I am buying a lot of REITs right now because they essentially allow you to invest in real estate at ~60-70 cents on the dollar with the added benefits of liquidity, diversification, and professional management.

Their valuations crashed over the past year due to fears of surging interest rates, but in most cases, I believe that the market has overreacted because REIT balance sheets are today the strongest they have ever been and rents are still growing at a rapid pace due to the high inflation.

So I am very bullish on many REITs and that’s where most of my new savings are going at the moment.

But that does not mean that I am bullish on each and every REIT.

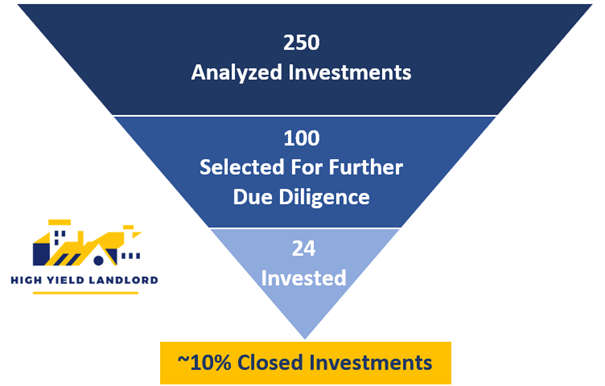

On the contrary, this is a sector in which you need to be very selective. Some REITs are overleveraged, others own challenged properties, and quite a few are poorly managed. On average, we invest in just 1 REIT out of 10:

High Yield Landlord

In today’s article, I want to highlight 5 REITs that I think are at high risk of cutting their dividend in the near term.

Depending on what you are looking for, some of these REITs may still be worth considering, but they will likely go through a bumpy ride in the coming quarters so be aware of that.

If you are in it mainly for the dividend, these REITs probably aren’t for you:

Piedmont Office Realty Trust (PDM)

Quite a few office REITs have announced dividend cuts over the past few quarters.

SL Green (SLG) slashed its dividend by 13%.

City Office (CIO) slashed it by 50%.

Vornado Realty (VNO) even fully suspended it!

And that’s understandable given that office REITs are really dealing with a perfect storm right now. The physical occupancy of office buildings remains exceptionally low as most employees now work at least part of the time from home. This has already led to a drop in demand, growing vacancies, dropping rents (adjusted for TI), and a growing need for capex. At the same time, increasingly many office landlords are defaulting on their loans and returning the keys to their lenders and this will ultimately make it more difficult for everyone to refinance their debt.

Piedmont Office Realty Trust

Even the likes of Blackstone (BX) and Starwood have defaulted on some properties and it is making lenders very nervous.

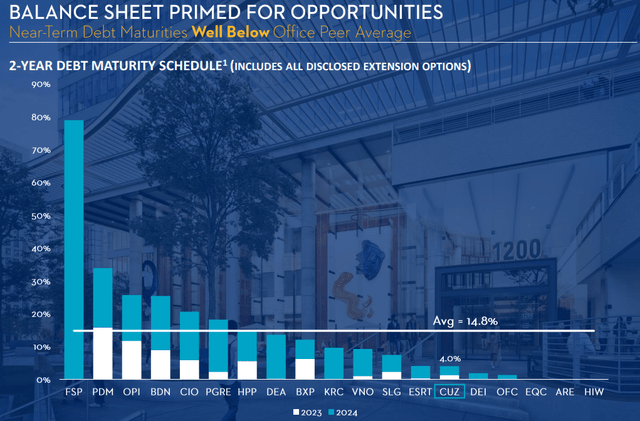

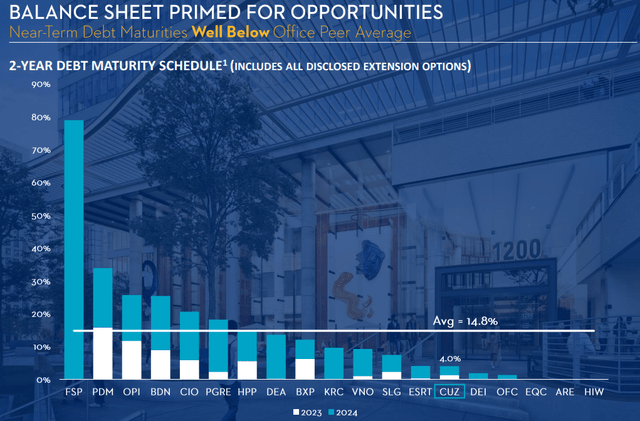

This is a particularly big problem for Piedmont Office Realty Trust because it has more debt than average and it has a very large chunk of it maturing over the next two years:

Cousins Properties

This does not mean that PDM is headed for bankruptcy, but it means that its current cash flow will likely come down quite significantly as it refinances its debt at much higher interest rates.

In fact, PDM just made the following announcement a few days ago:

Piedmont Office Realty Trust announced today that it… has priced an offering of $400 million aggregate principal amount of 9.250% senior unsecured notes due 2028 at 99.000% of the principal amount…

…Piedmont intends to use the net proceeds from the offering, together with cash on hand, if necessary, to fund the purchase of all of its outstanding 4.45% senior notes due 2024…

Ouch!

It is refinancing debt at a near 10% interest rate – a near 500 basis point expansion in its interest expense. The cap rates of its properties are much lower than that.

Today, the company’s payout ratio may not seem high, but as an increasingly large portion of its cash flows goes to interest expense and capex, I think that a dividend cut is now becoming increasingly likely.

