Tesla, Inc. (NASDAQ:TSLA) shares plunged after a Q2 double beat was overshadowed by expectations for further price cuts and ensuing margin headwinds in the foreseeable future. Blighted by rising interest rates that are reducing the affordability of already premium-priced electric vehicles (“EVs”), CEO Elon Musk left further price cuts on the table to retain demand for Tesla vehicles.

Variability around average selling prices goes back to Elon’s point. We don’t control interest rates. We don’t control macro consumer sentiment. But we have an obligation to be responsive to that to ensure that we’re matching supply and demand and keeping things balanced. And so, this is how we’re managing the next handful of quarters.

Source: Tesla 2Q23 Earnings Call Transcript

The development comes as Tesla’s automotive gross margins (ex-credit sales) fall deeper into the teens, with anticipation for further pressure on vehicle average selling prices ahead to incrementally stifle visibility into the EV maker’s profit recovery trajectory. While management has repeatedly highlighted their optimism for Tesla’s longer-term growth drivers, such as Full Self-Driving and other AI developments, they remain hard to underwrite into the stock’s current valuation given uncertainties to their respective monetization timelines. In the meantime, with investors still hyper-focused on profitability amid tightening financial conditions and weakened confidence in Tesla’s dynamic pricing strategy, we expect volatility to be the near-term theme for the stock.

Defending Demand Means Further Margin Compression Headwinds

Given aggressive price cuts implemented across its core operating margins this year, Tesla’s earnings beat during the second quarter alongside record deliveries is an impressive feat, nonetheless. However, earlier investor optimism that the worst of price cuts might be over, given impressive second quarter delivery volumes, was quashed by Musk during Tesla’s earnings call this week, as he hinted at a need for further discounts to make up for reduced affordability stemming from rising borrowing costs.

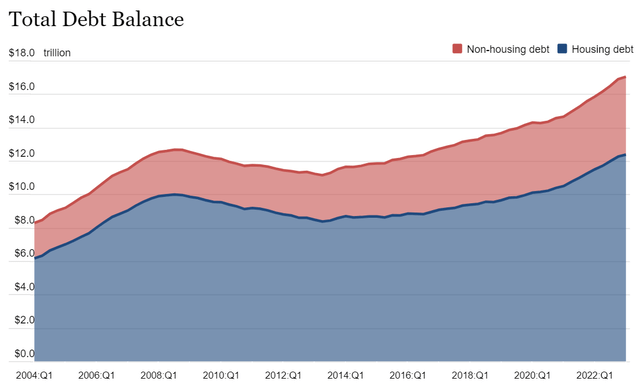

So, if interest rates continue to rise, that reduces the affordability of cars. And for a lot of people, they’re really — they’re just really breaking even every month. In fact, if you look at the rise in credit card debt, they are, in fact, not breaking even every month. Credit card debt is looking scary. So, we just don’t control the market conditions. If market condition is stable, I think prices will be stable. If they’re not stable, then we would have lower prices. Yes.

Source: Tesla 2Q23 Earnings Call Transcript

In addition to price cuts, anticipation for increased opex spend to support AI, full self-driving (“FSD”), and other growth initiatives in the pipeline at Tesla are expected to weigh further on its profitability, putting prospects for a swift return to high-20% auto gross margins further out of reach. While lower commodity prices – particularly in lithium, which management had repeatedly alluded optimism to during the second quarter earnings call – and improved ramp-up in the Austin and Berlin facilities are compensating factors, impending summer factory upgrades in the coming months are expected to generate “idle costs,” underscoring a shaky cost structure for the automotive segment within the foreseeable future. This will drive further volatility in the stock’s performance in the near term as investors adjust to tempered forward expectations on Tesla’s earnings and cash flows.

Recall that much of Tesla’s valuation premium to date has hinged on its competitive advantage relative to peers – spanning market share gains in the transition to electric and an unmatched automotive production cost structure ensuing from industry-leading manufacturing efficiencies. And narrowing margins ahead are expected to diminish the attributed premium in the near term, given the lack of structural support within the foreseeable future.

