Written by Sam Kovacs.

Introduction

Do you think markets will go up or down over the next 5 months?

Surely you have an opinion.

Surely you had an opinion 5 months ago? Let’s be frank. Did it work out the way you wanted it to?

What if I told you it didn’t matter, you shouldn’t care, markets could go up or down and you could still generate strong double digit yields?

The idea of generating a high yield and not having to be preoccupied by your principal in the short run is a great one.

After all, if you want to live off of your investments, having them spit out cashflow to finance your desired lifestyle without being too concerned with day-to-day movements is certainly a better way of doing things.

It’s a proposition which nearly sounds too good to be true.

There is no doubt that investing in high yielding stocks comes with many risks that mean that you’re often uncomfortable with the idea that your capital might decline in value, your dividends might be cut, or worse: Both.

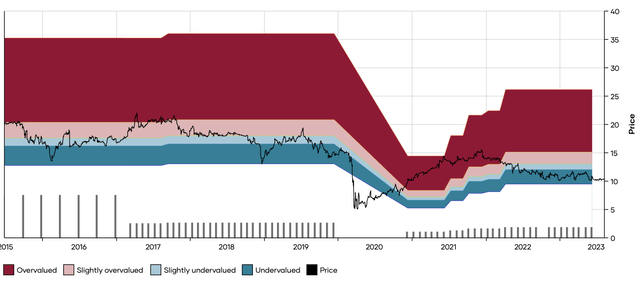

There is no doubt when looking at Eagle Point Credit Co (ECC) that while it yields a lot, it has eroded shareholder value constantly over the past 5 years. Reduced NAV, reduced share price, reduced dividends.

ECC DFT Chart (Dividend Freedom Tribe)

But the problem is that some investors just need big fat yields.

There’s no way around it, rising cost of living means they need and demand more from their portfolios.

No worries, when there is a will, there’s a way, and we’ve developed a strategy which has been generating very high yields with vastly reduced risk.

We realized that the only way we were comfortable generating safe high double digit yields by buying and selling securities was to use a cash covered put selling strategy.

Here’s how it works.

We select promising stocks and sell put options with strike prices lower than the current stock price. By doing so, we collect upfront premiums while setting aside the necessary cash to buy the stock if the option is exercised. If the stock remains above the strike price, the option expires harmlessly, and we pocket the premium. It’s a repeatable process designed to consistently put money in your pocket.

Our strategy is all about yield. We calculate the annualized yield based on the premium received and the cash reserved. It’s like earning interest on your investment, but with the potential for much higher returns. We filter tens of thousands of options on a daily basis, and we consistently find options with annualized yields between 10% and 50% (yes you read that well, and we’ll be sharing such trades with you).

We don’t believe in taking unnecessary risks. That’s why our strategy includes a meticulous risk management system. We avoid stocks with upcoming earnings announcements and use a multi-pronged approach to minimize the chance of assignment. Plus, we spread our options across different stocks, sectors, and expiration dates to dilute the impact of any single event.

Black Swan “flash crashes” are the only real threat to the strategy, which could cause one time losses once in a blue moon. Otherwise the strategy is designed to work well in bull markets, bear markets and flat markets as well.

We recently shared an article showing how 96.8% of the trades we suggested on Seeking Alpha using the strategy were winning trades (that’s to say they expired worthless).

Why does selling put options lead to higher risk-adjusted returns?

Our strategy capitalizes on market psychology. We sell options to two key groups:

- The gamblers who hope for a miracle but often end up losing money. We provide them with options that offer us high yields while giving them a minimal chance of success.

- The risk-averse insurance buyers who tend to overpay for protection. We exploit their tendency to seek safety by offering options that benefit us while playing on their biases.

We have a systemized, data centric approach which the Options By Kovacs account will be sharing continuously with investors on Seeking Alpha in months to come and eventually open its doors to investors to execute its strategy with all the tech and tools we’ve been building for ourselves.

In the meantime, here is a list of trades I’ve been looking at and a few I’ve executed.

I’ve deployed just about $28,000 in cash secured puts on trades from this list including COIN and U this morning.

I’ll provide an extra list as a blog post on the Options by Kovacs account later, highlighting any trades that are still valid and new ones which might have slipped in. Option prices are volatile and the contracts are relatively illiquid, which explains why prices you see here, might not be applicable by the time you go to execute the trade.

