After my first article, I continue my studies about dividend companies. As I was navigating the internet, I came across a particular business working in an intriguing sector: Genuine Parts Company (NYSE:GPC), a company distributing automotive replacement parts and industrial components. Over the last five years, it was not able to compound its business and the management team mainly focused on acquisitions. The commitment to dividend payment, mixed with some uncertainties, led me to assign a “hold” rating for this corporation.

I will conduct a brief stock price analysis, a business overview and explore financial data. Finally, I will conclude with a valuation using the discounted cash flow model.

Stock Overview

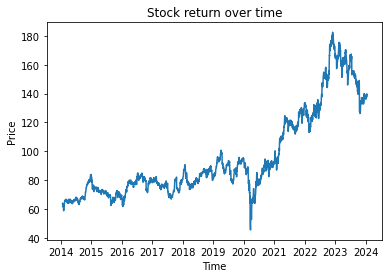

In the last decade, the stock performance was poor and significantly underperformed the main indexes. Since 2014 the stock return has been around 70% while in the same period S&P 500 grew almost 165%. The stock is down more than 25% from its recent high and investors are wondering whether it is the proper time to buy.

GPC stock return over the last 10 years (Author calculation)

The current market capitalization is $20.1 billion. This is the value that I will use to compare my valuation.

GPC Stock Analysis – Business Overview

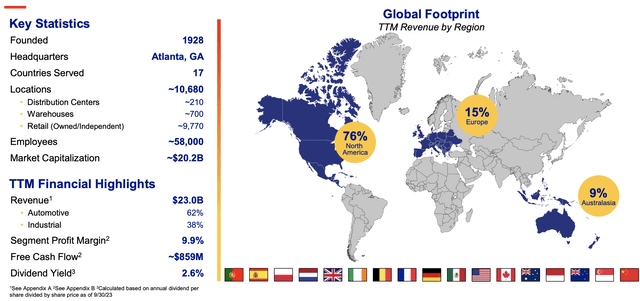

Today, Genuine Parts Company is a global service organization engaged in the distribution of automotive and industrial replacement parts with approximately 58,000 employees and over 10,000 operations in 17 countries across North America, Europe and Australasia.

While many investors categorize the company as part of the consumer cyclical sector, I hold a different perspective. In my opinion, replacement parts play a crucial role for both individuals and companies. For instance, in times of crisis, an individual experiencing a breakdown in their car would prioritize replacing the necessary parts. Similarly, for a company dealing with a malfunctioning piece of machinery, the immediate concern would be to repair it swiftly to restore production. This underscores the essential and non-discretionary nature of the company’s products, which may not strictly adhere to the typical cyclical patterns associated with consumer goods.

Company overview (Company’s presentation)

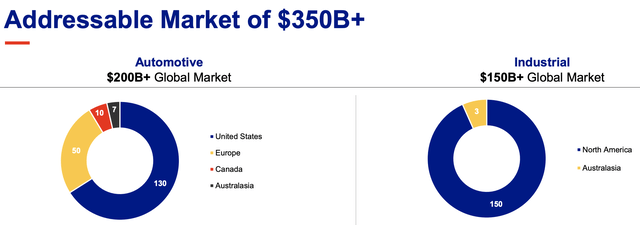

The company operates in a non-cyclical industry, which enables its management to concentrate on long-term goals and compound growth across economic cycles. The market in which the company operates is vast, however, with modest growth expectations of around 2%-3% per year, as depicted in the company’s last presentation. Although the growth rates of individual markets may appear modest, the overall non-cyclical nature of the business, coupled with the size of the market, still represents significant prospects for sustained and stable expansion in the foreseeable future.

The total addressable market for the company (Company’s presentation)

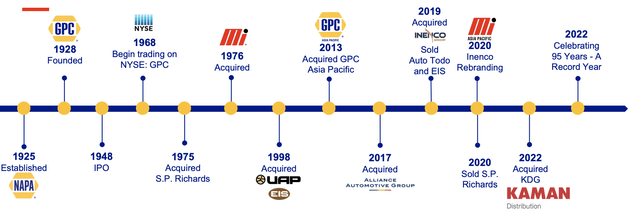

Upon analyzing the picture below, it is evident that the company has primarily focused on acquisitions instead of achieving organic growth over the past few years. While M&A deals typically lead to synergies, none have been highlighted by the corporation.

Company’s acquisition history (Company’s presentation)

For more information about Genuine Parts company strategy, sustainability and strategic focus, please check the Company’s investor relation presentation.

GPC Stock Analysis – Financials

It appears that despite the company having significant growth opportunities in a large market, the management team may be content with the current state of affairs and not actively pursuing strategies to enhance competitiveness. This could be a strategic choice, possibly driven by a focus on maximizing current profitability or a belief that the existing market position is secure.

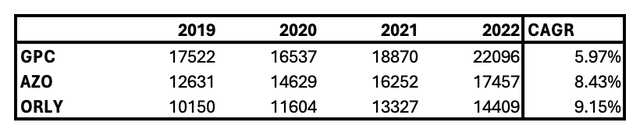

I researched its 2 main competitors to study their growth over the last 4 years. Our company grew at slightly less than 6% CAGR, AutoZone (AZO) grew at around 8.5% while O’Reilly Automotive (ORLY) grew at something more than 9%. Despite making two acquisitions between 2019 and 2022, our company is losing market shares to its competitors.

Revenue comparison (Author’s calculation)

I believe that a complacent approach to competitiveness can pose risks in the long term, and I would shift my opinion from hold to sell if I do not see any major changes in the next year.

