Investment thesis

Our current investment thesis is:

- Equifax has a high-quality business model, with a wide moat, high margins, and a range of systemically important services.

- Growth and margins will likely improve in the coming years, as its “New EFX” strategy unleashes operational gains and new growth avenues.

- Aside from this, the fundamental trajectory looks positive, although current economic conditions represent near-term issues. Q2 was difficult for the business, as the difficult mortgage and hiring market caused a poor financial showing.

- Relative to other data businesses, EFX is highly attractive, with better growth and margins.

- EFX is trading at a noticeable premium, implying the longer-term improvement forecast is already priced in.

Company description

Equifax (NYSE:EFX) is a leading global data analytics and technology company that provides credit reporting, risk assessment, and identity verification services. The company operates in North America, Latin America, Europe, and Asia Pacific, serving a wide range of customers including financial institutions, businesses, and consumers.

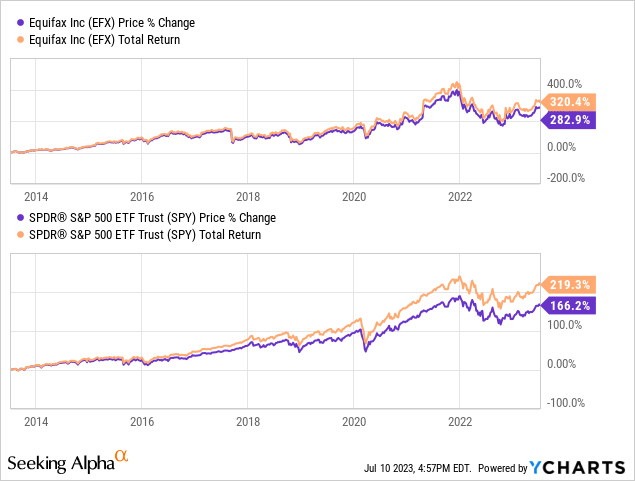

Share price

Equifax’s share price has performed well in the last decade, significantly outperforming the wider market. This is a reflection of its market position and positive growth trajectory.

Financial analysis

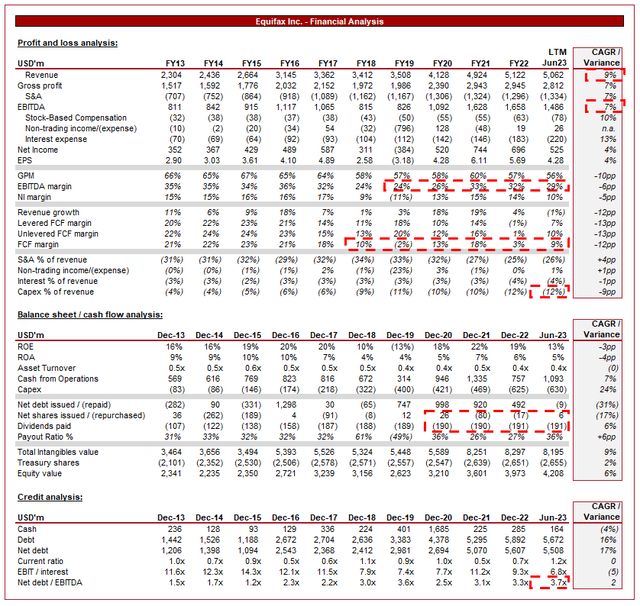

Equifax financials (Capital IQ)

Presented above is Equifax’s financial performance for the last decade.

Revenue & Commercial Factors

Equifax’s revenue has grown at a CAGR of 9% in the last 10 years, an impressive achievement given the lack of material diversion from this trajectory.

Business Model

Equifax’s business model revolves around collecting, analyzing, and delivering vast amounts of data to help businesses make informed decisions. Equifax leverages its extensive data assets, advanced analytics capabilities, and technology platforms to deliver insights that support risk management and enable businesses to better understand their customers.

