Receive free Markets updates

We’ll send you a myFT Daily Digest email rounding up the latest Markets news every morning.

The euro slipped on Monday after data pointed to a slowing eurozone economy, ahead of a raft of major central bank policy decisions later in the week.

The single market’s currency fell 0.4 per cent against the dollar to $1.109 after the region’s flash composite purchasing managers’ index, a measure of manufacturing and services activity in the region, dropped to an eight-month low of 48.9 in July from June’s 49.9.

The reading marked the second successive month of the index coming in below the 50 mark, which indicates the majority of businesses reported a contraction in activity, as high borrowing costs weighed on the economy.

An increase of 0.25 percentage points in the European Central Bank’s benchmark rate, to 3.75 per cent, is considered almost certain when policymakers meet on Thursday, with one more upwards move likely in the coming months.

Europe’s region-wide Stoxx 600 added 0.1 per cent, recouping early-morning losses, as did Germany’s Dax and London’s FTSE 100. France’s Cac 40 lost 0.2 per cent, dragged down by declines in consumer goods stocks.

Spain’s Ibex 35 index fell 0.6 per cent after the country posted inconclusive election results over the weekend, with the right and left both failing to secure a clear path to forming a government.

Across the Atlantic, the US Federal Reserve is expected to raise its key interest rate by 0.25 percentage points on Wednesday, from the current target range between 5 per cent and 5.25 per cent.

Investors and economists are nonetheless divided over whether the rise will mark the end of the US central bank’s 16-month-long monetary policy tightening campaign, after inflation data earlier in the month showed that consumer prices rose at the slowest pace since 2021.

Contracts tracking Wall Street’s benchmark S&P 500 rose 0.2 per cent, while those tracking the tech-focused Nasdaq 100 added 0.3 per cent ahead of the New York open.

Wall Street equities sold off late last week, after a string of disappointing earnings reports triggered a decline in the high-flying technology sector.

Investors will pay careful attention to industry heavyweights Microsoft and Alphabet, due to report earnings on Tuesday, followed by Meta on Wednesday.

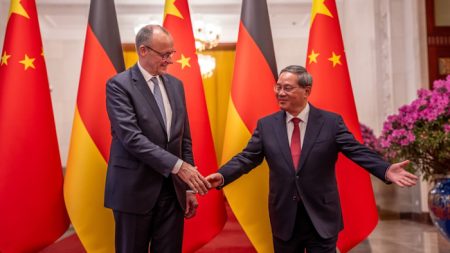

In Asia, China’s benchmark CSI 300 index dropped 0.4 per cent while Hong Kong’s Hang Seng lost 2.1 per cent.

As China’s economy has struggled to recover from three years of severe Covid-19 lockdowns, investors will be hoping for more stimulus measures from the country’s officials at the widely anticipated Politburo meeting this week.

Read the full article here