|

Ticker |

Underlying last price |

Contract Name |

Exp Date |

Last Price |

Strike |

DFT Buy Below |

Bid |

Ask |

Bid/Ask spread |

Days before exp |

In the money |

Margin Of Safety |

Yield |

Net Yield |

Assignment risk |

Std Dev Safety |

Implied Volatility |

Volume |

Next Earnings Date |

|

Allegiant Travel Company (ALGT) |

102.71 |

ALGT230915P00100000 |

09/15/2023 |

3.3 |

100 |

4 |

4.4 |

9.52381 |

31 |

2.638497 |

47.0967741935 |

46.92016129032 |

0 |

0.6870006985 |

45.22 |

2 |

2023/11/01 |

||

|

Papa Murphy’s Holdings Inc. (FRSH) |

22.76 |

FRSH230915P00022500 |

09/15/2023 |

1.05 |

22.5 |

0.9 |

1.05 |

15.384615 |

31 |

1.142355 |

47.0967741935 |

46.31182795699 |

0 |

0.2898148914 |

46.41 |

12 |

2023/10/31 |

||

|

QuantumScape Corp – Class A (QS) |

7.44 |

QS230908P00006500 |

09/08/2023 |

0.2 |

6.5 |

0.21 |

0.25 |

17.391304 |

24 |

12.634409 |

49.1346153846 |

45.625 |

0 |

2.7627361526 |

69.55 |

0 |

2023/10/25 |

||

|

Coinbase Global Inc – Class A (COIN) |

80.5 |

COIN230825P00072000 |

08/25/2023 |

0.8 |

72 |

0.89 |

0.98 |

9.625668 |

10 |

10.559006 |

45.1180555556 |

44.35763888889 |

0 |

5.0771140899 |

75.91 |

102 |

2023/11/02 |

||

|

Beyond Meat Inc (BYND) |

12.93 |

BYND230908P00010500 |

09/08/2023 |

0.22 |

10.5 |

0.32 |

0.4 |

22.222222 |

24 |

18.793503 |

46.3492063492 |

44.17658730159 |

0 |

3.3250101011 |

85.96 |

6 |

2023/11/08 |

||

|

Coinbase Global Inc – Class A (COIN) |

80.5 |

COIN230915P00070000 |

09/15/2023 |

2.6 |

70 |

2.58 |

2.72 |

5.283019 |

31 |

13.043478 |

43.3963133641 |

43.14400921659 |

0 |

1.9906213755 |

77.15 |

199 |

2023/11/02 |

||

|

Overstock.comInc. (OSTK) |

31.71 |

OSTK230908P00028000 |

09/08/2023 |

0.78 |

28 |

0.8 |

0.95 |

17.142857 |

24 |

11.699779 |

43.4523809524 |

42.63764880952 |

0 |

2.9333027453 |

60.66 |

0 |

2023/10/26 |

||

|

QUALCOMM Incorporated (QCOM) |

114.02 |

QCOM230825P00109000 |

08/25/2023 |

1.2 |

109 |

1.27 |

1.31 |

3.100775 |

10 |

4.402736 |

42.5275229358 |

42.0252293578 |

2.4 |

4.6674376655 |

34.43 |

45 |

2023/11/08 |

||

|

Zscaler Inc. (ZS) |

144.91 |

ZS230908P00125000 |

09/08/2023 |

3.18 |

125 |

3.45 |

3.6 |

4.255319 |

24 |

13.739562 |

41.975 |

41.7925 |

0 |

2.9484386658 |

70.87 |

3 |

2023/09/14 |

||

|

Unity Software (U) |

36.54 |

U230825P00033000 |

08/25/2023 |

0.42 |

33 |

0.39 |

0.43 |

9.756098 |

10 |

9.688013 |

43.1363636364 |

41.47727272727 |

0 |

6.0046269827 |

58.89 |

11 |

2023/11/08 |

||

|

Unity Software (U) |

36.54 |

U230901P00033000 |

09/01/2023 |

0.56 |

33 |

0.65 |

0.7 |

7.407407 |

17 |

9.688013 |

42.2905525847 |

41.31461675579 |

0 |

3.6062299401 |

57.68 |

2 |

2023/11/08 |

||

|

Beyond Meat Inc (BYND) |

12.93 |

BYND230929P00010000 |

09/29/2023 |

0.47 |

10 |

0.52 |

0.6 |

14.285714 |

45 |

22.66048 |

42.1777777778 |

40.96111111111 |

0 |

1.9595060495 |

93.8 |

55 |

2023/11/08 |

||

|

Camping World Holdings Inc. Class A Commom Stock (CWH) |

27.91 |

CWH230825P00026000 |

08/25/2023 |

0.25 |

26 |

0.3 |

0.4 |

28.571429 |

10 |

6.843425 |

42.1153846154 |

40.00961538462 |

0 |

4.9678803856 |

50.28 |

3 |

2023/10/31 |

||

|

iRobot Corporation (IRBT) |

37.25 |

IRBT230915P00035000 |

09/15/2023 |

1.25 |

35 |

1.2 |

1.7 |

34.482759 |

31 |

6.040268 |

40.3686635945 |

39.86405529954 |

0 |

1.4687998885 |

48.42 |

212 |

2023/11/07 |

||

|

Dynatrace Inc (DT) |

46.3 |

DT230825P00045000 |

08/25/2023 |

0.6 |

45 |

0.5 |

0.6 |

18.181818 |

10 |

2.807775 |

40.5555555556 |

39.33888888889 |

1.01 |

3.32955823 |

30.78 |

0 |

2023/11/01 |

||

|

Boston Beer Company Inc. (SAM) |

361.36 |

SAM230915P00360000 |

09/15/2023 |

9.9 |

360 |

11.9 |

13.4 |

11.857708 |

31 |

0.376356 |

38.9202508961 |

38.87119175627 |

2.81 |

0.1648544753 |

26.88 |

2 |

2023/10/26 |

||

|

Erie Indemnity Company (ERIE) |

288.77 |

ERIE230915P00290000 |

09/15/2023 |

9.53 |

290 |

9.5 |

11.8 |

21.596244 |

31 |

0.425945 |

38.5706340378 |

38.50973303671 |

0 |

0.1490387313 |

33.65 |

6 |

2023/10/26 |

||

|

CME Group Inc. (CME) |

206.45 |

CME230825P00205000 |

08/25/2023 |

2.15 |

205 |

2.15 |

2.35 |

8.888889 |

10 |

0.702349 |

38.2804878049 |

38.01341463415 |

0 |

1.5824535439 |

16.2 |

10 |

2023/10/25 |

||

|

Celsius Holdings Inc (CELH) |

183 |

CELH230915P00175000 |

09/15/2023 |

6.44 |

175 |

5.6 |

5.9 |

5.217391 |

31 |

4.371585 |

37.6774193548 |

37.57649769585 |

0 |

1.1262994503 |

45.7 |

25 |

2023/11/08 |

||

|

Luminar Technologies Inc – Class A (LAZR) |

6.36 |

LAZR230922P00005500 |

09/22/2023 |

0.26 |

5.5 |

0.23 |

0.3 |

26.415094 |

38 |

13.522013 |

40.1674641148 |

37.54784688995 |

0 |

1.700923118 |

76.36 |

14 |

2023/11/02 |

||

|

Vertiv Holdings Co – Class A (VRT) |

34.58 |

VRT230915P00032500 |

09/15/2023 |

1 |

32.5 |

