Overview

My recommendation for American Woodmark (NASDAQ:AMWD) is a hold rating as I await more visibility into the timing of turnaround for the AWMD repair and remodel (R&R) segment. While the current macro-dynamics favors new residential construction, the lack of resale housing has impaired R&R near-term growth. Management comments that provide little visibility until the spring of CY24 also put further pressure on valuation.

Business

AMWD is a national manufacturer of kitchen cabinets, bathroom vanities, office cabinetry, home organization products, and hardware. Currently, AMWD is one of the leading players in the United States, with around ~12% of the revenue share. As of FY23, the business brought in a total of $2 billion in revenue, ~$260 million in EBITDA, and $82 million in earnings. Based on FY22 disclosure, around half of the $2 billion in revenue comes from the Home Center Retailers channel, 40% of it comes from builders, and the rest from independent dealers and distributors. AMWD offers a range of products that include both stock and semi-custom products from various brands. AMWD’s main public competitor is Fortune Brands Innovations (FBIN).

New residential construction to drive growth

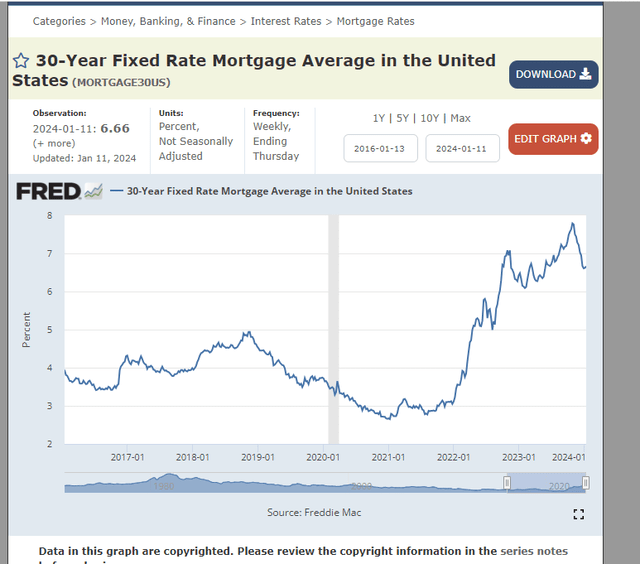

In the near term, I see a strong growth tailwind in the new residential construction space. As many might have already known, the Fed has raised the interest rate at an alarming rate over the past few quarters, from near 0% to 5+%. The consequential impact is that mortgage rates have increased significantly as well, from ~3% to as high as 8%.

FRED

While the common understanding is that high mortgage rates will cause house prices to fall, this has not been the case for the US, and there is a compelling reason as to why this is the case. Existing homeowners who purchased their homes when mortgage rates were much lower are not going to sell their homes. If they do so, they are on the hook to refinance their mortgage, which is a lot higher. Because of this, there is a severe lack of housing supply in the market today. Lack of housing supply does not mean there is a lack of demand; there is a base of home buyers (e.g., couples that got married) that still need to purchase their own home. Since there is a lack of resale flats, these buyers will naturally flock towards new homes.

I believe AMWD is well-positioned to capture this demand with its Timberlake brand, which is a direct-to-builder brand and is made to be affordable (the brand caters to lower-priced homes). Given the state of the macroenvironment, I expect housing to start to accelerate (it has accelerated in recent months) as builders accelerate construction activity to meet higher levels of demand, and this will directly benefit AMWD.

Yeah. It was more your latter comment around rotation to origin. So as you rotate Timberlake historical business to an origins platform that will be at a lower price point but a better margin profile for the enterprise.”from: 3Q2021 earnings call

Repair and remodel should remain weak

While new residential construction will support growth, the current macrodynamics should continue to pressure AMWD’s R&R sales. As fewer old flats are being sold, my expectation is that there is a lesser need for R&R. The recent performance is evident of this, as R&R sales declined by 15.6%, driven by a decline across all channels (home center down 18%, builder down 11%, and dealer down 20%). The fact that sales also softened sequentially suggests that the underlying economy remains weak. I expect these trends to continue for the foreseeable future until the mortgage rate starts to ease back, which is dependent on the fed’s cutting rates. In addition, the lack of visibility into how performance will be for the next few months should put the stock in rangebound.