The business operates in three key segments:

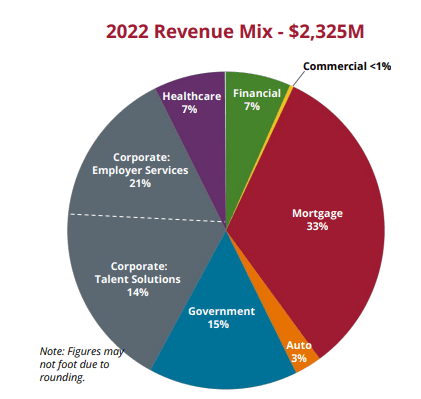

- Workforce Solutions (45.4% in FY22) – offers services that enable customers to verify data such as income, employment, and educational history, among other criteria, of people in the United States. Also assisting employer customers with complying with and automating payroll-related services.

EWS (EFX)

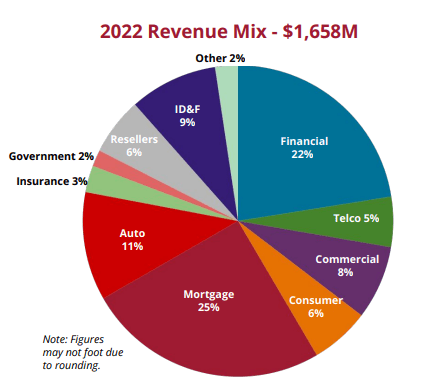

- USIS segment (32.4%) – provides consumer and commercial information services, such as credit information and credit scoring, credit modeling, and portfolio analytics, among others.

USIS (EFX)

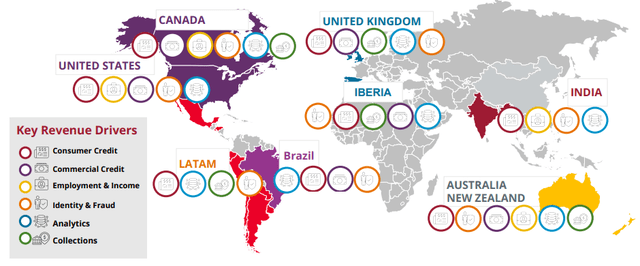

- International segment (22.2%) – offers a range of the above services in international geographies.

International (EFX)

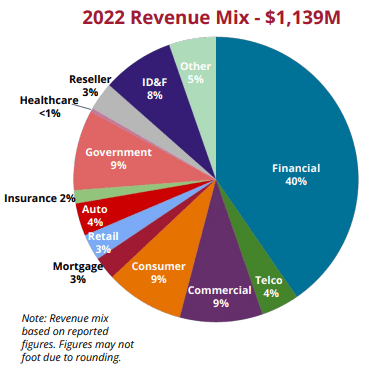

As a specialist in credit information, Equifax has high exposure to financials, mortgages, auto, commercial, and consumers. As a result of this, although revenue is diversified by region and industry, the business is inherently cyclically linked to economic development. During a period of economic expansion, we generally see relaxed monetary policy and credit expansion. Conversely, the vice versa is true during a downturn.

Equifax is a leading business in the credit industry, building its significant position through sticky customers, infrastructure investment, data accumulation, and deep expertise. This has afforded the business a wide moat, as new entrants are unable to easily replicate the services it (and its comparable peers) provide. Further, its brand is a key factor underpinning this, as clients and third parties understand that the findings from Equifax can be trusted and are based on sound information. This moat has allowed the business to share in industry growth experienced, with the market large enough for the key players.

Equifax is looking to develop its current business model, leaning into the technological revolution to streamline its operations, improving growth and profitability.

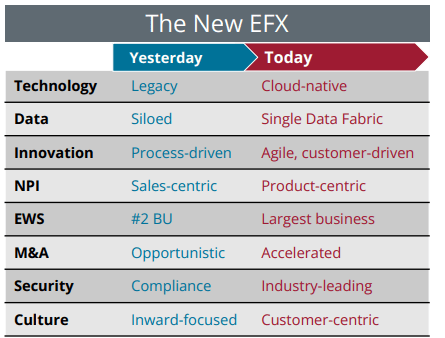

Dubbed “The New EFX”, it involves the expansion into cloud-based solutions, a development that many industries and businesses have focused on, as costs decline and the value proposition increases. Further, the business is seeking to transition its focus to products, seeking to transition the business to an agile and innovative one. This is likely a necessary transition, as the dominance of the leading players has reduced the incentives to invest in product development. This has the potential to at least operationally improve the business, but certainly scope for growth acceleration.

