Wealth – the difference between what people own and what they owe – serves as a financial buffer in an emergency and as a means towards upward economic mobility. People can use their wealth to buy a new house, move if better job opportunities open up elsewhere and support their families’ education, among other things. Yet, wealth is highly unequally distributed, especially by race and ethnicity and those gaps show no sign of abating. This leaves Black and Latino/Hispanic households in particular financially more vulnerable and with fewer opportunities for upward economic mobility.

The Federal Reserve’s Distributional Financial Accounts show, among other things, total wealth by race and ethnicity – for Black, Latino and white households. This data set also includes quarterly estimates of the number of households in each racialized population category. The data then allow for the calculation of the average per-household wealth for Black, Latino/Hispanic and white households on a quarterly basis from 1989 to 2023.

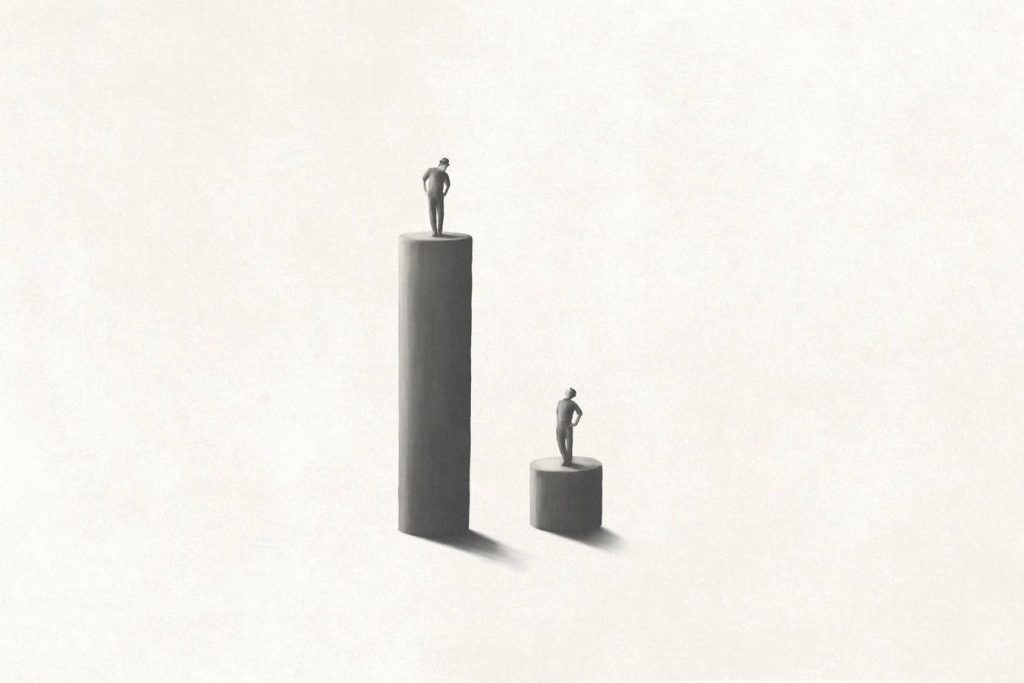

Racial Wealth Gaps Have Stayed High In Strong Economy

The wealth differences between Black and Latino/Hispanic households, on the one side, and white households, on the other side, stayed large through 2023. Black households typically have less than one-fourth of the average wealth of white households. By September 2023, the latest quarter, for which data are available, Black households owned 23.5% of the wealth of white households. The average wealth of Latino households was less than one-fifth – 19.2% — of that of white households (see Figure below). Black and Latino households thus face greater risks and less economic mobility than is the case for white households.

Average wealth heavily skews towards wealthier households. Median wealth – which evenly divides groups by wealth – better reflects the typical household’s wealth in each group. Data from the Federal Reserve’s triennial Survey of Consumer Finances shows that Black and Latino households also have much lower median wealth than was the case for white households in 2022, the last year, for which these data are available. For instance, the median wealth of African Americans amounted to $44,900 or 15.8% of the median wealth of white households ($285,000) in 2022. In comparison, the median Latino/Hispanic household owned $61,600 in 2022, or 21.6 percent of the median wealth of white households. By either measure – average or median wealth – Black and Latino/Hispanic households face greater economic risks or fewer economic opportunities than is the case for white households.

Importantly, the gaps in household wealth by race and ethnicity show few signs of diminishing. Average wealth grew substantially for all groups during and after the pandemic. But, the wealth gaps by race and ethnicity stayed fairly constant. The average wealth of Black households amounted to 23.7% of the average wealth of white households in December 2019, before the pandemic and its financial market disruptions started (see Figures below and above). The average wealth of Latino households equaled 18.6% of the average white household’s wealth then. At least the racial and ethnic wealth gaps did not worsen, as they did during and after the Great Recession (see Figures below and above), and as they have been since 1989.

Black and Latino Households Have A Lot Fewer Emergency Savings

Less wealth means fewer financial protections during an emergency such as a family member getting sick, someone getting laid off or a car needing repairs, among other events. Black and Latino households had on average much fewer liquid savings on average than was the case for white households. In September 2023, the average Black household owned $24,288 in checking accounts, money market mutual funds and other liquid savings. This was 14.5% of the average amount of liquid savings of $167,234 for white households at the same time. The total liquid savings of Latino households stood at $25,299 or 15.1% of what white households owned (see Figure below). Median liquid savings were much lower one year earlier in 2022, as data from the Survey of Consumer Finances shows. The median amount was $2,010 for Black households, $2,000 for Latino households and $12,000 for white households. Black and Latino households regularly have to face economic emergency with smaller financial protections than is the case for white households.

Households, especially Black and Latino households, needed to dip into their savings repeatedly when inflation increased in late 2021 and early 2022. Many households had built up savings thanks to stimulus payments – officially known as Economic Impact Payments – and other benefits such as expanded Child Tax Credits (see Figure below). But, by September 2023, those extra savings were largely gone, in part to cover higher costs and in part to buy a house amid rising prices. Black households on average had $6,556 dollars less in liquid savings in September 2023 than in December 2019. In comparison, Latino households had roughly the same amount then as they did before the pandemic started, while white households had 13.4% more – or $19,768 (see Figure below). Black and Latino households are regularly in a much worse position to weather a financial emergency than is the case for white households.

Part of the decline in liquid savings likely came from some households using those savings as down payments for a house amid rising real estate prices. The homeownership rates of all racial and ethnic groups grew during the pandemic. By the third quarter of 2023, 45.5% of Black households and 49.4% of Latino/Hispanic households owned their own house, while this was the case for 74.5% of white households. These numbers show more widespread homeownership than in 2019, when 44.0% of Black households, 48.1% of Latino/Hispanic households and 73.7% of white households owned their own home. But, considering the trend in liquid savings, especially Black and Latino/Hispanic homeowners face increasingly more risks than white households do.

Household wealth has increased for all population groups during the pandemic. Preexisting wealth gaps by race and ethnicity largely stayed in place during that time. While some households gained access to homeownership during that time, that upward mobility may have come with greater short-term financial risks. In other words, Black and Latino/Hispanic households more often than white households had to choose between a short-term financial safety blanket and longer-term economic mobility and stability.

Read the full article here