1.05 |

1.15 |

9.090909 |

31 |

6.015038 |

38.0397022333 |

37.49627791563 |

0 |

1.4438780334 |

49.05 |

163 |

2023/10/25 |

||

|

PNC Financial Services Group Inc. (PNC) |

127.28 |

PNC230825P00121000 |

08/25/2023 |

1 |

121 |

1.2 |

1.35 |

11.764706 |

10 |

4.934004 |

36.1983471074 |

35.7458677686 |

2.39 |

5.2890202482 |

34.05 |

3 |

2023/10/13 |

||

|

Super Micro Computer Inc. (SMCI) |

269.46 |

SMCI230929P00220000 |

09/29/2023 |

10 |

220 |

9.7 |

10.3 |

6 |

45 |

18.355229 |

35.7626262626 |

35.70732323232 |

0 |

2.1351111714 |

69.73 |

7 |

2023/10/31 |

||

|

Upstart Holdings Inc (UPST) |

34.82 |

UPST230929P00025000 |

09/29/2023 |

1.2 |

25 |

1.11 |

1.17 |

5.263158 |

45 |

28.202183 |

36.0133333333 |

35.52666666667 |

0 |

2.1084988249 |

108.49 |

16 |

2023/11/07 |

||

|

Baxter International Inc. (BAX) |

42.81 |

BAX230901P00042000 |

09/01/2023 |

0.67 |

42 |

0.7 |

0.85 |

19.354839 |

17 |

1.892081 |

35.7843137255 |

35.0175070028 |

0.6 |

1.3921898108 |

29.18 |

0 |

2023/10/26 |

||

|

Norfolk Southern Corporation (NSC) |

215.43 |

NSC230825P00210000 |

08/25/2023 |

1.45 |

210 |

2 |

2.2 |

9.52381 |

10 |

2.52054 |

34.7619047619 |

34.50119047619 |

2.02 |

3.619186562 |

25.42 |

6 |

2023/10/25 |

||

|

Celsius Holdings Inc (CELH) |

183 |

CELH230922P00175000 |

09/22/2023 |

9 |

175 |

6.3 |

6.9 |

9.090909 |

38 |

4.371585 |

34.5789473684 |

34.49661654135 |

0 |

0.9226592281 |

45.51 |

3 |

2023/11/08 |

||

|

Ambarella Inc. (AMBA) |

72.78 |

AMBA230825P00068000 |

08/25/2023 |

0.74 |

68 |

0.65 |

0.8 |

20.689655 |

10 |

6.567738 |

34.8897058824 |

34.08455882353 |

2.85 |

5.1310456682 |

46.72 |

0 |

2023/08/29 |

||

|

Upstart Holdings Inc (UPST) |

34.82 |

UPST230922P00025000 |

09/22/2023 |

1.15 |

25 |

0.89 |

0.96 |

7.567568 |

38 |

28.202183 |

34.1947368421 |

33.61842105263 |

0 |

2.4797636957 |

109.24 |

48 |

2023/11/07 |

||

|

Baxter International Inc. (BAX) |

42.81 |

BAX230825P00042000 |

08/25/2023 |

0.49 |

42 |

0.4 |

0.5 |

22.222222 |

10 |

1.892081 |

34.7619047619 |

33.45833333333 |

0 |

2.6409547898 |

26.15 |

0 |

2023/10/26 |

||

|

QUALCOMM Incorporated (QCOM) |

114.02 |

QCOM230825P00108000 |

08/25/2023 |

1 |

108 |

1 |

1.03 |

2.955665 |

10 |

5.279775 |

33.7962962963 |

33.28935185185 |

2.4 |

5.4732123509 |

35.21 |

49 |

2023/11/08 |

||

|

Luminar Technologies Inc – Class A (LAZR) |

6.36 |

LAZR230901P00005500 |

09/01/2023 |

0.11 |

5.5 |

0.1 |

0.15 |

40 |

17 |

13.522013 |

39.0374331551 |

33.18181818182 |

0 |

3.815053444 |

76.1 |

0 |

2023/11/02 |

||

|

Super Micro Computer Inc. (SMCI) |

269.46 |

SMCI230908P00215000 |

09/08/2023 |

3.4 |

215 |

4.7 |

5.1 |

8.163265 |

24 |

20.210792 |

33.246124031 |

33.14001937984 |

0 |

4.2221492314 |

72.8 |

0 |

2023/10/31 |

||

|

Dynatrace Inc (DT) |

46.3 |

DT230901P00045000 |

09/01/2023 |

0.7 |

45 |

0.7 |

0.9 |

25 |

17 |

2.807775 |

33.3986928105 |

32.68300653595 |

1.42 |

1.916839097 |

31.45 |

0 |

2023/11/01 |

||

|

Wayfair Inc. Class A (W) |

78.36 |

W230922P00067000 |

09/22/2023 |

2.52 |

67 |

2.29 |

2.44 |

6.342495 |

38 |

14.497192 |

32.8299293009 |

32.61488609584 |

0 |

2.1069654795 |

66.09 |

1 |

2023/11/02 |

||

|

Amgen Inc. (AMGN) |

261.77 |

AMGN230825P00260000 |

08/25/2023 |

2.49 |

260 |

255 |

2.32 |

2.59 |

10.997963 |

10 |

0.676166 |

32.5692307692 |

32.35865384615 |

1.2 |

1.0615080816 |

23.25 |

3 |

2023/11/02 |

|

|

AirBnb (ABNB) |

133.24 |

ABNB230825P00124000 |

08/25/2023 |

1.01 |

124 |

1.11 |

1.2 |

7.792208 |

10 |

6.934854 |

32.6733870968 |

32.23185483871 |

1.4 |

6.2345366518 |

40.6 |

21 |

2023/11/07 |

||

|

Marathon Petroleum Corporation (MPC) |

148.54 |

MPC230825P00140000 |

08/25/2023 |

1.19 |

140 |

1.24 |

1.4 |

12.121212 |

10 |

5.749293 |

32.3285714286 |

31.9375 |

2.8 |

6.5271913209 |

32.15 |

81 |

2023/10/31 |

||

|

Camping World Holdings Inc. Class A Commom Stock (CWH) |

27.91 |

CWH230901P00026000 |

09/01/2023 |

0.35 |

26 |

0.4 |

0.6 |

40 |

17 |

6.843425 |

33.0316742081 |

31.79298642534 |

1.42 |

3.5516646872 |

41.37 |

0 |

2023/10/31 |

||

|

QuantumScape Corp – Class A (QS) |

7.44 |

QS230922P00006500 |

09/22/2023 |

0.21 |

6.5 |

0.23 |

0.27 |

16 |

38 |

12.634409 |

33.987854251 |

31.77125506073 |

0 |

1.7659607031 |

68.72 |

0 |

2023/10/25 |

||

|

Rivian Automotive Inc – Class A (RIVN) |

21.38 |

RIVN230825P00018000 |

08/25/2023 |

0.18 |

18 |

0.17 |

0.2 |

16.216216 |

10 |

15.809167 |

34.4722222222 |

31.43055555556 |

0 |

7.0628472161 |

81.7 |

284 |

2023/11/09 |

||

|

Five9 Inc. (FIVN) |

69.57 |

FIVN230915P00065000 |

09/15/2023 |

1.55 |

65 |

1.75 |

1.95 |

10.810811 |

31 |

6.568923 |

31.699751861 |

31.42803970223 |

0 |

1.6672510483 |

46.39 |

543 |

2023/11/09 |

||

|