New EFX (EFX)

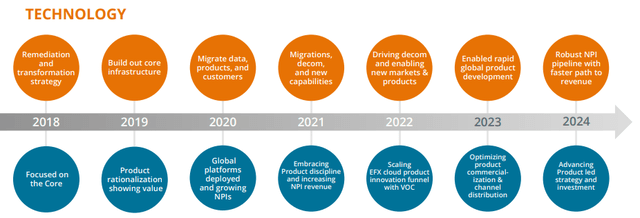

The following illustrates the current trajectory the business is on, with the company currently scaling its cloud products. We believe this could be a game-changer, as it reduced the need for data centers and heavy capex, potentially improving margins.

Technology timeline (EFX)

Our expectations are for positive operational development at the least. Headcount reduction and cloud services will cause margin appreciation, with more acquisitions driving growth.

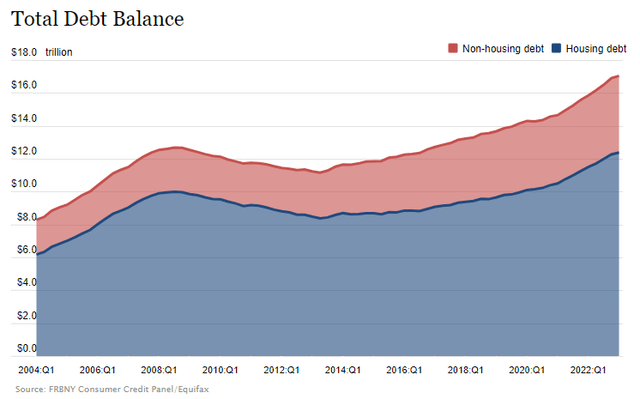

The positive growth trajectory is a reflection of the positive economic conditions in the West, with record low interest rates and an increased appetite for debt. As the following illustrates, household debt has substantially growth since 2004.

Household Debt (NYFED)

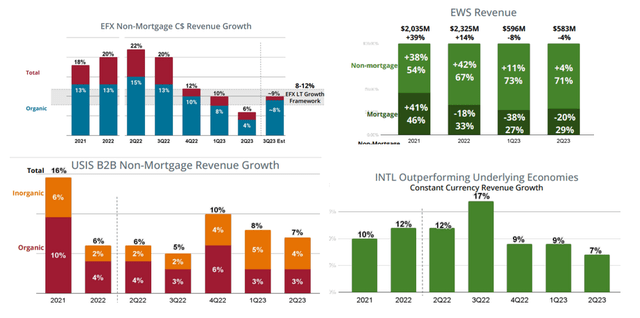

EFX has achieved positive growth in recent quarters, although this has been on a noticeable downward trend. The declining growth trajectory is a reflection of current economic conditions. Before discussing this, it is worth highlighting that despite these concerns, which are fairly global, EFX’s international business has remained robust, continuing to grow into Q2’23.

Quarterly performance (Equifax)

With rising rates and high inflation, many countries are experiencing a reduction in consumer spending, especially in the discretionary category, as finances come under threat. This reduces the demand for credit services associated with debt, as consumers are encouraged to reduce lending. This is a similar case for corporates, as they derisk and reduce debt-fueled expansion.

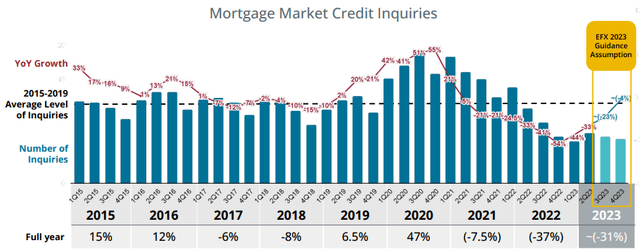

The largest impact, however, is the cost of debt. As this rises, the ability to raise debt declines, as default levels increase and a small proportion of consumers and businesses meet the necessary threshold. The largest impacted segment is clearly mortgages, as consumers avoid property purchases due to the increased cost. As the following illustrates, mortgage credit inquiries remain in a deflated position.

