ASE Technology (NYSE:ASX) is a fantastically run semiconductor business based in Taiwan. Its business has more than doubled in the last 6 years and has seen its impact increase all over the globe. It also works with the more popular Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) and counts the company as one of its key partners. It is profitable, has low debt, and has healthy cash flows. Despite all this, the company is trading at a big discount, and in this article, I will aim to explain why this could be the case and why the discount valuation could accurately reflect the risks.

At a bargain

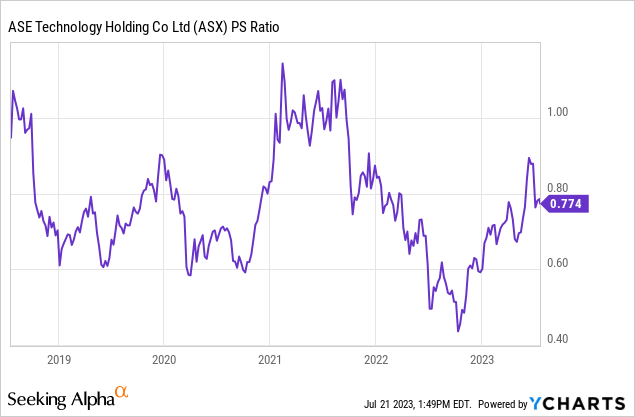

The company trades at Price-to-Earnings multiple of 9x and a Sales multiple of 0.7x. This is far from sector medians of 25x and 2.9x respectively for the Technology sector. Focusing specifically on the semiconductor industry, you see this starts to get even better. Overall, the industry is trading at an average PE of 35x and PS of 7x. This suggests that the stock is heavily undervalued.

This low valuation has been the case for a while and there are reasons why it’s cheap and may continue to exhibit this behavior in the near future.

Current environment and an uncertain future

The current environment shows a clear slowdown for electronic devices. Keeping the AI-related hype aside, the reality is that most technology companies with a heavy dependence on semiconductors have seen slowing sales and expect to see a bigger hit in the near future.

Taiwan Semiconductor Manufacturing (TSM) experienced a significant decline in its stock value after reducing its revenue projections and postponing production at its Arizona plant to 2025. The global chip industry is facing challenges due to a prolonged electronics market slump, and TSMC’s projection of a 10% sales drop for the year has raised concerns among investors. As noted by an analyst, this is the third cut TSMC has made in this cycle.

This is not just one company. There is consensus that this is the sharpest slowdown in a decade. The weakening demand for automotive components is further exacerbated by the decline in personal computer and smartphone sales. The industry’s stockpiles of chips have been growing since the peak of the Covid-19 pandemic, leading to an extended semiconductor inventory adjustment in 2023. While some expect the decline to bottom out this year, there are concerns about the steepness of the drop given the substantial backlogs. These backlogs are further worsened by the current state of the Chinese economy.

China’s economy faced weak second-quarter growth as both domestic and international demand declined, leading to a rapid faltering of post-COVID momentum. Policymakers are under pressure to deliver more stimulus to support economic activity and curb unemployment. Despite annual GDP growth of 6.3%, it fell short of the forecasted 7.3%, signaling the end of China’s post-COVID boom. Weakening retail sales and lukewarm industrial output indicate a bleak and faltering recovery, with the risk of missing the modest 5% growth target for 2023. Policymakers may roll out more stimulus measures, but analysts warn that a quick turnaround is unlikely due to growing debt risks and structural distortions. The weak overall momentum and global recession risks raise concerns about achieving the growth target, and a deeper slowdown could lead to more job losses and deflationary risks.

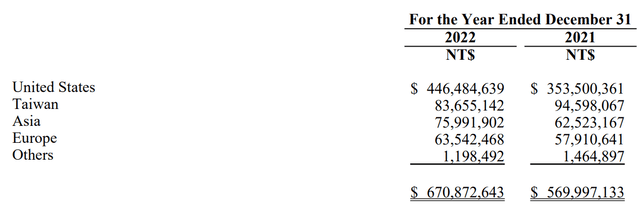

Net Revenues from External Customers. While 2022 saw a demand increase from Asia, 2023 is going to look a lot different (Company’s 2022 Annual Report)

Many semiconductor companies, expecting a sluggish second half of 2023, are already eyeing past this and looking into a recovery in the second quarter of 2024.

But there is a growing chorus that the recession may be pushed from 2023 to 2024. As the economy displayed greater durability than anticipated and the United States managed to steer clear of a recession thus far, the likelihood of a recession in 2023 has been diminishing. Consequently, bets and predictions have begun to extend into the future.