Celsius Holdings Inc (CELH) |

183 |

CELH230922P00172500 |

09/22/2023 |

9.76 |

172.5 |

5.5 |

6.2 |

11.965812 |

38 |

5.737705 |

30.6254767353 |

30.54195270786 |

0 |

1.1872504455 |

46.42 |

0 |

2023/11/08 |

||

|

American Eagle Outfitters Inc. (AEO) |

15.92 |

AEO230825P00015000 |

08/25/2023 |

0.13 |

15 |

0.14 |

0.16 |

13.333333 |

10 |

5.778894 |

34.0666666667 |

30.41666666667 |

2.84 |

4.7613916558 |

44.3 |

11 |

2023/09/06 |

||

|

Texas Instruments Incorporated (TXN) |

168.87 |

TXN230901P00165000 |

09/01/2023 |

1.93 |

165 |

175 |

2.35 |

2.43 |

3.34728 |

17 |

2.291704 |

30.5793226381 |

30.38413547237 |

2.2 |

2.0091558394 |

24.49 |

11 |

2023/10/24 |

|

|

Zscaler Inc. (ZS) |

144.91 |

ZS230908P00120000 |

09/08/2023 |

2.4 |

120 |

2.41 |

2.61 |

7.968127 |

24 |

17.18998 |

30.5434027778 |

30.35329861111 |

0 |

3.6159190631 |

72.3 |

0 |

2023/09/14 |

||

|

SoFi Technologies Inc (SOFI) |

8.68 |

SOFI230922P00007500 |

09/22/2023 |

0.25 |

7.5 |

0.25 |

0.28 |

11.320755 |

38 |

13.59447 |

32.0175438596 |

30.09649122807 |

0 |

2.0157218638 |

64.78 |

239 |

2023/10/31 |

||

|

PNC Financial Services Group Inc. (PNC) |

127.28 |

PNC230825P00120000 |

08/25/2023 |

0.65 |

120 |

1 |

1.1 |

9.52381 |

10 |

5.719673 |

30.4166666667 |

29.96041666667 |

2.39 |

5.7118487684 |

36.55 |

13 |

2023/10/13 |

||

|

Sterling Construction Company Inc (STRL) |

79.98 |

STRL230915P00080000 |

09/15/2023 |

2.55 |

80 |

2.05 |

2.35 |

13.636364 |

31 |

0.025006 |

30.1713709677 |

29.95060483871 |

0 |

0.0095593652 |

30.8 |

3 |

2023/11/06 |

||

|

Beyond Meat Inc (BYND) |

12.93 |

BYND230825P00010500 |

08/25/2023 |

0.11 |

10.5 |

0.1 |

0.11 |

9.52381 |

10 |

18.793503 |

34.7619047619 |

29.54761904762 |

0 |

7.7844176565 |

88.12 |

7 |

2023/11/08 |

||

|

Wayfair Inc. Class A (W) |

78.36 |

W230922P00066000 |

09/22/2023 |

3.04 |

66 |

2.04 |

2.22 |

8.450704 |

38 |

15.773354 |

29.6889952153 |

29.4706937799 |

0 |

2.2889743727 |

66.19 |

6 |

2023/11/02 |

||

|

SL Green Realty Corporation (SLG) |

33.95 |

SLG230915P00027500 |

09/15/2023 |

0.6 |

27.5 |

0.7 |

0.95 |

30.30303 |

31 |

18.998527 |

29.9706744868 |

29.3284457478 |

0 |

3.1978890517 |

69.95 |

63 |

2023/10/18 |

||

|

Southern Co (SO) |

68.87 |

SO230825P00067000 |

08/25/2023 |

0.38 |

67 |

0.55 |

0.7 |

24 |

10 |

2.715261 |

29.9626865672 |

29.14552238806 |

1.61 |

4.1941182482 |

23.63 |

1 |

2023/11/02 |

||

|

Azenta Inc (AZTA) |

56.07 |

AZTA230915P00055000 |

09/15/2023 |

1.6 |

55 |

1.35 |

1.75 |

25.806452 |

31 |

1.908329 |

28.9002932551 |

28.57917888563 |

0 |

0.5190351986 |

43.29 |

0 |

2023/11/14 |

||

|

Lennox International Inc. (LII) |

372.66 |

LII230825P00370000 |

08/25/2023 |

0 |

370 |

2.85 |

7 |

84.263959 |

10 |

0.713787 |

28.1148648649 |

27.96689189189 |

3.82 |

0.8907090304 |

29.25 |

0 |

2023/10/26 |

||

|

Apple Inc. (AAPL) |

179.46 |

AAPL230825P00175000 |

08/25/2023 |

1.35 |

175 |

1.34 |

1.35 |

0.743494 |

10 |

2.485233 |

27.9485714286 |

27.63571428571 |

3 |

4.2828622692 |

21.18 |

6009 |

2023/11/02 |

||

|

Overstock.comInc. (OSTK) |

31.71 |

OSTK230908P00027000 |

09/08/2023 |

0.55 |

27 |

0.5 |

0.65 |

26.086957 |

24 |

14.853359 |

28.1635802469 |

27.31867283951 |

0 |

3.6611803953 |

61.7 |

1 |

2023/10/26 |

||

|

Mueller Industries Inc. (MLI) |

76.49 |

MLI230915P00075000 |

09/15/2023 |

1.55 |

75 |

1.75 |

2.1 |

18.181818 |

31 |

1.947967 |

27.4731182796 |

27.2376344086 |

3.04 |

0.8727451048 |

26.28 |

2 |

2023/10/24 |

||

|

Upwork Inc (UPWK) |

13.85 |

UPWK230915P00012500 |

09/15/2023 |

0.45 |

12.5 |

0.3 |

0.4 |

28.571429 |

31 |

9.747292 |

28.2580645161 |

26.84516129032 |

0 |

2.019825918 |

56.82 |

18 |

2023/11/01 |

||

|

Southwest Airlines Company (LUV) |

33.53 |

LUV230825P00032000 |

08/25/2023 |

0.31 |

32 |

0.25 |

0.27 |

7.692308 |

10 |

4.563078 |

28.515625 |

26.8046875 |

0 |

5.3813357949 |

30.95 |

120 |

2023/10/26 |

||

|

CME Group Inc. (CME) |

206.45 |

CME230901P00205000 |

09/01/2023 |

2.8 |

205 |

2.55 |

3 |

16.216216 |

17 |

0.702349 |

26.7073170732 |

26.55021520803 |

1.2 |

0.8860077214 |

17.02 |

6 |

2023/10/25 |

||

|

Allegiant Travel Company (ALGT) |

102.71 |

ALGT230915P00095000 |

09/15/2023 |

2.2 |

95 |

2.15 |

2.45 |

13.043478 |

31 |

7.506572 |

26.6468590832 |

26.46095076401 |

0 |

1.8367379746 |

48.12 |

2 |

2023/11/01 |

||

|

Broadcom Inc. (AVGO) |

853.37 |

AVGO230825P00800000 |

08/25/2023 |

5.46 |

800 |

630 |

5.8 |

6.2 |

6.666667 |

10 |

6.254028 |

26.4625 |

26.3940625 |

2.8 |

5.9107206022 |

38.62 |

83 |

2023/09/07 |

|

|

NXP Semiconductors NV (NXPI) |

207.25 |

NXPI230825P00192500 |

08/25/2023 |

1.15 |

192.5 |

1.4 |

1.55 |

10.169492 |

10 |

7.117008 |

26.5454545455 |

26.26103896104 |

2.8 |

7.0436770824 |