Mortgage enquiries (Equifax)

Our expectation is that these issues will remain for the coming 12-24 months, as central banks slowly reduce rates once inflation comes under control.

EFX’s inability to hedge against its cyclicality is reflected above, with non-mortgage growth consistently declining since 2021.

Competitive Positioning

EFX’s competitive positioning revolves around three key factors:

- EFX possesses a comprehensive and diverse data repository, encompassing credit and financial data, employment and income verification, and identity information.

- The company’s expertise in data analytics allows the business to provide valuable insights.

- EFX’s brand is highly regarded in the market, allowing the business to win mandates based on the trust it has developed.

Data Industry

EFX faces competition from other credit reporting agencies and data analytics companies, including Experian (OTCQX:EXPGF) and TransUnion (TRU). These three businesses have a lion’s share of the market, operating a monopolistic position.

Heightened concerns regarding data privacy and security regulations necessitate ongoing investments in cybersecurity and compliance measures. Equifax was famously caught out by this, with the threat only increasing since then. There is now a heightened risk of regulation and greater punishment.

Increasingly, companies are seeking non-traditional data sources to gain deeper insights into consumer behavior and creditworthiness. This is driving development in data usage and the value proposition posed.

Technological development, such as through machine learning and AI, represents a key opportunity to better analyze and manipulate data sources to provide actionable insight. This can allow EFX to branch out beyond its direct exposure to credit, supporting diversification.

International expansion represents a continued opportunity, as although the business is global, it is lacking exposure to many countries. Further, with continued economic growth in developing nations (such as India), EFX can position itself to achieve outsized growth.

Geographical reach (EFX)

Q2

EFX has posted a pretty poor quarter, with the share price down c.10% at the time of writing. Revenue growth was flat, owing to a mortgage market that looks to be in freefall. Management has estimated that the market is down c.37%, leaving the business unable to offset this impact.

The International business continues to outperform, with a CC growth of 7%, Further, USIS is up 6%, owing to non-mortgage revenue growth of 7% and strong online B2B growth.

Given the issues, management has revised down its guidance, something we expected to occur, although this was based on the assumption that international markets will weaken.

Finally, EFX’s acquisition of Boa Vista Servicos has been approved, giving the business significant capabilities in Brazil.

Economic & External Consideration

We have already discussed the economy but it is worth considering how EFX sees conditions developing.

The company currently expects:

- Reduced hiring in the US. This will impact data searches.

- International economies slowing, reducing the offsetting impact from this segment.

- Mortgage market origination down further in H2.

This is clearly bearish, implying the business faces a difficult period ahead. EFX non-mortgage is expected to be mid-to-high single digits, assuming growth will normalize. Further, Mortgage revenue is expected to be down high single digits, despite the business gaining market share. Finally, EFX expects continued cost savings through its cloud investment, which based on the Q2 results is materializing.

Margins

EFX’s margins have been quite volatile over the historical period, with a current EBITDA-M of 29% and a NIM of 10%. This has subsequently softened in the recent quarters due to continued

Given the investment in cloud and technological capabilities, we expect an upward margin trajectory, allowing the business to exceed its decade-high levels in the coming 5-10 years. This said, the business has yet to show margin consistency (increased by 7% in FY21 but declined since then) and better visibility as to where margins will land.

Balance sheet & Cash Flows

EFX has a large debt balance, with a ND/EBITDA ratio of 3.7x and interest representing 4% of revenue. For this reason, we would like to see some deleveraging in the coming years, although its strong cash flows mean this is not overly concerning.

Shareholder distributions have come in the form of dividends, with a respectable 6% growth rate. This said, the yield itself is fairly unimpressive, mainly due to its large capex commitments currently. This will begin to subside, allowing distributions to improve.

