Ring Energy (NYSE:REI) began with a great idea to acquire some very profitable leases and then operate those leases to build a company that someone would want to purchase (hopefully at a big premium). However, covid challenges got in the way of the transition from a concept company (or development stage stock) to an operating entity. This left the company struggling to repay the debt load when the market began to concentrate on debt while the debt market would not consider the whole story as it previously did. What was considered a conservative deal to acquire the Northwest Shelf at the time became an onerous debt pile as a result. Now the acquisition of the Stronghold leases appears to resolve some of those outstanding transition issues by getting production to a reasonable level that will more likely handle the debt load.

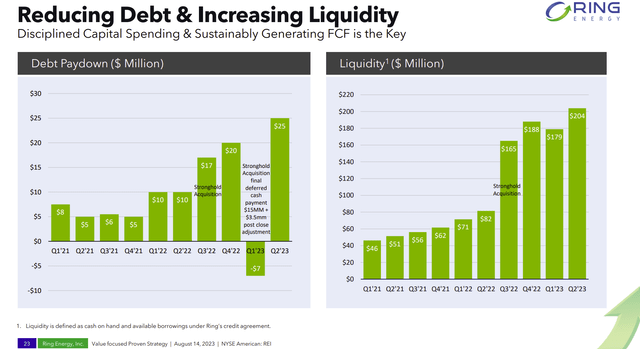

More importantly, management announced a debt repayment of $25 million dollars for the second quarter. The fact that this company can repay debt at all with oil prices considerably lower is a major accomplishment over the previous fiscal year. It very much looked to Mr. Market like negative cash flow was in store for the current year. Never mind that most commodity industries generally adjust to rapidly changing prices on a regular basis. Nor did Mr. Market consider the effects of the hedging program in the two comparison years. Instead, it was a “straight up” decision that lower prices would hurt the company badly.

Instead, management announced debt progress that was aided by a noncore lease sale. It is very likely that once recession fears fade, this company will receive a better reception from the market than is the case right now.

Ratio Performance

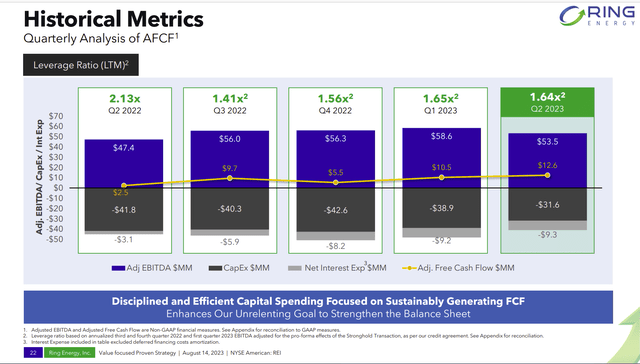

Management does have a history of improving ratios. That is definitely a first step.

Ring Energy Debt Ratio Improvement History And Free Cash Flow Results (Ring Energy Presentation At Enercom Denver August 14, 2023)

What the market wants to see is conservative ratios using much lower assumed selling prices. So, the market will be watching for debt progress during the current year when selling prices have declined.

Since these wells breakeven at lower prices, then spreading fixed costs over more production automatically will lower the corporate breakeven price. That means the company will make money at lower selling prices from this acquisition even before low breakevens and other benefits are considered.

Generally, any new company looks for an optimal production level that maximizes corporate profitability. Ring Energy was well on its way to that when oil prices went negative. So, management did what many managements did and literally went further by shutting all production in and “living off the hedge program” until the oil price recovery was well underway. But “living off the hedges” did not impress Mr. Market because Mr. Market does not value hedge income at all. So, the price of the stock sank to some unthinkable levels.

The Debt Situation

Now, finally, the debt market is slowly thinking about relaxing a little (very little). The company actually managed to increase its liquidity as a result of the stronghold acquisition. Next, the priority has to be to get ratios that the market is comfortable with. Management now appears to be well on its way thanks to the acquired production.

Ring Energy Debt Retirement Progress (Ring Energy Presentation At Enercom Denver August 14, 2023)

The market gets qualms about any step backwards (like the one shown above in the first quarter) even if the reasons were well established ahead of time. Further holding back the price is the worry about the debt payment progress shown above. It really was too small for the amount of debt.

