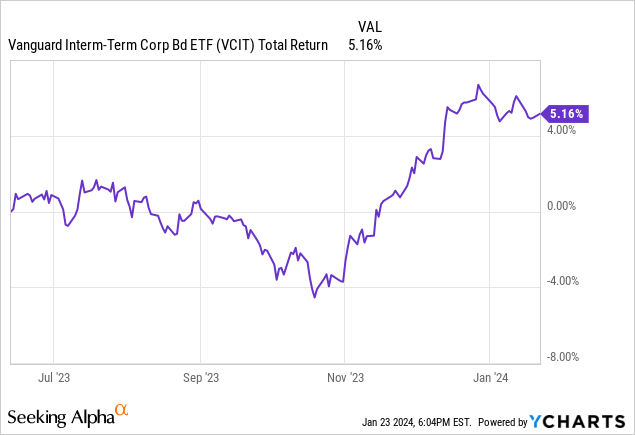

Back in June 2023, I covered Vanguard Intermediate-Term Corporate Bond Index Fund ETF Shares (NASDAQ:VCIT). I gave it a Buy rating because I expected both falling market interest rates and 2024 cuts to the Fed funds rate. I expected this because of a recession, but clearly, that hasn’t happened. Regardless, my underlying thesis of falling rates still materialized to an extent. Since my rating, VCIT has returned 5.16%.

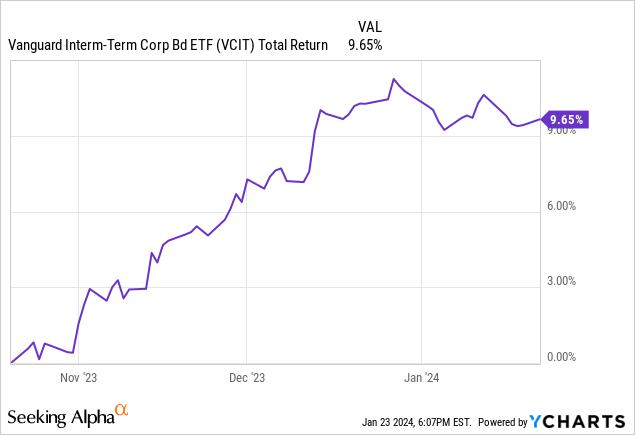

A 5.16% return is solid, but my rating came a little too soon. In late October, VCIT bottomed, and since then, VCIT (and almost the entire bond market) has taken off. Since late October, VCIT is up over 9.5%!

This brings up many questions. Was the rally overdone? Is the rally over? Is VCIT still a Buy? Before we answer these questions, let’s take a closer look at VCIT.

Holdings

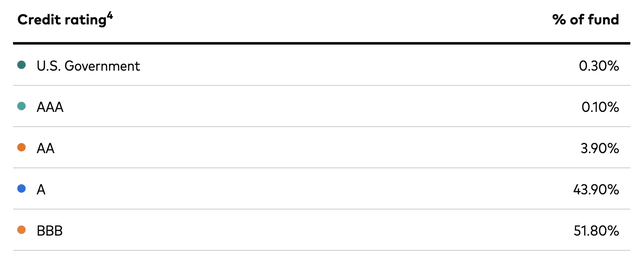

VCIT holds a total of 2,105 intermediate-term corporate bonds. The ETF’s average maturity is 7.3 years. Almost all of VCIT’s holdings are in either A bonds or BBB, making up about 44% and 52% of its AUM, respectively.

VCIT’s holdings by credit rating (vanguard.com)

While VCIT holds lower-level investment-grade bonds, they are still considered safe and have low default risk.

Yield

VCIT has an impressive yield. Currently, VCIT has a 30-day SEC yield of 5.09%. The yield is high because of a few factors. First, VCIT holds corporate bonds, which usually have a higher yield than treasuries because they have higher risk. Also, because VCIT has an intermediate-term average maturity, the yield is usually higher than shorter-term bond ETFs. However, until very recently, this wasn’t the case. Because of the inverted yield curve, there was a point where VCSH, Vanguard’s short-term corporate bond ETF, yielded more than VCIT. As of right now, the inversion has fixed itself and now VCIT yields slightly more than VCSH.

Was the rally overdone and is it over?

As I mentioned earlier, VCIT rallied over 9.5% in about 3 months. In my opinion, the rally was overdone. This doesn’t necessarily mean that VCIT will go down, but rather that it will likely be flat or at least its rise will slow for some time. One of the reasons I believe this is because the market seems to be overly optimistic about Fed rate cuts. The market is expecting that the Fed will start to cut interest rates in March. Economists at Goldman Sachs also expect this. I don’t think that we will see cuts this soon. I expect rate cuts in mid-2024, and I seem to be in good company. Reuters surveyed 123 economists and found that most of them don’t agree with the market and Goldman. Out of the 123 economists, “Nearly 45%, or 55 economists bet on a June start, while 31 said May. Only 16 saw a cut in March. The rest forecast the Fed would start cutting rates in response to cooling inflation only in the second half of the year.” Even if rates aren’t cut as soon as the market expects, they will almost certainly be cut in either Q2 or Q3, leading to capital appreciation for VCIT.

Is VCIT still a Buy?

I maintain my Buy rating for VCIT for a variety of reasons, the first of which is that we almost certainly know rate cuts are coming in 2024. If/when the Fed cuts short-term rates, the market will be told that a higher-for-longer scenario is unlikely, especially if these cuts come before H2. Some uncertainty on what is going to happen is priced into the market, so when we get confirmation that rates will be cut, bonds will appreciate.

VCIT returns come from two components, price and yield. I believe over the next 6-9 months, VCIT will have a healthy positive return. Over the next few months, VCIT’s momentum may slow, but it’s likely to continue to trend up. Once rate cuts start, VCIT momentum will pick up. While you wait for the capital appreciation to kick in, you receive a nice yield of over 5%.

Risks

The corporate bonds VCIT holds are investment grade, but that doesn’t mean that they are free from default risk. If rates are cut because we enter a severe recession, VCIT could still have a rough time. While usually rate cuts are associated with positive bond returns, if the recession is severe it could cut into corporate profits and cause some bond defaults. This would hurt VCIT. However, I don’t think this is a likely scenario. The general consensus is that there will not be a recession. Even the minority who predict a recession in the near future don’t expect it to be severe. While a severe recession is unlikely, it is still a threat to VCIT investors.

Reader takeaways

VCIT has performed well in the last 6 months and had a very strong last 3 months. While exactly when rate cuts will start is up for debate, it’s almost certain that rate cuts will come in 2024. Once this happens, VCIT will appreciate. While you wait, you can receive VCIT’s high yield of 5.09%. I rate VCIT a Buy.

Read the full article here