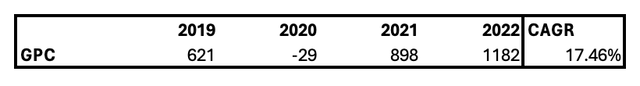

Fortunately, there is also some good news. The company, in the last 4 years had a good boost in net income that passed from $621 to $1182 million for an annual compound growth rate of 17%.

Net income evolution (Author’s calculation)

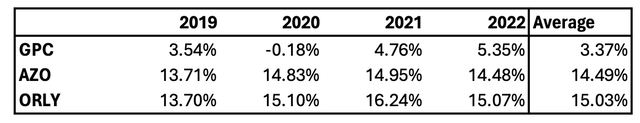

The company has been able to increase its net margin, but it still has lower margins compared to its peers. Over the last four years, GPC’s average margin was 3.37%, while its competitors maintained margins of around 15%. This significant difference is alarming and raises concerns about the potential loss of market share and an inability to generate profits comparable to its competitors. These issues weaken its future competitiveness.

It would be beneficial for the company to address these problems soon and provide a plan to shareholders on how it intends to increase revenue growth and net margins.

Net margin evolution (Author’s calculation)

Focusing on the balance sheet, the company’s current ratio is equal to 1.16, revealing that the company can pay its current liabilities using its current assets. However, by removing inventories from current assets, I obtain a concerning quick ratio of 0.39.

The company has $5 billion in long-term debt, which is too much considering $3.8 billion in equity and $4.4 billion in goodwill as a consequence of all the past acquisitions.

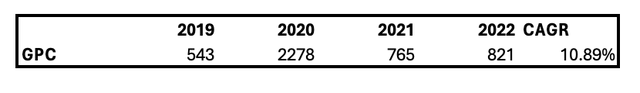

However, the company’s free cash flow has improved in the last 5 years and is likely to continue to grow also in the future. I expect the company to continue using the cash flow generated to pay down debt and reward shareholders.

Free cash flow evolution (Author’s calculation)

If the company has one or two bad years, it may have some difficulties and ultimately has to increase its debt or dilute shareholders. I expect the leaders to pay attention to debt in the future and tighten control over the net working capital, particularly by reducing the inventory level.

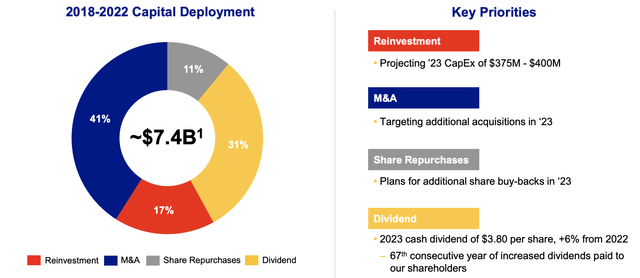

The capital allocation is mainly focused on M&A (41%) and rewarding shareholders (42%) while only the remaining 17% is reinvested in the business. I would like to see a reversal in this trend meaning that the company has confidence in its assets and this could lead to a more sustainable growth strategy.

Capital allocation (Company’s presentation)

GPC Stock Analysis – Valuation

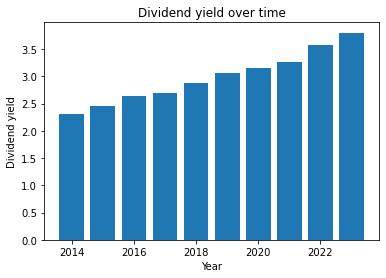

The company has earned the designation of a “dividend king” by consistently and continuously increasing dividends year after year. This track record reflects a commitment to providing a reliable and growing stream of income to its shareholders.

Dividends per share paid over last 10 years (Author calculation)

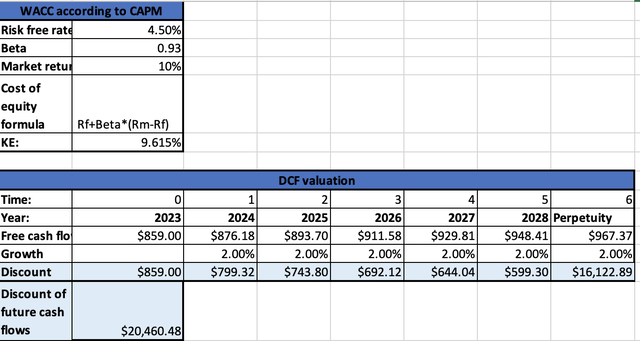

Since free cash flow is pretty stable for the company, I am going to evaluate it through a discounted cash flow model.

Considering a risk-free rate of 4.5% in the U.S., a company’s current beta of 0.93 and a market return of 10% I obtain a cost of equity of 9.615% which will be my discounting factor. Taking a moderate approach, I projected a constant 2% FCF growth in the future, similar to the expected growth of the industry, obtaining a fair value of $20.46 billion.

Company’s valuation (Author’s calculation)

GPC seems to be trading to its fair value right now. If the corporation does not have any major moat or excellent future perspectives, as in this case, I prefer to start buying it with a 15-20% discount from its fair value. In the meantime, considering dividend growth and its current dividend yield, I would not suggest actual shareholders to sell their shares. That is the reason why I assigned a “hold” rating to the stock.

GPC Stock Analysis – Conclusion

At first glance, the company attracted me for its good dividend yield of around 2.65%. After some deeper analysis, I noted that it is facing some challenges in keeping up with the same pace set by its main competitors. Moreover, the management team seems too focused on acquisitions rather than reinvesting in the business. Finally, the company is trading at its fair value and as a value investor, I would prefer to buy it with a significant discount to reduce the risks and increase my return.

Read the full article here