Management is attempting to improve the situation with an all-cash acquisition. The lenders’ reaction has yet to be fully determined. Now if they like it, there may be a bank line expansion that follows. The lenders generally accept accretive acquisitions for companies to improve debt ratios.

It was indeed a very big deal that the debt is now around $425 million (give or take) which is much less than double the previous amount given that production has doubled. The latest transaction would get the debt levels closer to a double. But there is a whole lot more production to service that double. Even more important is all the low-cost reworks that could prove to boost profitability in the near future.

Of course, Mr. Market wants proof. So, management will have to execute properly. But that execution requires nothing extraordinary. In fact, management had some slides in the first quarter earnings package that showed some preliminary results. That (of course) needs to be followed up with expected decline rates, fast paybacks, and then some reasonable profitability. But since this is what management has been doing all along, the risk of an unpleasant outcome is very low.

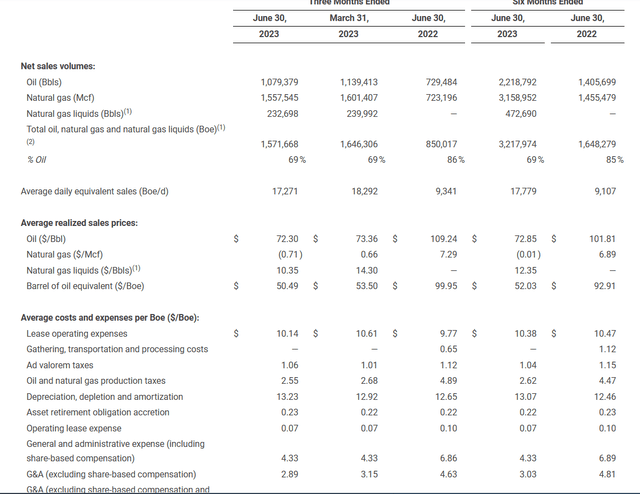

Sales Prices

The market is well aware that commodity selling prices are “ahem” not quite what they were last year. But those “not quite” prices were prices we were all praying for back when it seemed like these prices were a dream.

Now these prices are not as good as last year. “Not as good” has now been interpreted to be bad with worse on the way. It is amazing how what once would have been “barn burner prices” is now subpar (or worse).

Ring Energy Second Quarter 2023, Earnings Comparison (Ring Energy Second Quarter 2023, Earnings Press Release)

What needs to be focused upon is the extent to which more very profitable production will drop the corporate breakeven to the point where the ratios please Mr. Market going forward. That will result in a higher valuation.

Therefore, debt progress at these lower commodity prices are likely to be well received. Production growth is unlikely in the current fiscal year as management will likely assimilate the acquisition first. It takes time to get everything operating optimally while catching up with deferred maintenance that is typical for such sales.

Key Ideas

The whole idea here is that the sum of all the parts (the company and the acquisitions) is greater than when they were independent. For the market that will be shown as free cash flow that can be used to repay debt.

The company has long drilled very profitable wells. It just did not have enough of those wells producing before the challenges of fiscal year 2020 hit.

Even in fiscal year 2020, management was hedged enough that it could live comfortably off the hedging income while shutting production. But the market focused upon the shut-in production while really worrying about the hedging income as nonrecurring.

What the market needs to realize is that the whole 2015-2020 period is unlikely to recur anytime soon. That means that the current recovery now occurring is likely to be far more normal than was the case in the 2015-2020 period. The rapid growth of the industry appears unlikely to resume.

If debt progress is not sufficient for the market, then there could be another acquisition. But right now, many expect liquids prices to run higher in the second half of the fiscal year or in early 2024.

This company is doing what it can to improve its situation no matter how the future turns out. The higher debt load makes this investment an above average risk but still a strong buy consideration. Generally, managements that do nothing are the ones that fail. This one is clearly taking action to improve its situation. Therefore, failure is probably off the table. Although a course correction or two is a possibility.

Companies that resolve their issues generally provide above average returns combined with less risk than managements that “sit there and take it”. Therefore, even though the debt load is considered high, investors should benefit from a reducing debt load combined with higher valuations from growth and greater recognition.

Read the full article here