Introduction

Atrium Mortgage (TSX:AI:CA) (OTCPK:AMIVF) is a Canadian mortgage investment corporation focusing on loans that traditional banks wouldn’t underwrite, but offer acceptable financial risk and underwriting risks to the company. According to the most recent annual information form, the size of the mortgages usually varies between C$0.3M to C$30M with the largest single mortgage in its portfolio accounting for C$45M at the end of 2022 (the company still has to file its full-year 2023 results and reports).

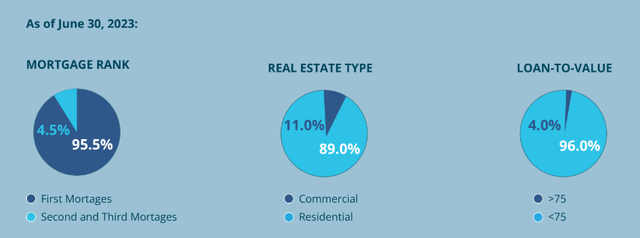

Atrium Investor Relations

The majority of the loan book consists of first mortgages, while the MIC focuses on residential real estate. As the housing market in Canada has been strong for a while, residential buildings will likely remain in high demand despite the current high-interest rates on the financial markets. The image above shows 96% of the loans have an LTV ratio of less than 75%. A 75% LTV ratio still is pretty high, but Atrium reassured its investors at the end of Q3 2023 by confirming the average LTV ratio across the portfolio is 61% which I think is a very manageable ratio.

The financial results so far – expect a record special dividend

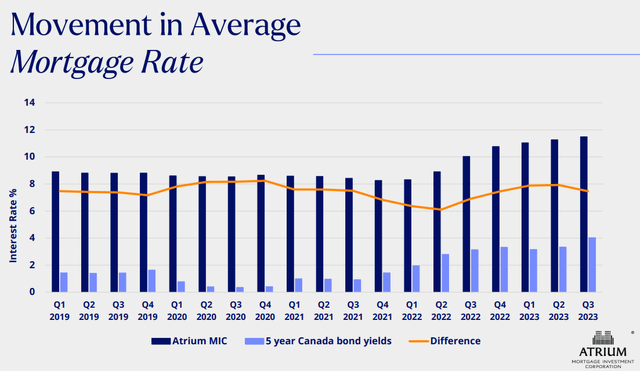

Atrium is benefiting from increasing interest rates: the size of its loan book has remained pretty stable; the weighted average interest rate on the mortgages exceeds 11% while the company’s cost of debt is just under 7.5% on its credit facility. Its total mortgage interest and fee-related revenue increased to C$25.2M.

Atrium Investor Relations

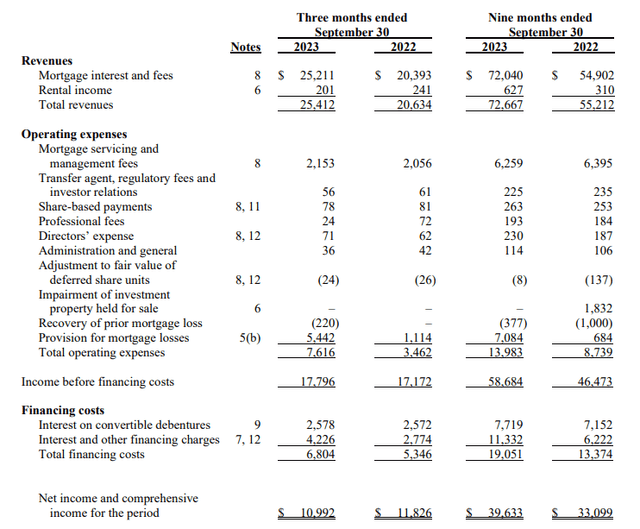

The operating expenses remained relatively flat and the total operating expenses of C$7.6M included a total loan loss provision of C$5.4M. As you can see below, that resulted in a net operating income of C$17.8M and after deducting the C$6.8M in interest payments on its own debt, the net income was C$11M or C$0.25 per share.

Atrium Investor Relations

That’s a very robust result, especially considering the MIC has been building up its loan loss provisions. Looking at the first nine months of 2023, Atrium reported a net income of C$39.6M or C$0.91 per share, and that included approximately C$7.1M in loan loss provisions.

