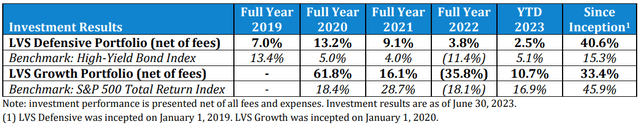

For the first six months of 2023, the Defensive Portfolio gained 2.5% (net of all fees and expenses) and the Growth Portfolio gained 10.7% (net).

Defensive Portfolio: opportunities with acquisition offers

The investment thesis for the Defensive Portfolio is that event-driven investments can generate more attractive returns than the traditional bond market with less correlation to other asset classes. We primarily employ merger arbitrage investments to achieve these return characteristics; however, we also incorporate other strategies and sub-strategies.

One of the sub-strategies is selectively investing in companies that receive non-binding acquisition offers. In a typical merger arb investment, the target company has a signed contract to be sold. Signed merger contracts are ironclad (read: hard to get out of). Occasionally, companies receive non-binding acquisition offers which represent a desire to acquire a company without a signed contract.

Most non-binding acquisition offers do not result in a company getting acquired. This is because deals are typically negotiated discreetly and are only announced after a successful negotiation. If an offer is announced publicly, there is a good chance that the recipient has already privately rejected the offer and the would-be acquirer is going public in a desperate attempt to muster some support from shareholders. Sometimes this tactic works but it usually doesn’t.

For legal reasons, some buyout offers need to be structured as public non-binding offers. For example, situations where a majority owner would like to squeeze out minority shareholders generally require immediate disclosure of a non-binding offer made. These situations tend to result in successfully closed deals because there is often a strong strategic rationale to consolidate ownership and the majority owner has influence over the sales process. Furthermore, these situations tend to result in bumps to the offer price because the company must form an independent committee to negotiate with the buyer. We invest in a handful of these situations each year with DCP Midstream serving as a recent example.

DCP Midstream (“DCP”) is an oil and gas pipeline company that was set up as a joint venture between Phillips 66 (PSX) and Enbridge (ENB). In August 2022, Phillips 66 acquired most of Enbridge’s ownership and announced an offer to buy the rest of the company for $34.75 per share. This was notable because Phillips 66 demonstrated its appetite to buy DCP via the Enbridge transaction. Also, the offer price was made at the closing share price (no premium), leaving room for a bump to the price. Finally, DCP Midstream is a strategic asset because it was already integrated with the Phillips 66 natural gas liquids value chain.

There were several signs pointing to a negotiated merger contract as a highly likely outcome. The only question was the final price. After conducting a valuation analysis, we were comfortable with holding the stock even if the deal fell through. There was limited downside to the pre-offer share price but there was ample room for a higher offer price which framed a nice risk/reward setup.

In January, DCP Midstream announced that the deal was negotiated at a price of $41.75, a 20% bump from the original $34.75 offer. We purchased DCP shares for around $38 per share. If you include $4.04 in dividends received, we roughly earned a 19% return (25% IRR) on this investment.

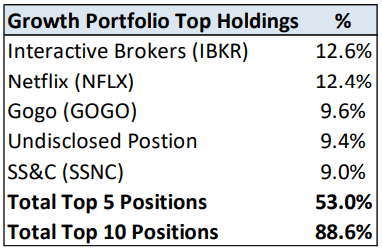

Growth Portfolio: getting more concentrated

The Growth Portfolio has become more concentrated over the past year. This can be measured by the number of stocks in the portfolio which is now at 13 and a greater weight from our top 5 holdings which is now at 53%. While I believe we have tilted the portfolio in a direction that will enhance our future returns, it is also a good time to restate our risk management policies.

The growth portfolio aims to hold 10 to 20 stocks. I view 15 positions as a sweet spot but we have flexibility depending on the opportunity set. More importantly, we limit how much we can invest in any single stock to 10% of the portfolio at cost. This means that we cannot lose more than 10% of our capital on any single stock even if the stock goes to zero. However, I am happy to hold a stock well above the 10% threshold if it appreciates and in the past, we have had positions balloon to as much as 20% of our portfolio.