Outlook

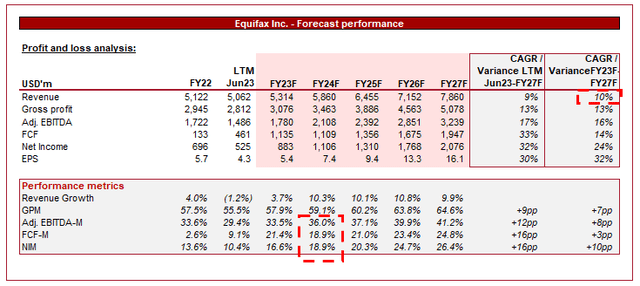

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Revenue is forecast to grow at an impressive 10% in the coming 5 years, with analysts forecasting a combination of economic recovery and improved performance through its value-development strategy. This looks reasonable on paper, although is highly dependent on economic conditions. We lean toward FY23 being slightly below the current forecast.

Margins are expected to materially improve, with adjusted EBITDA-M improving from 29.4% in the LTM to 41.2% in FY27F.

Industry analysis

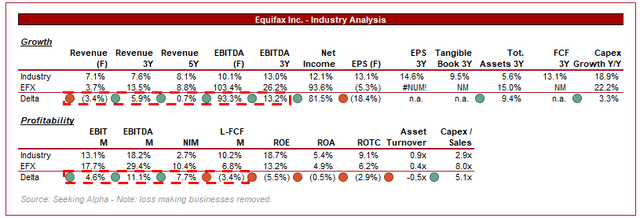

Research and Consulting Services (Seeking Alpha)

Presented above is a comparison of EFX’s growth and profitability to the average of its industry, as defined by Seeking Alpha (32 companies).

EFX performs well relative to this peer group, noting that it includes growing businesses that are highly profitable. The key area of development in our view is its substantial margin superiority, allowing its profitability growth to be outsized.

Relative to TransUnion and Experian, Equifax is in the middle ground. TransUnion has higher profitability and better growth, while Experian lags beyond EFX on both.

Valuation

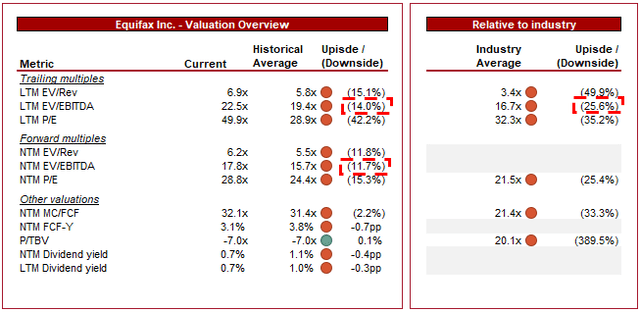

Valuation (Capital IQ)

EFX is currently trading at 22x LTM EBITDA and 18x NTM EBITDA. This is a premium to its historical average.

A premium is warranted in our view, as the business has achieved improved scale and continues on a positive trajectory. The key value driver is its strategic development, which looks to be yielding improved margins at a minimum, with analysts buying into the growth story.

Further, the peer group premium is equally justified due to its higher margin and growth. This premium currently should not be overtly large, as the business is cyclical in nature. Many of the data businesses on the other hand have consistent growth due to sticky revenue.

Based on this, we do not see substantial upside, as its financial improvement looks sufficiently priced in. Had the near-term outlook been strong, we may have squeezed in a buy rating. However, with the outlook bleak, it is likely EFX will trade sideways, if not further down come Q3.

Final thoughts

EFX is a fantastic business. It has a highly defensible market position, a solid business model, and is innovating. The current development plans look positive, suggesting growth and margins will improve in the coming decade.

Unfortunately, the improvement ahead is already priced in and the business looks unable to positively respond to the current market conditions, implying no upside and only execution risk. Investors have seemingly got ahead of themselves with this stock and so it is worth being patient given there is no immediate light at the end of the tunnel.

Read the full article here