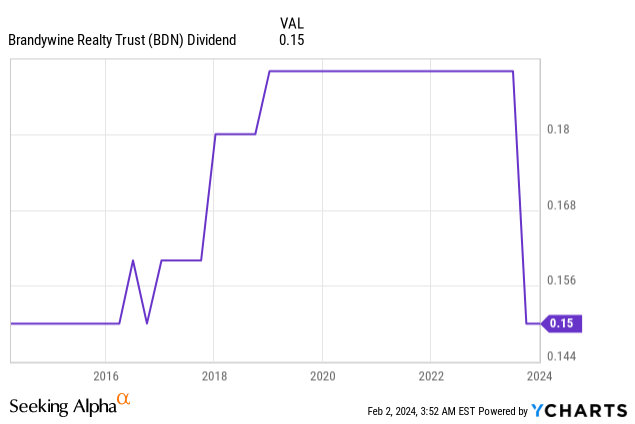

Brandywine Realty’s (NYSE:BDN) 21% dividend cut in September last year brought the office property owner in line with peers across a space that has become the poster boy for the casualties experienced since the Fed embarked on a multi-year fight with inflation. Peers like Hudson Pacific Properties (HPP) and Office Properties Income (OPI) have essentially suspended their payouts entirely with the sector now facing an amalgamation of headwinds. Higher base interest rates have rendered debt expensive and meant a tapering of FFO as rising office vacancies from the new post-pandemic work zeitgeist add further pressure. The REIT last paid a quarterly cash dividend of $0.15 per share, unchanged sequentially and $0.60 annualized for what’s currently a 13.6% dividend yield. This is down from a peak of 21% in the summer of 2023 but still far above its historical average.

Critically, whether or not to buy BDN should be based on the future safety of a quarterly distribution now at levels last seen in 2016. The internally managed office REIT is currently swapping hands for 4.07x its annualized FFO from its most recent quarter, an incredibly cheap multiple that reflects continued market angst around the direction of the most troubled part of commercial real estate. To be clear, it would take an acquirer roughly four years for their initial investment in BDN to be repaid. Office property anxiety is only set to ramp up on upcoming debt maturities this year.

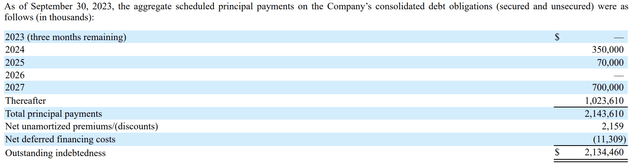

Brandywine Realty Trust Fiscal 2023 Third Quarter Form 10-Q

BDN has a roughly $2.13 billion total debt balance with roughly $350 million of this coming up for repayment in 2024. Overall, BDN has a very well-staggered debt maturity profile that is set against cash and cash equivalents of $58.3 million as of the end of its most recently reported fiscal 2023 fourth quarter.

FFO Coverage And Vacancies

BDN’s fourth-quarter FFO came in at $0.27 per share, down 5 cents from $0.32 in the year-ago quarter. This came against an operating property portfolio that was 88% occupied and 89.6% leased at the end of the quarter, both of these dipped from 89.8% occupancy and a 91% lease rate in the year-ago period. BDN is currently confidently covering its dividend by 180%, a high coverage ratio that matches with the prior coverage before the cut. Hence, the actual coverage figure is not important as office REITs continue their fight against the Fed and the structural shift in office work to a hybrid format. US national office vacancy rose to 19.6% in the fourth quarter of 2023, its highest-ever level and up from the average pre-pandemic office vacancy rate of 16.8%.

BDN could choose to suspend the dividend or further reduce the payout to focus on debt repayments. For example, peer office REIT Vornado Realty (VNO) is not paying a 2024 dividend until the end of the year to focus on debt repayments. Whilst BDN has a favorable debt maturity profile, the REIT is facing at least $300 million of debt repayments this year net of its cash position. BDN’s $600 million unsecured revolving credit facility, which had no borrowing as of the end of the fourth quarter, will suffice to address this. Around 96% of BDN’s debt is also fixed. That BDN will not be forced to lean on asset sales to address its debt should provide leeway for the continued payout of the dividend at its current level. Hence, I think the current double-digit yield will be maintained, a prospect further bolstered by what looks set to be the first interest rate cut at the 1 May 2024 FOMC meeting. The US economy also remains strong despite expectations of a recession and a soft landing should form a tailwind for the besieged property owner.

Leasing Momentum And Fighting The Fed

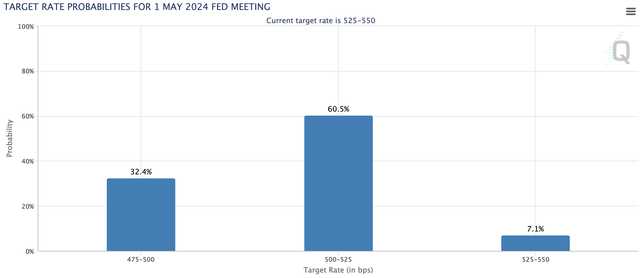

CME FedWatch Tool

A reduction of base interest rates forms one of the most potent near-term upward catalysts for BDN’s multiple. Initial market expectations of a March rate cut going into the year have since been pared back following the January FOMC meeting but there is currently a 60% probability that the Fed funds rate will be cut by 25 basis points from its current level of 5.25% to 5.50% in the May meeting. BDN’s leasing momentum has also been encouraging with 240,000 square feet of new and renewal leases signed during the fourth quarter, the figure for the full year was 1,517,000 square feet. Critically, the REIT also pushed through a 7.5% rental rate growth on a cash basis.

Whilst a recession could spark further downside, a floor seems to have been set in terms of valuation. BDN does face further risk as leases come up for renewal in an increasingly brutal US office property market but no material debt maturity until 2027 has set the REIT up to better navigate the continued commercial real estate minefield. I don’t have a position here though but I’d consider the dividend safe for a while.

Read the full article here