Introduction

In April, I wrote an article on SA about Peruvian cement maker Cementos Pacasmayo (NYSE:CPAC) in which I said that early 2023 could be challenging due to falling cement production in the country.

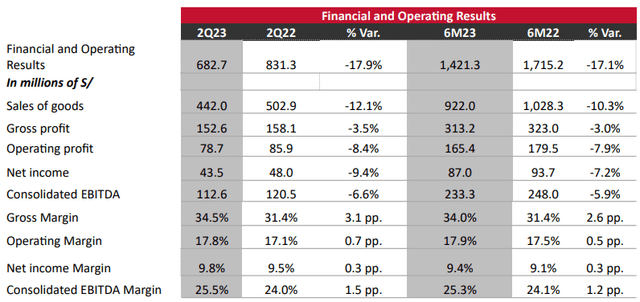

Well, the company released its Q2 2023 financial results on July 20, and I think that they were decent as revenues went down by 12.1% year on year while net income came in at 43.4 million Peruvian soles ($11.9 million), just 9.5% lower than the same period of the record 2022. In my view, cement demand in Peru has been surprisingly resilient over the past months in light of weak economic growth and continuing political protests. It seems that Q3 could be even better for Cementos Pacasmayo thanks to the lack of negative effects of cyclones on cement demand, and I’m keeping a buy rating on the stock. Let’s review.

Overview of the Q2 2023 financial results

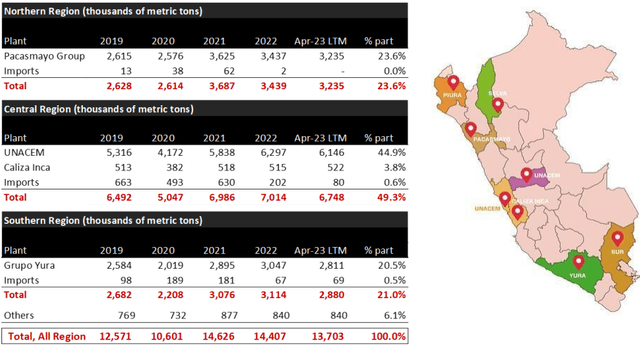

In case you’re not familiar with Cementos Pacasmayo or my earlier coverage, here’s a short description of the business. The company was established in 1949 by Luis Hochschild Plaut and is the second-largest cement producer in Peru today. The portfolio of Cementos Pacasmayo is mostly made up of blended cements which have an average of 22% less clinker than traditional Portland cements and the company has three production facilities with a cement production capacity of 4.9 million MT/year and a clinker capacity of 2.8 million MT/year. Since it’s not economically feasible to move cement over long distances due to the low value-to-size ratio, the market in Peru is split between three companies that have regional monopolies – Cementos Pacasmayo in the northern region, UNACEM in the Central region, and Cemento Yura in the southern region. Caliza Inca and several other small producers have a market share of about 10%.

Cementos Pacasmayo

Another interesting fact about the Peruvian cement market is that a major part of demand comes from the so-called “self-construction” segment, which includes individuals that usually gradually buy bags of cement to build or improve their homes. This means that cement in the country is usually highly sensitive to economic growth. About three-quarters of the sales of Cementos Pacasmayo come from this segment.

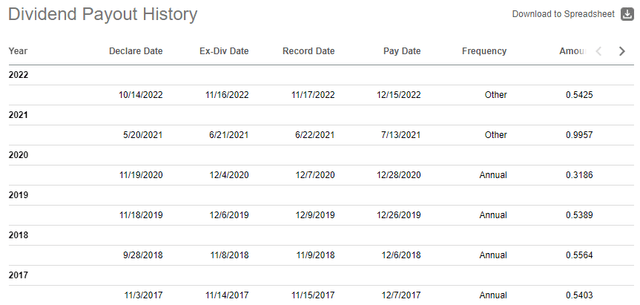

Looking at the ownership structure of the company, Eduardo Hochschild Beeck (a son of Luis Hochschild Plaut) holds 50% of the shares, and Peruvian pension funds own another 24% of the share capital. About 8% of the shares of Cementos Pacasmayo are currently trading on the NYSE in the form of American depositary receipts (ADRs). The company has a dividend yield of 10% as of the time of writing, and it has paid a total of $3.49 per ADR of dividends since 2017. It usually distributes a special dividend once per year.

Seeking Alpha

Turning our attention to the Q2 2023 financial results, revenues decreased by 12.1% to 442 million Peruvian soles ($121.6 million) as cement demand in April was negatively impacted by heavy rainfall due to cyclone Yaku. Yet, the EBITDA margin improved to 25.5% from 24% a year earlier as a 17.9% decrease in the sales volume meant that Cementos Pacasmayo didn’t have to rely on imported clinker during the quarter. This boosted the net income margin to 9.8%.