36.88 |

10 |

2023/11/06 |

||

|

Piedmont Lithium Ltd (PLL) |

45.49 |

PLL230915P00040000 |

09/15/2023 |

0.8 |

40 |

0.9 |

1.05 |

15.384615 |

31 |

12.068587 |

26.4919354839 |

26.05040322581 |

0 |

2.6590171175 |

53.44 |

68 |

2023/11/06 |

||

|

Southwest Airlines Company (LUV) |

33.53 |

LUV230901P00032000 |

09/01/2023 |

0.44 |

32 |

0.4 |

0.42 |

4.878049 |

17 |

4.563078 |

26.8382352941 |

25.83180147059 |

3.66 |

3.2419578552 |

30.22 |

63 |

2023/10/26 |

||

|

Delta Air Lines Inc. (DAL) |

44.23 |

DAL230825P00042000 |

08/25/2023 |

0.33 |

42 |

0.31 |

0.35 |

12.121212 |

10 |

5.041827 |

26.9404761905 |

25.6369047619 |

3.21 |

5.6693370476 |

32.46 |

161 |

2023/10/12 |

||

|

American Airlines Group Inc. (AAL) |

15.88 |

AAL230825P00015000 |

08/25/2023 |

0.13 |

15 |

0.12 |

0.13 |

8 |

10 |

5.541562 |

29.2 |

25.55 |

3.04 |

5.8206332242 |

34.75 |

22 |

2023/10/19 |

||

|

C3.ai Inc – Class A (AI) |

33.9 |

AI230825P00028000 |

08/25/2023 |

0.2 |

28 |

0.21 |

0.23 |

9.090909 |

10 |

17.40413 |

27.375 |

25.41964285714 |

0 |

7.4524958214 |

85.24 |

83 |

2023/08/30 |

||

|

Rhythm Pharmaceuticals Inc. (RYTM) |

26.44 |

RYTM230915P00022500 |

09/15/2023 |

1 |

22.5 |

0.5 |

1.5 |

100 |

31 |

14.901664 |

26.164874552 |

25.37992831541 |

0 |

2.5730324035 |

68.19 |

0 |

2023/11/07 |

||

|

Unity Software (U) |

36.54 |

U230825P00032000 |

08/25/2023 |

0.22 |

32 |

0.23 |

0.24 |

4.255319 |

10 |

12.42474 |

26.234375 |

24.5234375 |

0 |

7.4897277446 |

60.55 |

16 |

2023/11/08 |

||

|

General Motors Company (GM) |

34.07 |

GM230901P00032000 |

09/01/2023 |

0.43 |

32 |

0.38 |

0.43 |

12.345679 |

17 |

6.075726 |

25.4963235294 |

24.48988970588 |

2.01 |

3.6715289065 |

35.53 |

85 |

2023/10/24 |

||

|

United Continental Holdings Inc. (UAL) |

52.31 |

UAL230825P00049000 |

08/25/2023 |

0.37 |

49 |

0.34 |

0.36 |

5.714286 |

10 |

6.327662 |

25.3265306122 |

24.20918367347 |

3.64 |

5.9617879673 |

38.74 |

2 |

2023/10/17 |

||

|

PNC Financial Services Group Inc. (PNC) |

127.28 |

PNC230825P00119000 |

08/25/2023 |

0.55 |

119 |

0.8 |

0.95 |

17.142857 |

10 |

6.505343 |

24.5378151261 |

24.07773109244 |

2.39 |

6.2849392673 |

37.78 |

1 |

2023/10/13 |

||

|

MasTec Inc. (MTZ) |

94.48 |

MTZ230915P00090000 |

09/15/2023 |

1.65 |

90 |

1.85 |

2.05 |

10.25641 |

31 |

4.741744 |

24.2025089606 |

24.00627240143 |

0 |

1.7774662694 |

31.41 |

6 |

2023/11/02 |

||

|

Upstart Holdings Inc (UPST) |

34.82 |

UPST230901P00023000 |

09/01/2023 |

0.42 |

23 |

0.27 |

0.32 |

16.949153 |

17 |

33.946008 |

25.2046035806 |

23.80434782609 |

0 |

6.1876285608 |

117.79 |

4 |

2023/11/07 |

||

|

General Motors Company (GM) |

34.07 |

GM230825P00032000 |

08/25/2023 |

0.23 |

32 |

0.22 |

0.24 |

8.695652 |

10 |

6.075726 |

25.09375 |

23.3828125 |

0.2 |

6.149861827 |

36.06 |

204 |

2023/10/24 |

||

|

QuantumScape Corp – Class A (QS) |

7.44 |

QS230901P00006000 |

09/01/2023 |

0.09 |

6 |

0.08 |

0.09 |

11.764706 |

17 |

19.354839 |

28.6274509804 |

23.25980392157 |

0 |

5.180251514 |

80.22 |

5 |

2023/10/25 |

||

|

Luminar Technologies Inc – Class A (LAZR) |

6.36 |

LAZR230825P00005500 |

08/25/2023 |

0.08 |

5.5 |

0.05 |

0.21 |

123.076923 |

10 |

13.522013 |

33.1818181818 |

23.22727272727 |

0 |

6.2380367044 |

79.12 |

67 |

2023/11/02 |

||

|

Rivian Automotive Inc – Class A (RIVN) |

21.38 |

RIVN230825P00018500 |

08/25/2023 |

0.14 |

18.5 |

0.13 |

0.15 |

14.285714 |

10 |

13.470533 |

25.6486486486 |

22.68918918919 |

0 |

6.3746203427 |

77.13 |

861 |

2023/11/09 |

||

|

AirBnb (ABNB) |

133.24 |

ABNB230825P00122000 |

08/25/2023 |

0.79 |

122 |

0.76 |

0.83 |

8.805031 |

10 |

8.435905 |

22.737704918 |

22.28893442623 |

1.4 |

7.408819549 |

41.56 |

1 |

2023/11/07 |

||

|

Broadcom Inc. (AVGO) |

853.37 |

AVGO230825P00795000 |

08/25/2023 |

4.9 |

795 |

630 |

4.8 |

5.3 |

9.90099 |

10 |

6.83994 |

22.0377358491 |

21.96886792453 |

2.8 |

6.3348853007 |

39.41 |

11 |

2023/09/07 |

|

|

SoFi Technologies Inc (SOFI) |

8.68 |

SOFI230825P00007500 |

08/25/2023 |

0.07 |

7.5 |

0.06 |

0.07 |

15.384615 |

10 |

13.59447 |

29.2 |

21.9 |

0 |

6.8859028815 |

72.06 |

168 |

2023/10/31 |

||

|

Rivian Automotive Inc – Class A (RIVN) |

21.38 |

RIVN230825P00017500 |

08/25/2023 |

0.09 |

17.5 |

0.12 |

0.14 |

15.384615 |

10 |

18.147802 |

25.0285714286 |

21.9 |

0 |

7.9357226319 |

83.47 |

7 |

2023/11/09 |

||

|

Super Micro Computer Inc. (SMCI) |

269.46 |

SMCI230825P00215000 |

08/25/2023 |

1.1 |

215 |

1.3 |

1.45 |

10.909091 |

10 |

20.210792 |

22.0697674419 |

21.81511627907 |

0 |

8.9732868715 |

82.21 |

138 |

2023/10/31 |

||

|

Roku Inc. (ROKU) |

82.26 |

ROKU230922P00070000 |

09/22/2023 |

1.38 |

70 |

1.6 |

1.67 |

4.281346 |

38 |

14.903963 |

21.954887218 |

