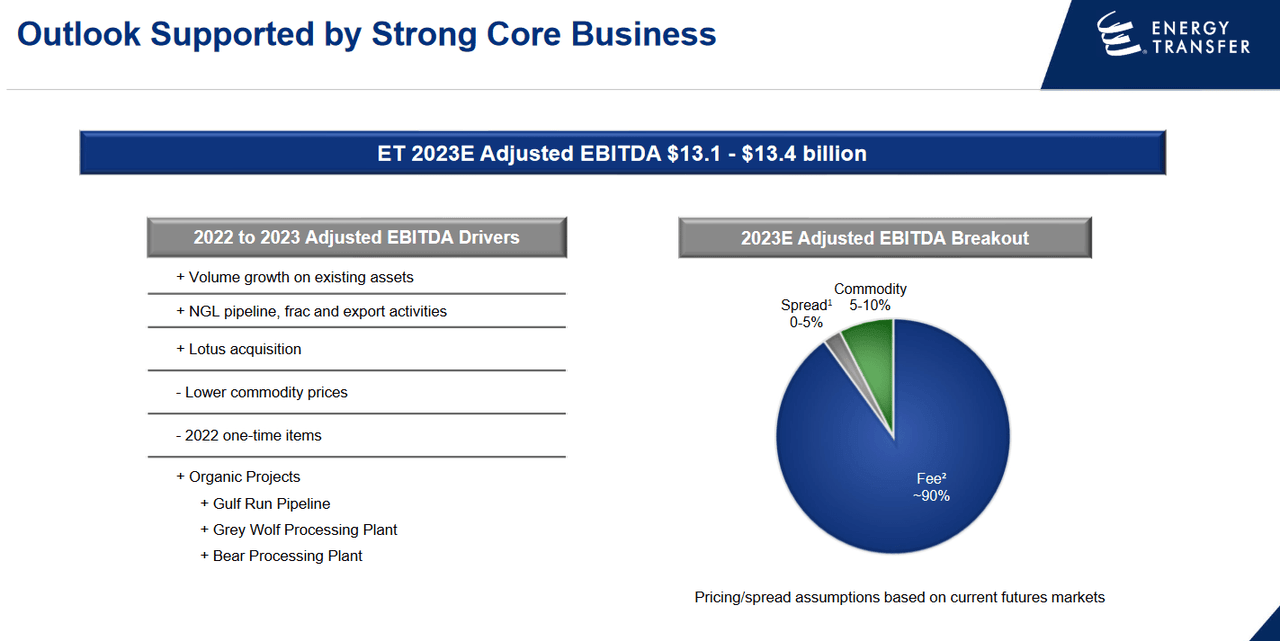

Outlook (Investor Presentation)

The growth drivers remain for the company as they are experiencing larger volumes which are lending them to see a lot of opportunities into investing further in their pipelines. Higher activity has made ET increasingly adamant about investing heavily. The last quarter showcased their investing $387 million in growth capital expenditures. In time I think this will show itself to be solid returns.