Cementos Pacasmayo

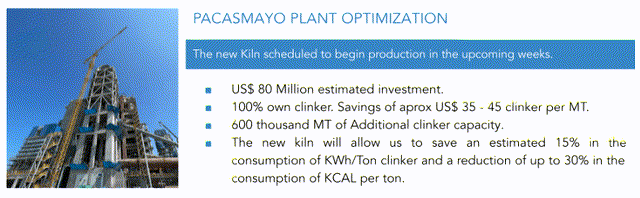

In my view, the EBITDA margin of Cementos Pacasmayo could surpass 26% by the end of 2023 as the company revealed in its Q2 financial report that a new $80 million kiln at the Pacasmayo plant is set to start production over the coming weeks (see page 8 here). This new kiln will boost the clinker capacity of that plant by 0.58 million MT/year. While Cementos Pacasmayo doesn’t currently rely on imported clinker due to the lower cement demand in the country, I expect margins to improve as the company shifts some of its less efficient output to this facility.

Cementos Pacasmayo

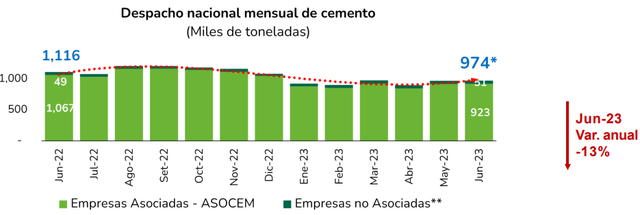

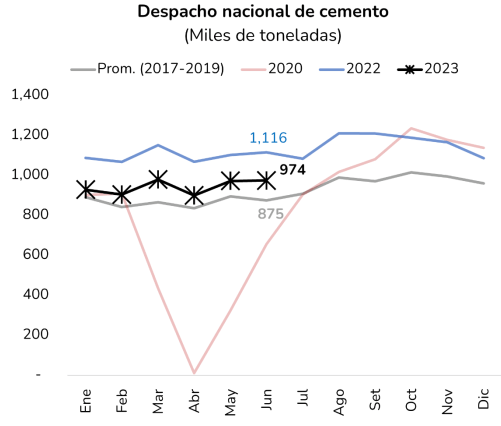

Turning our attention to the overall cement demand in Peru, I’m surprised that it rebounded in May and June and remains above pre-pandemic levels. According to data from the Association of Cement Producers of Peru (ASOCEM), cement deliveries in both months surpassed 950,000 MT. While the June volumes were about 13% lower compared to a year earlier, they were significantly higher than the average shipments for this month for the period between 2017 t and 2019.

ASOCEM ASOCEM

It seems that demand from the self-construction sector is unusually strong at the moment despite ongoing political protests and weak GDP growth. According to data from the government’s INEI statistics agency, the country’s GDP shrank by 1.43% in May, which was even higher than the declines registered in January (-1.02%) and February (-0.51%) when political protests were at their peak. Considering there are no heavy rainfalls forecast for the next two months and that the government expects GDP growth in July to be the strongest so far in 2023, I’m optimistic that cement demand in the country will remain strong over the coming months. This should enable Cementos Pacasmayo to book stronger revenues and EBITDA over the second half of the year, and I’m optimistic that the company could distribute another dividend of above $0.50 per ADR in late 2023 or early 2024.

Looking at the valuation, the company has an enterprise value of $877.6 million as of the time of writing while the LTM EBITDA stands at 486 million soles ($133.7 million), putting the EV/EBITDA ratio at just below 6.6x. Considering cement demand in the country has been strong over the past few months and GDP is expected to rebound, I think that Cementos Pacasmayo should be trading at above 8x EV/EBITDA. This translates into $7.71 per ADR or an upside potential of 42.2%.

Turning our attention to the risks of the bull case, I think there are two major ones. First, it’s possible that cement demand in Peru was strong in May and June because the “self-construction” segment was compensating for lower purchases in April with the aim of making up for delays in construction projects before the end of the summer. If this is the case, cement demand in the country could move closer to pre-pandemic levels over the fall. Second, we could see heavy rainfall during the rainy season (October to November) due to the global El Nino Phenomenon and the coastal El Nino. This could dampen cement demand in Peru in late 2023 and early 2024.

Investor takeaway

I think that 2023 is shaping up as a strong year for Cementos Pacasmayo, although not as strong as the record 2022. Cement demand has been surprisingly high over the past few months, and I think that the company’s EBITDA for 2023 could top 450 million soles ($123.8 million) if we get low rainfall levels during the rainy season. In my view, Cementos Pacasmayo looks cheap at the moment at 6.6x EV/EBITDA on a TTM basis.

Read the full article here