My risk management framework was influenced by this blog post by Australian hedge fund manager John Hempton titled ‘When do you average down?’. In the article, Hempton drew lessons on risk management from how Bill Miller went from running the best-performing mutual fund in the 1990’s and 2000’s to blowing up investor capital and having to shut down. Miller’s fund essentially kept doubling down on stocks he believed in. Many of these stocks went to zero or never recovered during the 2008 financial crisis.

There are a few key lessons. First is that there is a fine line between investment conviction and hubris and one should never bet the farm on any single stock. The second lesson is quantitative. You can only lose what you invest in a stock (stocks can’t go negative) but if you keep adding to losing positions, you can lose much more than your initial investment. The third lesson is regarding behavioral biases. Investors are programmed to be averse to losses and take gains too early on winners, the academic literature refers to this tendency as the disposition effect.

Hempton’s resolution in the blog post is one we have adopted. We have a budget for the total amount of capital we can allocate to any single idea. This takes some discipline as it can be tempting to continue chasing stocks that trade at growing discounts to their true intrinsic value but it also mitigates the risk of being wrong and materially impairing capital. We also endeavor to fight the disposition effect by being slow to sell winning positions – a topic for a future letter.

Growth Portfolio Review

We made some changes to the Growth Portfolio in Q2.

Exited Investments: Mastercard (MA) and Adobe (ADBE).

We have owned Mastercard on and off since inception. We re-initiated the position in summer 2022 during the broader market sell-off. The stock traded off to an attractive valuation and we believed the tailwinds from a reopening of international travel still had legs. This was a small portfolio position and the stock has appreciated in the year we have owned it. The stock’s valuation is once again rich and the tailwinds from international travel and consumer spending appear to be tapering. We sold the position because we believe other opportunities within our existing portfolio will generate superior returns.

Adobe is another long-time holding that we sold in the quarter. Last year Adobe announced the acquisition of Figma which made sense from a strategic standpoint but the deal’s valuation and financing were puzzling. Adobe agreed to pay a 50x ARR multiple for Figma which represented a peak software industry multiple – but the company inked this deal after software industry valuation multiples collapsed. Additionally, Adobe financed most of the acquisition with the issuance of shares, materially diluting existing investors. Capital allocation mistakes can destroy shareholder value over time even if the core business is world class. We viewed the Figma deal as a red flag although we felt that the stock was too cheap to sell at the time. That changed in 2023 as Adobe’s stock rallied along with other software companies due to the current excitement over artificial intelligence. Adobe’s valuation re-rated in the first half of 2023, providing an opportunity to exit the position.

Increased Investments: Gogo (GOGO) and Interactive Brokers (IBKR)

We initiated an investment in Gogo in Q1 and published a write-up on the stock in April 2023. Gogo’s stock price declined by over 15% in the middle of the quarter and we used that opportunity to significantly increase our ownership. We could not find a good reason as to why the stock declined and within a few weeks, the stock price reversed and hit a new 52-week high price.

We also modestly added to our position in Interactive Brokers in the mid-$70s. We initiated our Interactive Brokers position last summer and published a write-up in September 2022. Interactive Brokers continues to trade at a discounted multiple as investors are skeptical that the company will continue to sustain the current level of net interest income beyond the near future. However, recent reports showing strength in the US economy and labor market suggest that interest rates won’t be cut in the near term. The company publishes monthly KPI metrics and investors appear to be ignoring recent strength in trading volume and margin loans. The current market environment of rising stock prices and elevated interest rates is a goldilocks environment for the company. With this last buy, we have now reached our limit of investing 10% of our portfolio at cost in the stock and can no longer increase the holding size.

Finally, we have initiated a position in a new undisclosed stock. I am not ready to discuss this idea publicly, but investors are welcome to reach out with any questions.

About LVS Advisory

LVS Advisory is a boutique investment firm focused on providing active investment management services for individuals, families, and institutions. The LVS Defensive Portfolio is an absolute return strategy focused on capital preservation. The LVS Growth Portfolio is a global equity strategy focused on capital appreciation. Luis V. Sanchez CFA is the Founder and Managing Partner of LVS Advisory. Luis is a licensed Investment Adviser Representative and a CFA Charterholder. LVS Advisory is a Registered Investment Adviser based in New York City.

Legal Disclaimer

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views.

This is not a solicitation of any order to buy or sell. We, any officer, or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results.

This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied upon as statements of fact.

LVS Advisory LLC is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term.

You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here