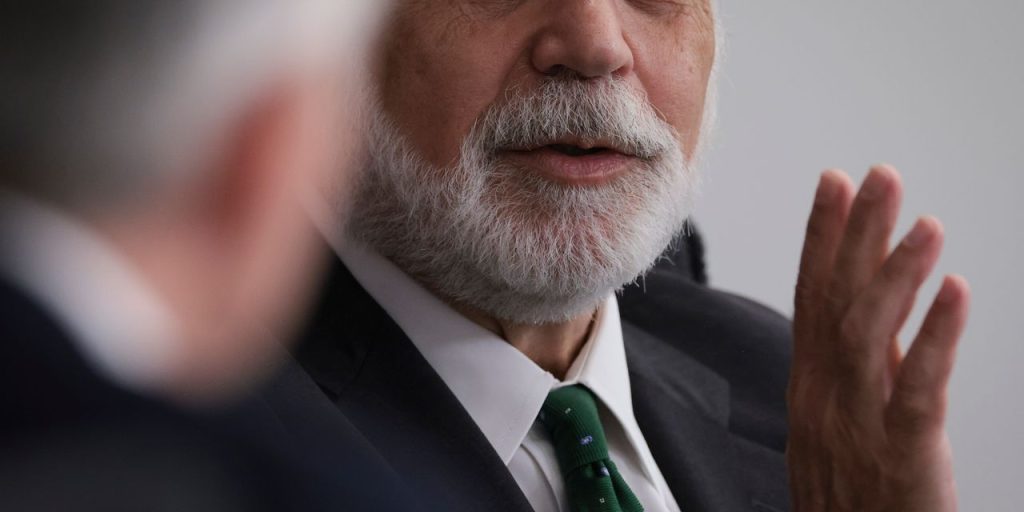

Former Federal Reserve Chairman Ben Bernanke on Thursday said it was clear that the Fed will raise interest rates next week but after that the outlook is cloudier.

After a 25 basis point hike in the fed funds rate next week, “the September meeting is very much up for grabs,” Bernanke said, in a webinar sponsored by Fidelity Investments. Bernanke is also currently a senior advisor to fund manager PIMCO.

“We have a number of reports between now and then, and it is possible this increase in July is the last one,” he added.

Once the Fed reaches the final level, it will hold rates steady. Talk of rate cuts this year are unrealistic, he said.

In the interview, Bernanke said inflation was likely to “pop up” in the next few months, but then price pressures will come down “more durably” into next year until the inflation rate falls to a 3%-3.5% range.

U.S. consumer prices rose a modest 0.2% in June and the yearly rate of inflation decelerated to 3% from 4% in the prior month. The last time inflation was that low was in March 2021.

“The basic news is good,” Bernanke said. After getting to 3%, the Fed “will take its time” trying to get all the way down to the target, he added.

Since March 2022 the Fed moved its benchmark rate up 500 basis points to 5.00-5.25%, a historically fast pace.

The data has created a lot of uncertainty at the Fed, Bernanke said. The central bankers don’t know if interest rates are high enough to bring inflation down. The signal they are getting is financial markets don’t show much tightness in credit conditions, he noted.

Adding to the uncertainty was “the mini-bank crisis” in March, caused by the collapse of Silicon Valley Bank, Bernanke said. While the crisis “seems to be better,” bank lending has been slowing and credit standards are tighter, he said.

The U.S. labor market is still “pretty hot” with pressure on wages and the Fed wants to see it cool before it declares victory on inflation, Bernanke said.

However, the U.S. economy is likely to be able to dodge a deep recession, he said.

The economy will continue to slow down, and, if there is a recession, it will be relatively mild, he added.

Read the full article here