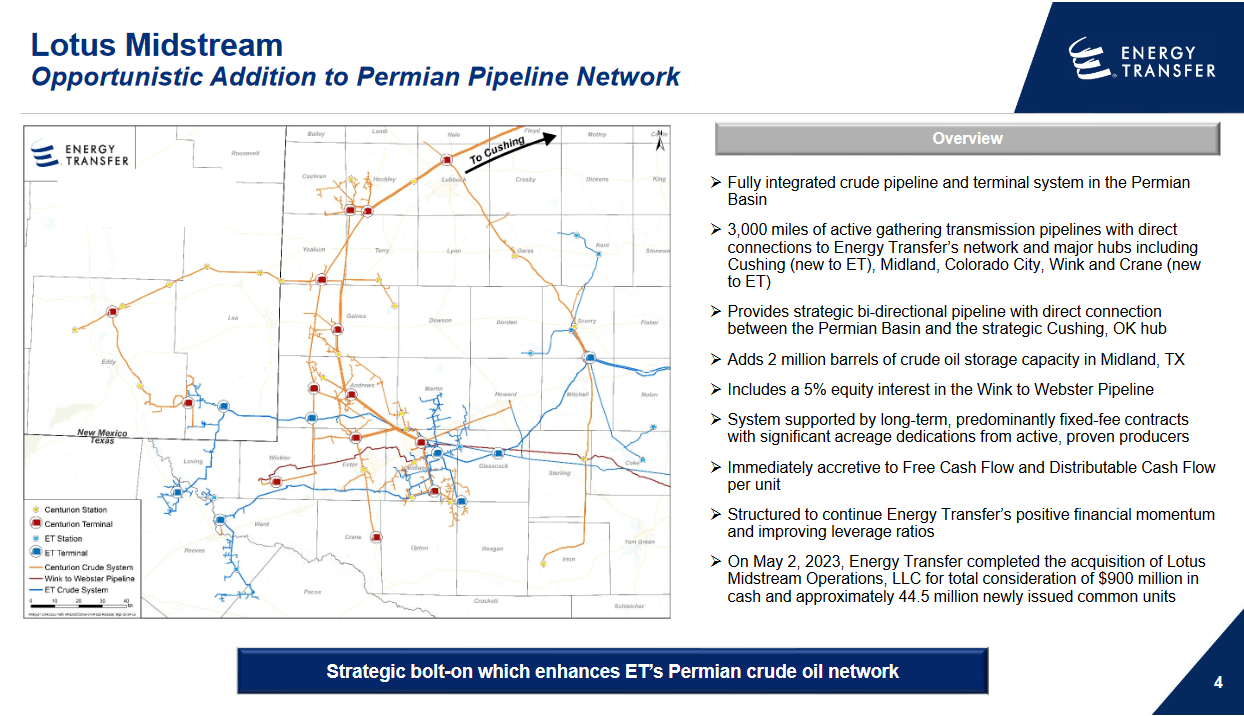

Lotus Midstream (Investor Presentation)

Another catalyst that seems to propel ET’s earnings and FCF growth through the latter part of 2023 is the strategic acquisition it executed earlier in the year. On May 2, 2023, Energy Transfer successfully finalized its purchase of Lotus Midstream Operations a strong move that is set to augment its financial performance. This acquisition, amounting to $930 million in cash coupled with the issuance of 44.5 million newly-created units, signifies the company’s deliberate expansion strategy to fortify its market presence and enhance its revenue-generating capabilities. The slight negative about this acquisition comes from the fact that a slight dilution of common shares occurred, hurting investors in ET. However, I think that over the long term, this slight dilution will do little as the added earnings from Lotus Midstream will more than make up for it.

Diving deeper into what Lotus offered, it was a fairly small pipeline operator that had amassed around 3000 miles of pipelines in the western part of Texas. The acquisitions made a lot of sense as the integration of Lotus was easy seeing as the existing infrastructure was very close to ET already. Just seeing from the last report the company noted Lotus was fully integrated and I think going into both Q3 and Q4 of 2023 we will see a significant impact on both the top and bottom line results.

Risks

Apart from the potential impact of interest-rate fluctuations, an ET’s ability to make consistent debt payments plays a pivotal role in ensuring its financial stability. The regularity and reliability of these debt obligations become crucial factors in maintaining solvency. It’s important to recognize that any circumstance leading to a reduction in a company’s cash flow could potentially trigger financial instability, especially if the company carries a significant debt burden. While midstream companies like ET typically exhibit relatively stable cash flows over the long term, it remains essential to acknowledge the risk associated with this aspect of their operations. Staying at a high leverage ratio does bring its risk and I don’t think it’s impossible to reason that it could have a connection to the discount that ET is receiving in comparison to the sector, despite the market position they hold.

