We previously covered Verizon Communications Inc. (NYSE:VZ) in October 2023, discussing how its excellent financial performance had been negated by the sustained stock sell-off.

With it already losing much of its value over the past few quarters, we had taken the prudent choice to re-rate the stock as a Hold, with the recommendation to wait for bullish support.

In this article, we shall discuss why we are re-rating the VZ stock as a Buy, after falling for the classic bear trap. Even then, it is impossible to time the market, especially given the extreme pessimism then.

For now, thanks to the moderation in its capex in 2024 and subsequent improvement in its Free Cash Flow generation, we may see the management achieve its debt to EBITDA target of 2.25x over the next few years, while also consistently paying out dividends.

Then again, the stock is only suitable for income-oriented investors whom are looking to hold indefinitely, no matter the noise in the stock market.

The Telecom Investment Thesis Remains Bumpy Due To Its Debt-Ridden Nature

For now, VZ has reported an excellent bottom line beat in its FQ3’23 earnings call, with revenues of $33.33B (+2.2% QoQ/ -2.6% YoY) and adj EPS of $1.22 (+0.8% QoQ/ -7.5% YoY).

This is on top of its improving Free Cash Flow generation of $14.63B (+18.1% YoY) over the past nine months, though mostly attributed to its moderating capex of $14.16B (-10.4% YoY) since its Net Cash Provided by Operating Activities remain stable at $28.79B (+2.1% YoY).

The VZ management has also raised its FY2023 FCF guidance to over $18B (+28.1% YoY) from the previous guidance of $17B (+20.9% YoY), with part of the tailwind attributed to the lower projected capex of $18.75B (-18.7% YoY).

We may also see 2024 bring forth promising FCF generation, attributed to the return to its normalized pre-pandemic capex levels of $17.25B, allowing the management to improve the health of its balance sheet while consistently delivering shareholder returns through dividend payouts.

For context, VZ reports a debt to EBITDA ratio 2.79x, based on its FQ3’23 adj EBITDA generation of $49.08B (+3.5% QoQ/ inline YoY) and its long-term debts of $137.24B (-3% QoQ/ +1.5% YoY).

Based on the $10.96B of annualized dividend obligations, it appears that the telecom may still be a few years away to its debt to EBITDA target ratio of 2.25x, with it also boasting a higher debt leverage compared to the sector median of 2.55x.

Then again, readers must also note that the telecom business is one that is fraught with debt, similar to that of REITs (debt-ridden and dilutive), meaning that those who invest in VZ must be comfortable with this trend and the resultant interest expenses.

For example, its direct peers, such as AT&T (T), also reports an elevated long-term debt level of $126.28B in the latest quarter (-1% QoQ/ +1% YoY), as with Comcast (CMCSA) at $94.35B (-0.6% QoQ/ -1.2% YoY), and T-Mobile (TMUS) at $71.86B (+2.4% QoQ/ +8.3% YoY).

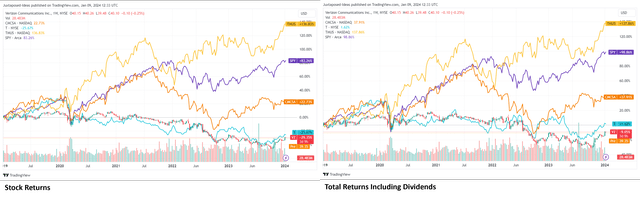

5Y Telecom Stock Returns

Trading View

Aside from TMUS, most telecom stocks do not offer capital appreciation prospects as well, with VZ and T underperforming the SPY over the past five years even after taking dividends into account.

Therefore, while VZ has committed to working capital improvements with its dividend prospects likely stable, investors must also temper their expectations.

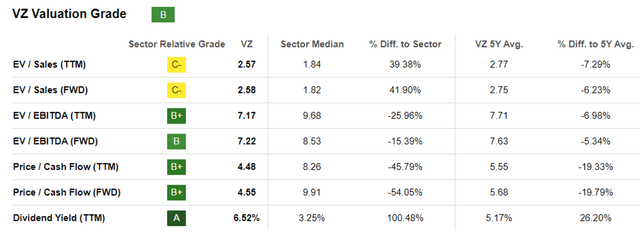

VZ Valuations

Tikr Terminal

For now, VZ’S FWD EV/ EBITDA valuations of 7.22x and FWD Price/ Cash Flow valuations of 4.55x have recovered drastically from the recent October 2023 bottom of 6.38x/ 3.42x and 1Y mean 6.93x/ 4.05x, respectively, though still a distance away from its 3Y pre-pandemic mean of 7.55x/ 6.7x.

