Wouldn’t we all like to get something for nothing? Have our cake and eat it too? Especially when it comes to buying “insurance” on the stock market? As someone who specializes in the esoteric field of “Tail Risk Hedging”, I am always asked by investors whether there is a cheaper way to buy protection against the downside and crashes in the market, because the thought of paying premium year after year — which bites into returns — is not always palatable.

To get straight to the point, assume that the S&P 500 is the stock market we are interested in hedging. As of this writing, the S&P 500 is at 4515 (Source: Bloomberg). If we price a one year put option struck at this level (known as “at-the-money spot” strike), the price of hedging is approximately 4.75%. If we buy this put option and wait for a year, and nothing happens, we will obviously lose 4.75% in premium. A call option with the same strike costs about 8.25%. So in this simple example, an investor who owns the S&P 500 index or similar stocks (e.g. by holding an ETF like SPY or IVV) can sell the call option to earn 8.25% and spend part of that money to buy the put option for 4.75% and net a positive “income” of 3.5%. If the market ends up higher than 4515 in one year, the investor gives up all the upside on their stock portfolio since the call option will end up in the money. If the market stays where it is, the investor gets to keep the 3.5%. If the market falls, the investor is fully protected against any decline in the market. So in this example the investor wins in two out of three situations, and in one situation does not lose anything. Basically by giving up potential upside, the investor is able to buy protection on the downside while earning a little bit on top.

There is no magic here. The reason that the call option costs so much more than the put option today is simply because the forward price of the S&P 500, which is the main driver of the option price, is “implied” to be at 4679, which is roughly 3.5% higher than the current price. And the reason for this is the relevant deposit rate of 5.25% for the year is much higher than the “dividend” yield of 1.6% of the S&P 500 (the situation is even better for lower dividend markets like the Nasdaq 100).

Now some investors might be averse to sacrificing all the upside to buy downside protection. So let’s change this to an investor who wants to keep a 10% upside. This investor sells a 10% out-of-the-money call and uses the proceeds to purchase a put that is 10% out of the money on the downside. Selling the call (strike around 4965) will generate, at today’s pricing levels, a premium of about 2.85%. And buying the put (strike around 4060) will cost about 2.6%. So net net the investor will take in 0.25%, and also have tilted the portfolio such that if the market rallies he will participate up to 10%, but more importantly, if the market crashes, then any losses beyond a 10% selloff will be made up one for one. Again, there is no free lunch here, it’s simply a sacrifice of some of the upside potential to protect on the downside. What’s attractive is that today, with stock markets at almost all-time highs, the yield curve inverted, and so many other risks on the horizon, it is possible to create an asymmetrical risk-reward without much out-of-pocket costs at all.

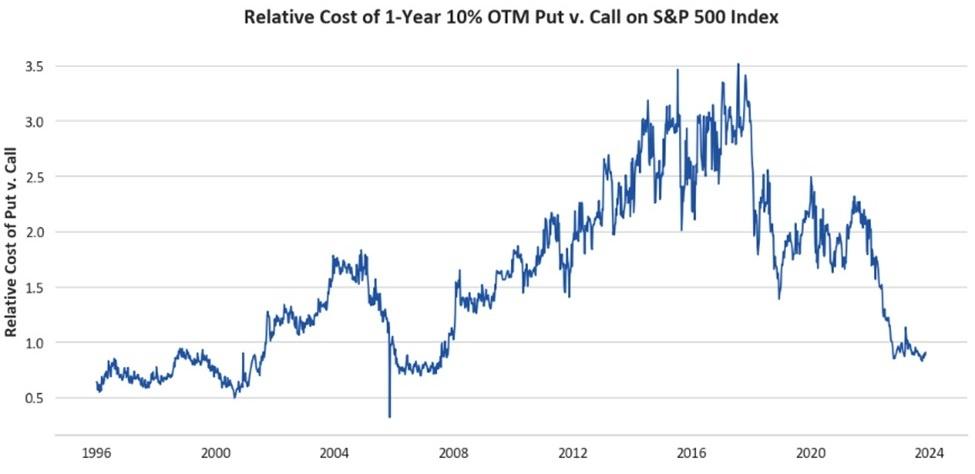

In the chart below we show the ratio of the price of a 10% out of the money put and a 10% out of the money call. When the ratio is lower than 1, the put costs less than the call, which is where we are today (Source: LongTail Alpha, Optionmetrics). The last time this happened was close to the 2008 financial crisis, and the time prior right around the tech meltdown/Nasdaq bubble bust of 2000.

Other investors might want to keep all of the upside and not want to sell any call options. These investors will pay 2.6% for the 10% out-of-the-money put. If they wait and the market rallies above its current level, they will lose all of the premium. But if the market falls more than 10% of its current level, they will be protected. Due to the implied forward price of the S&P 500 being so much higher than in recent history, this is relatively a very cheap level. For reference, a further out of the money put, such as a 20% out-of-the-money put costs only 1.35%!

Like we said above, there is no magic here. The reason we can achieve this outcome is as always…a lack of communication. Here the communication mismatch is between the level of short-term interest rates and the level of dividend yields. Over time, since the stock market tends to be more risky than short-term interest rates, one should expect dividend yields to be higher than the short-term interest rate. But today we are in a world where a good fraction of the S&P 500 is made up of large capitalization growth stocks that don’t pay any dividends, and are unlikely ever to. So buying these stocks is buying into the story of further gains in their prices. If one believes that the magnificent seven stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet) will keep going up, then they have to keep going up at a faster pace than what is built into the forward price of these stocks. And as we discussed it above, the forward price is basically the spot price inflated up by the difference between the interest rate and the dividend yield.

This is a bit like fighting gravity. We know when carry is negative, the financial system does not work very well. Today, the negative carry in owning large capitalization growth stocks is very large. If one thinks of the cost of carry as paying a premium to own the growth, then the right way to think about the growth stocks is that one is paying a premium to own these stocks. And the premium is about 4% a year. The gravitational force has a tendency to pull down those who fight it, hard.

Putting this all together we can see that the stock market today has massive negative carry which makes shorting (rather than owning it) the positive carry trade. Of course, nothing is guaranteed, and perhaps the stock market rallies even more and overcomes the negative carry embedded in its pricing. But given the incredibly low levels of volatility, one can create a downside hedge while earning the carry.

Asymmetric risk-rewards are always a welcome thing in the investing business. There is never a free lunch, but when distortions across markets (here between interest rates and dividend yields), arise, it is good to pay attention and see if there is an opportunity to generate some return or create more defense in the portfolio cheaply. Today happens to be one of these times.

Read the full article here