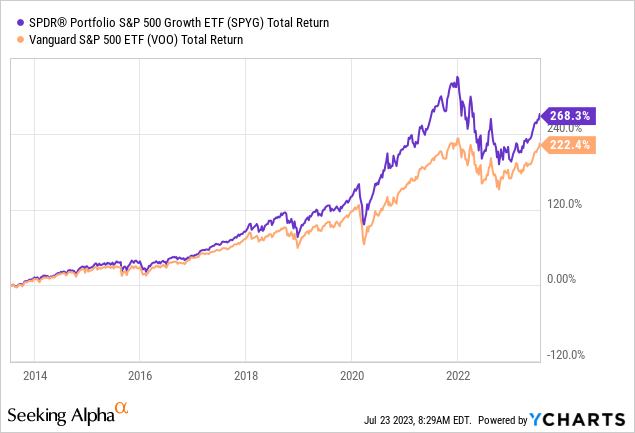

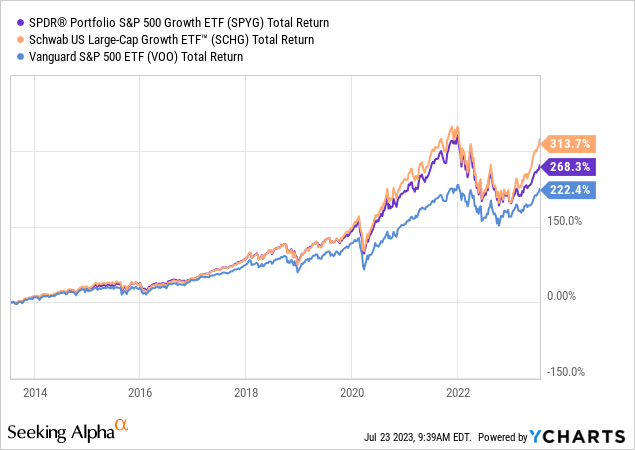

State Street Global Advisors’ SPDR Portfolio S&P 500 Growth ETF (NYSEARCA:SPYG) is up 23.7% YTD, has an attractive long-term performance track record, and sports a very cost-efficient expense ratio of only 0.04%. The fund focuses on the S&P500 strongest growth companies based on sales growth, momentum, and earnings change to price ratio. Over the past 10-years, the SPYG ETF has outperformed the Vanguard S&P 500 ETF (VOO) by 46%:

Investment Thesis

My followers know I advise investors to build a well-diversified portfolio and to hold it through the market’s ups-n-downs. The foundation of my personal portfolio is the S&P500 (via ETFs like VOO) and it is the benchmark by which I judge my returns.

The majority of investors – and even professional money managers – lag the returns of the S&P500. As a result, most investors reading this article would likely be better off becoming a Boglehead (inspired by legendary investor and Vanguard founder John Bogle) and simply own only a low-cost S&P500 ETF like VOO.

However, the goal of my equity portfolio is to not just match the returns of the S&P500, but to consistently beat them. My followers know I try to achieve that goal by owning individual growth stocks (primarily in the technology sector) and a smattering of growth oriented ETFs. That being the case, let’s take a closer look at the SPYG ETF to see if it is a contender for some capital allocation within our portfolios.

Top-10 Holdings

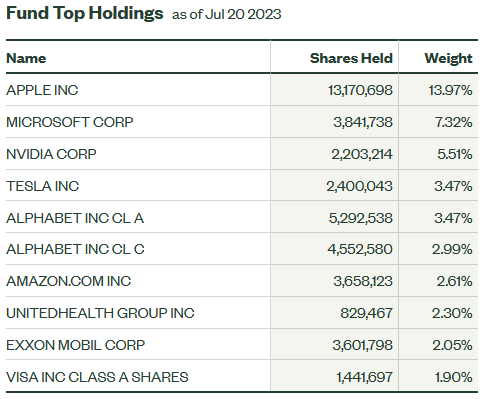

The top-10 holdings in the SPYG ETF are shown below and were taken directly from the State Street Global Advisors’ SPYG webpage where investors can find more detailed information on the fund.

State Street Global Advisor

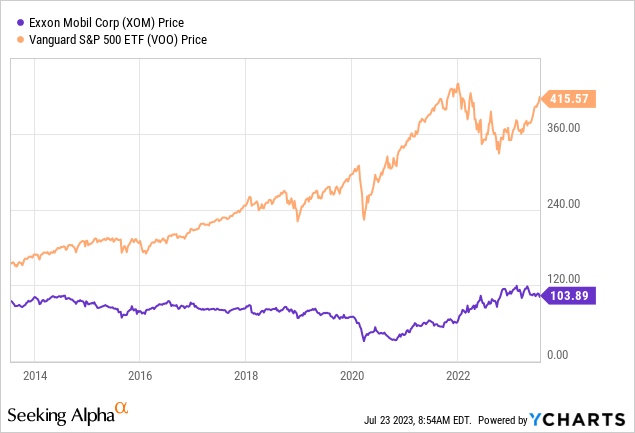

As can be seen in the graphic, the fund is full of the generally regarded best large-cap growth companies in the S&P500 – that is, with the possible exception of Netflix and the somewhat surprising inclusion of Exxon (XOM), which until just recently has been a significant laggard for many years. Indeed, despite a strong showing last year, Exxon’s stock price today is about where it was a decade ago and has drastically under-performed the S&P500 over that time frame:

