Thesis

There are several ways to gain exposure to Bitcoin, but before now I have not found any of them particularly attractive. Until recently, I considered ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) to be just another lackluster way to invest into Bitcoin. However, now that the 2x Bitcoin Strategy ETF (BITX) exists, I consider BITO the single best way to gain exposure to Bitcoin through a non-crypto brokerage. This is because entering a short position in BITX provides a reasonably effective way to hedge BITO. I currently rate ProShares Bitcoin Strategy (BITO) as a Buy.

Fund Background

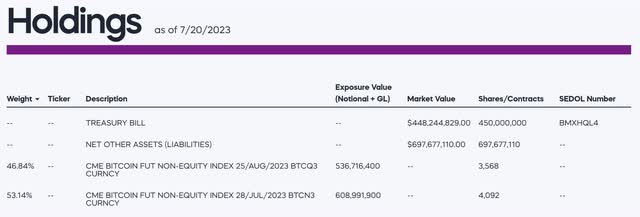

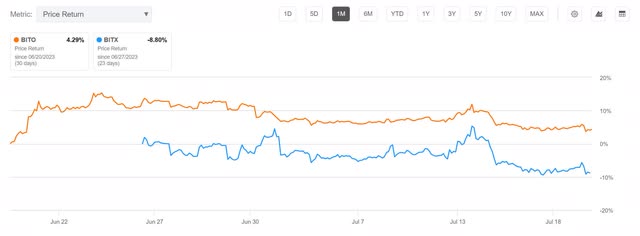

BITO explains their strategy in their prospectus. This particular exchange traded fund charges a 0.95% management fee and gains exposure to bitcoin through futures contracts. Instead of holding a majority of their assets as cash to act as a cushion against margin calls, BITO holds treasury bills.

BITO Holdings (Proshares.com) BITO Fund Summary (Seeking Alpha)

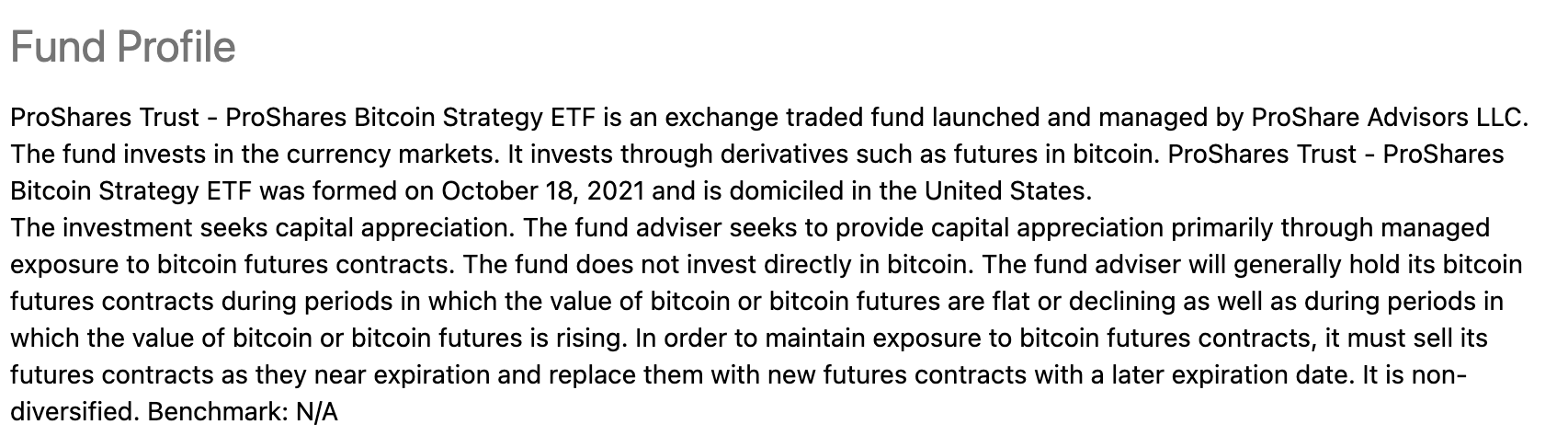

BITO has been trading since last October and paid its first distribution in January. So far this year, they have paid a total of $2.22 per share. At the share price of $15.88 for July 20th, this comes out to a calculated trailing yield of 13.98%. Assuming their variable distribution maintains a rate similar to its average so far, adding 6 additional distributions will likely place the annual yield into the 25-30% range.

