The market price of First Financial Bankshares, Inc. (NASDAQ:FFIN) has corrected by around 27% over the last twelve months, partly due to the large unrealized losses on the Available-for-Sale securities portfolio. Despite the correction, the stock is still not a buy, in my opinion. Further, the company’s earnings are set to decline this year due to margin pressure in the first half of the year. I’m expecting First Financial Bankshares to report earnings of $1.49 per share for 2023, down 9% year-over-year.

Loan Growth to Finally Slow Down in the Second Half

First Financial’s loan growth has proven to be more resilient than previously anticipated. Growth improved to 3.0% for the second quarter from 2.0% in the first quarter of 2023. I’m expecting high-interest rates to finally take a toll in the second half of the year. High rates should hurt credit demand, especially for residential real-estate loans which make up around a quarter of the total loan portfolio.

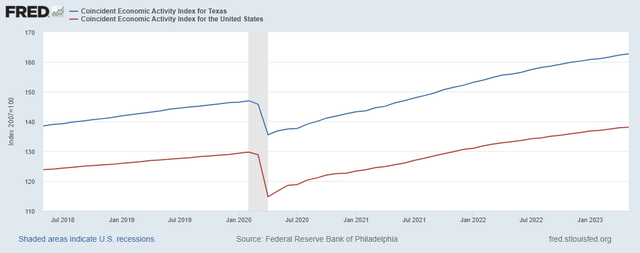

However, the strong economies of First Financial Bankshares’ markets will sustain loan growth. the company serves customers throughout the state of Texas. As a result, Texas’ coincident economic activity index is a good gauge of product demand. As can be seen in the chart below, the slope for Texas seems steeper now than it was before the pandemic. Further, the state’s trendline is steeper than the trendline for the national average. As a result, I’m positive about loan growth in the near term.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio’s growth rate to slow down to 1.5% for the third and fourth quarters of 2023. For the full year, I’m expecting a loan growth of 8%. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net Loans | 3,902 | 4,142 | 5,104 | 5,326 | 6,366 | 6,893 |

| Growth of Net Loans | 13.5% | 6.2% | 23.2% | 4.3% | 19.5% | 8.3% |

| Other Earning Assets | 3,223 | 3,493 | 4,995 | 6,935 | 5,524 | 5,186 |

| Deposits | 6,180 | 6,604 | 8,676 | 10,566 | 11,006 | 11,079 |

| Borrowings and Sub-Debt | 469 | 381 | 430 | 671 | 643 | 589 |

| Common equity | 1,053 | 1,227 | 1,678 | 1,759 | 1,266 | 1,456 |

| Book Value Per Share ($) | 7.7 | 9.0 | 11.8 | 12.3 | 8.8 | 10.2 |

| Tangible BVPS ($) | 6.5 | 7.7 | 9.5 | 10.1 | 6.6 | 8.0 |

| Source: SEC Filings, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Margin Likely to Remain Rangebound

First Financial Bankshares’ net interest margin slipped further in the second quarter of 2023 even as interest rates rose. This trend is not surprising as the company’s assets are quite slow to re-price. Fixed-rate loans made up a hefty 42.81% of total loans at the end of March 2023, as mentioned in the first quarter’s 10-Q Filing (this figure hasn’t yet been updated for the second quarter). Further, only 5.75% of the fixed-rate loans were due within a year. Therefore, a large part of the loan portfolio will not re-price this year even as market interest rates rise.

Moreover, the average asset yield is sticky because of the sizable securities portfolio, which makes up around 43% of total earning assets. Only around 5% of the securities are scheduled to mature within a year, according to details given in the first quarter’s 10-Q Filing.

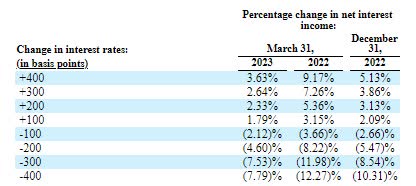

The results of the management’s rate-sensitivity analysis given in 1Q’s 10-Q filing show that a 200-basis points hike in rates could increase the net interest income by 2.33% over twelve months.