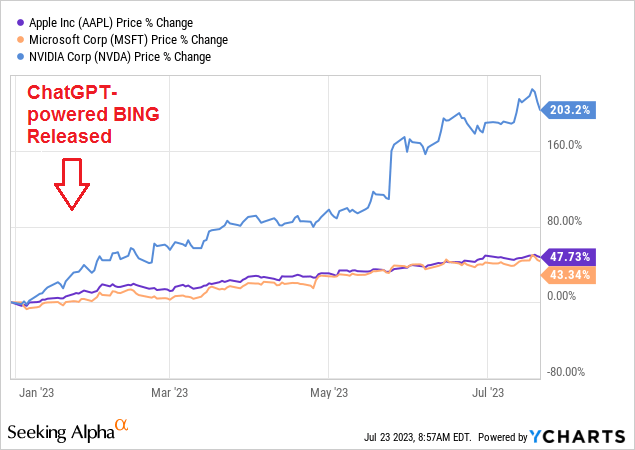

Regardless, the SPYG ETF has benefited from very strong performance by its top-3 holdings: Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). All three have performed very well this year due, primarily, to positive expectations due to the emerging influence of AI. The “kickoff” event was arguably in February when Microsoft released a ChatGPT powered Bing.

Seeking Alpha Y-Charts

Tesla (TSLA) is the #5 holding with a 3.5% weight and is up a whopping 140% YTD. Tesla delivered a strong Q2 report last week: Non-GAAP EPS came in at $0.91 (a $0.09 beat) while revenue of $24.93 billion (+47.3% yoy) beat by $200 million.

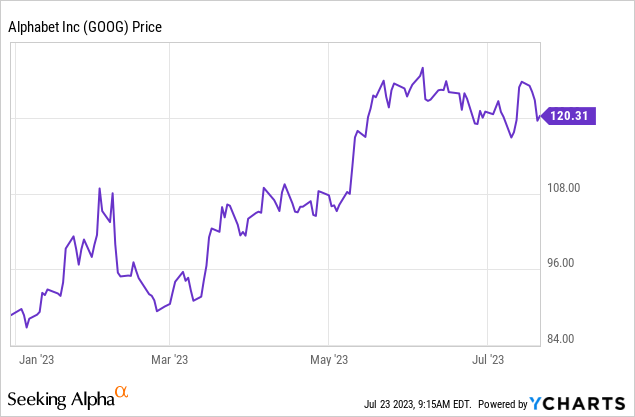

I said TSLA was the #5 holding because if we count both classes of Alphabet stock (GOOG) (GOOGL), Google is the #3 holding with a 6.5% allocation. GOOG is up 34% YTD despite a significant drop in the stock price in February over fears that its search business could be negatively impacted by a ChatGPT powered BING (I added to my position in GOOG during that episode):

Amazon (AMZN) is the #7 holding with a 2.6% weight. Amazon has rallied sharply this year (+51.5%) as investors have come to realize that the company can deploy AI over its wealth of consumer data to improve both its advertising and cloud businesses.

Performance

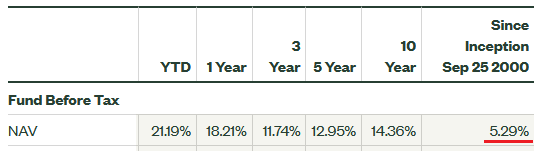

As mentioned previously, the SPYG ETF has a strong performance track record with an average 10-year total return of 14.4%:

State Street Global Advisors

However, the life-of-fund returns of 5.3% annually is rather pathetic, in my opinion. That’s primarily because the fund was started in 2000, right as the .com bust was in full-swing.

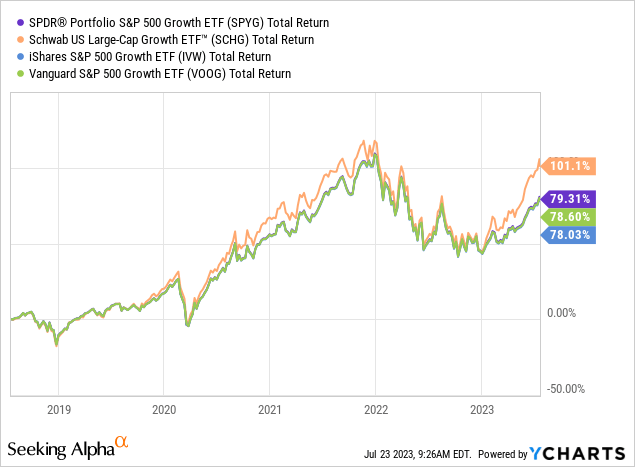

The following graphic compares the 5-year total returns of SPYG against some of its direct competitors: the Schwab U.S. Large-Cap Growth ETF (SCHG), the iShares S&P 500 Growth ETF (IVW), and the Vanguard S&P 500 Growth ETF (VOOG):

As can be seen from the graphic, the SCHG ETF has been the leader of the pack by a significant margin. Like the SPYG ETF, the SCHG ETF also has a very affordable expense fee of only 0.04%.

The primary difference in the two funds’ top-10 holdings is that SCHG has a much larger allocation to Microsoft (12.6% versus 7.3%) as well as a 3.3% allocation to META Platforms (META), which has more than doubled year-to-date. In addition, SCHG’s portfolio does not include Exxon.

Risks

Risks of buying the SPYG ETF at this point in the cycle is that some of these S&P large-cap growth companies are arguably richly valued (NVDA, for example, has a forward P/E = 56x). That said, while SPYG’s price-to-book ratio of 7.2x is significantly above that of the S&P500 (4.4x), its P/E ratio of 23.8x is actually below that of the S&P500 (26.3x).

Summary & Conclusion

The SPYG ETF is a cost-efficient fund that has a strong 10-year performance track record that has significantly beaten the total returns of the S&P500 (see chart below) – which is what I think investors should be looking for in a growth-oriented ETF. However, the SCHG ETF has performed even better, and – in my opinion – is the superior option.

All things considered, I rate the SPYG ETF a BUY.

Read the full article here