This is further corroborated by management’s repeated allusion to Tesla’s longer-term growth drivers – including AI and FSD – which lack visibility on their respective commercial realization and monetization roadmaps. As discussed in our previous coverage on the stock, Tesla’s implementation of price cuts and ensuing margin compression risks are expected to be compensated by the longer-term lifetime value ensuing from vehicle sales (e.g., Supercharging and other subscriptions), which will also depend on the realization of deferred FSD revenues once technological and regulatory hurdles are addressed. This is in line with management’s recent commentary that the “short-term variances in gross margin and profitability really are minor relative to the long-term picture,” with specific reference to autonomous mobility as a key catalyst for renewed growth.

And in the latest development related to the emerging technology, Musk expects FSD in the U.S. to be “better than humans by the end of this year.” But Musk’s disclaimer on how he has historically been overly optimistic about the technology’s materialization timeline, and clarification that his optimism for FSD to be better than humans by year’s end does not equate to regulatory approval, underscores the lack of “financially material” catalyst for Tesla in the near term while the underlying business also grapples with deteriorating macroeconomic conditions and increasing industry competition.

While FSD monetization and AI integration represent value accredit factors for Tesla, the overall lack of visibility on their respective materialization roadmaps is likely to do little in shielding the stock’s sensitivity to near-term weakness in the underlying business fundamentals resulting from incremental price cuts and ensuing challenges to auto profit margins.

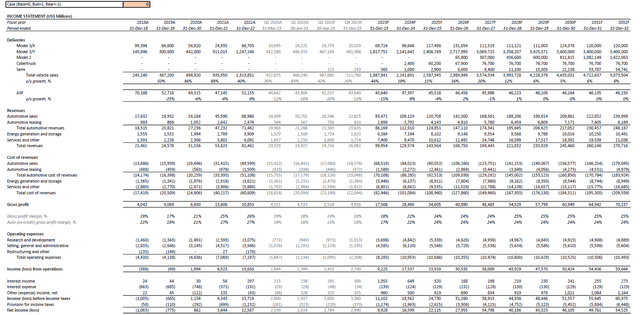

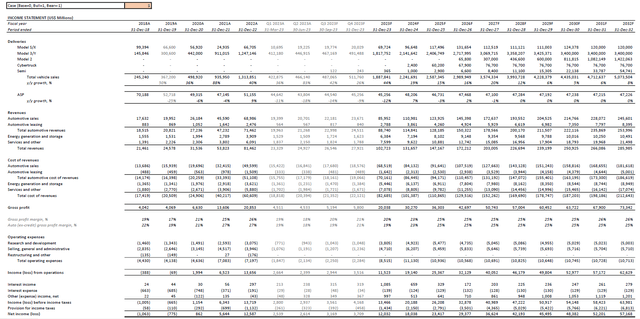

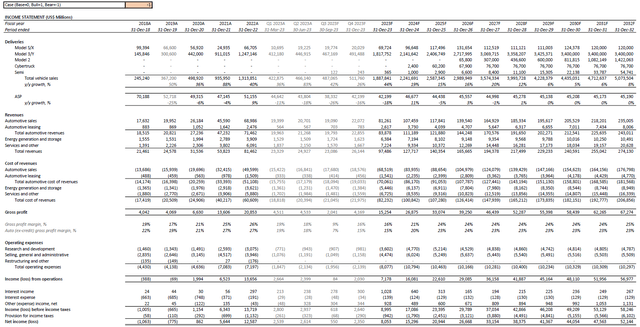

Fundamental Analysis Update

While we had previously been optimistic about the potential stabilization of Tesla’s pricing strategy given adequate demand response observed during the second quarter, we are now readjusting our base case for further challenges to the bottom line in the near-term given management’s expectations for additional price cuts to compensate for persistent rate hikes ahead. With management focused on ensuring demand resilience – even at the cost of profitability – we expect Tesla to achieve its delivery target of more than 1.8 million vehicles for the year. However, topline growth is expected to stay tepid due to ASP pressures, with total automotive revenue growth expected to expand at the low double-digit percentage range in the second half of the year. Automotive gross margins (ex-credit sales) are expected to fall to the mid-teens as a result, before recovering to levels observed in the first half of the year exiting 2023, helped by post-factory-upgrade and continued Austin/Berlin ramp-up cost efficiencies.

Author

In the bull case scenario, we are pricing in greater optimism for modest sequential ASP growth despite the rising rate environment. The upside scenario assumption considers optimism for a resilient demand environment that will potentially outstrip supply in the near term, especially considering upcoming factory upgrades in the third quarter which will impact inventory volumes. The bull case ASP growth assumption is also in line with net upward (though modest) price adjustments observed near mid-year across Tesla’s line-up in China, as well as the company’s increasing preference for purchase incentives, such as free charging and a newly implemented referral program, over outright MSRP cuts in recent months. As a result, automotive gross margins (ex-credit sales) could potentially see modest expansion and exit the year in the low 20% range.