1Q 2023 10-Q Filing

I’m expecting the fed funds rate to increase by a further 25-50 basis points in the second half of 2023. Considering my outlook on interest rates and the characteristics of First Financial Bankshares’ assets, I’m expecting the margin to grow by just four basis points in the second half of 2023.

Earnings Likely to be Lower this Year

Earnings of First Financial Bankshares will most probably decline this year mostly due to the margin pressure in the first half of the year. On the other hand, subdued loan growth will support earnings. Overall, I’m expecting the company to report earnings of around $1.49 per share for 2023, down 9% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22 | FY23E |

| Net interest income | 273 | 289 | 350 | 370 | 401 | 386 |

| Provision for loan losses | 6 | 3 | 20 | (1) | 17 | 14 |

| Non-interest income | 102 | 108 | 140 | 142 | 132 | 118 |

| Non-interest expense | 191 | 197 | 228 | 242 | 235 | 233 |

| Net income – Common Sh. | 151 | 165 | 202 | 228 | 234 | 213 |

| EPS – Diluted ($) | 1.11 | 1.21 | 1.42 | 1.59 | 1.64 | 1.49 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Risk Appears High Due to Unrealized Losses

Unrealized losses are the biggest source of risk for First Financial Bankshares as it has a very large Available-for-Sale (“AFS”) securities portfolio. This portfolio has racked up large unrealized losses over the past year and a half because when interest rates rose, the market value of fixed-rate AFS securities fell. These unrealized losses totaled $490.28 million at the end of June 2023, which is a whopping 36% of the total equity balance.

Uninsured and uncollateralized deposits made up around 36% of total deposits at the end of March 2023, as mentioned in the last presentation. (Figures for the end of June 2023 are not available as yet). Fortunately, the available liquidity was 133% of the uninsured/uncollateralized deposits. Although this coverage isn’t as high as I’d like, it definitely eases concerns.

Expected Return Justifies a Hold Rating

First Financial Bankshares is offering a low dividend yield of 2.4% at the current quarterly dividend rate of $0.18 per share. The earnings and dividend estimates suggest a payout ratio of 48% for 2023, which is above the five-year average of 38%, but still easily sustainable. Therefore, my earnings outlook doesn’t present much of a threat to the dividend payout.

First Financial Bankshares has historically traded at a premium compared to peers; therefore, the peer average multiples alone aren’t sufficient to value the company. Further, the historical multiples can’t accurately depict the current valuation because the interest rate environment (and consequently the unrealized loss on AFS securities) is now higher than in previous years. As a result, I’ve decided to value First Financial using both peer and historical multiples.

Multiplying the peer and historical price-to-earnings ratio (“P/E”) averages with First Financial’s estimated earnings gives target prices of $14.3 and $38.5, respectively. Further, multiplying the peer and historical price-to-tangible book ratio (“P/TB”) averages with First Financial’s estimated tangible book value per share gives target prices of $11.9 and $36.7 respectively. The average target price for December 2023 is $25.4, which implies a 16.7% downside from the July 21 closing price. The following table shows my calculations.

| Valuation Using the P/E Multiple | |||

| Average P/E | FFIN’s 2023 EPS | Target Price | |

| Peers | 9.6 | 1.49 | 14.3 |

| Historical | 25.9 | 1.49 | 38.5 |

| Valuation Using the P/TB Multiple | |||

| Average P/TB | FFIN’s 2023 TBVPS | Target Price | |

| Peers | 1.5 | 7.97 | 11.9 |

| Historical | 4.6 | 7.97 | 36.7 |

| Average of all four target prices | 25.4 | ||

| Current Market Price | 30.5 | ||

| Upside/(Downside) | (16.7)% | ||

| Source: Seeking Alpha, Yahoo Finance, Author’s Calculations | |||

Adding the forward dividend yield to the average target price gives a total expected return of negative 14.3%. Hence, I’m adopting a hold rating on First Financial Bankshares.

Read the full article here