BITO Dividend History (Seeking Alpha)

NAV Erosion

Both funds suffer from NAV erosion but for different reasons. BITO uses futures contracts to gain exposure to its underlying. Mechanically, this is similar to how United States Oil ETF (USO) gains exposure to crude oil, or how United States Natural Gas Fund, LP (UNG) gains exposure to natural gas. When compared to its underlying, BITO suffers from erosion due to losses from rolling their futures position.

I found an article from 2021 discussing a projected 17% annual degradation from the roll costs at that time. As the market matured, roll costs continued to fall in 2022. By this May, estimates were that BITO would underperform the spot market by 10% to 13% annualized. Since the beginning of the year, BITO has underperformed BTC by 27.42%. If the 13.98% trailing yield is added back in to its value, BITO is only lagging BTC by 13.44%.

BITO vs. BTC-USD Year-To-Date Performance (Tradingview via Seeking Alpha)

BITX is a Leveraged ETF which are notorious for value degradation over longer time frames. They are designed to perform with specific behavior in comparison to the daily performance of their underlying. Enough investors have misunderstood or misjudged the effects of their long-term behavior that FINRA and the SEC have both issued warnings. Because of this value erosion, I believe it is unwise to be long a leveraged ETF over longer time periods. Fortunately, one of the most efficient things for us to do is to short a bullish leveraged ETF. This means instead of working against us, this long term value degradation should work in our favor.

As it is still relatively new, I was unable to find an estimate for the average decay for BITX, but I did find an article detailing the major factors that go into its rate. For reference, I was able to find an early 2022 article detailing estimates that the 2X ProShares Ultra S&P 500 (SSO) would decay only about 1.5% per year, while the 3X Direxion Daily Semiconductor Bull (SOXL) LETF would likely lose about 41%. This implies that if a triple leveraged Bitcoin ETF becomes available, it should be even more appealing than BITX.

Correlation

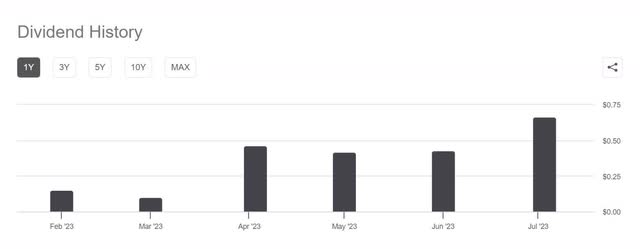

Because BITO and BITX both use the price of Bitcoin as their underlying, they are highly correlated.

BITO vs. BITX (Tradingview via Seeking Alpha)

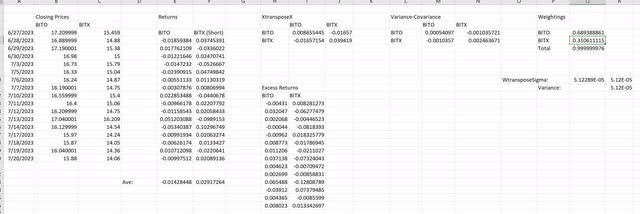

With less than a month of data to work from, I do not trust the accuracy of values derived from minimum variance weighting calculators. For reference, these are typically built using 252 data points, and we have less than 20. Even this small sample size is confirming the strong covariance between the two assets.

BITO – BITX Minimum Variance Weighting (By Author)

According to my calculation, to form a low variance couple BITO should be 68.94% weight, and the short BITX position should be at 31.06% weight. Because the sample size is so small, I do not trust these values and will wait for more data before entering a position.