Author

In the downside scenario, vehicle ASP could potentially decline in the double-digit percentage range. The tepid assumption takes into consideration potentially lower take-rates on the higher-priced Model S/X relative to the premium line-up’s growth observed during the second quarter, as well as more aggressive price cuts to ensure demand resilience amid persistent macroeconomic uncertainties as well as stiffening competition. As alluded by management during the second quarter earnings call, U.S. economic conditions remain on shaky grounds, with the combination of rising credit card debt, elevated borrowing costs, and persistent inflation weighing on consumption.

Specifically, American household debt (including mortgage, auto, student, and other non-housing loans) are surging toward new records, with credit card borrowings staying elevated and “bucking the typical trend of balance declines in first quarters,” while delinquencies are also on the rise.

Bloomberg News

The upcoming resumption of student loan payments after a multi-year moratorium granted under the Biden administration’s leadership during the pandemic is expected to crimp consumption further by diminishing monthly disposable income – borrowers are expected to be short $400 a month on average once student loan payments resume later this year. Taken together, big-ticket purchases – such as EVs – will become further out of reach. And the potential for Tesla to opt for further price cuts to compensate for affordability considerations, alongside expectations for reduced take-rates on the higher-priced premium Model S/X vehicles, could result in more aggressive auto ASP declines in the downside scenario.

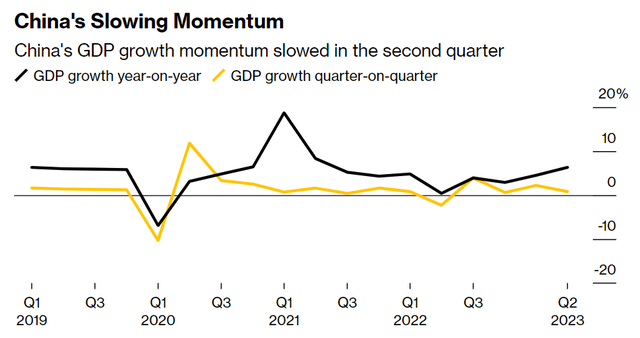

Meanwhile, in China, the bleak post-pandemic economic recovery outlook could also mean further pricing pressures ahead for Tesla. Despite a slew of supportive measures implemented by Beijing, there has been little respite to China’s faltering economy this year. The latest data shows China’s second quarter GDP grew at a “slower-than-expected pace of 6.3%” on a y/y basis, which compares to stringent COVID lockdowns in the same period during 2022. The metric grew by less than 1% from the first quarter, underscoring the turmoil of rising youth unemployment, a persistent property market slump, and deteriorating consumer spending.

Bloomberg News

Paired with rising competition from BYD Company (OTCPK:BYDDF; OTCPK:BYDDY) and other domestic EV pure plays, the dire situation in the downside scenario could potentially incentivize further price cuts at Tesla to maintain demand in the region and support incremental penetration in growth opportunities emerging within lower-tier cities.

Author

Tesla_-_Forecasted_Financial_Information.pdf

The Bottom Line

Following the post-earnings plunge, Tesla stock now trades at about 65x estimated earnings. Yet, this represents an eyewatering premium to the broader Nasdaq 100 gauge’s average of about 27x estimated earnings at current levels (or 20.8x 10-year average), and the 38x blended average of Tesla’s mega-cap peers still.

The stark post-earnings pullback underscores investors’ angst over the near-term fluid state of Tesla’s profitability prospects returning to the driver’s seat once again. While there are still many long-term valuation upside drivers at Tesla’s disposal – spanning continued optimism for market share gains in the transition to electric, emerging Supercharging advantage to drive an incremental auto revenue stream and monetization of FSD and AI features over time – their uncertain commercialization timelines will eventually anchor investors’ immediate considerations back to the underlying business’ near-term fundamentals, with margin compression risks as a key overhang weighing on the stock’s valuation prospects – especially after management’s warning of inevitable price cuts to come. As a result, the stock’s upside potential in the near term will likely stay muted as markets digest anticipation for further challenges to Tesla’s profitability trajectory on automotive sales in the near term, which will bode unfavorably under the currently uncertain market climate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here