21.74906015038 |

0 |

2.5531743747 |

56.07 |

5 |

2023/11/01 |

||

|

Norfolk Southern Corporation (NSC) |

215.43 |

NSC230908P00210000 |

09/08/2023 |

2.1 |

210 |

2.95 |

3.5 |

17.054264 |

24 |

2.52054 |

21.3640873016 |

21.25545634921 |

3.85 |

1.4869362944 |

25.78 |

0 |

2023/10/25 |

||

|

Zscaler Inc. (ZS) |

144.91 |

ZS230908P00115000 |

09/08/2023 |

1.53 |

115 |

1.62 |

1.77 |

8.849558 |

24 |

20.640397 |

21.4239130435 |

21.22554347826 |

0 |

4.292438784 |

73.13 |

3 |

2023/09/14 |

||

|

PPG Industries Inc. (PPG) |

139.63 |

PPG230825P00135000 |

08/25/2023 |

0.83 |

135 |

0.8 |

0.95 |

17.142857 |

10 |

3.315906 |

21.6296296296 |

21.22407407407 |

2.82 |

4.9039944097 |

24.68 |

2 |

2023/10/18 |

||

|

MongoDB Inc. (MDB) |

364.41 |

MDB230825P00325000 |

08/25/2023 |

2.06 |

325 |

1.9 |

2.33 |

20.330969 |

10 |

10.814742 |

21.3384615385 |

21.17 |

0 |

7.0564546604 |

55.94 |

49 |

2023/08/31 |

||

|

Ford Motor Company (F) |

12.2 |

F230825P00011500 |

08/25/2023 |

0.09 |

11.5 |

0.08 |

0.09 |

11.764706 |

10 |

5.737705 |

25.3913043478 |

20.63043478261 |

2.59 |

5.6101321083 |

37.33 |

715 |

2023/10/26 |

||

|

Erie Indemnity Company (ERIE) |

288.77 |

ERIE230915P00280000 |

09/15/2023 |

4.9 |

280 |

4.9 |

7.1 |

36.666667 |

31 |

3.037019 |

20.6048387097 |

20.54176267281 |

0 |

1.1697236123 |

30.57 |

238 |

2023/10/26 |

||

|

Camping World Holdings Inc. Class A Commom Stock (CWH) |

27.91 |

CWH230915P00025000 |

09/15/2023 |

0.5 |

25 |

0.45 |

0.6 |

28.571429 |

31 |

10.42637 |

21.1935483871 |

20.48709677419 |

0 |

2.9595493063 |

41.48 |

20 |

2023/10/31 |

||

|

Baxter International Inc. (BAX) |

42.81 |

BAX230901P00041000 |

09/01/2023 |

0.39 |

41 |

0.4 |

0.5 |

22.222222 |

17 |

4.227984 |

20.9469153515 |

20.16140602582 |

0.2 |

2.9235847641 |

31.05 |

3 |

2023/10/26 |

||

|

PNC Financial Services Group Inc. (PNC) |

127.28 |

PNC230825P00118000 |

08/25/2023 |

0.24 |

118 |

0.65 |

0.75 |

14.285714 |

10 |

7.291012 |

20.1059322034 |

19.64194915254 |

2.19 |

7.1289027203 |

37.33 |

0 |

2023/10/13 |

||

|

Louisiana-Pacific Corporation (LPX) |

63.87 |

LPX230915P00060000 |

09/15/2023 |

1.1 |

60 |

1 |

1.15 |

13.953488 |

31 |

6.059183 |

19.623655914 |

19.32930107527 |

0 |

2.3788593112 |

29.99 |

0 |

2023/10/31 |

||

|

Eli Lilly and Company (LLY) |

537.42 |

LLY230825P00525000 |

08/25/2023 |

3.04 |

525 |

2.79 |

3.1 |

10.526316 |

10 |

2.311042 |

19.3971428571 |

19.29285714286 |

1.6 |

3.6265271207 |

23.26 |

28 |

2023/11/02 |

||

|

Sirius XM Holdings Inc. (SIRI) |

4.7 |

SIRI230915P00004000 |

09/15/2023 |

0.09 |

4 |

0.08 |

0.14 |

54.545455 |

31 |

14.893617 |

23.5483870968 |

19.13306451613 |

0 |

2.6658609182 |

65.78 |

4 |

2023/10/31 |

||

|

Broadcom Inc. (AVGO) |

853.37 |

AVGO230825P00790000 |

08/25/2023 |

4.2 |

790 |

630 |

4.1 |

4.6 |

11.494253 |

10 |

7.425853 |

18.9430379747 |

18.87373417722 |

2.8 |

6.7676312045 |

40.05 |

10 |

2023/09/07 |

|

|

Eli Lilly and Company (LLY) |

537.42 |

LLY230901P00525000 |

09/01/2023 |

6.3 |

525 |

4.6 |

5.2 |

12.244898 |

17 |

2.311042 |

18.81232493 |

18.75098039216 |

3.6 |

2.1554919208 |

23.02 |

11 |

2023/11/02 |

||

|

Telephone and Data Systems Inc. (TDS) |

18.04 |

TDS230915P00015000 |

09/15/2023 |

0.3 |

15 |

0.25 |

0.3 |

18.181818 |

31 |

16.851441 |

19.623655914 |

18.44623655914 |

0 |

2.8111665165 |

70.58 |

187 |

2023/11/02 |

||

|

BridgeBio Pharma Inc (BBIO) |

31.55 |

BBIO230915P00025000 |

09/15/2023 |

0.4 |

25 |

0.4 |

0.5 |

22.222222 |

31 |

20.760697 |

18.8387096774 |

18.13225806452 |

0 |

3.5100584538 |

69.64 |

0 |

2023/11/02 |

||

|

MongoDB Inc. (MDB) |

364.41 |

MDB230825P00320000 |

08/25/2023 |

0.92 |

320 |

1.59 |

1.99 |

22.346369 |

10 |

12.186823 |

18.1359375 |

17.96484375 |

0 |

7.8011053486 |

57.02 |

5 |

2023/08/31 |

||

|

QUALCOMM Incorporated (QCOM) |

114.02 |

QCOM230908P00105000 |

09/08/2023 |

0.91 |

105 |

1.25 |

1.29 |

3.149606 |

24 |

7.910893 |

18.1051587302 |

17.8878968254 |

0 |

3.5892451152 |

33.52 |

0 |

2023/11/08 |

||

|

Roku Inc. (ROKU) |

82.26 |

ROKU230908P00071000 |

09/08/2023 |

0.9 |

71 |

0.84 |

0.9 |

6.896552 |

24 |

13.688305 |

17.9929577465 |

17.67165492958 |

0 |

3.7488981265 |

55.53 |

0 |

2023/11/01 |

||

|

MGM Resorts International (MGM) |

45.66 |

MGM230825P00043000 |

08/25/2023 |

0.19 |

43 |

0.22 |

0.24 |

8.695652 |

10 |

5.825668 |

18.6744186047 |

17.4011627907 |

3.85 |

6.0822907158 |

34.96 |

5 |

2023/11/01 |

||

|

Guardant Health Inc (GH) |

35.81 |

GH230915P00030000 |

09/15/2023 |

0.51 |

30 |

0.45 |

0.55 |

20 |

31 |

16.224518 |

17.6612903226 |

17.07258064516 |

0 |

3.3602571767 |

56.85 |

105 |

2023/11/02 |

||

|

EOG Resources Inc. (EOG) |

129.78 |

EOG230915P00078500 |

09/15/2023 |