Anyone wanting to try this before we have a larger sample of data should be cautious. By testing the ratio out with a small position, one should be able to track its behavior over multiple days. If the value of the couple changes significantly over the testing period, its ratio would need to be adjusted. Only after a ratio is found which holds a stable value, should the coupled position be sized up.

Hedge Behavior

BITO is already lagging Bitcoin by over 13% YTD, this places its annual decay rate above the May estimate of 10-13%. If we extrapolate this 13% out for the full year, it should fall around in a range of around 25-30% annually. With BITO’s erosion rate working against the hedged couple, and BITX’s working for the position, the net erosion rate of the couple will be a function of the difference between the two and their relative weightings. The pairing should fall out of calibration over time, so it will have to be rebalanced periodically. Although BITO and BITX are both highly correlated to the same underlying, the fact that this hedge offers protection from volatility yet is imbalanced in weight, works in its favor.

Say, for example, some time passes and Bitcoin doubles: BITO, which is weighted more, should go up by somewhat less than double due to losses from rolling. The BITX position, which is weighted less but moves at 2x to Bitcoin, will go down in value to roughly one fourth of its original size. The difference in weight means the couple will still gain in value. A very rough back-of-the-napkin estimate for this: the 69% of the position that is in BITO goes up by a conservative estimate of 60-70%, to 110-117% of the original position size. The 31% that was in BITX shrinks by roughly 75% to 7.75% of the original position size (this is ignoring the nav erosion). So after a doubling of Bitcoin, the BITO/BITX couple would be somewhere in the ballpark of 117.75-124.75% of its original size. I should note that the 60-70% estimate was chosen intentionally low to allow for the possibility of significant losses from rolling over an unknown number of months. The shorter the time frame Bitcoin doubles in, the less decay BITO will experience, so actual results may under or over perform this rough estimate.

The same estimate only in reverse, over time Bitcoin halves: BITO, still taking losses from rolling and weighted at 69% falls by slightly more than half to 33-34%. The 31% that was short BITX is still benefiting from NAV erosion and is now worth slightly more than twice its original value and has grown to 63% of the original position size. The BITO/BITX couple would now be worth somewhere in the ballpark of 96-97% of its original size, and would likely be in desperate need of rebalancing. If BITO didn’t experience NAV erosion, I would expect for this result to be very close to 100%.

The hedge is biased to participate in more of Bitcoin’s upside than its downside. One might attempt to slightly over-hedge so that the short position ends up growing the value of the couple (even through NAV erosion) in the event of a dramatic downturn. Also, selling covered calls against BITO and covered puts against BITX is also a choice one can consider as a way of generating additional cash flow, but this is less appealing because getting exercised on either side means having to immediately rebalance the couple.

Risks

The same risks that affect Bitcoin also affect the long-term value of BITO. If Bitcoin were to underperform, so should BITO. The cost to roll Bitcoin futures has been going down, but it is possible it begins trending upward; this would increase BITO’s erosion and make it less appealing. Also, BITO is an actively managed fund. Although this risk is low, human error is always a possibility.

Catalysts

BITO’s exposure to Bitcoin grants it significant potential upside. As Bitcoin is a limited resource, demand has the potential to carry its value to extreme values.

Conclusions

Because of a combination of BITX’s long-term decay, the benefits one gets from rebalancing assets after they have fallen out of correlation, and their difference in weighting, I expect that regular rebalancing will produce gains for as long as Bitcoin stays volatile.

Before the existence of BITX, I had no easy way to hedge exposure to Bitcoin. Now that we have these two highly correlated assets available to us, BITO is far more appealing. I do not have plans to purchase BITO or BITX in the near future, but I do plan on entering a hedged position once enough data becomes available. Anyone who wants to take part in Bitcoin’s current price action should not be dissuaded by my hesitancy.

What Am I Missing?

Although I have been trading and investing for many years, it was only a few months ago that I decided to brush off my old statistics skills and teach myself how to design low variance portfolios for high margin applications. It is more important to me to hand out correct information to my readers than to maintain an image of perfection, so if any of you see anything wrong with my math or my understanding, please let me know about it in the comments.

Read the full article here