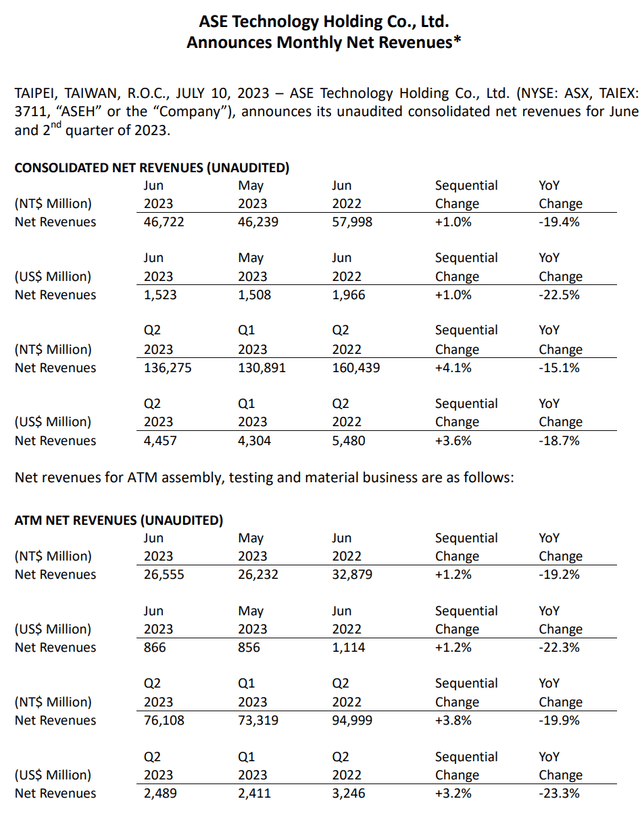

ASE Technology Investor Relations website

In the last three months, ASE Technology saw a double-digit percentage decline in net revenues compared to the same time last year. For the latest month, the decline exceeded 20%!

If we saw an approximate 20% decline in the revenues for Q2-2023 (with no recession) what could we expect for 2024?

An uncertain macro could be one big reason why the valuation is cheap.

Geopolitical Risk – China’s Taiwan Interests

This take draws inspiration from Nassim Taleb, renowned author of “The Black Swan.” It serves as a crucial reminder that the most significant risks are often the ones that are the most overlooked and for any investment, it is crucial to consider the tail risks. While it is hard to predict what it could be in the majority of instances, it is not in the case of industries based in Taiwan.

In many of Xi Jinping’s addresses on Taiwan, he has made it clear that reunification with Taiwan remains a priority. Recent news amps up the rhetoric by expressing China’s readiness for the worst outcome, including new military readiness laws, building new air-raid shelters across the cities from Taiwan, and actively seeking backing for its plans.

War could definitely mean bad news for the entire stock market as a whole, but the most vulnerable industry would be semiconductors, and an invasion could be the ultimate black swan risk. The smartest investor of our time, Warren Buffett himself, sold out of his position in Taiwan Semiconductor, citing the same geopolitical risks.

It is highly likely that the market to a certain degree is reflecting this risk and could be another reason why the valuation is cheap.

When would this thesis be invalidated?

In my opinion, for this thesis to turn out wrong, it is not a matter of logic (as the facts are clear) but more of a matter of time. If the AI-related semiconductor boom significantly picks up it would provide the additional boost this industry requires. But contrary to the present hype, this is not something that would be reflected in the immediate future. Considering the overall size of the pie, it would take some time before this becomes a significant part of ASE’s revenues.

Also, the company is already significant steps toward derisking its exposure to China-related concerns. In its 2022 annual report, this is what the company had to say –

The deglobalization of the semiconductor supply chain will become the new normal in the future, and packaging and testing plants will gradually change from focusing on cost to considering supply chain dynamics and customer needs when expanding their capacity. As deglobalization becomes inevitable, the world’s three major wafer plants with advanced processes will set up factories in the United States and Europe one after another. Taiwan’s and the United States’ global leaders in wafer/packaging and testing will also successively establish advanced packaging and testing plants in Europe and America to serve the local wafer plants that produce advanced process chips and to work with American design industry customers ahead of time…

In terms of electronics manufacturing services (EMS), we have expanded the supply chain from Taiwan and China to Vietnam, Mexico, and Europe in the world. At the same time, we will also continue to plan to expand factory sites, infrastructure, and smart production equipment to prepare ourselves for the next economic cycle…

But as semiconductor setups go, it takes a significant amount of time to fully operationalize a plant, and consequently it could be a couple of years before this exposure is at least partially hedged.

Read the full article here