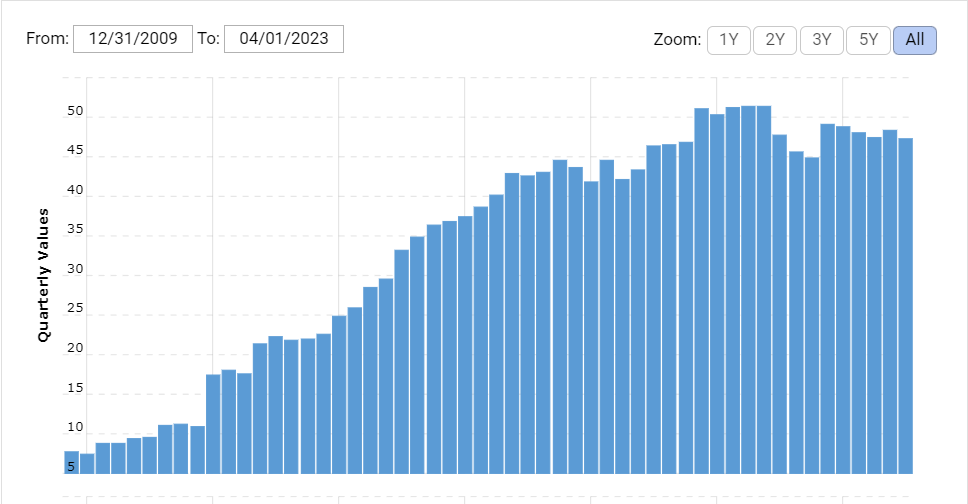

Debt (Macrotrends)

An event that adversely affects a company’s cash flow, such as declining demand for its products or services, unforeseen operational disruptions, or economic downturns, could potentially disrupt its ability to meet its debt obligations. This scenario can be particularly concerning if the company’s debt levels are high relative to its cash flow generation.

Financials

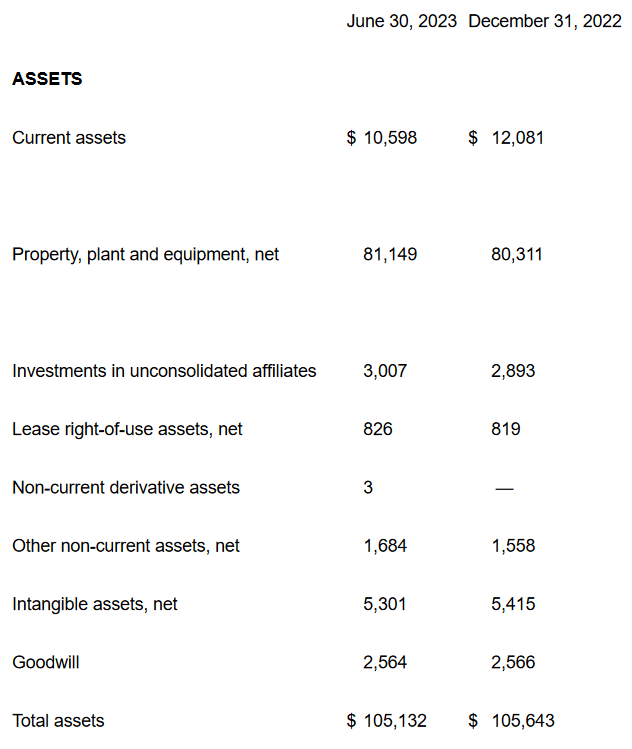

One of the issues that I think comes along with ET is the slightly leveraged balance sheet they have. The company has a cash position of $10.5 billion, down from $12 billion in December of 2022. Impacted of course by the previous acquisition the company made.

Assets (Balance Sheet)

Looking at the debt however the company has made solid progress on spying it down, but it still sits at $44 billion. This will require a large amount of FCF to pay down, something that ET is generating. Reiterating that in Q2 FY2023 alone they had over $1.5 billion in DCF doesn’t make me worried the least that they will need to divert more capital to pay down debt. Comparing the net debt to the projected EBITDA for 2023 we get a ratio of 3.6 which in most cases I would say is quite worrying, but as we have discussed already ET, the asset base they hold is a highly leverageable and growing demand for natural gas will keep them afloat and able to pay down debt in large amounts going forward.

Valuation & Wrap Up

ET is a massive company operating in the energy sector and specializing in natural gas and its pipelines and transportation of it. As mentioned in the title I think the company is trading at a discount as opposed to where it should be. Based on earnings its 10% below the sector and with FCF which is a highlight of the business its 26% below the sector. This paints the picture that there is a limited downside here if we are basing the valuation on where the sector is.

Stock Chart (Seeking Alpha)

I think that with such a dominant position and ability to fuel growth through acquisitions then ET is actually at a great entry point to start an investment. The large amount of FCF has made the company able to maintain a high dividend yield of over 9%. The company is well covered here on Seeking Alpha and liked, but disregarding some of that I think ET offers fantastic additions as a dividend income stock and one that will appreciate in stock price over the long term. Rating ET a strong buy.

Read the full article here