A heavier load may not always signify a positive. But in the context of the freight environment, J.B. Hunt (NASDAQ:JBHT) could benefit from more to carry.

JBHT Q2 Results

The quarterly stats weren’t good. On a YOY basis, revenues, operating income, and EPS were all down double-digits and worse than consensus estimates. Consistent with the prior quarter, the declines were primarily attributable to lower volumes relating to a weakened import-freight environment.

From an individual segment perspective, weakness was most pronounced in Highway Services, which is comprised of the Integrated Capacity Solutions (“ICS”) and Truckload segments. Within this category, revenues were down 43% in ICS and 16% in Truckload, driven by weakness in both volume and revenue per load. The declines were also reflective of the unfavorable spot rate environment.

JBHT’s largest segment, Intermodal (“JBI”), as well as Final Mile (“FMS”), both reported revenue declines of 19%. But in a more positive note, the Dedicated Contract Services (“DCS”) unit was down to a lesser extent of just 2%. The DCS unit also posted strong growth in operating income of 21%. The only other segment to report growth in the bottom line was FMS, which grew 12%.

Market Reaction To J.B. Hunt Q2 Results

Shares were steady in extended trading immediately following the release. But in the new trading day, the stock gained 2.3% following positive sentiment surrounding recovery in the operating environment. In one research note, analysts at Baird expressed confidence in moderation in the pressures facing the freight environment. This was paired with a ratings upgrade on JBHT’s rival, Forward Air Corporation (FWRD).

JBHT, too, was viewed favorably by analysts at Goldman Sachs (GS) following the release due to the expectation the company would outperform later in the business cycle. At a price target of $202/share, as estimated by GS, shares would have upside potential of about 5% from current trading levels.

YTD, the stock is up over 11.5%. And over the past year, shares have gained 10.5%. This lags both the broader S&P 500 (SPY) index and the Dow Jones Transportation Average, which are both up in the mid-double digits over the same period.

Seeking Alpha – Basic Trading Data Of JBHT

Key Takeaways From JBHT Q2 Results

Intermodal Volumes Remain Weak But Trend Appears Promising: Volumes in JBHT’s largest operating segment declined another 7% in Q2 following a 5% decline in Q1. The company also didn’t receive the same uplift in their Eastern network loads as they did previously. Volumes here were down 6%. This compares to growth of 1% in the prior quarter.

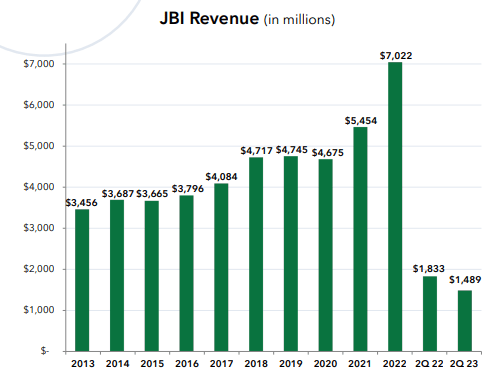

JBHT Q2FY23 Investor Presentation – Revenue Trends In JBHT’s Intermodal Segment

The overall weakness continues to be negatively impacted by the weakened import-related freight environment as well as by the domestic destocking cycle. But there are signs of a pending reprieve. Intermodal President, Darren Field, noted on the evening conference call that volumes were down to a lesser extent of 4% in June following declines of 9% and 8% in the months of April and May, respectively.

A continuation of the positive trend in volumes would likely bode well for segment margins since their cost structure is more conducive to a higher volume environment.

Resiliency Of DCS: Despite segment weakness elsewhere, DCS continues to outperform. In Q2, JBHT sold another healthy volume of trucks following the 200 sold during Q1. And at the current pace, Contract Services President, Nick Hobbs, expressed confidence of their ability to hit their sales target of 1K to 1.2K trucks for the year.

Though revenues were down 2%, the extent of the decline was less severe than in other segments. Additionally, the unit reported a sizeable 21% increase in operating income. This compares to double-digit declines elsewhere, save their FMS segment, which grew operating income 12% during the period.

The continuing strength in DCS provides a long-term protective buffer against weaknesses in other areas. The contracts, for example, average five years with annual inflation-embedded price escalators. As such, the unit isn’t exposed to risks pertaining to volatile spot rates. Looking ahead, I expect this unit to remain a strongpoint of overall operations.

No Comment On Yellow Corporation (YELL): On Monday, the Teamsters union threatened a strike against rival trucking company, YELL, after it missed healthcare and pension payments. According to the board of trustees of the fund that manages benefits for Teamsters members, the payments total more than +$50M.

As YELL works on addressing the issue, which is expected to further strain the company’s already precarious liquidity position, the consensus view is that a strike would benefit rival carriers, such as JBHT. When asked about the development on the conference call, CEO, John Roberts, declined to comment.

In my view, I can see any strike at YELL being the final nail in their operations. This would then be seen as a net positive for JBHT.

Is JBHT Stock A Buy, Sell, Or Hold?

In their last two conference calls, J.B. Hunt President, Shelley Simpson, has acknowledged being in a freight recession. Since then, little appears changed. The operating environment is still highly deflationary. And the negative effects of this are still being compounded by inflationary pressures, particularly in wages.

Declining volume is also impacting most segments. Import-related freight continues to hold back volume performance in Intermodal. And in Highway Services, both segment volumes and trailer turns remain down 20% or more in the ICS and JBT segments.

Markets, however, appear optimistic about an eventual recovery in the freight environment. Spot rates, for example, have exhibited signs of bottoming out. Management also noted that the destocking cycle appears to be at or near the end. This was evidenced by the moderation in the volume declines in June.

Shares have bid up accordingly. But for prospective investors, the stock is already trading at or near consensus targets. The average Wall Street price target is $195.50/share. That’s right where shares currently sit. Analysts at Goldman recently noted a price target just above $200/share. Though positive, this doesn’t provide much further upside for investors.

And in my own view, I would prefer to see volume begin to turn positive before considering new or further initiation in the stock. A more positive trend in volume would then likely translate to margin improvement and overall gains in the bottom line. Though JBHT appears to be heading in the right direction, the environment still appears too weak. And, as such, I believe shares are valued fairly, given these considerations.

Read the full article here