I think every builder will tell you now is not the best time to ask as we go through the winter months, but as we get into the spring selling season, that’ll dictate how the back half of ’24 looks. from: 2Q2024 earnings call

Balance sheet and cash flow generation

One really good thing about AMWD is the way they manage their balance sheet. Management has historically taken a conservative approach, maintaining a net cash position through the depths of the GFC before adding leverage for its RSI acquisition. This conservative approach to its balance sheet and capital allocation has helped to yield strong free cash flow generation. In terms of leverage, RH is currently in a net debt position of around $280 million, slightly more than the 1x net debt to EBITDA ratio. The important fact is that AMWD has been strictly focused on paying down this debt since the peak of >4x EBITDA back in 2017/18 (RSI acquisition).

The conservative approach to handling its balance sheet is well complemented by AMWD’s ability to generate cash. For a business like AMWD, it has done extremely well in converting earnings to cash flow, often converting more than 100% of earnings to free cash flow. Out of the past 10 years, FCF has exceeded earnings in 7 years, and they are not driven by stock-based compensation, implying very effective management of capex and working capital. With its cash balance growing and management focusing on paying down debt, I believe this opens up opportunities for AMWD to conduct acquisitions again. If we assume that AMWD increases its leverage ratio back to 4x, the business could easily shore up another $700 million in cash.

Valuation and risk

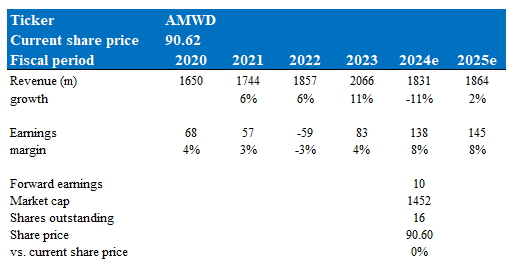

Author’s valuation model

According to my model, AMWD is valued at $90.60. This target price is based on my growth forecast of -11% in FY24 and 2% growth in FY25. My assumption for FY24 is that the R&R decline continues to outweigh the positive from new residential construction growth, which has been evident in 1H24 performance (1Q sales down 8.2% and 2Q2 sales down 15.6%). FY25 should see some form of recovery, or at least stabilization, as the Fed is already looking to cut rates, which means the economy must have moved in the intended direction. Margins, on the other hand, should stay at the current level as the improvements from operational improvements, easing of the supply chain, and reduced headcounts are structural. That said, the latter two are sort of one-off events; hence, I do not expect margins to see improvements again.

I think there is a mix of positives and negatives going on within AMWD. It has growth tailwinds from new residential construction and a strong balance sheet profile that provides flexibility for M&A, but is faced with headwinds from the R&R side and a lack of visibility for the next few months performance. I believe the market is paying more attention to the negative aspects of things; as such, valuation has been pressured at the low end of the AMWD historical trading range. Also, when compared to FBIN, which is expected to grow revenue in high single-digits and has a structurally higher margin profile, AMWD compares badly. Comparatively, AMWD should trade at a discount, and it does. FBIN trades at 18x forward PE, and AMWD trades at 10x forward PE. I expect this discount to last until there is visibility for the AMWD R&R segment to improve.

Summary

I recommend a hold rating for AMWD as I await clearer visibility into the turnaround timing for the R&R segment. The current macro-dynamics favoring new residential construction provide a growth tailwind, particularly with AMWD’s well-positioned Timberlake brand. However, the weakened R&R sales, reflective of the ongoing lack of resale housing. AMWD conservative management of its balance sheet and strong cash flow generation are commendable, providing flexibility for potential acquisitions.

Read the full article here