After the strong rally, it appears the market is taking profits on commentary around the outlook for margins. It’s not only that they were lower quarter-over-quarter (QoQ), but also Tesla provided zero insight as to how much lower margins can go. The market does not like uncertainty. It’s somewhat ironic that during the call Musk can wax poetic about the complexities of AI, neural net training, the 6-million dollar man, and robotic taxis yet when it comes to basic profitability drivers, he can’t say anything. The former drove the price post Q123 and the latter is driving the price today.

Did reported automotive gross margins bottom?

Likely not.

Telsa had a reported Q223 automotive gross margin of 19.2% vs Q123 of 21.10% vs Q422 of 25.90%. Meanwhile, Q223 group operating margins were of 9.6% vs Q123 of 11% vs Q422 of 16%.

Reported automotive gross margins and operating margins peaked in Q222 at 32.9% and 19.3% respectively. Since then, both have been steadily declining downward. The stock is weaker today because the market does not know where or when these two metrics will ultimately bottom.

Looking ahead, Tesla will continue to focus on volumes through lower prices and at the expense of margins. Here’s what Zachary Kirkhorn, CFO said:

“Second, we continue to work towards our goals of maximizing volumes on both, our vehicle and energy business, but most importantly, doing so in a way that generates the capital to continue our pace of R&D and capital investments. This requires a strong focus on per unit COGS reductions in each of our key businesses, as well as working capital improvements on raw materials, work in process inventory and customer AR, all of which progressed appropriately in Q2.

If we look specifically at our automotive business, our gross margin showed a modest reduction and remained healthy, despite action taken to further improve vehicle affordability early in the quarter. We recognized – we realized per unit cost improvements in nearly every category, including material cost and commodities, manufacturing costs and logistics”

In response to a question on pricing, Tesla continues the point that the company is having to lower prices due to the higher interest rate environment

Question:

“How has the order intake trended relatively to production levels during Q2? And how has it trended in the quarter-to-date period? Conceptually, how does Tesla decide when is it appropriate to reduce prices or at other sales incentives to increase demand?”

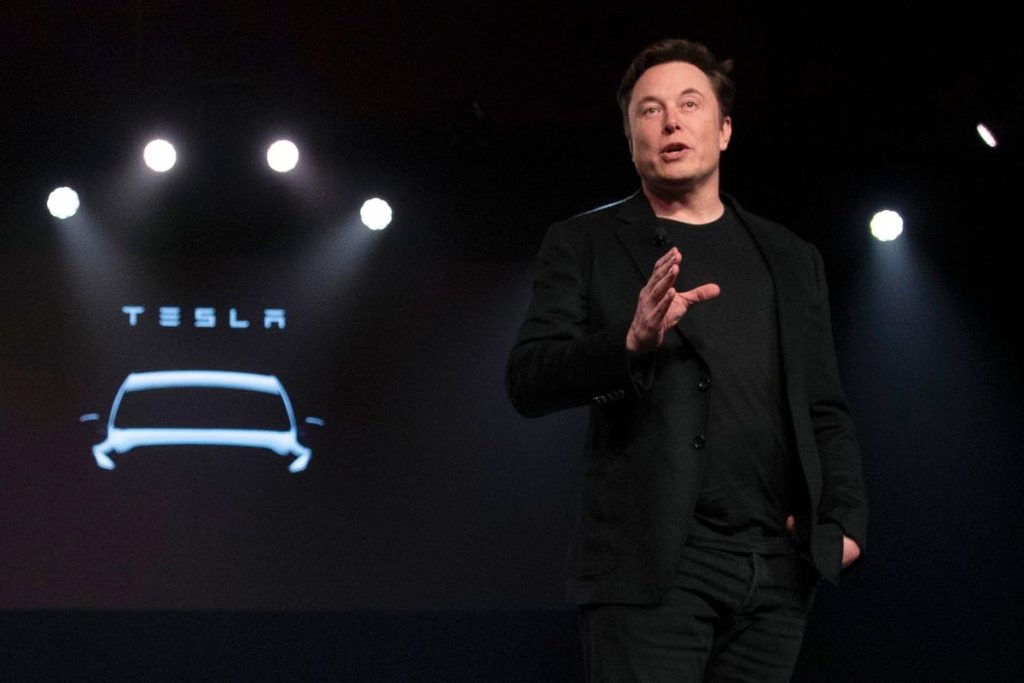

Elon Musk

“[…] Buying a new car is a big decision for vast majority of people. So, any time there’s economic uncertainty, people generally pause on new car buying at least to see what happens. And then obviously, another challenge is the interest rate environment. As interest rates rise, the affordability of anything bought with debt decreases, so effectively increasing the price of the car.

So when interest rates rise dramatically, we actually have to reduce the price of the car because the interest payments increase the price of the car. And this is — at least up until recently, it was, I believe, the sharpest interest rate rise in history. So, we had to do something about that […]

When asked again about automotive margins, management did not provide a direct answer. For our purposes, we prefer management teams to answer directly as it increases uncertainty to not provide visibility into contracting margins.

Question:

“With the emphasis of price cuts to drive volume growth eating into automotive gross margin, can investors expect to see automotive gross margin stabilize or even rise due to efficiencies outpacing the cuts? And if so, when?”

Elon Musk:

“Where’s that crystal ball, again? If I may, look, the short-term variances in gross margin and profitability really are minor relative to the long-term picture. Autonomy will make all of these numbers look silly.

Zachary Kirkhorn

“I fully agree with you. I mean, I think the only thing in the short term that matters is what I said in my opening remarks, which is are we generating enough money to continue to invest. And the portfolio of products and technologies that the technical teams are investing in right now, this is intense. It’s intense in terms of investment; it’s intense in terms of potential.”

Conclusion:

The sentiment post Q223 isn’t much different than in Q123. As we all know, Tesla rallied after Q1. This time around, given the stock is at higher levels, there may be less AI sentiment to support it in the short term. Q3 won’t be a catalyst and analysts will likely reduce numbers.

While many will argue that Tesla is one of the most advanced AI companies in the world, my response is “sure” but Tesla is also heavily exposed to consumer spending — and this is entirely out of their control. The comment on interest rates is the most important comment from the call as high interest rates mean Tesla must lower prices. In a way, management is agreeing that quite a bit about the current situation is out of management’s control. While some will talk about recurring software revenue from robotaxis as the most important catalyst, the harsh reality is that the FED lowering rates is the most important catalyst for Tesla today. That may not be as exciting as AI, but Tesla is one of many tech stocks whose revenue growth and profitability is on borrowed time until the Fed instills a more dovish policy.

The I/O Fund Analyst Team contributed to this analysis.

Please note: The I/O Fund conducts research and draws conclusions for the company’s portfolio. We then share that information with our readers and offer real-time trade notifications. This is not a guarantee of a stock’s performance and it is not financial advice. Please consult your personal financial advisor before buying any stock in the companies mentioned in this analysis. Beth Kindig and the I/O Fund own shares in TSLA at the time of writing and may own stocks pictured in the charts.

If you would like notifications when my new articles are published, please hit the button below to “Follow” me.

Read the full article here