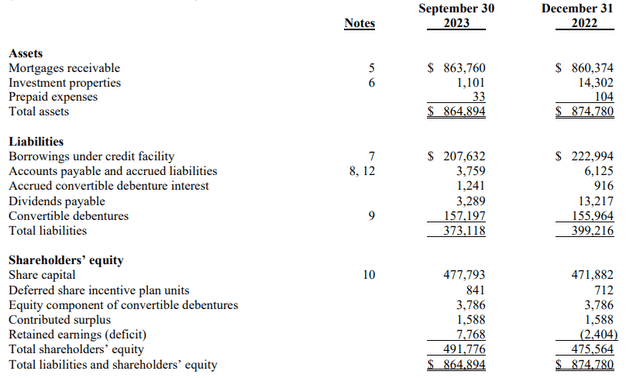

Looking at the balance sheet, Atrium held approximately C$864M in mortgages and this was financed with just under C$210M of bank debt, while the corporation also has convertible debentures as part of its funding mix.

Atrium Investor Relations

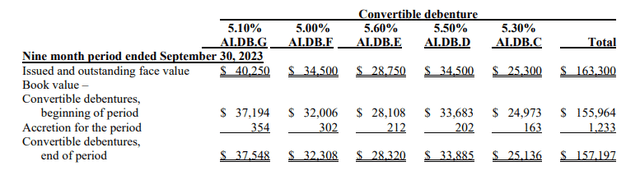

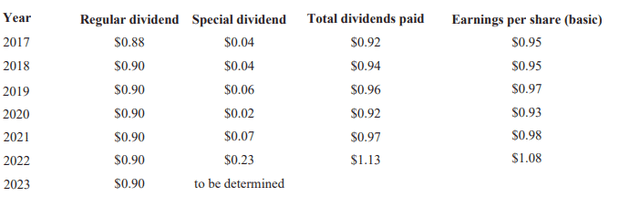

The total face value of the convertible debentures is C$163.3M

Atrium Investor Relations

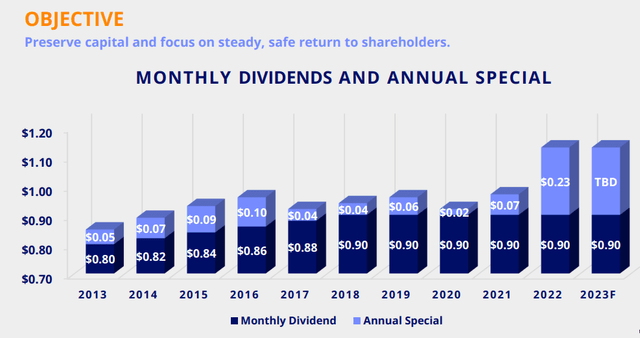

The company continues to pay an attractive dividend with a base dividend of C$0.90 per year (payable in twelve monthly installments of C$0.075) and in order to comply with the mortgage investment corporation rules, there usually also is a special dividend at the end of the year.

At the end of September, Atrium had a total of C$365M in bank debt and convertible debentures outstanding, resulting in an LTV ratio of approximately 42%. The equity value at the end of Q3 2023 was C$491.8M and divided over the current share count of 43.9M shares, this represents a book value of C$11.20 which means the stock is currently trading at book value.

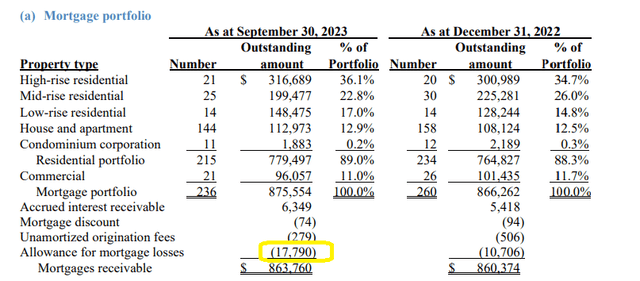

As the mortgages underwritten by the company have an average LTV ratio of 61%, it’s perhaps surprising to see Atrium building up its loan loss provisions. As you can see below, the total amount of provisions booked against the loan book is almost C$18M, or in excess of 2% of the total loan book.

Atrium Investor Relations

The mortgage portfolio has a pretty short duration: the average duration was just 10.5 months, and about a quarter of its mortgages were due in the final quarter of 2023 while about 45% of the loan book will have to be refinanced this year. That will be the real litmus test here to see how easily the borrowers can refinance their debt.