1.35 |

78.5 |

120 |

1.15 |

1.3 |

12.244898 |

31 |

39.513022 |

17.2488185741 |

17.02383398397 |

0 |

930.4679476022 |

0.5 |

4 |

2023/11/02 |

|

|

Upstart Holdings Inc (UPST) |

34.82 |

UPST230825P00025000 |

08/25/2023 |

0.12 |

25 |

0.13 |

0.14 |

7.407407 |

10 |

28.202183 |

18.98 |

16.79 |

0 |

8.5539278474 |

120.34 |

621 |

2023/11/07 |

||

|

Wayfair Inc. Class A (W) |

78.36 |

W230922P00061000 |

09/22/2023 |

1.19 |

61 |

1.08 |

1.19 |

9.69163 |

38 |

22.15416 |

17.0060396894 |

16.7698446937 |

0 |

3.12201496 |

68.16 |

5 |

2023/11/02 |

||

|

ImmunoGen Inc. (IMGN) |

15.12 |

IMGN230915P00013000 |

09/15/2023 |

0.45 |

13 |

0.2 |

0.3 |

40 |

31 |

14.021164 |

18.1141439206 |

16.75558312655 |

0 |

2.7174963063 |

60.75 |

1 |

2023/11/03 |

||

|

Pacific Gas & Electric Co. (PCG) |

17.2 |

PCG230825P00016500 |

08/25/2023 |

0.07 |

16.5 |

0.09 |

0.13 |

36.363636 |

10 |

4.069767 |

19.9090909091 |

16.59090909091 |

2.83 |

5.4333033326 |

27.34 |

21 |

2023/11/02 |

||

|

Comerica Incorporated (CMA) |

50.09 |

CMA230929P00041000 |

09/29/2023 |

0 |

41 |

0.85 |

1.05 |

21.052632 |

45 |

18.147335 |

16.8157181572 |

16.5189701897 |

0 |

2.7395319038 |

53.73 |

0 |

2023/10/20 |

||

|

Super Micro Computer Inc. (SMCI) |

269.46 |

SMCI230825P00210000 |

08/25/2023 |

1.05 |

210 |

0.95 |

1.1 |

14.634146 |

10 |

22.066355 |

16.5119047619 |

16.25119047619 |

0 |

9.6596541506 |

83.38 |

50 |

2023/10/31 |

||

|

Broadcom Inc. (AVGO) |

853.37 |

AVGO230825P00785000 |

08/25/2023 |

2.73 |

785 |

630 |

3.5 |

3.9 |

10.810811 |

10 |

8.011765 |

16.2738853503 |

16.20414012739 |

2.8 |

7.1673879849 |

40.8 |

15 |

2023/09/07 |

|

|

PPG Industries Inc. (PPG) |

139.63 |

PPG230825P00134000 |

08/25/2023 |

0.85 |

134 |

0.6 |

0.75 |

22.222222 |

10 |

4.032085 |

16.3432835821 |

15.93470149254 |

2.82 |

5.7941376578 |

25.4 |

0 |

2023/10/18 |

||

|

Tesla Inc. (TSLA) |

239.76 |

TSLA230915P00206670 |

09/15/2023 |

2.66 |

206.67 |

2.78 |

2.81 |

1.073345 |

31 |

13.801301 |

15.8379339355 |

15.75247745744 |

0 |

3.3755545153 |

48.14 |

138 |

2023/10/18 |

||

|

General Motors Company (GM) |

34.07 |

GM230825P00031500 |

08/25/2023 |

0.15 |

31.5 |

0.15 |

0.16 |

6.451613 |

10 |

7.543293 |

17.380952381 |

15.64285714286 |

0.6 |

7.3914149068 |

37.25 |

17 |

2023/10/24 |

||

|

C3.ai Inc – Class A (AI) |

33.9 |

AI230825P00027000 |

08/25/2023 |

0.12 |

27 |

0.13 |

0.14 |

7.407407 |

10 |

20.353982 |

17.5740740741 |

15.5462962963 |

0 |

8.6516869851 |

85.87 |

352 |

2023/08/30 |

||

|

Coinbase Global Inc – Class A (COIN) |

80.5 |

COIN230825P00067000 |

08/25/2023 |

0.32 |

67 |

0.3 |

0.33 |

9.52381 |

10 |

16.770186 |

16.3432835821 |

15.52611940299 |

0 |

7.7462896401 |

79.02 |

56 |

2023/11/02 |

||

|

Tesla Inc. (TSLA) |

239.76 |

TSLA230922P00205000 |

09/22/2023 |

3.15 |

205 |

3.3 |

3.4 |

2.985075 |

38 |

14.497831 |

15.4621309371 |

15.39184852375 |

0 |

2.8795592144 |

48.36 |

67 |

2023/10/18 |

||

|

Dynatrace Inc (DT) |

46.3 |

DT230825P00044000 |

08/25/2023 |

0.35 |

44 |

0.2 |

0.35 |

54.545455 |

10 |

4.967603 |

16.5909090909 |

15.34659090909 |

1.01 |

5.5807170334 |

32.49 |

0 |

2023/11/01 |

||

|

Cloudflare Inc – Class A (NET) |

65.64 |

NET230908P00054000 |

09/08/2023 |

0.48 |

54 |

0.55 |

0.6 |

8.695652 |

24 |

17.73309 |

15.4899691358 |

15.0675154321 |

0 |

4.7945020454 |

56.25 |

1 |

2023/11/02 |

||

|

Comerica Incorporated (CMA) |

50.09 |

CMA230922P00041000 |

09/22/2023 |

0.5 |

41 |

0.65 |

0.85 |

26.666667 |

38 |

18.147335 |

15.2278562259 |

14.87644415918 |

0 |

3.1995214099 |

54.48 |

1 |

2023/10/20 |

||

|

United Continental Holdings Inc. (UAL) |

52.31 |

UAL230825P00048000 |

08/25/2023 |

0.16 |

48 |

0.21 |

0.23 |

9.090909 |

10 |

8.239342 |

15.96875 |

14.828125 |

3.04 |

7.3225225213 |

41.07 |

6 |

2023/10/17 |

||

|

Beyond Meat Inc (BYND) |

12.93 |

BYND230901P00009500 |

09/01/2023 |

0.08 |

9.5 |

0.08 |

0.09 |

11.764706 |

17 |

26.527456 |

18.080495356 |

14.69040247678 |

0 |

6.1059185281 |

93.28 |

0 |

2023/11/08 |

||

|

Wayfair Inc. Class A (W) |

78.36 |

W230922P00060000 |

09/22/2023 |

0.98 |

60 |

0.93 |

1.06 |

13.065327 |

38 |

23.430322 |

14.8881578947 |

14.64802631579 |

0 |

3.2782870337 |

68.65 |

1 |

2023/11/02 |

||

|

Zscaler Inc. (ZS) |

144.91 |

ZS230908P00110000 |

09/08/2023 |

0.96 |

110 |

1.07 |

1.18 |

9.777778 |

24 |

24.090815 |

14.7935606061 |

14.58617424242 |

0 |

4.8766291532 |

75.13 |

4 |

2023/09/14 |

||

|

Tesla Inc. (TSLA) |

239.76 |

TSLA230915P00205000 |

09/15/2023 |

2.51 |

205 |

2.53 |

2.55 |

0.787402 |

31 |

14.497831 |

14.5310778914 |

14.4449252557 |

0 |

3.5210452118 |

48.48 |

3678 |

2023/10/18 |

||

|

Draftkings (DKNG) |

29.36 |

DKNG230922P00024000 |

09/22/2023 |