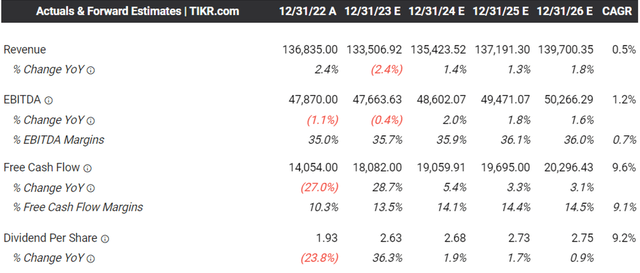

The Consensus Forward Estimates

Tikr Terminal

Perhaps much of the tailwind is attributed VZ’s FQ3’23 bottom line beat and raised FY2023 Free Cash Flow guidance, as discussed above, implying minimal disruptions to its dividend investment thesis, with its profitability also expected to be stable through FY2025.

This is on top of the lifting market sentiments from the cooling inflation and the speculative Fed pivot from Q1’24 onwards, despite the fact that 74% of its long-term debts are on fixed interest rates of 3.7% as of December 2023 (+0.1 points YoY).

It appears that the rising tide lifts all boats indeed, with the VZ stock similarly rallying, despite the moderate deterioration observed in its Dividend Safety, based on its TTM Interest Coverage of 6.10x and TTM Dividend Coverage Ratio of 1.78x.

This is compared to its 5Y average of 7.48x/ 1.96x and sector median of 3.96x/ 2.16x, respectively.

Assuming minimal lead-related rectification costs and prudent balance sheet management, it appears that we may see VZ’s prospects slowly recover ahead, attributed to the bullish support we have observed since the October 2023 bottom.

For now, market analysts also expect the telecom to report FQ4’23 revenues of $34.56B (+3.6% QoQ/ -2% YoY), adj EBITDA of $12.23B (-4.2% QoQ/ -0.2% YoY), and Free Cash Flow of $6.68B (-47.1% QoQ/ +112.3% YoY) on January 23, 2023.

With the YoY expansion in its FCF partly attributed to the improvement in its working capital, we may see VZ achieve its ambitious FY2023 FCF target of over $18B indeed (+28.1% YoY), with any beat likely to be extremely welcomed by Mr. Market, leading to the stock’s sustained upward performance.

So, Is VZ Stock A Buy, Sell, or Hold?

VZ 20Y Stock Price

Trading View

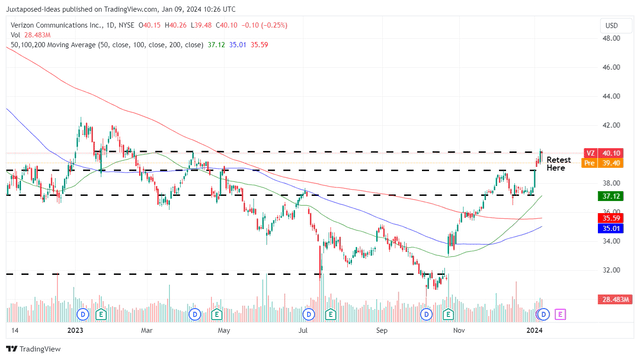

For now, the VZ stock has rapidly broken out of its 50/ 100/ 200 day moving averages, with the golden crossing of the 50/ 200 day moving averages suggesting a long-term bullish support ahead.

At the same time, the stock continues to offer an expanded forward dividend yield of 6.62%, compared to the 4Y average of 5.44% and the sector median of 3.14%.

Does this mean that we are re-rating the VZ stock as a Buy here?

Yes, but with one caveat.

VZ has rallied drastically by +26.2% since the recent bottom, with it currently retesting the previous resistance level of $39s after breaking through the $37s and $39s.

Assuming that the stock is able to retain much of its gains, it appears that its dividend investment thesis has recovered indeed, with a robust 13Y floor at the $30s.

And it is for these reasons that we believe that VZ offers a viable DRIP strategy for long-term shareholders whom are looking to hold indefinitely, since capital losses are only realized if the portfolio is liquidated. This is despite the loss in its stock value by nearly -50% since December 2020 and the unknown volatility moving forward.

At the same time, income-oriented investors may still add to their well-diversified income portfolio, depending on their risk appetite and dollar cost averages.

Lastly, this Buy rating comes with an inherent warning, since the lead legal headwinds have yet to pass, with market analysts expecting a $8B remediation costs for VZ, though still much lower compared to the projected $34.4B for T.

Read the full article here