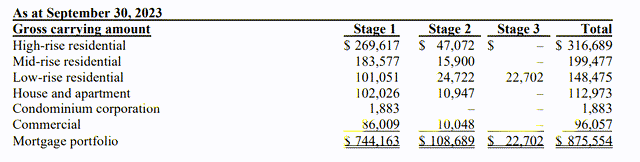

At the end of September, the company classified C$22.7M of its loan book as a stage 3 asset, while approximately C$109M of the loan book was a stage 2 asset. The total allocated provision for the assets in stage 3 was C$4.4M, representing approximately 20% of the loan value.

Atrium Investor Relations

On the conference call, Atrium’s management elaborated on the stage 2 and stage 3 loans and seems to expect full repayment or the realization of collateral on most of them. The C$47.1M loan in the high-rise residential segment in stage 2, for instance, is secured against a 4.5 acre site appraised at C$83M. Even if that valuation has come off by 30-40%, Atrium should still be able to recoup its entire investment. The management also provided additional color on some other loans (the emphasis is mine):

The remaining four loans are located in Greater Vancouver and only recently went into default, in fact, in November 1. The loans totaled $34 million and they are connected to a single sponsor. As a result of ongoing legal proceedings, I am unable to speak in much detail about the loans, but I will tell you what I can. The loans range in size from $3.6 million to $12.7 million and are secured by low rise development sites, mostly townhouse sites in Langley, Richmond and White Rock, all suburbs of Vancouver. One is the construction loan and the other three are bridge loans. We are still gathering information at this early stage.

Defaults in the single-family mortgage portfolio totaled $9.9 million, up just slightly from last quarter. These loans have loan to values ranging from 56% to 87%. As such, we don’t think there is much if any loss exposure on the single family mortgage portfolios.

Atrium Investor Relations

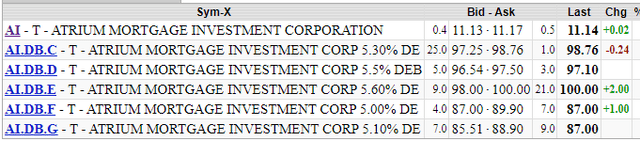

During FY 2022 the total dividend distribution was C$1.13 per share, while the special dividend for FY 2023 will be announced next week. Considering Atrium already reported total earnings of C$0.91 per share in the first nine months of 2023, shareholders can likely expect another substantial double-digit special dividend as Atrium’s management mentioned it is ‘ on track for the largest special dividend’ in its history. That would make sense, as there is no reason to assume the Q4 earnings result will be substantially lower than the C$0.25 reported in the third quarter. It is not easy to guesstimate the Q4 earnings as those could be heavily impacted by additional loan loss provisions, but given management’s confidence level on the Q3 call, I’m not expecting any massive issues or problems to pop up. A Q4 result in line with, or even slightly better than Q3 appears likely.

Atrium Investor Relations

I don’t own the stock, but the debentures

I understand loan loss provisions may make investors nervous and as the real estate market may remain soft for the next few quarters, the convertible debentures may offer an interesting alternative. As you can see below, the conversion prices are substantially higher than the current share price, so we should just consider the debentures to be straight cash debt securities; I think it is unlikely any of them will end up in the money.

Atrium Investor Relations

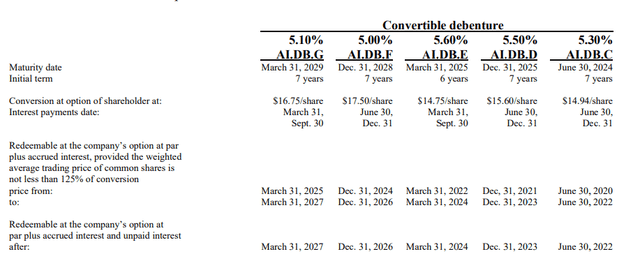

The Series C convertible debenture matures in less than 5 months from now and trades at just 98.76 cents on the dollar, which could be a good way to park some cash as the total absolute return would be around 3.5% in the next five months. I also like the Series D debenture, which is currently available for 97.5 cents on the dollar. With a 5.5% coupon and a maturity date at the end of next year, the yield to maturity is approximately 6.75%.

Stockwatch.com

The longer duration debt is also appealing. Both the F series and G series closed at 87 cents on the dollar and in the case of the Series G, which matures in Q1 2029, the yield to maturity is 8.1%, and I think that’s rather appealing. After all, the balance sheet indicates there’s almost C$500M in shareholder equity ranked junior to the debt securities.

Investment thesis

I currently have no position in Atrium Mortgage, but I may initiate a long position after seeing how the mortgage investment corporation deals with the defaults. I do have a long position in some of the debentures and I will be looking to add either the series F or G debentures to my portfolio, based on which one offers the highest yield to maturity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here