PDM is one of the few office REITs that has resisted a dividend cut so far, but for how much longer?

The recent refinancing news is very concerning.

Blackstone Mortgage Trust (BXMT)

BXMT is one of the largest commercial mortgage REITs.

It is quite popular among individual investors because of its 11% dividend yield.

But here’s the issue: it holds the highest exposure to the office sector of any of its peers.

| SECTOR EXPOSURE | Residential | Office | Retail | Industrial | Hotel |

| Starwood Property (STWD) | 33% | 23% | 2% | 6% | 16% |

| Blackstone Mortgage (BXMT) | 27% | 34% | 4% | 9% | 19% |

| KKR RE Finance (KREF) | 44% | 25% | 0% | 13% | 5% |

| Apollo CRE Finance (ARI) | 19% | 18% | 16% | 3% | 23% |

| Ladder Capital (LADR) | 37% | 24% | 6% | 7% | 4% |

| NexPoint RE Finance (NREF) | 95% | 0% |

0% |

0% | 0% |

…and at the same time, it also has the highest leverage of any of its peers:

| DEBT METRICS | Portfolio LTV | Debt-To-Equity |

| STWD | 60% | 3.8x |

| BXMT | 64% | 4.5x |

| KREF | 66% | 4.2x |

| ARI | 58% | 3.0x |

| LADR | 68% | 2.7x |

| NREF | 69% | 2.7x |

That’s a bad combo… especially as its dividend payout ratio is today already tight at around 90%.

If they have to repossess a few office buildings and have to heavily reinvest in them to make them desirable to tenants, they could rapidly see their payout ratio surpass 100%, likely forcing a dividend cut.

I think that there are better options in its peer group.

Brandywine Realty Trust (BDN)

BDN is in a similar situation as PDM in my opinion.

It owns a lot of office buildings, which are today struggling, it has more leverage than average, and unfortunately for them, they also have quite a lot of debt maturities in the next two years:

Cousin Properties

I think that PDM’s assets are actually more compelling on average than those of BDN. PDM is mostly invested in growing sunbelt markets, but BDN is very heavily invested in Philadelphia, which is a weaker market today.

Moreover, BDN has even more leverage with a Debt-to-EBITDA of about 8x.

Therefore, I think that investors should be very concerned about BDN’s future refinancings and the new costs that they will bring.

They also have quite a few development projects and adjusted for this capex, their dividend payout ratio is already very tight, so a dividend cut is likely here as well.

DIC is a German real estate investment firm that owns a diversified portfolio of industrial and office properties, and it also operates a large and growing asset management business that earns fee income.

I am actually bullish on DIC and own a position, but I think that a full suspension of the dividend is quite likely.

DIC is today in a tough space because it is overleveraged, has near-term debt maturities, and needs to sell assets, but they are very few transactions happening in Germany right now.

DIC Asset

To win some time, the company recently announced that it had renegotiated its debt maturities in a way that will extend them a bit, but it will come at a much higher interest expense.

This gives them more time to sell assets to fix their balance sheet, but the flip side of things is that the dividend will likely be fully suspended because it doesn’t really make sense for them to pay out €60 million of cash dividend each year when it could be used to pay off some of its near-term debt that’s become very expensive.

I think that there is significant upside if they can fix the balance sheet and this is why I own a position, but I wouldn’t buy it for the dividend at this point.

Annaly Capital Management (NLY)

NLY is one of the largest and best-known agency mortgage REITs.

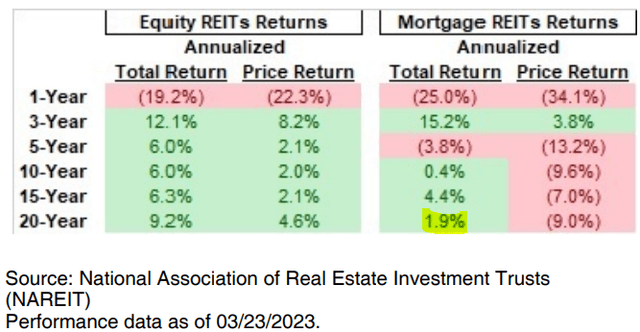

I have stayed away from these companies because they have a horrible track record, despite paying high dividends.

Over the last 2 decades, they have only earned a 2% annual return to investors and that’s including the dividend!

NAREIT

And I think that especially today, this is a very tough business because interest rates and spreads have become even more unpredictable, and for this reason, some have argued that their business model is broken and I tend to agree.

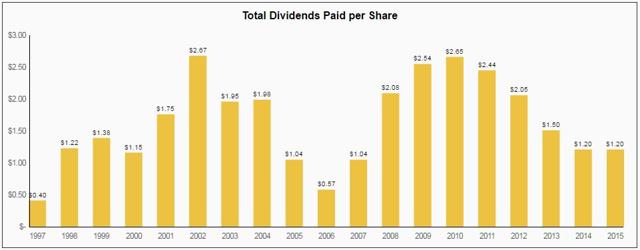

Just look at NLY’s track record of dividend payments:

Annaly Capital Management

They have respectively cut their dividend and I think that they will again in the future.

Bottom Line

I am very bullish on many REITs because I think that as inflation continues to cool down and the economy dips into a recession, the Fed will be quick to slash interest rates, and this will lead to an epic recovery with a number of REITs appreciating by 50-100% and I earn a ~6-8% dividend yield while I wait.

But that does not mean that every REIT is worth buying. You need to be selective because not all REITs have the balance sheet or assets to keep paying their dividend and could suffer significant downside before an eventual recovery.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here