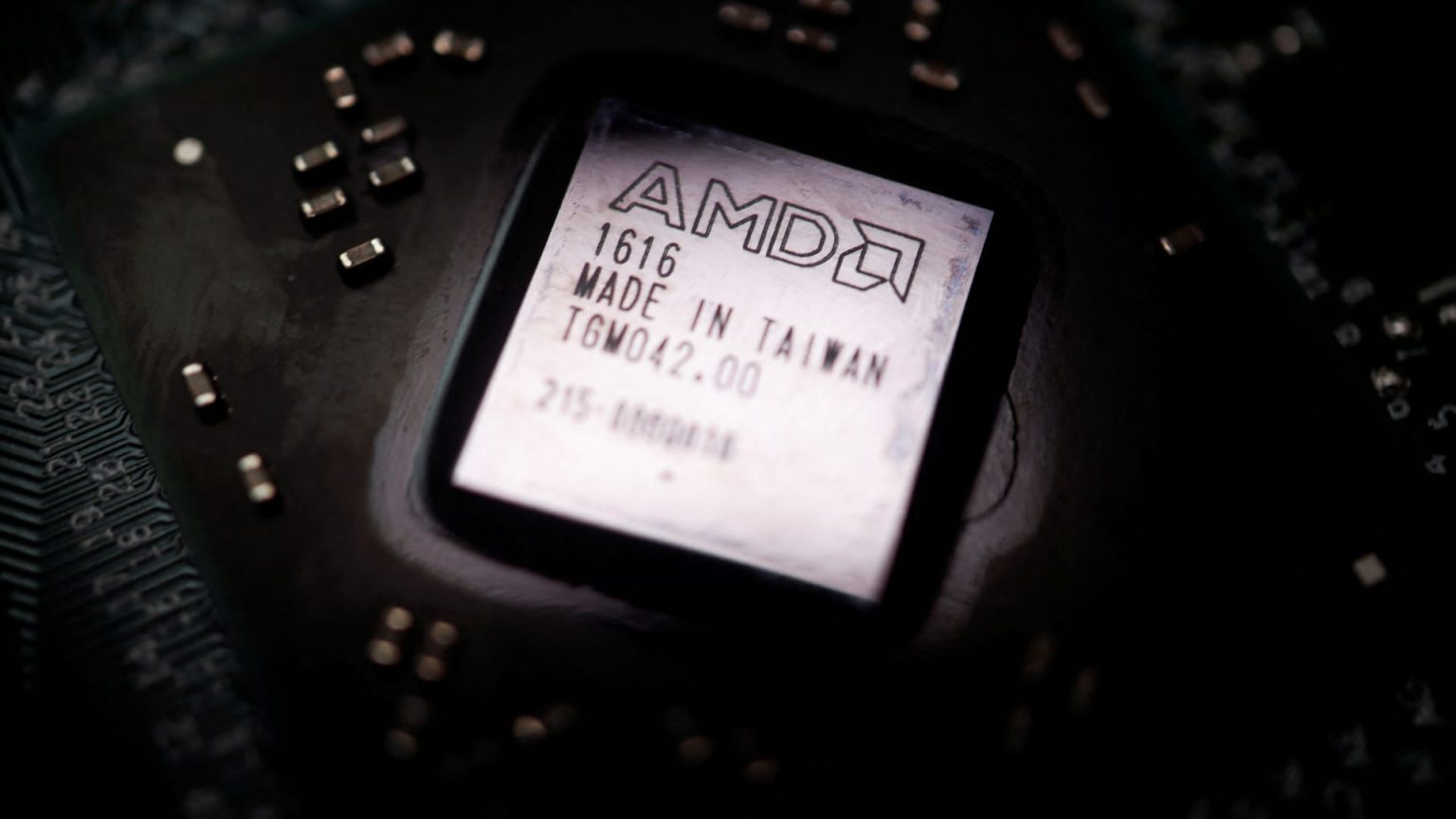

Check out the companies making headlines before the bell. Alphabet — Alphabet’s stock declined 5.2% after posting disappointing fourth-quarter advertising revenue . The Google parent topped Wall Street’s expectations on the top and bottom lines, but recorded advertising revenue of $65.52 billion. That fell short of the $65.94 billion expected by analysts polled by StreetAccount. Paramount Global — The media company’s stock surged more than 13% in premarket trading on news that billionaire entrepreneur Byron Allen submitted a $14.3 billion takeover offer . The deal values Paramount at about $30 billion, including debt and equity. Advanced Micro Devices — The semiconductor company’s shares slid 4.3% after posting fourth-quarter earnings Tuesday that came out in line with consensus expectations. AMD beat quarterly revenue estimates, but also gave a softer-than-expected first-quarter forecast. For the first quarter, the company said it expects roughly $5.4 billion in sales, plus or minus $300 million, while analysts had forecasted a revenue of $5.73 billion. Microsoft — Shares edged lower by 0.2% after the tech giant beat on top and bottom lines for its fiscal second quarter, but issued a lighter-than-expected third-quarter revenue outlook. The stock had slipped as much as 2% in extended trading immediately after the results were released. Boeing — The airline stock gained 1.3% after Boeing narrowed its losses at the end of last year, reporting an adjusted loss per share of 47 cents, compared to analysts’ consensus expectations of 78 cents. Revenue of $22.02 billion beat analysts’ forecast of $21.1 billion, per LSEG. Boeing’s CEO said now is “not the time” for financial targets as the company deals with fallout from its fuselage panel blowout incident earlier this month. Starbucks – Shares of the coffee chain were higher in premarket trading even after a disappointing financial update for its fiscal first quarter. Starbucks posted earnings per share of 90 cents, falling below analysts’ expectations by 3 cents, according to LSEG. Revenue slightly missed estimates too, coming it at $9.43 billion versus the $9.59 billion expected. The stock initially fell in extended trading Tuesday but has since recovered and is now higher by 4.7%. Tesla — Shares of the electric vehicle maker fell 2.9% after a Delaware judge on Tuesday rejected Tesla CEO Elon Musk ‘s $56 billion pay package, saying that the company’s board of directors failed to prove “that the compensation plan was fair. Mondelez International — Shares of the snack maker dropped 4.4% after the company reported a slowdown in growth for the fourth quarter and said it expects muted growth in comparable sales for 2024. Mondelez did post a beat on fourth-quarter adjusted earnings per share and in-line revenue, however. SoFi Technologies — The digital banking stock lost 3.1% on the heels of a Morgan Stanley downgrade to underweight from equal weight. Morgan Stanley pointed to revenue headwinds and execution risks that can hamper profitability goals. Manhattan Associates — The supply chain software provider surged 11% premarket after fourth quarter earnings and revenue topped analysts’ highest estimates, and issued first quarter financial guidance that also surpassed expectations. — CNBC’s Tanaya Macheel, Alex Harring, Samantha Subin, Yun Li and Scott Schnipper contributed reporting.

Read the full article here