While currently there’s a lot of pessimism surrounding The Boeing Company (NYSE:BA), there are reasons to believe that we’re not going to see a repeat of the 2019 scenario that brought the company to its knees. That’s why I believe that the latest depreciation of the company’s shares has created an opportunity to acquire the company for cheap since the growth opportunities are likely going to outweigh the risks in the long run.

Is The Crisis Overblown?

Back in November, I called Boeing the potential recovery trade of the decade. The company was in the final stages of recovering from the 737 Max crisis that began in 2019 and resulted in the destruction of billions of dollars in shareholder value. After that article was published, the stock appreciated by over 20% in a matter of weeks until the moment another crisis emerged and led to the evaporation of all those profits. At the time of this writing, Boeing’s total return since the publication of that article is ~0%.

It’s not hard to figure out why that’s the case if you have been following the news in recent weeks. At first, the company’s 737 Max plane which was operated by Alaska Air (ALK) suffered a midair emergency, which prompted the FAA to ground all of the 737 Max 9 planes until further notice. After that, Boeing’s jets suffered a collision at Chicago’s O’Hare International Airport, the 737 plane of the Secretary of State had a critical failure in Davos, and the 747 cargo plane of Atlas Air (AAWW) caught fire midair. All of those events in such a short period were mostly responsible for the depreciation of Boeing’s shares that we’ve witnessed in the last couple of weeks.

However, despite all of those developments, it’s safe to assume that Boeing will avoid a 2019 scenario that brought the company to its knees. First of all, similar models of planes from the Max series have been in operation for almost a decade and have not suffered an incident similar to the one that Alaska Air had, which indicates that Boeing is not facing a systemic problem that could’ve taken years to be fixed. At the same time, in recent days, the FAA allowed the 737 Max 9 jets to return to the skies, which prompted major airlines along with Alaska Air to resume flying its latest Boeing planes.

What’s more is that after a five-year hiatus, the Chinese airlines resumed all operations of 737 Max jets in late December, while last Thursday Boeing received formal approval from the Chinese regulator to resume the deliveries of its latest planes to the country. Even though China is scaling the production of its own narrow-body jet, the reality is that the air travel market is recovering, and China already needs new jets in numbers to expand its passenger capacity. That’s why China alone is expected to account for 19% of global plane deliveries this year.

On top of all of that, Boeing has been actively expanding in other markets to minimize its domestic risks. Earlier this month, it received another major order from India for 150 Max jets, and we could potentially see the signing of new orders next month when the Singapore air show kicks in since the passenger traffic is now close to the pre-pandemic levels.

Considering all of this, I remain optimistic about Boeing’s ability to execute a proper recovery even though it faced a major setback this month. If we take a look at the latest Q4 earnings report that was released earlier today, we’ll see that the company’s revenues increased by 10.2% Y/Y to $22.02 billion and beat the street consensus by $940 million. At the same time, the non-GAAP EPS of -$0.47 was above the consensus by $0.32, as the company is finally executing a proper turnaround that could help the business recover from the 2019 Max crisis in the following years.

What’s more is that at the end of Q4, the company had a backlog that’s worth $520 billion and includes over 5600 commercial planes, an increase from over 5100 jets at the end of Q3. Such an increase in backlog indicates that the demand is there and there is every reason to believe that Boeing would be able to scale its production and grow over the coming years.

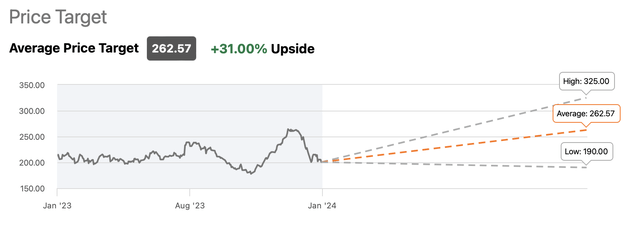

In addition to that, it appears that after the latest depreciation of Boeing’s shares, the company once again appears to be undervalued. My DCF model from September showed that Boeing’s fair value is $231.05 per share, while the consensus on the street is that the company’s intrinsic value is much higher and its shares represent an upside of nearly 30% at the current price. Therefore, I remain optimistic about Boeing’s future.

Boeing’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

It makes sense to believe that the temporary grounding of Boeing 737 Max 9 planes this month certainly is going to have some impact on the company’s future performance. We already saw major banks like Barclays (BCS) and Bank of America (BAC) reduce their outlook for the company with the latter calling the current situation not tenable for Boeing. However, it seems that that comment was made before the jets were given the green light to resume their operations, so in the end the blowback could be minimal given the positive developments of recent days. While Boeing decided not to provide a forecast for 2024, the quick return to operations of 737 Max 9 planes along with the rising demand for its jets could mitigate all the grounding-related downside over time.

Considering this, I believe that the only major long-term risk that could undermine Boeing’s recovery is the rising competition. On the one hand, we have the European Airbus (OTCPK:EADSY), which in 2023 managed to deliver a total of 720 planes against Boeing’s 528 planes, and is likely going to expand its lead in 2024 due to the recovering air travel market.

At the same time, China is also aiming to become more self-reliant and is planning to expand the market share of its homemade C919 jet on the mainland and beyond. The C919 is already operated on domestic routes, while Chinese regulators are in close contact with the Europeans to receive the certification for their homemade jet to operate on the old continent. On top of that, China recently completed the construction of the biggest civil wind tunnel complex to ensure that it’s able to break the Boeing-Airbus duopoly. Given how Boeing is constantly entangled in crises of different degrees, the rising competition could prompt the airlines to more actively look for alternatives over time.

The Bottom Line

Even though some might think that Boeing’s luck appears to be running out, there are reasons to believe that the worst for the company is behind it. Despite the latest safety incidents, it’s more than likely that a 2019 scenario is going to be avoided while the growing backlog along with the rising air travel demand will be able to mitigate the damages caused by the temporary grounding of 737 Max 9 planes over time. Therefore, I believe that Boeing is a solid buy with a decent upside at the current distressed price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here