Introduction

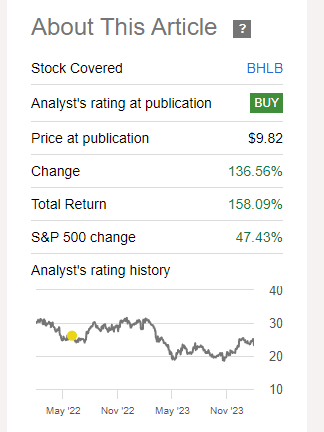

I first discussed Berkshire Hills Bancorp, Inc. (NYSE:BHLB) in August 2020 when the bank was still dealing with the fallout from the COVID pandemic. The total return since making that call is approximately 158%, outperforming the S&P 500 by in excess of 100% in the same period.

Seeking Alpha

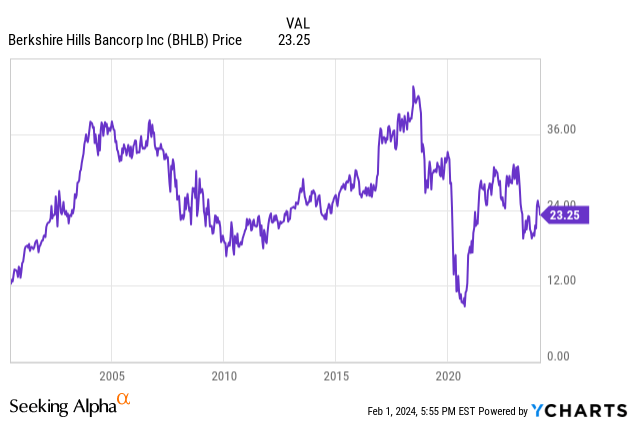

I moved to a ‘hold’ rating in June 2022 and the share price indeed moved sidewards since. After exceeding $30/share before the implosion of Silicon Valley Bank, the stock dipped below $20 before recovering some lost ground and is now trading at approximately $23/share.

I’m not worried about the Q4 loss

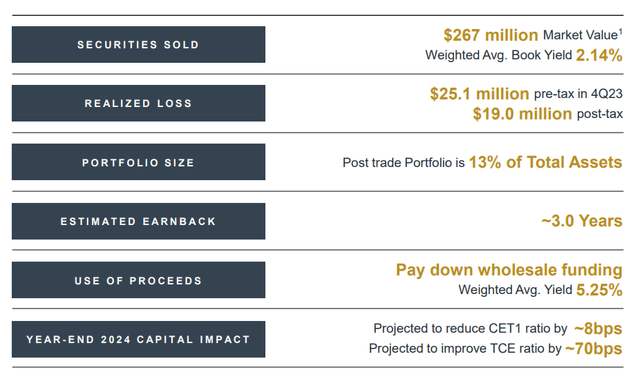

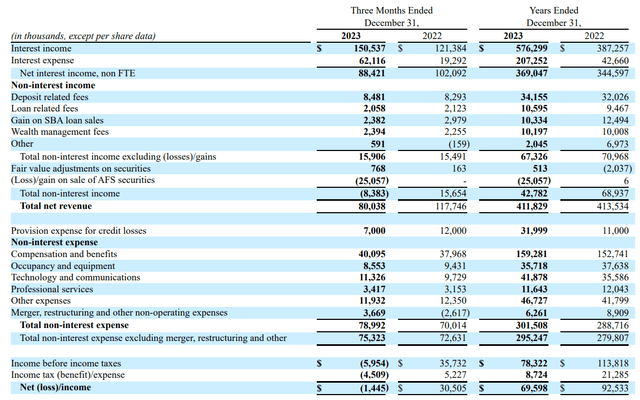

While the headline result for the fourth quarter of 2023 is a big surprise, there is a relatively straightforward explanation. As the income statement below shows, the bank recorded a $25M loss on the sale of securities available for sale. The bank decided to sell in excess of a quarter of a billion in securities AFS and the proceeds from selling these lower-yielding securities were used to reduce borrowings by a similar amount. This should boost the net interest income and net interest margin and the bank’s management has indicated an improvement of approximately $7M per year for a payback period of approximately three years.

BHLB Investor Relations

While I’m not trying to downplay the Q4 loss, it is an unfortunate and non-recurring event. While we definitely can’t deny the bank’s net interest income has been under pressure, BHLB remains quite profitable. As you can see below, the net interest income came in at $88.4M and while that is almost 15% lower than in the same quarter in 2022, the situation should improve in 2024 as the bank is guiding for a net interest income of $362-364M which works out to just over $90M per quarter, a slight improvement over the Q4 2023 run rate.

BHLB Investor Relations

Berkshire Hills Bancorp also reported a non-interest income of almost $16M offset by approximately $79M in non-interest expenses. This results in a total net non-interest expense of approximately $63M excluding the impact of the $25.1M writedown. The bank’s pre-tax loss of $6M is somewhat surprising but keep in mind this would have been a pre-tax gain of approximately $19M if it wasn’t for the write-down of the securities available for sale. Additionally, the bank recorded a $7M loan loss provision during the quarter as well. On a normalized basis (including the weak net interest income and including the $7M loan loss provision), the net profit would likely have been closer to $14M or $0.33/share.

That still isn’t great for a stock trading north of $20/share and even if you’d look at the FY 2023 results, BHLB isn’t terribly cheap. The bank reported a total net profit of $69.6M which works out to $1.61 per share, but this still includes the $25.1M loss on the sale of securities available for sale. Excluding this, the EPS would likely have exceeded $2.10/share.

The image below shows the guidance for 2024. As you can see, the bank is guiding for a net interest income of $362-364M. Let’s use the mid-point here and assume $363M as net interest income.

BHLB Investor Relations

The bank also disclosed it expects a non-interest income of $76-78M while the total expenses will come in around $295M. This means the total pre-tax and pre-provision income will be approximately $140M. BHLB anticipates allocating $33-36M to its loan loss provisions resulting in a pre-tax income of approximately $105M and a net profit of $83M based on an average tax rate of 21% (which is the midpoint of the 20-22% guidance).

Based on the current share count of 43.5M shares, this implies an EPS of $1.91, indicating the bank is currently trading at 11-12 times earnings. However, Berkshire Hills will likely spend about $40M on share repurchases and this should reduce the share count to approximately 42 million shares (assuming there will be some dilution as well). That would boost the EPS to $1.98.

Investment thesis

The stock is currently trading at a small premium to its tangible book value which was $22.82 at the end of last year. Ideally, BHLB will be able to buy back stock below its TBV which would obviously be value-enhancing, but the anticipated earnings retention will help as well. The bank is currently paying a dividend of $0.18 per share per quarter which costs approximately $31M per year. Assuming $40M will be spent on share buybacks, about $12M would be retained on the balance sheet as equity. Taking all these elements into consideration (including an anticipated decrease of the share count to 42 million shares), the TBV could increase to $24 by the end of this year.

And that makes BHLB somewhat attractive. While the earnings multiple isn’t very impressive, one could expect this to improve going forward as the bank deals with the rate cycle. The exposure to offices is manageable ($493M with an average LTV ratio of 59%) but the market will likely keep an eye on the office and CRE exposure.

I’m on the sidelines right now. The bank is well-managed and the plans to buy back stock could prove to be a good allocation of capital. But I’d like to see how the bank’s earnings evolve over the next few quarters.

Read the full article here