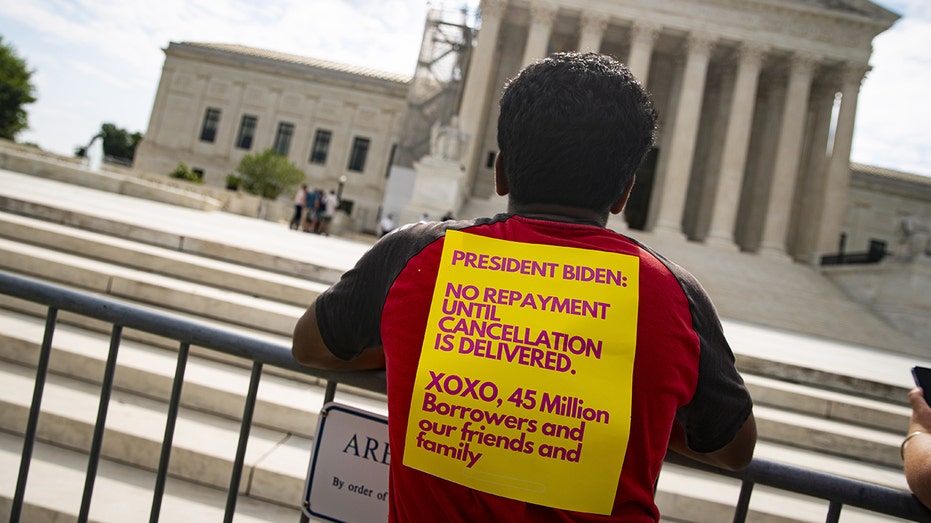

The Supreme Court ruled Friday that the Biden administration cannot go forward with its student loan debt handout program.

In a 6-3 decision, the court held that federal law does not allow the secretary of education to cancel more than $430 billion in student loan debt.

“The Secretary’s plan canceled roughly $430 billion of federal student loan balances, completely erasing the debts of 20 million borrowers and lowering the median amount owed by the other 23 million from $29,400 to $13,600,” Chief Justice John Roberts wrote for the majority. “Six States sued, arguing that the HEROES Act does not authorize the loan cancellation plan. We agree.”

President Biden strongly disagreed with the court’s decision and will make an announcement Friday at 3:30 p.m. detailing new actions to protect student loan borrowers, the White House said.

“I will stop at nothing to find other ways to deliver relief to hard-working middle-class families,” Biden said in a statement.

BIDEN STUDENT LOAN ‘REDISTRIBUTION’ COULD BENEFIT FELONS, GOP OFFICIALS CLAIM IN LETTER DEMANDING DETAILS

The White House source said Biden intends to blame Republicans for denying student borrowers the relief he promised to deliver to them.

Biden’s student loan initiative, which had been on hold pending litigation, involved the federal government providing up to $10,000 in debt relief — and up to $20,000 for Pell Grant recipients — for people who make less than $125,000 a year. The program was expected to cost the government more than $400 billion.

Biden made the unprecedented push for debt cancelation in August 2022, and his administration accepted some 16 million applications before Republicans objected and the program was put on hold.

SUPREME COURT RULES IN FAVOR OF COLORADO GRAPHIC DESIGNER WHO REFUSED TO CREATE SAME-SEX WEDDING WEBSITES

Republicans argued Biden lacked the authority to unilaterally forgive student loans. Estimates from the Congressional Budget Office said Biden’s plan would cost taxpayers roughly $400 billion. Republicans were outraged at the total, arguing the forgiveness would be unfair to those who either paid their way through college, repaid their loans or never attended college in the first place.

The justices heard two separate challenges to the law. In one case, Department of Education v. Brown, the court said a pair of private borrowers who sought to challenge the loan forgiveness plan lacked standing to sue.

The second and more relevant case is Biden v. Nebraska, where six states sued challenging the loan forgiveness scheme. The court found that Missouri at least had standing to sue because the program would open a nonprofit government corporation set up by the state, called MOHELA, to face an estimated $44 million in annual fees.

READ THE SUPREME COURT’S DECISION BELOW. APP USERS: CLICK HERE

Biden’s administration had relied on a federal statute, called the HEROES Act, to enact the plan, claiming the law gave the secretary of education power to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs … as the secretary deems necessary in connection with a war or other military national emergency.”

The court majority shot down that argument. “The authority to ‘modify’ statutes and regulations allows the Secretary to make modest adjustments and additions to existing regulations,” Roberts wrote, “not transform them.”

Roberts went on to say the Department of Education’s “modifications” to the law “created a novel and fundamentally different loan forgiveness program” than what Congress intended in the HEROES Act. This program effectively granted loan forgiveness “to nearly every borrower in the country,” Roberts said.

BIDEN VETOES CANCELING HIS $400 BILLION STUDENT LOAN HANDOUT, VOWS HE’S ‘NOT GOING TO BACK DOWN’

“The Secretary’s comprehensive debt cancelation plan cannot fairly be called a waiver — it not only nullifies existing provisions, but augments and expands them dramatically,” the chief justice wrote. “It cannot be mere modification, because it constitutes ‘effectively the introduction of a whole new regime’ … And it cannot be some combination of the two, because when the Secretary seeks to add to existing law, the fact that he has ‘waived’ certain provisions does not give him a free pass to avoid the limits inherent in the power to ‘modify.’

“However broad the meaning of ‘waive or modify,’ that language cannot authorize the kind of exhaustive rewriting of the statute that has taken place here.”

The court’s three liberal justices dissented. “The majority overrides the combined judgment of the Legislative and Executive Branches, with the consequence of eliminating loan forgiveness for 43 million Americans. I respectfully dissent from that decision,” Justice Elena Kagan wrote.

Biden’s Education Department had already been exploring potential workarounds to offer handouts via other means in anticipation of a ruling against the administration.

Republicans unveiled their own plan to address student loans and high college costs in June, introducing a series of five bills. The plan from Senate Republicans supports programs aimed at making sure students understand the real cost of college and also shuts off loans for programs that do not result in salaries that are high enough to justify those loans.

“This would prevent some of the worst examples of students being exploited for profit. It would force schools to bring down cost and to compete for students. What an idea,” Sen. Tommy Tuberville, R-Ala., said of the bill. “It would also protect students from getting buried in debt they can never, ever pay.”

Fox News’ Mark Meredith contributed to this report.

Read the full article here