Investment action

I recommended a sell rating for Silicon Laboratories (NASDAQ:SLAB) when I wrote about it the last time, as I was very worried about the fundamentals of the business deteriorating at a worse pace than I expected. As such, I thought it was best to sell the stock in case the situation turned worse. Indeed, Q4’23 performance was very weak, and my mistake was underestimating the market willingness to look forward to the next recovery (and not about things getting worse from here). However, based on my current outlook and analysis of SLAB, I have upgraded to a neutral rating.

I see the merit to the medium-to-long-term bull case for SLAB, but I think the focus should still remain on the near-term bear case that could dispel the bull case if Q4’23 turns out not to be the trough of this cycle (i.e., revenue declines further). While management guided for a softer revenue decline in Q1’24, the expected decline is huge: a 21% sequential decline and a 58% y/y decline. Also, visibility is low, so revenue could decline much worse than expected. Until I see more clarity on demand recovery, I am staying neutral.

Review

SLAB reported a very weak performance as expected, with Q4’23 sales coming in at $86.8 million, which is a sequential decline of 57% and 66% vs. Q4’22. The weakness was seen across all end-markets, where Industrial & Commercial (IAC) was down 51% sequentially and Home & Life [HNL] was down 68% sequentially. The gross margin also declined accordingly, touching 50.9%. However, EPS came in at -$1.19, which was better than what consensus expected.

The past few quarters were extremely tough for SLAB, with revenues falling by ~70% to ~$87 million in Q4’23 from the peak revenue of ~$270 million in Q3’22. This massive decline was a result of both weak end demand and a large inventory build at both the distribution and end customer levels. Regarding these two factors, it is fair to say that SLAB has no control over the end market demand situation; however, the inventory surplus situation was arguably the most significant one that SLAB has ever faced (Q4’23 annual revenue decline was the worst decline the company ever faced for the past 2 decades), and as such, the business struggled to adjust its supply chain to better position itself. However, what is done is done, and I think SLAB made the right move by taking aggressive but painful actions to drain out excess inventories in the channel and at its customers in Q4’23. This was well reflected in its inventory days, which declined from 90 days in 3Q to 79 days.

In my opinion, there are two compelling narratives for SLAB today: the near-term bear case and the mid-to-long-term recovery bull case.

The bear case is that weak demand and elevated inventory continued to impact both segments in the quarter, with the broad industrial category experiencing the largest decline. Management guidance for Q1’24 ($105 million) also suggests that revenue is going to continue to decline in large magnitude (21% sequentially and ~58% vs. Q1’23). The thing is, given how management has handled the inventory situation (which showed that they had little visibility), I am not sure how accurate or reliable this guide is. I mean, revenue literally fell by 66% in a single quarter, 2x worse than what SLAB experienced in Q3’21 and 2Q07.

The bull case (discussed below) hinges on the fact that Q4’23 was the trough. Suppose Q1’24 came in with a worse than expected decline; the entire bull case narrative will be heavily challenged, and the stock sentiment will likely flip negatively.

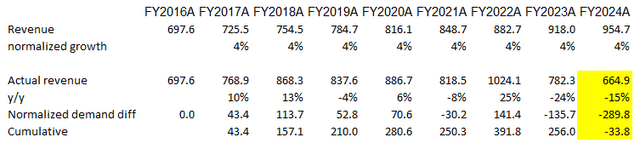

The bull case for SLAB is that Q4’23 was indeed the trough. As a result of their decisive actions to slash shipments in Q4’23, Management managed to take control of the demand-supply imbalance, and things will only get better from here. For the whole of FY23, SLAB generated $782 million in revenue; this is roughly the same level it did 7 years ago. Suppose FY16 was the year of normalized demand, and SLAB grows revenue at a GDP+ level of 4% (given SLAB exposure to the IoT market that has a long-term growth runway, growing above GDP should not be an issue), FY24 will be the year were almost all excess demand is cleared out of the system (assuming consensus FY24 revenue growth), and FY25 will be the year of growth.

Author’s work

Based on the booking trend in Q4’23 (bookings have improved slightly sequentially for both business segments in Q4’23), demand seems to be recovering in FY24, which suggests revenue decline to be softer than FY23.

Management also continues to expand its design win pipeline in 2023, which has grown by double digits vs. last year, which I believe should drive strong revenue recovery over the next several years and is a strong indicator of future revenue growth. Within the design wins are some large deals that could help the headline figure look better if they are booked early in the recovery cycle. In particular, SLAB is starting to ramp up this year on multi-year design wins in retail, smart cities, and healthcare. The long-lasting and multi-year design of these massive win ramps should ensure a steady stream of revenue for the foreseeable future.

My take on the situation has turned from very bearish to neutral. I do think that the focus right now should be on how the near-term will develop instead of focusing on the medium-to-long-term bull case, as SLAB is still expected to see a huge revenue decline in Q1’24. In fact, if we look at consensus quarterly estimates, the growth is all weighted on Q4’24, and from now until then, the macro situation could flip for the worse (which could further drag down tech spending), causing consensus and the market to lose faith in any form of recovery in FY24. Let’s also not forget that management has little visibility today. As such, until I see further evidence that Q4’23 is indeed the trough, I am not going to turn bullish.

Valuation

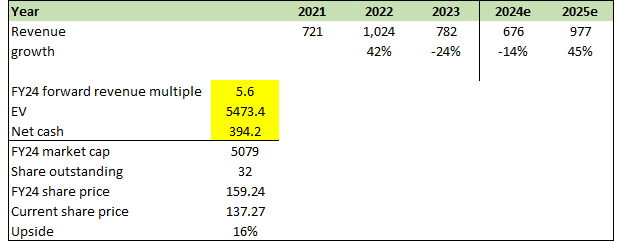

Author’s work

One additional thing to point out is that the upside is not very attractive from this level, even if we assume the market (consensus) is right in the timing of growth. Consensus is assuming near $1 billion in revenue in FY25 (similar to FY22 levels), which pretty much means that SLAB will normalize by the end of 2025. Suppose that is true, and we attached the same multiple that SLAB is trading at today, 5.6x forward revenue, which is near 2x above its historical average of 4x forward revenue and has never sustained at this level outside of the COVID period. The upside is only 16%. For the risk that an investor is going to undertake in the near term, I don’t think 16% is attractive enough.

Final thoughts

My recommendation on SLAB has shifted from a sell recommendation to a neutral outlook. I do recognize the potential for a mid-to-long-term recovery, however, I believe the near-term bear case should be the focal point due to the significant sequential and year-over-year revenue declines expected in Q1’24. The uncertainty surrounding demand recovery and management’s limited visibility also makes me feel uncertain. Importantly, the current valuation and modest upside are not attractive for me to take the near-term risks.

Read the full article here