0.27 |

24 |

0.37 |

0.42 |

12.658228 |

38 |

18.256131 |

14.8081140351 |

14.20778508772 |

0 |

3.1612572662 |

55.47 |

0 |

2023/11/03 |

||

|

Carnival Corporation (CCL) |

16.73 |

CCL230908P00014500 |

09/08/2023 |

0.16 |

14.5 |

0.15 |

0.16 |

6.451613 |

24 |

13.329348 |

15.7327586207 |

14.15948275862 |

0 |

3.768677761 |

53.79 |

59 |

2023/09/28 |

||

|

QUALCOMM Incorporated (QCOM) |

114.02 |

QCOM230825P00107000 |

08/25/2023 |

0.45 |

107 |

0.43 |

0.46 |

6.741573 |

10 |

6.156815 |

14.6682242991 |

14.15654205607 |

0.8 |

6.3338144004 |

35.48 |

113 |

2023/11/08 |

||

|

Roku Inc. (ROKU) |

82.26 |

ROKU230908P00068000 |

09/08/2023 |

0.72 |

68 |

0.64 |

0.67 |

4.580153 |

24 |

17.335278 |

14.3137254902 |

13.97824754902 |

0 |

4.6753093589 |

56.39 |

5 |

2023/11/01 |

||

|

QuantumScape Corp – Class A (QS) |

7.44 |

QS230908P00006000 |

09/08/2023 |

0.09 |

6 |

0.07 |

0.11 |

44.444444 |

24 |

19.354839 |

17.7430555556 |

13.94097222222 |

0 |

3.942076358 |

74.67 |

1 |

2023/10/25 |

||

|

Texas Instruments Incorporated (TXN) |

168.87 |

TXN230915P00160000 |

09/15/2023 |

1.87 |

160 |

175 |

1.9 |

1.93 |

1.56658 |

31 |

5.252561 |

13.9818548387 |

13.87147177419 |

3.6 |

2.4787443738 |

24.95 |

52 |

2023/10/24 |

|

|

Amgen Inc. (AMGN) |

261.77 |

AMGN230825P00255000 |

08/25/2023 |

1.56 |

255 |

255 |

0.98 |

1.17 |

17.674419 |

10 |

2.58624 |

14.0274509804 |

13.81274509804 |

2.6 |

4.2927582855 |

21.99 |

5 |

2023/11/02 |

|

|

AirBnb (ABNB) |

133.24 |

ABNB230908P00118000 |

09/08/2023 |

1 |

118 |

1.08 |

1.16 |

7.142857 |

24 |

11.438007 |

13.9194915254 |

13.72616525424 |

0 |

4.228318397 |

41.14 |

0 |

2023/11/07 |

||

|

AirBnb (ABNB) |

133.24 |

ABNB230908P00120000 |

09/08/2023 |

1.08 |

120 |

1.08 |

1.17 |

8 |

24 |

9.936956 |

13.6875 |

13.49739583333 |

0 |

3.7894819129 |

39.88 |

27 |

2023/11/07 |

||

|

Sirius International Insurance Group Ltd (SG) |

14.05 |

SG230915P00012000 |

09/15/2023 |

0.23 |

12 |

0.15 |

0.3 |

66.666667 |

31 |

14.590747 |

14.7177419355 |

13.24596774194 |

0 |

2.9256519892 |

58.72 |

1 |

2023/10/26 |

||

|

MongoDB Inc. (MDB) |

364.41 |

MDB230825P00315000 |

08/25/2023 |

1.18 |

315 |

1.15 |

1.42 |

21.011673 |

10 |

13.558903 |

13.3253968254 |

13.15158730159 |

0 |

8.5005149476 |

58.22 |

4 |

2023/08/31 |

||

|

iRobot Corporation (IRBT) |

37.25 |

IRBT230915P00030000 |

09/15/2023 |

0.35 |

30 |

0.35 |

0.45 |

25 |

31 |

19.463087 |

13.7365591398 |

13.14784946237 |

0 |

3.6094213042 |

63.49 |

132 |

2023/11/07 |

||

|

Eli Lilly and Company (LLY) |

537.42 |

LLY230825P00520000 |

08/25/2023 |

2.15 |

520 |

1.85 |

2.18 |

16.377171 |

10 |

3.241413 |

12.9855769231 |

12.88028846154 |

1.6 |

5.0345346312 |

23.5 |

65 |

2023/11/02 |

||

|

Five9 Inc. (FIVN) |

69.57 |

FIVN230915P00060000 |

09/15/2023 |

0.75 |

60 |

0.65 |

0.8 |

20.689655 |

31 |

13.755929 |

12.7553763441 |

12.46102150538 |

0 |

3.3033851805 |

49.03 |

0 |

2023/11/09 |

||

|

Coinbase Global Inc – Class A (COIN) |

80.5 |

COIN230825P00066000 |

08/25/2023 |

0.28 |

66 |

0.24 |

0.26 |

8 |

10 |

18.012422 |

13.2727272727 |

12.44318181818 |

0 |

8.1398219973 |

80.77 |

49 |

2023/11/02 |

||

|

Carnival Corporation (CCL) |

16.73 |

CCL230922P00014000 |

09/22/2023 |

0.33 |

14 |

0.19 |

0.23 |

19.047619 |

38 |

16.317992 |

13.0357142857 |

12.00657894737 |

0 |

2.8791073456 |

54.44 |

15 |

2023/09/28 |

||

|

PPG Industries Inc. (PPG) |

139.63 |

PPG230825P00133000 |

08/25/2023 |

0.61 |

133 |

0.45 |

0.6 |

28.571429 |

10 |

4.748263 |

12.3496240602 |

11.93796992481 |

2.82 |

6.7019184449 |

25.86 |

0 |

2023/10/18 |

||

|

Dynatrace Inc (DT) |

46.3 |

DT230908P00043000 |

09/08/2023 |

0 |

43 |

0.35 |

0.5 |

35.294118 |

24 |

7.12743 |

12.378875969 |

11.84835271318 |

0 |

3.2857329305 |

32.99 |

0 |

2023/11/01 |

||

|

Roku Inc. (ROKU) |

82.26 |

ROKU230908P00067000 |

09/08/2023 |

0.47 |

67 |

0.53 |

0.57 |

7.272727 |

24 |

18.550936 |

12.0304726368 |

11.68998756219 |

0 |

4.9117134751 |

57.44 |

3 |

2023/11/01 |

||

|

Sterling Construction Company Inc (STRL) |

79.98 |

STRL230915P00075000 |

09/15/2023 |

0.95 |

75 |

0.7 |

0.95 |

30.30303 |

31 |

6.226557 |

10.9892473118 |

10.75376344086 |

0 |

2.2365065205 |

32.78 |

5 |

2023/11/06 |

||

|

SoFi Technologies Inc (SOFI) |

8.68 |

SOFI230901P00007000 |

09/01/2023 |

0.05 |

7 |

0.05 |

0.06 |

18.181818 |

17 |

19.354839 |

15.3361344538 |

10.73529411765 |

0 |

5.6020460562 |

74.18 |

96 |

2023/10/31 |

||

|

Vector Group Ltd. (VGR) |

10.99 |

VGR230915P00010000 |

09/15/2023 |

0.15 |

10 |

0.1 |

0.2 |

66.666667 |

31 |

9.008189 |

11.7741935484 |

10.00806451613 |

0 |

3.0592490615 |

34.67 |

25 |

2023/11/01 |

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here