The remittances space is in the middle of a multi-year transformation as it works to respond to a changing world. Customer types, use cases and pay-in and pay-out methods are all evolving, and while we are many years from the true end of cash use, it has seen a rapid decline in many markets.

Meanwhile, the number of people sending remittances continues to grow. According to the International Organization for Migration, 3.6% of the global population in 2020 were migrants, up from 2.8% in 2000. That number is only expected to rise as climate change and regional conflicts create increased migrationary pressures, with my own company FXC Intelligence projecting that the consumer-to-consumer cross-border payment market will grow 80% between 2023 and 2030 to reach a total size of $3.3tn.

This is creating a remittance landscape where players are having to evolve fairly rapidly in response to the changing needs of their customers. For some – particularly those that have traditionally excelled in the cash-led, retail-focused remittance space – this has sometimes proved a challenge. However, the latest earnings season, Q2 2023, indicates an industry that is turning a corner – and in which priorities are starting to shift.

Remittances see positive growth, but is it enough?

This quarter, all the major publicly traded remittance companies – Ria owner Euronet, Western Union

WU

This is par for the course for most, but for Western Union it represents the first quarter since 2021 where the company has seen its revenues rise above the previous year’s numbers, and has also been paired with a rise in transaction rates – something also seen by Euronet and Intermex.

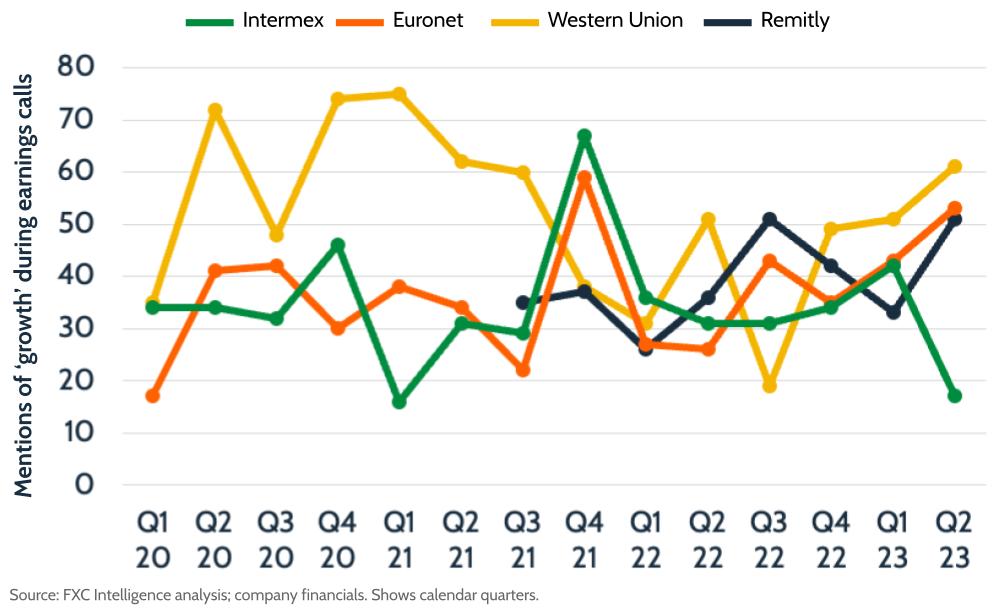

Notably, almost all players saw their discussion of growth increase during earnings season, with mentions of the word during earnings calls at the highest they had been in several quarters for Euronet, Western Union and Remitly, while only Intermex saw a drop.

Mentions of ‘growth’ in quarterly earnings calls, 2020-2023

However, this was not reflected in shareholder reactions. While Wise and Remitly saw a positive response, Euronet, Western Union and Intermex all saw a drop. For Euronet, this is largely due to other parts of its business, while its money transfers segment, which includes retail-led Ria and digital-led Xe, saw promising growth in its US-outbound and international-originated money transfers, offset by drops in its US domestic business.

However, Intermex disappointed investors with a slowdown in its core Latin American and Caribbean markets, though the recent acquisition of La Nacional boosted the top line. Meanwhile Western Union’s growth was largely driven by short-term benefits including Argentinian inflation and a change to Iraqi central bank policy that is unlikely to contribute to longer-term results.

Despite the inevitably reactionary nature of the public markets, what investors appeared to be missing was the confidence in a long-tail strategy – despite a significant upswing in mentions of the word on calls from all remittance players apart from Intermex.

Remittance players have all got plans in place for future growth, but whether they will deliver on them remains to be seen.

The battle for digital

The critical mid to long-term factor for the remittances sector is undoubtedly the shift to digital. Recently established players including Remitly and Wise are 100% digital on the send side, and while expat-focused Wise is digital-only on the receive side, migrant-focused Remitly supports a number of payout types, including cash.

However, for traditionally retail-led players, digital has become a vital part of future growth – and for many is increasingly being seen as the primary, if not sole, source of long-term growth as a company. This represents a dramatic pivot for players that have been operating in a relatively similar way for decades, and adjusting to it has not been without its problems.

Retail major MoneyGram reached 50% share of transactions being digital in Q1 2023, up from less than 20% in Q1 2020. However, it opted to go private to reinvest and pivot the company to digital-first, away from the pressures of the quarterly earnings cycle.

Euronet, meanwhile, reached 35% digital transactions in Q2 2023, while Intermex reached 31% – a five percentage point increase over the past year – although it defines digital as being either on the send or receive side.

By contrast, though Western Union does not report its share of transactions, it did see 21% of its branded revenues being digital in the quarter, a number that has remained more-or-less flat since it began reporting it in Q1 2022.

Crucially, while MoneyGram, Euronet and Intermex all appear to be seeing measurable growth in their digital offering, there is less evidence of this at Western Union, which has contributed to an interesting milestone this quarter. Although Western Union remains far above its peers in terms of overall revenues, its digital C2C business was for the first time outpaced by both Remitly and Wise this quarter in terms of revenue.

This suggests that Western Union’s digital shift is stuttering amid a wider strategy to refocus the business under recently appointed CEO Devin McGranahan. Here the company is taking a multi-year approach, but investors will need to see evidence that the tide is beginning to turn.

Omnichannel solutions?

For many of these traditionally retail-led remittance companies, there have been suggestions of a hybrid approach, in the form of an omnichannel strategy where customers are engaged across both digital and traditional channels.

In theory, this is an effective way to bridge the gap between digital and retail, but there are signs that some of the prior enthusiasm for this is waning. Keyword analysis shows that usage of the term omnichannel, which was always significantly lower than either retail or digital, has dropped off in the past few quarters, with only Western Union mentioning it in Q2 2023.

Mentions of ‘omnichannel’ in quarterly earnings calls, 2020-2023

By contrast, while Euronet and Western Union have both seen a slight downward trend in mentions of the word ‘digital’ on earnings calls, it remains at almost 20 mentions for Euronet and almost 50 for Western Union, while Intermex has seen a steady increase since 2020 to reach almost 30 mentions in Q2 2023.

All of the companies have also seen a notable decline in mentions of retail, except for Western Union, where mentions jumped to around 45 instances – the third-highest quarter across the last three years. This all speaks to a remittance landscape where digital is a key priority, and where omnichannel may not be as effective a hybrid solution as it previously was thought to be.

There are positive signs this quarter for the evolution of traditional remittances, but we are yet to see a firm, industry-wide response to digitisation at a scale investors have confidence in.

Read the full article here